S&P 500 Hourly H-L-C

The S&P 500 has opened into, from a Market Profile standpoint, a strong area for sellers. This is their best value thus far. As pointed out in the latest technical update, sellers have a less than two-day window to work with right now unless they start to get some satisfaction soon.

The S&P 500 has opened into, from a Market Profile standpoint, a strong area for sellers. This is their best value thus far. As pointed out in the latest technical update, sellers have a less than two-day window to work with right now unless they start to get some satisfaction soon.

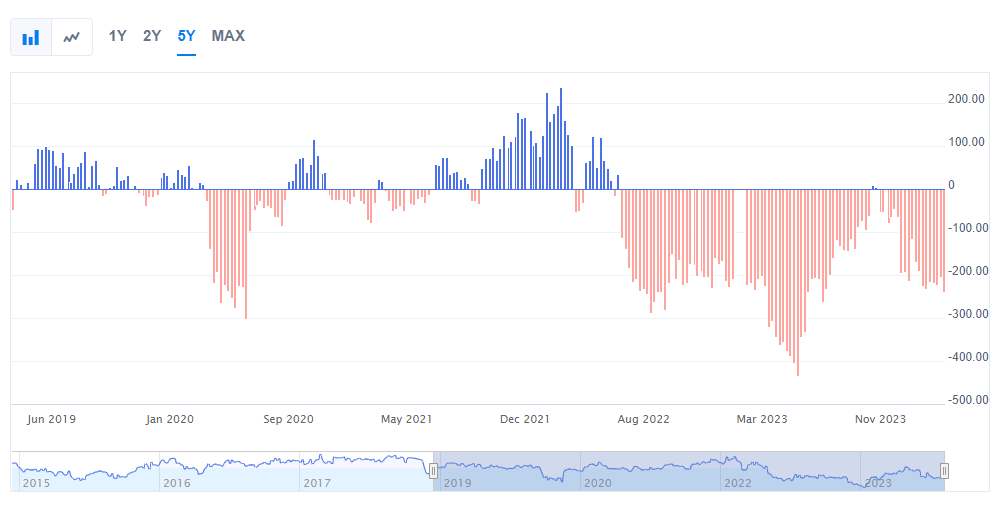

CFTC S&P 500 Speculative Net Positions

The price action this morning leaves the technical points pretty much the same. Resistance is key now at 5179/5180 and rallies through that should retest the intraday highs at 5189/5190. Closes over 5190 set up a drive to 5288 with counts toward 5432. A breakout over 5432 will open potential to the 5720 area. Closes over 5720 offer upside targets at 6000/6008.

The price action this morning leaves the technical points pretty much the same. Resistance is key now at 5179/5180 and rallies through that should retest the intraday highs at 5189/5190. Closes over 5190 set up a drive to 5288 with counts toward 5432. A breakout over 5432 will open potential to the 5720 area. Closes over 5720 offer upside targets at 6000/6008.

Support is at 5158, 5148, key at 5139 and pivotal at 5131/5130. A breakdown under 5130 will test 5122/5121 with potential to the 5104 area. Support remains at 5092 though 5080 where there is a gap. A breakdown under 5080 sets up a move to 5054 with potential to 5023/5020 with gap support of 5038. A breakdown under 5020 sets up a move to 4987/4983. Closes under 4983 suggest critical support of 4933/4920. A breakdown under 4920 should test 4774 with potential to 4714. Under 4714 counts toward 4646 with potential to pivotal support at 4518/4510. Daily closes under 4510 count toward 4447 with counts to 4315. Closes under 4315 have potential to critical short-term support of 4121/4115 through 4103.

Resistance

|

Support

|