TECHNICAL ANALYSIS (by Intraday Dynamics)

Tracking the Ten Year Note

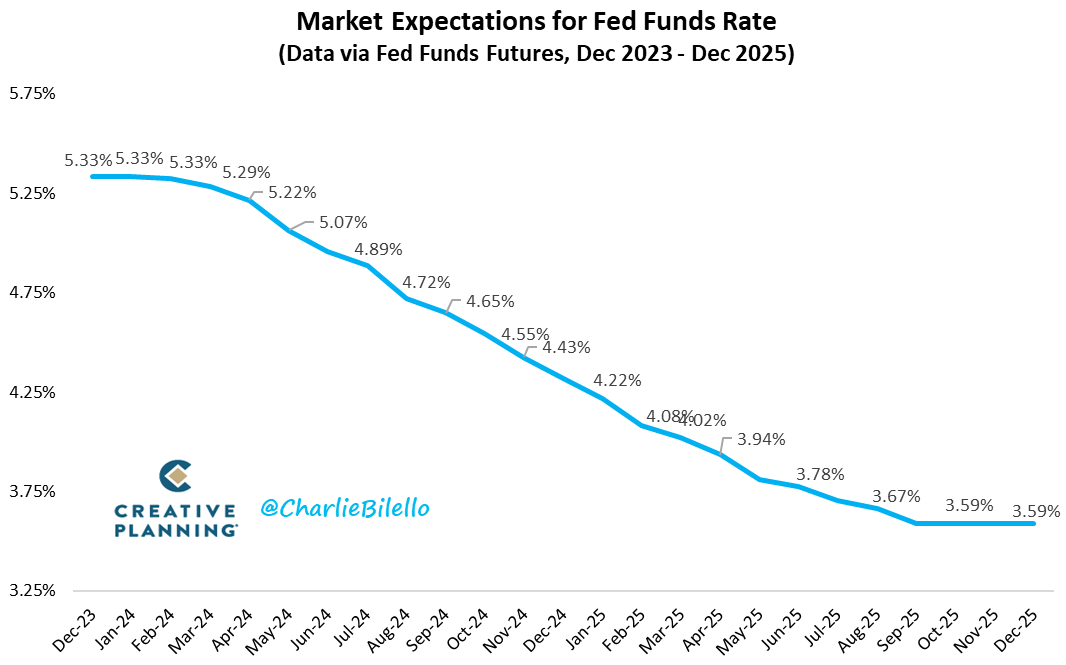

The 10-year Notes moved sharply higher last week on Fed news, driving the spot contract (DEC23) into pivotal short-term resistance. The weekly is working off deeply oversold conditions and the daily stochastics are hooking higher at a high level…flashing a preliminary bearish divergence if prices cannot continue higher. MAR24 is now top step and DEC goes off the board this week…so MAR24 will take over the spot continuation charts at a small premium. Therefore, translate all spot prices to MAR24 following this week.

The 10-year Notes moved sharply higher last week on Fed news, driving the spot contract (DEC23) into pivotal short-term resistance. The weekly is working off deeply oversold conditions and the daily stochastics are hooking higher at a high level…flashing a preliminary bearish divergence if prices cannot continue higher. MAR24 is now top step and DEC goes off the board this week…so MAR24 will take over the spot continuation charts at a small premium. Therefore, translate all spot prices to MAR24 following this week.

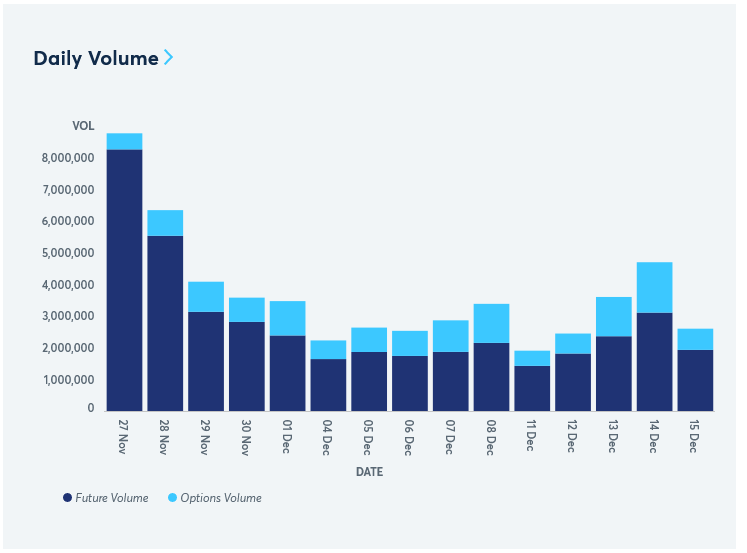

Ten Year Notes Futures Volume

(Source: CME Group)

(Source: CME Group)

Ten Year Notes Daily Continuation H-L-C The daily continuation is trying to hook higher as it moves out of an inverted head and shoulders pattern. Prices hit pivotal resistance at 112175/112250. There is an unmet objective on the spot daily at 113065. Continued rallies should carry spot prices to 113605 with a wall of intermediate-term resistance now between 113020 through 114075/114130. Closes over 11430 are bullish and suggest a move to 117000. Long-term resistance is 117000 and critical at 118270/118400. Any breakout over 118400 is bullish and can carry toward 122020 to 123005.

The daily continuation is trying to hook higher as it moves out of an inverted head and shoulders pattern. Prices hit pivotal resistance at 112175/112250. There is an unmet objective on the spot daily at 113065. Continued rallies should carry spot prices to 113605 with a wall of intermediate-term resistance now between 113020 through 114075/114130. Closes over 11430 are bullish and suggest a move to 117000. Long-term resistance is 117000 and critical at 118270/118400. Any breakout over 118400 is bullish and can carry toward 122020 to 123005.

Ten Year Notes Weekly Continuation H-L-C

Ten Year Notes Hourly H-L-C MAR24

Ten Year Notes Hourly H-L-C MAR24

Support, basis the MAR24, is 111055, 110035, 109080 and pivotal at 108135/108110. Closes under 108110 counts to 107110 with potential to 105215. Support is critical on the monthly chart through 104050/104010.

Support, basis the MAR24, is 111055, 110035, 109080 and pivotal at 108135/108110. Closes under 108110 counts to 107110 with potential to 105215. Support is critical on the monthly chart through 104050/104010.

Resistance

- 112175/112250 *** ↑

- 113020 **

- 113065 *** ↑ TARGET

- 114075/114130 *** ↑

- 115030 **

- 115185 **

- 116160 ***↑

- 117000 *** ↑

Support

- 111055 **

- 110035 **

- 109080 ***

- 108135/108110 *** ↓

- 107110 ***

- 106110

- 105215 *** ↓

- 104050/104010 *** ↓

Charts courtesy of CQG, Inc, Bilello Blog and YCharts