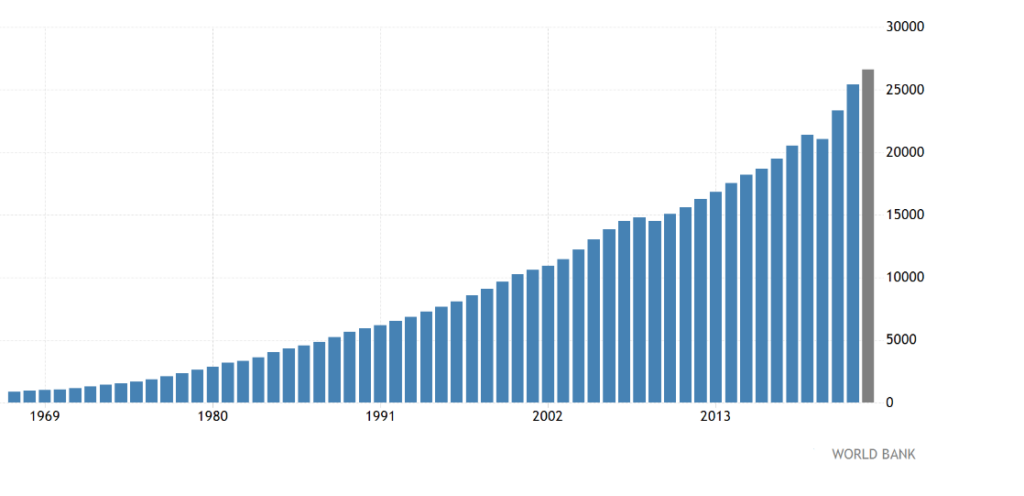

Vica’s economic outlook for 2024

A cautiously optimistic perspective unfolds, forecasting a consistent GDP growth of 2.3 percent for the United States. The driving force behind this growth is the resilience exhibited in sectors like government, healthcare, and services, poised to lead the charge in job creation.

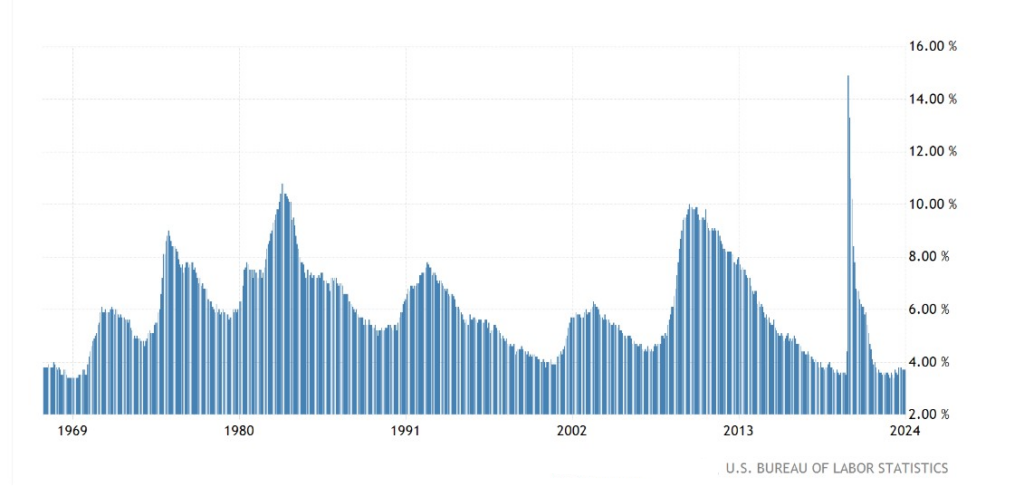

Employment Trends

The U.S. economy has been historically resiliant during election years. Sectors like government, healthcare, and services are expected to play a pivotal role in absorbing the workforce, and forecast the unemployment rate around 3.8%, just shy of the 4.0% mark.

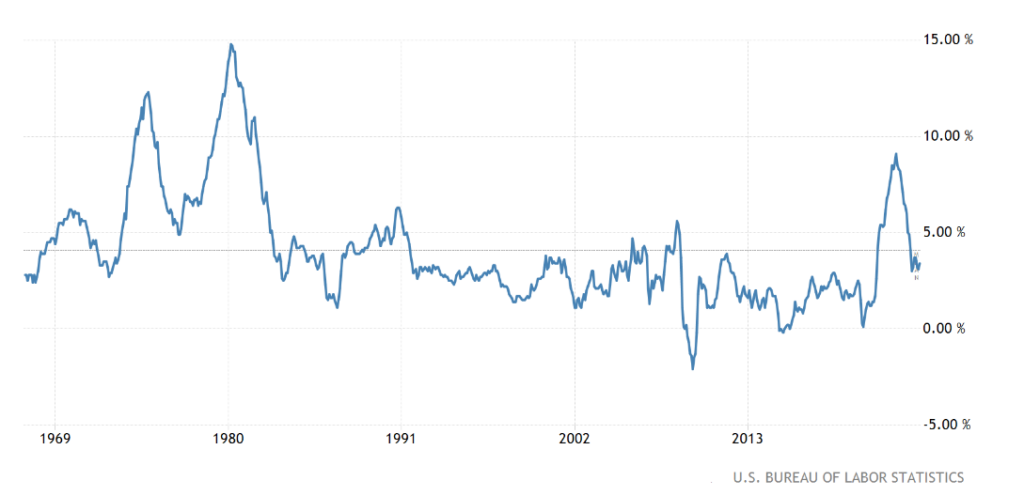

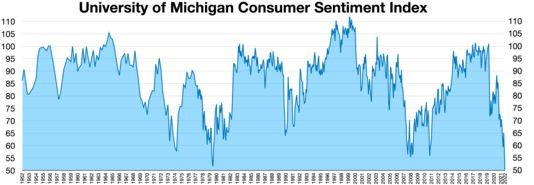

Inflationary Pressures

We anticpate slighlt higher inflation, projected to range between 3.50% to 4.00%. This inflation uptick necessitates a strategic approach from policymakers and businesses, balancing growth and stability.

Interest Rates Dilemma

In an unexpected twist, despite concerns about inflation, interest rates are anticipated to decrease. We project the benchmark borrowing rate to fluctuate between 3.75% and 4.25% by year end, presenting unique challenges and opportunities for businesses and consumers, disrupting traditional financial paradigms.

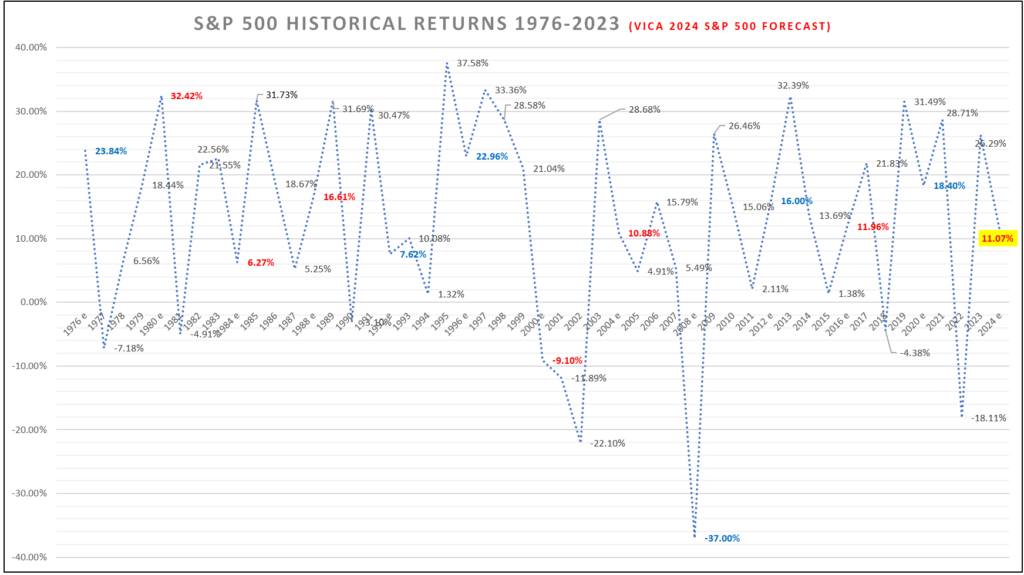

Stock Market Dynamics

We forecast the S&P 500 to gain anywhere from 9.75% to 11.25%. This optimism is grounded in the resilience of the U.S. economy, supported by sectors poised for growth. In addition, internal pressures faced by the Federal Reserve to accomate politcal agendas.

Trends and Geopolitical Considerations

Our analysis does not solely rely on statistical models as we consider emerging trends and geopolitical events. From technological advancements to geopolitical shifts, these factors influence economic trajectories.

In Summary

Our outlook for the US economy in 2024 is cautiously optimistic, projecting a consistent 2.3 percent GDP growth. This positive trend is attributed to the resilience exhibited in 2023, even amidst aggressive rate hikes. Historical patterns during election years indicate that President Biden could experience a more favorable economic landscape, featuring low unemployment and inflation levels within historical norms. Additionally, monetary easing may be employed to bolster the incumbent’s prospects.