Crude oil futures (Z22) closed fractionally higher on Friday and settled week down just under $2 for the nearby futures. The near-term technicals are neutral while the intermediate-term still lean toward a bearish posture.

December futures are flagging to the side of the most recent test of intermediate-term support against the 8173/7884 area. As outlined previously, that level represents basically a 38.2% correction of the entire contract move from 2020 lows to the top this year at 11078. Volume and open interest remain lethargic and have declined throughout the entire year. The daily has worked off some of the short-term oversold conditions and the oscillators now threaten to hook downward which could result in a steep and sharp decline which should include some increase in volume.

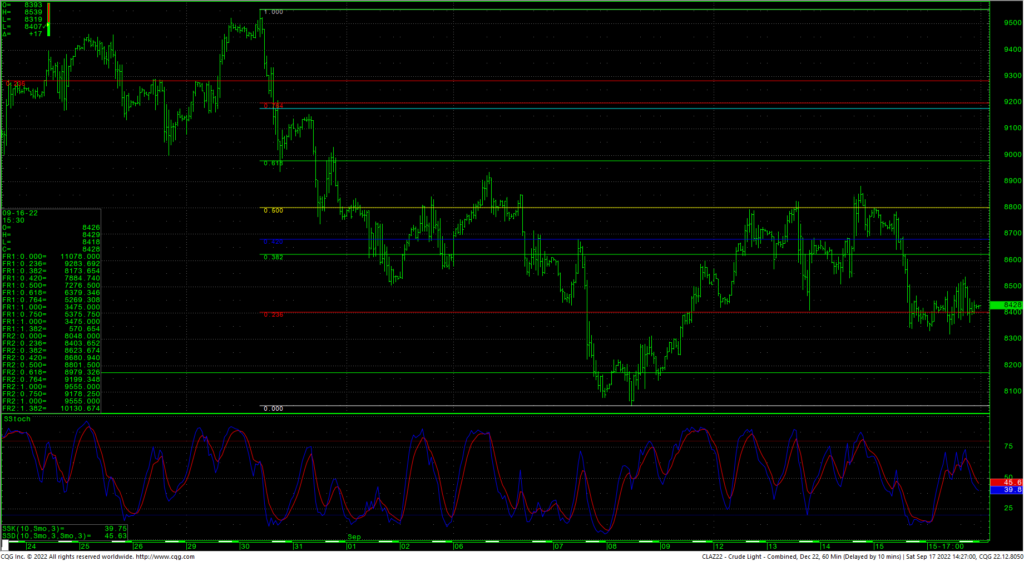

Z22 December Crude Oil Futures–Hourly

The hourly chart is neutral with the sideways trade, but prices remain in the lower portion of the distribution, which can be seen as a near-term bearish indicator. Resistance for Z22 is at 8539 and 8625. Rallies over the 8625 area should retest 8801/8810. Closes over 8810 on the daily are needed for near-term strength and should carry to pivotal short-term resistance is 8979/9000. Closes over 9000 are bullish and setup a test of 9200 with potential to retest the 9555 swing highs.

The weekly continues to trough into some oversold conditions—again, with declining volume and open interest throughout all of 2022. As long as spot prices remain under the 9000/9020 level, they remain on the defensive. A continued breakdown now under the 8172/7884 level open counts into the 7100/6600 level (based simply on the breakout of two months of sideways trade to the right of the spike top).

As outlined in the last update, a case could be made for a head and shoulders pattern developing. In this scenario, spot crude could be expected to trade back toward the $50 level eventually. Support for the Z22 remains critical now at 8050 and 7940 with the 7884 area as a last gasp support point. Closes under 7940/7884 should open counts to 7276/7212. The 7200 level represents some strong long-term support for the Z22 and closes below that suggest 6379/6360 with counts to 6020.

Charts courtesy of CQG, Inc.