TECHNICAL ANALYSIS (by Intraday Dynamics)

VIX Volatility Index Daily Close

DJIA Daily Candles

DJIA Daily Candles

With Wednesday’s close, the Dow is now down -5.16% from its record high close of 28 March 2024…a decline of 2054 points in just 13 trading sessions. The steep decline has triggered some panic as the VIX is now sitting at levels last seen when the market bottomed out in the Fall of 2023. A ‘typical’ mid-cycle correction is in the 5% range. Now that we are here, what is next for the Dow? Is the market ‘over’ and sellers are once again to be in charge…or is this action normal in the course of bull market cycle, and prices are going to recover and begin a new leg? Meaning, will the Dow eventually take out the critical $40K level after trading 111 points short of that area in March? Note there are still unfilled monthly targets at 40106/40107 and 40245/40250.

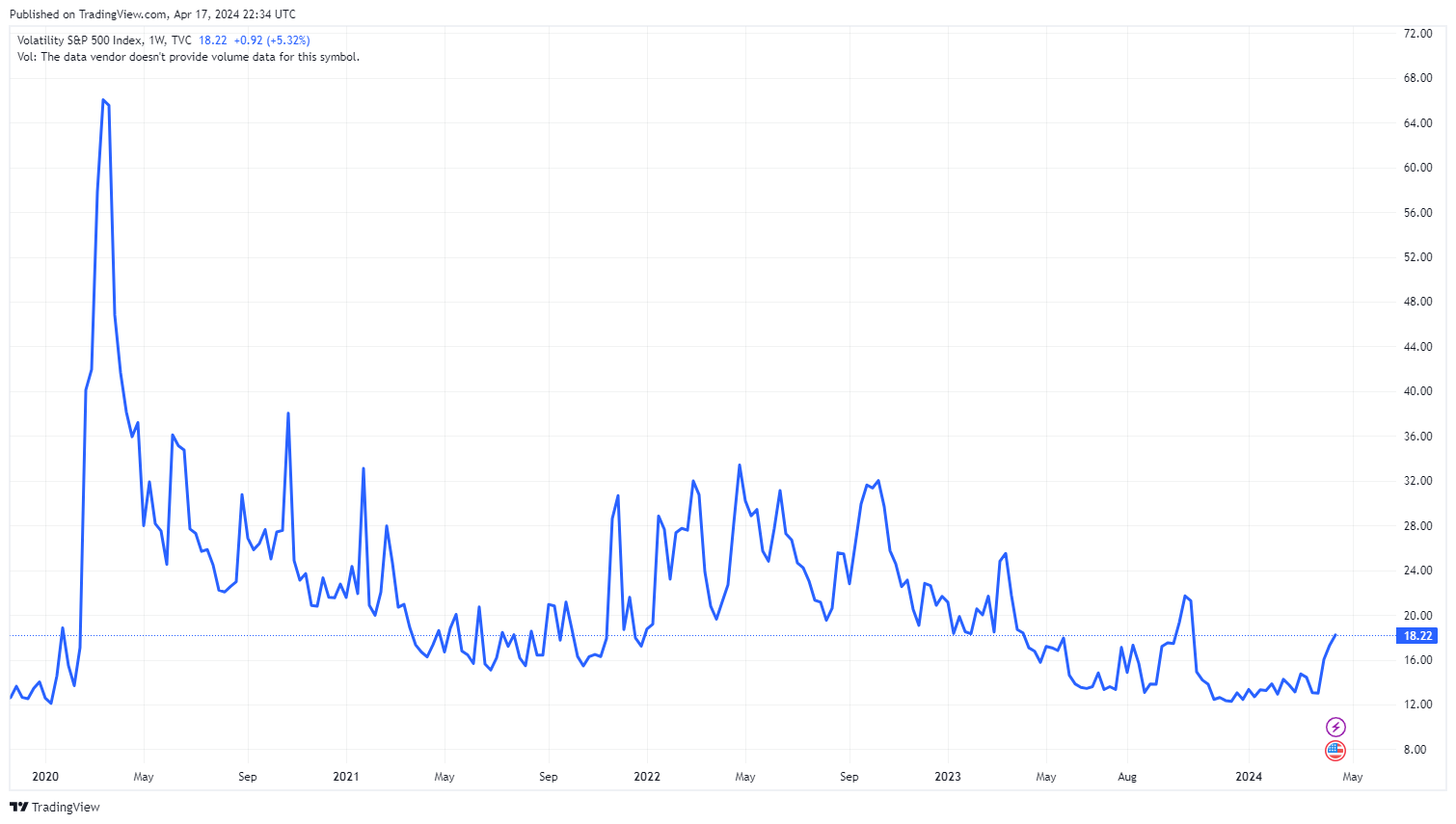

With Wednesday’s close, the Dow is now down -5.16% from its record high close of 28 March 2024…a decline of 2054 points in just 13 trading sessions. The steep decline has triggered some panic as the VIX is now sitting at levels last seen when the market bottomed out in the Fall of 2023. A ‘typical’ mid-cycle correction is in the 5% range. Now that we are here, what is next for the Dow? Is the market ‘over’ and sellers are once again to be in charge…or is this action normal in the course of bull market cycle, and prices are going to recover and begin a new leg? Meaning, will the Dow eventually take out the critical $40K level after trading 111 points short of that area in March? Note there are still unfilled monthly targets at 40106/40107 and 40245/40250.

Remember that, as we have been pointing out since the end of last month, “…we are now in a critical cycle window that runs between now and the end of April. Trade can become much more active with potential for wider swings and short-term moves.

Speculators have been short sellers at the highs, and they have been handsomely rewarded in the past three weeks. A direct 180 from where they were back in October of last year when specs were heavily short, and commercials were long. Now the VIX is reaching levels last seen at the lows last October, but the specs have been covering their shorts with the latest selloff.

*Read more and sign up for a 30-Day FREE TRIAL at: Intraday Dynamics