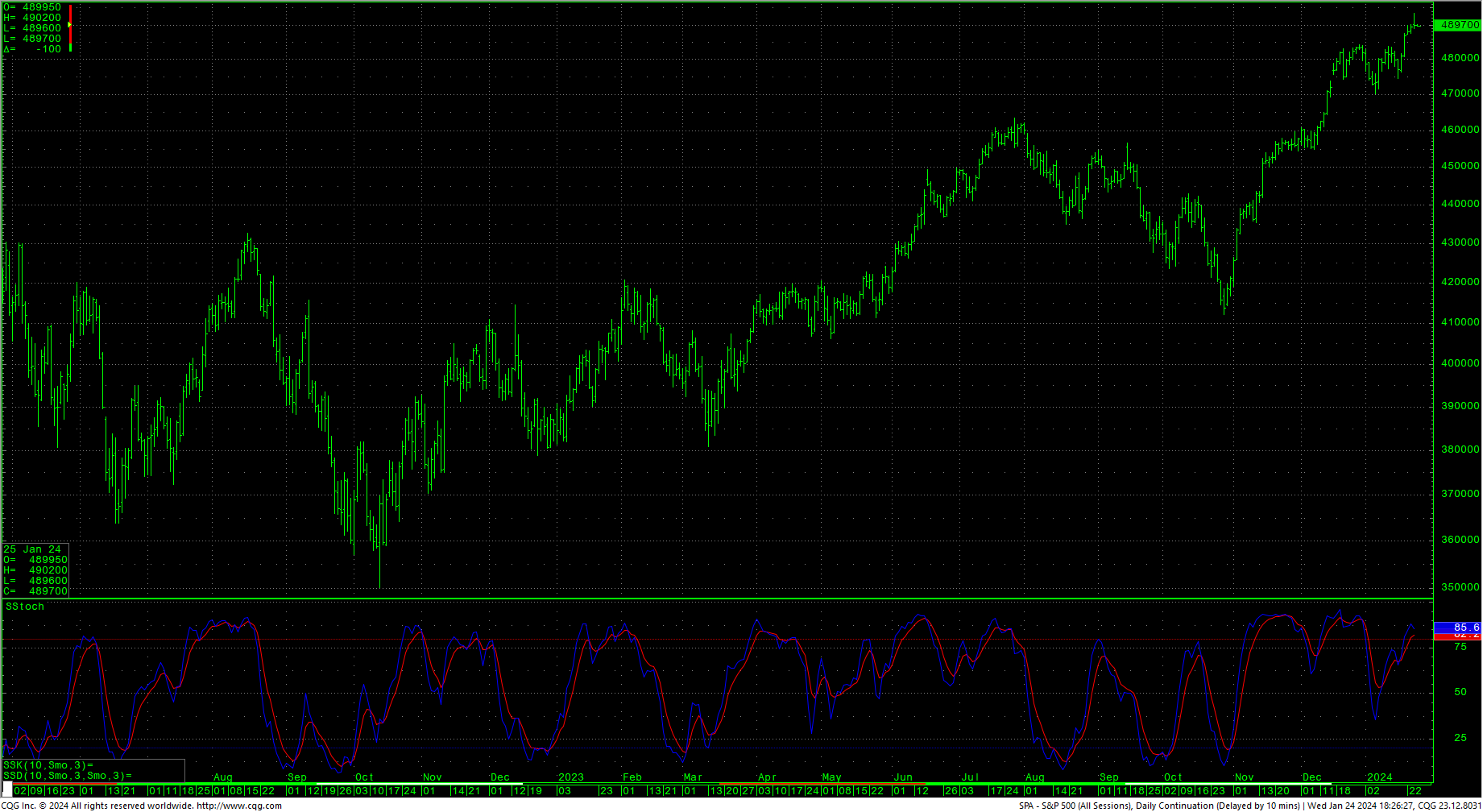

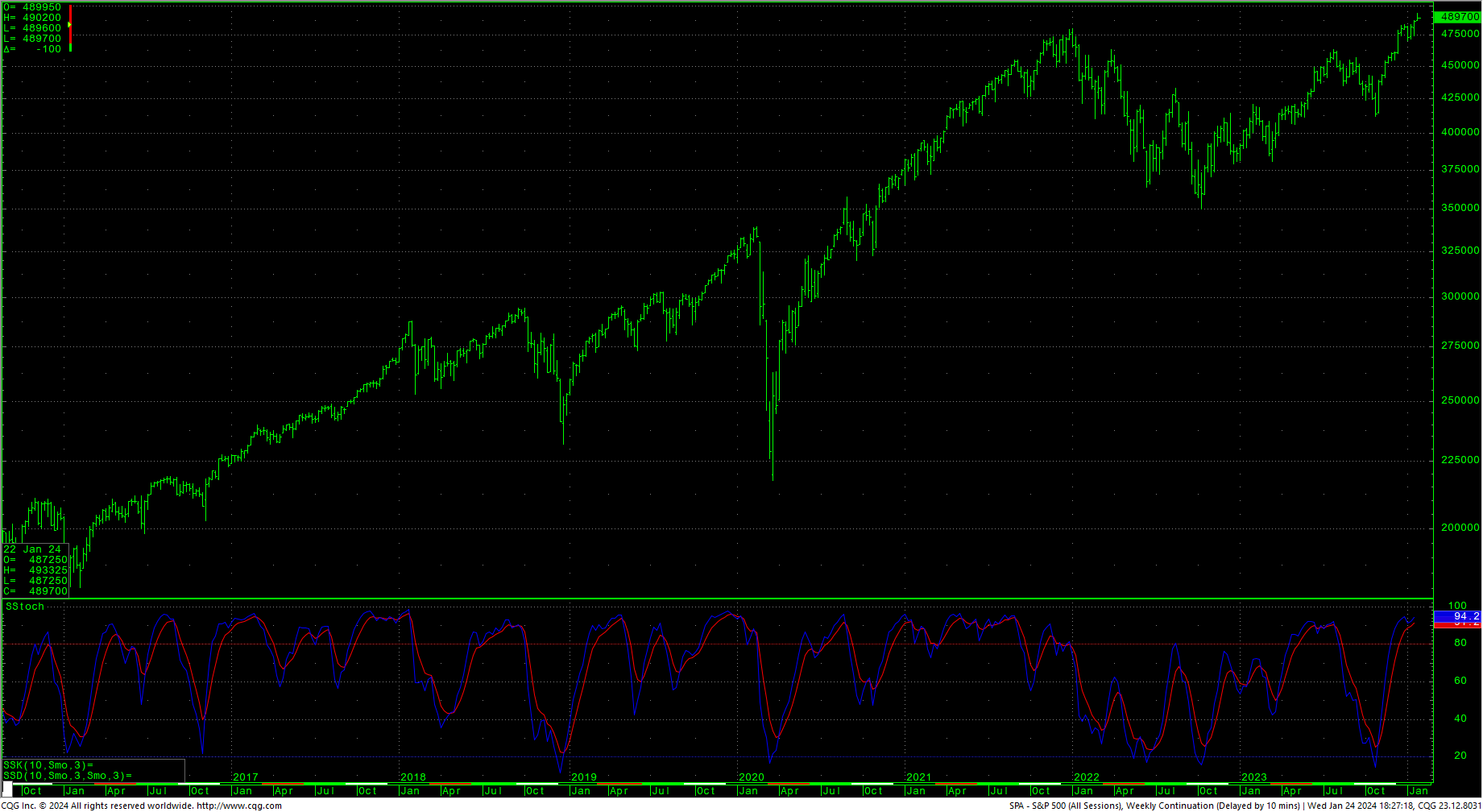

S&P500 Nearby Futures Weekly H-L-C

We have just moved through a critical timing point and are on the precipice of two big data numbers. Thursday morning, we get Real GDP with most estimates coming in at +2.0%. Anything above 2% is likely to be bearish for both stocks and bonds as it will take the wind out of the rate cut hopes for this spring. On Friday. We get PCE data…guesses for the Core are 0.2% with personal income at 0.3% and personal spending at 0.5%. Again, ‘good’ numbers there are ‘not good’ for the idea that interest rates will be lowered soon.

We have just moved through a critical timing point and are on the precipice of two big data numbers. Thursday morning, we get Real GDP with most estimates coming in at +2.0%. Anything above 2% is likely to be bearish for both stocks and bonds as it will take the wind out of the rate cut hopes for this spring. On Friday. We get PCE data…guesses for the Core are 0.2% with personal income at 0.3% and personal spending at 0.5%. Again, ‘good’ numbers there are ‘not good’ for the idea that interest rates will be lowered soon.

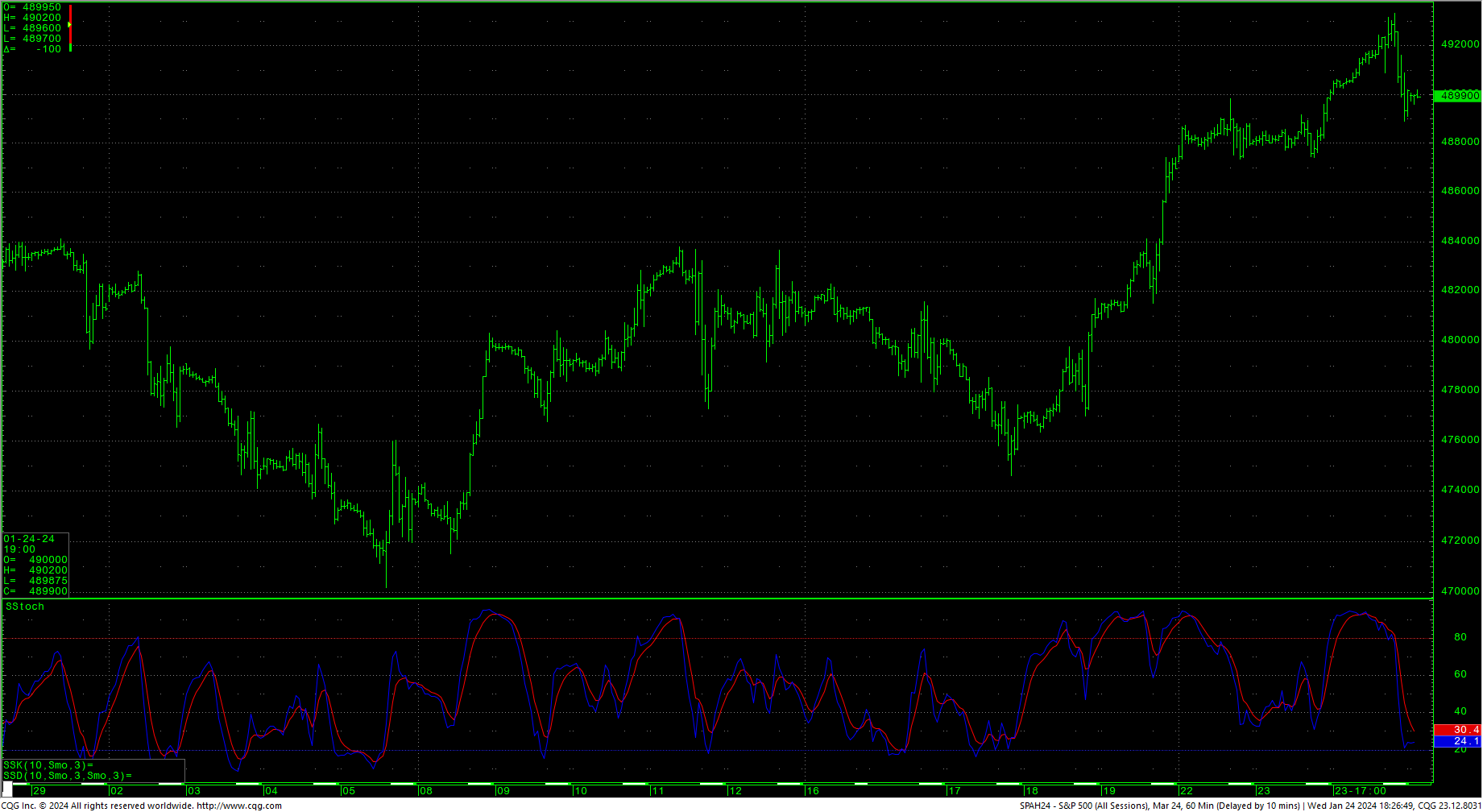

S&P500 SPH4-March Futures Hourly H-L-C

The cash S&P topped the psychological 4900 level in Wednesday’s trade and then fell to close slightly higher, on the bottom of the day’s range (in critical daily timing). Wednesday’s futures (March: SPH4 or SPAH4 for all sessions) clocked in at 4933.25. This area is just short of some key overhead targets on the SPH4 chart at 4948 and 4974. The hourly ended the day sliding into slightly oversold conditions. The daily is slightly overbought and still in a possible bearish divergence with the new highs based on the stochastics. The weekly has moved into some overbought conditions. Sentiment is flashing extreme greed on the close Wednesday.

The cash S&P topped the psychological 4900 level in Wednesday’s trade and then fell to close slightly higher, on the bottom of the day’s range (in critical daily timing). Wednesday’s futures (March: SPH4 or SPAH4 for all sessions) clocked in at 4933.25. This area is just short of some key overhead targets on the SPH4 chart at 4948 and 4974. The hourly ended the day sliding into slightly oversold conditions. The daily is slightly overbought and still in a possible bearish divergence with the new highs based on the stochastics. The weekly has moved into some overbought conditions. Sentiment is flashing extreme greed on the close Wednesday.

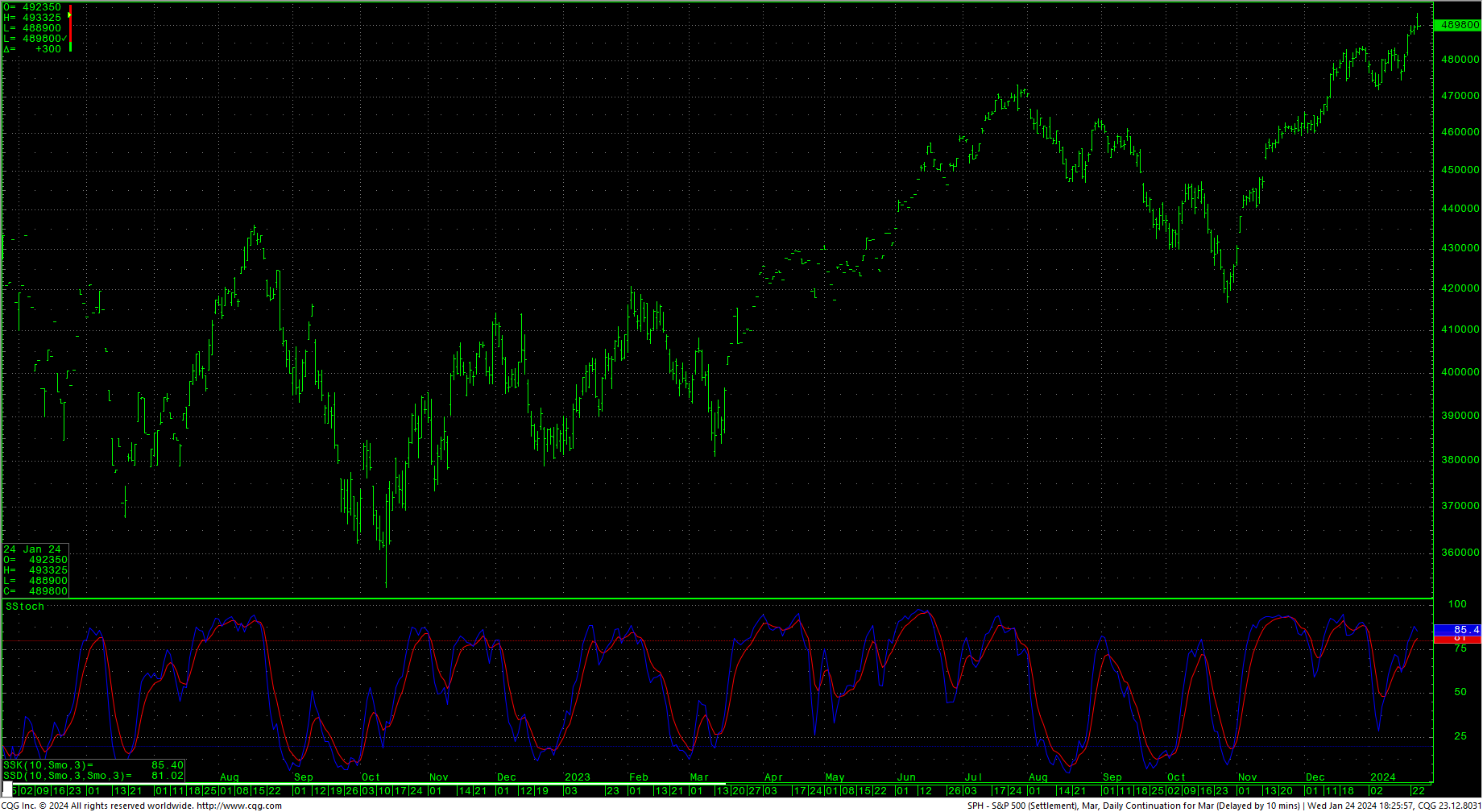

S&P500 MAR-MAR Futures Daily H-L-C

Short-term, support is at 4877.50/4874.25 and breaching that should test 4843.50 with support through 4836.50. Support is key at 4816.25/4815.00 and near-term critical at 4789/4788. Closes under 4788 open lower counts for S&Ps.

Short-term, support is at 4877.50/4874.25 and breaching that should test 4843.50 with support through 4836.50. Support is key at 4816.25/4815.00 and near-term critical at 4789/4788. Closes under 4788 open lower counts for S&Ps.

Resistance is 4906. 4911 and pivotal at 4916.25/4918. A drive back over 4918 sets up 4923 with a chance to test the highs at 4933.25. A breakout over 4933.25 should minimally carry the SPH4 to the 4948/4949 target area. Closes over that level open counts to the next upside objective at 4974.

S&P500 Spot Futures Daily H-L-C

- 4877.50/4874.25 *** ↓

- 4859.75 **

- 4850.00 **

- 4843.50/4841.75 *** ↓

- 4836.50 *** ↓

- 4829 **

- 4816.25/4815.00 *** ↓

- 4805.25 **

- 4789/4788 *** ↓ pivotal

Resistance

- 4906.00 **

- 4911.00 ***

- 4916.25/4918.00 *** ↑

- 4923.00 **

- 4933.25 *** ↑

- 4948 *** ↑ Target

- 4960 **

- 4974 *** ↑ Target

Charts courtesy of CQG, Inc.,