MARKETS TODAY May 25th, 2023 (Vica Partners)

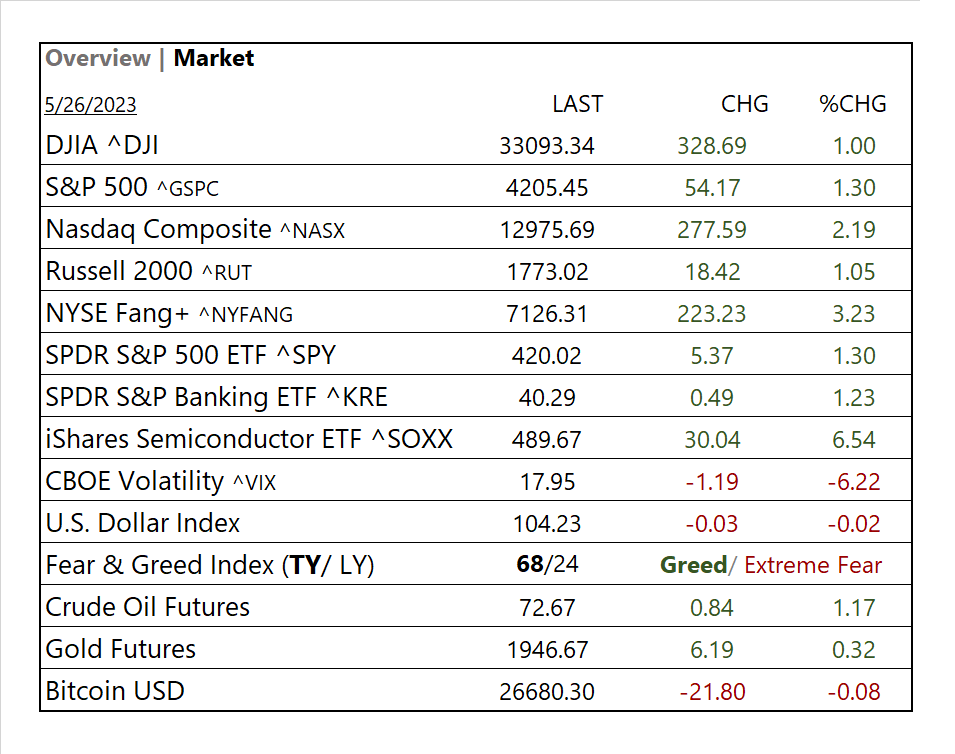

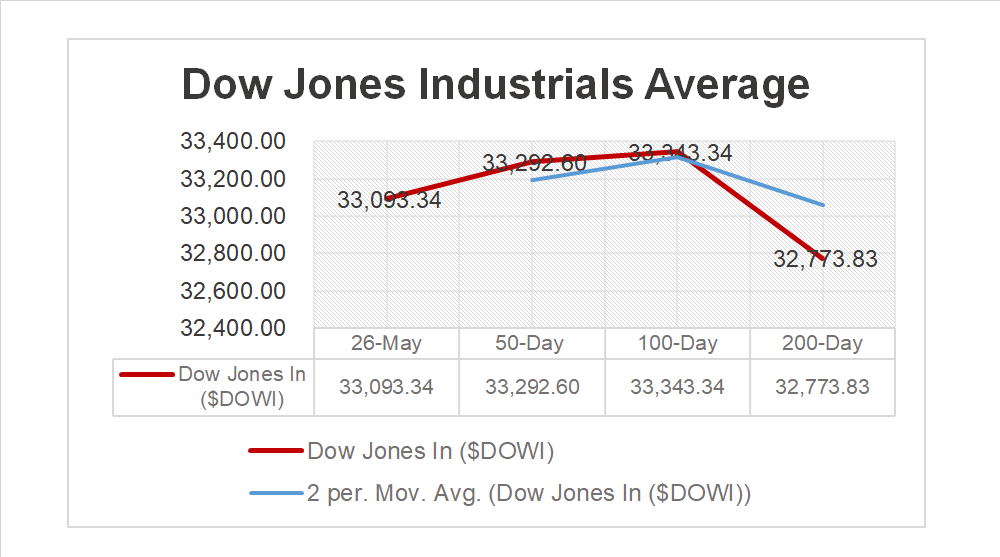

On Thursday, US Markets finished mixed, S&P 500 +0.88%, DOW -0.11% and the Nasdaq +1.71%. 6 of 11 of the S&P 500 sectors lower: Energy -1.89% underperformed/ Information Technology +4.45% outperformed. Treasury Yields, USD Index, Bitcoin and WTI Oil all gained. In economic news, Initial weekly jobless claims came in light, GDP Q1 ‘23 U.S. economic growth beat forecasts, April pending home sales flat.

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 +0.37%, Shanghai Composite +0.35% and Hong Kong’s Hang Seng -1.93%. US futures were trading at 0.5% above fair value. European markets finished higher, France’s CAC 40 +1.24%, Germany’s DAX +1.20% and London’s FTSE 100 +0.74%.

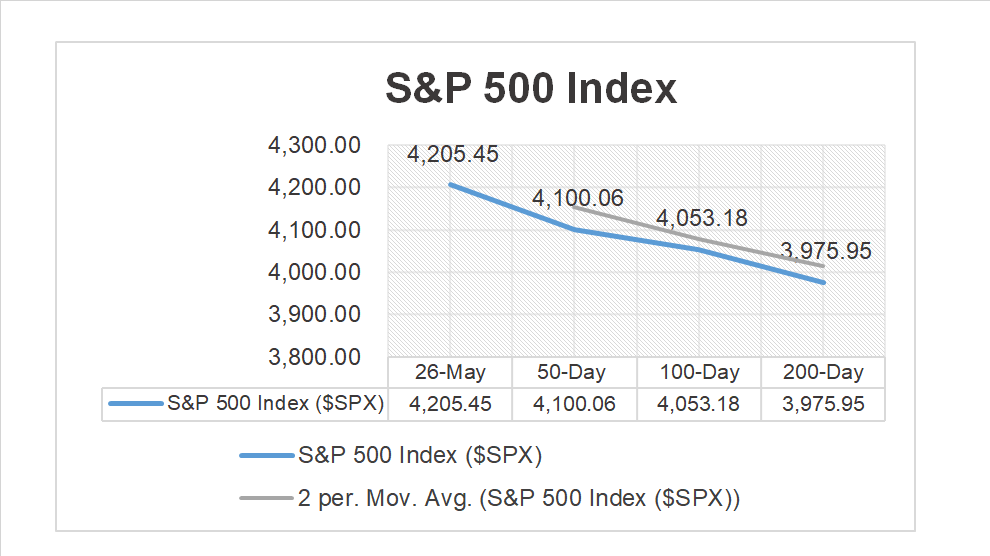

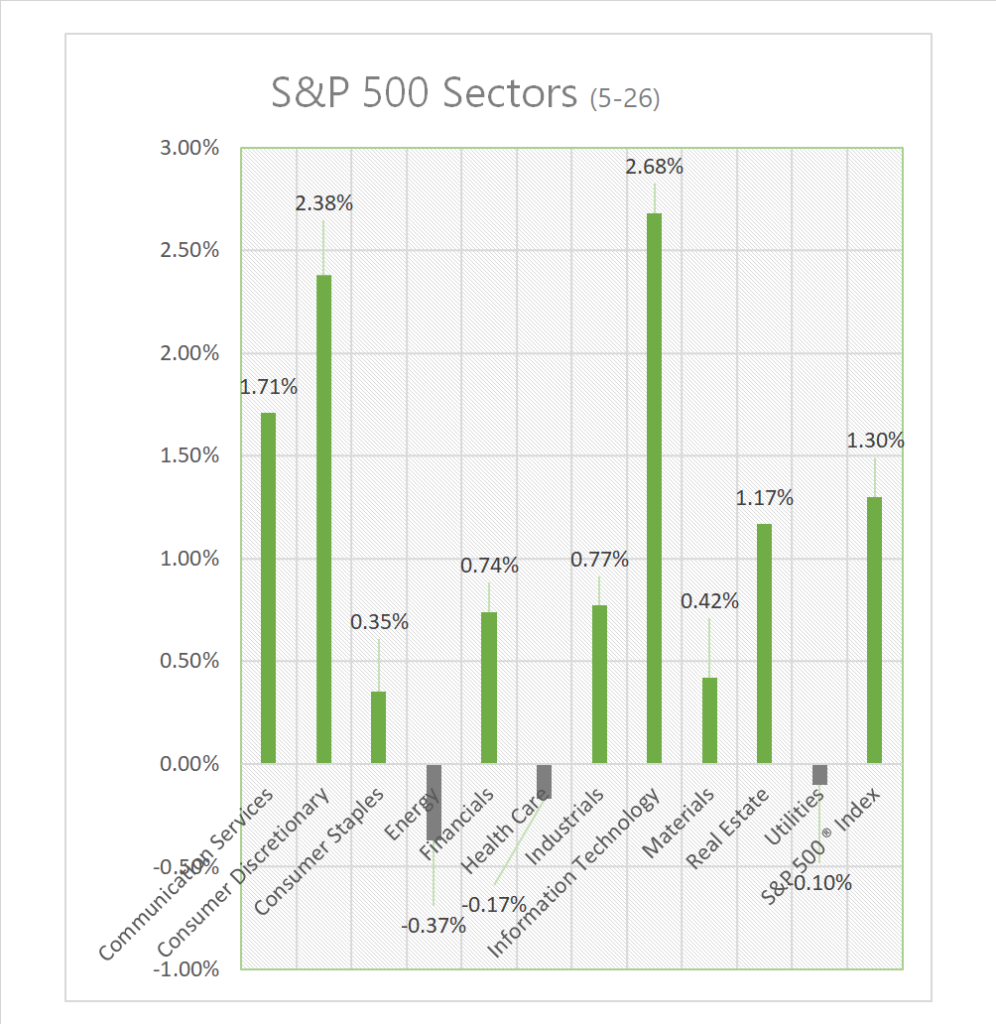

Today US Markets finished broadly higher, S&P 500 +1.30%, DOW +1.00 and the Nasdaq +2.19%. 8 of 11 of the S&P 500 sectors higher: Information Technology +2.68% outperformed/ Energy -0.37% lagged. On the upside, Gold, Oil and the Bloomberg Commodity Index. In economic news, multiple releases points to resilience of overall economic activity.

Takeaways

- Economic news points to resilience of overall economic activity.

- NYSE Fang+ ^NYFANG +3.2%

- iShares Semiconductor ETF (SOXX) +6.5%

- 8 of 11 of the S&P 500 sectors higher: Information Technology +2.68% outperformed/ Energy -0.37% lagged

- Gold and Oil up

- Futures are currently pricing in >50% chance of a 25bps hike

- Earnings thin, no real headlines

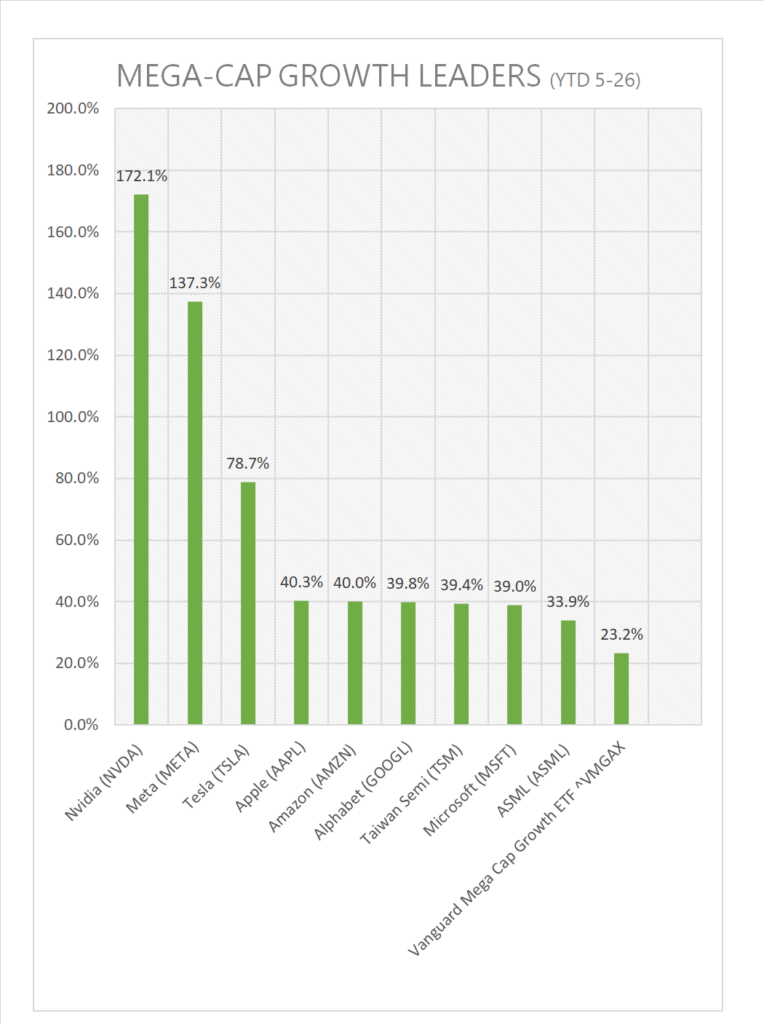

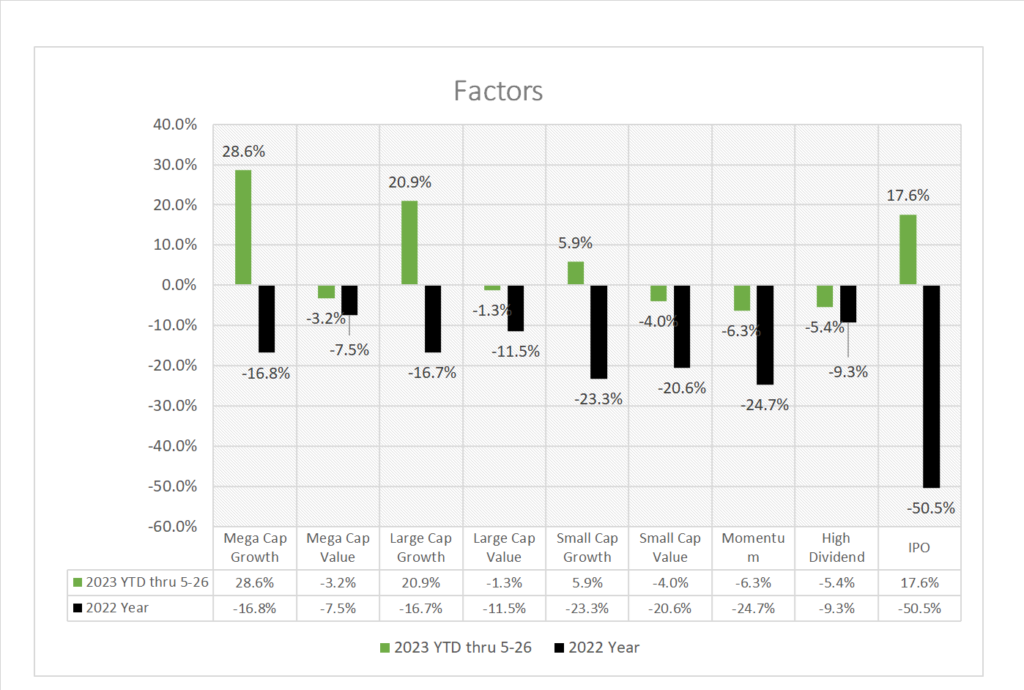

Pro Tip: Watch Mega Cap Growth (note NVDA YTD performance)…

Sectors/ Commodities/ Treasuries

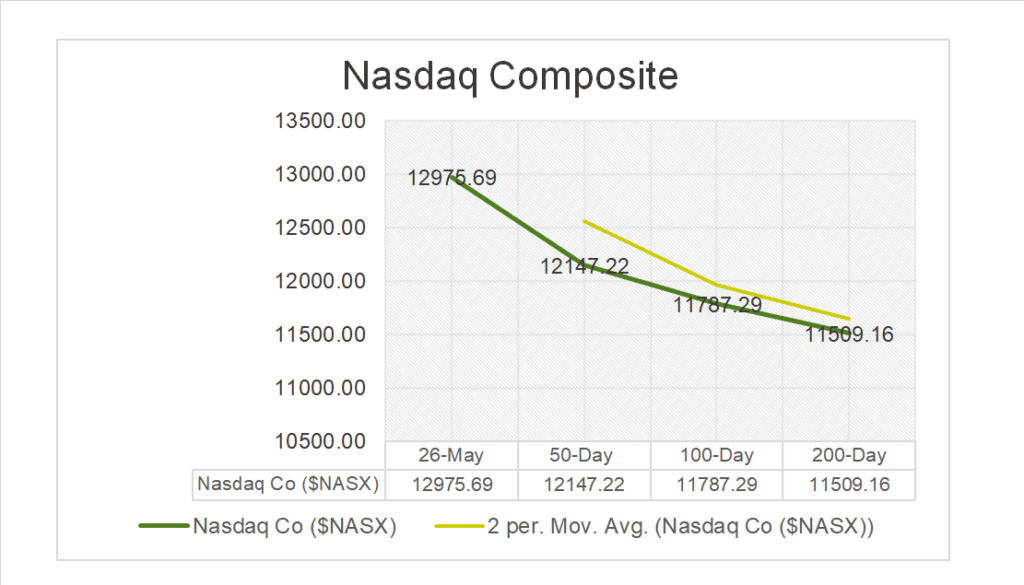

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 8 of 11 of the S&P 500 sectors higher: Information Technology +2.68%, Consumer Discretionary +2.38% outperform/ Energy -0.37%, Health Care -0.17% lagged.

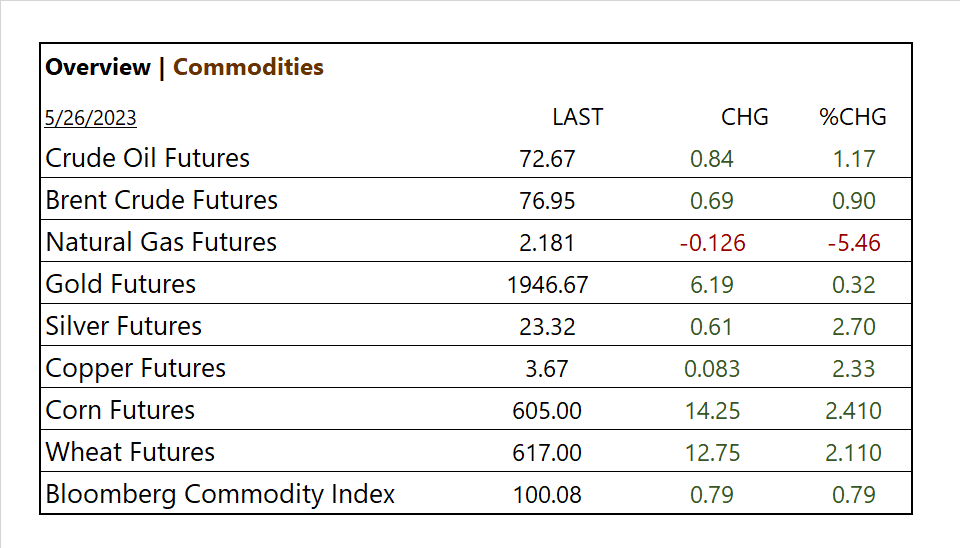

Commodities

Factors (YTD)

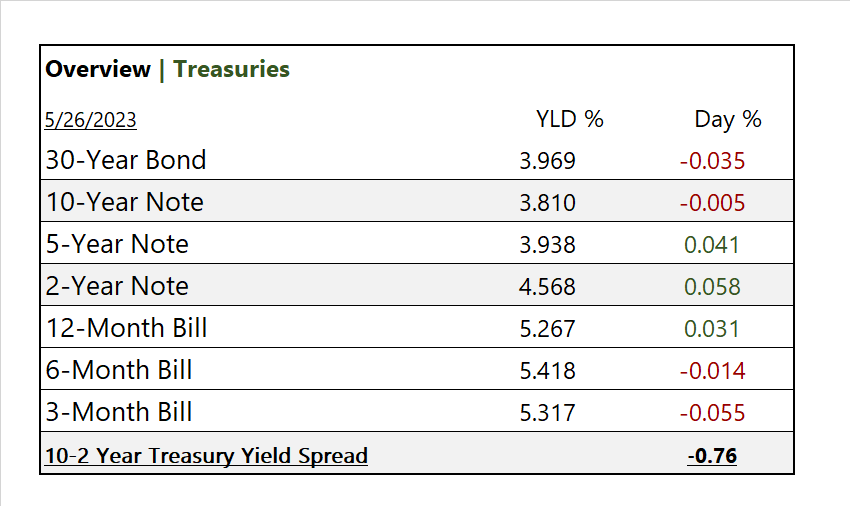

US Treasuries

Notable Earnings Today

- +Beat: PDD Holdings DRC (PDD), Booz Allen Hamilton (BAH)

- – Miss: IVERIC bio (ISEE), PagSeguro Digital (PAGS), Buckle (BKE), Moneygram (MGI)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML)

Economic Data

US

- Durable-goods orders; period April, act 1.1%, fc -0.8%, prev. 3.3%

- Durable-goods minus transportation; period April, act -0.2%, prev. -0.3%

- Personal income (nominal); period April, act 0.4%, fc 0.4%, prev. 0.3%

- Personal spending (nominal); period April, act 0.8%, fc 0.4%, prev. 0%

- PCE index; period April, act 0.4%, prev. 0.1%

- Core PCE index; period April, act 0.4%, fc 0.3%, prev. 0.3%

- PCE (year-over-year); period April, act 4.4%, prev. 4.2%

- Core PCE (year-over-year); act 4.7%, fc 4.6%, prev. 4.6%

- Advanced U.S. trade balance in goods; period April, act -$96.8B prev. -$82.7B

- Advanced retail inventories; period April, act 0.2%, prev. 0.5%

- Advanced wholesale inventories; period April, act -0.2%, prev.-0.3%

- Consumer sentiment (final); period May, act 59.2, fc 57.7, prev. 57.7

News

Company News

- AI Stocks Are Flying, but Don’t Call the Craze a Bubble – WSJ

Energy/ Materials

- Phasing Out Fossil Fuels Hasn’t Worked. Europe Has a New Idea for COP28 – Bloomberg

Central Banks/Inflation/Labor Market

- Fed ‘pause’ on rate hikes in doubt after strong US data – Reuters

- Biden Says Debt-Ceiling Deal Is ‘Very Close’ – WSJ

China

- China Industrial Profits Slide as Weak Demand Weighs on Economy – Bloomberg

- Speculators Boost Yen Shorts to Most in a Year as Currency Slips – Bloomberg