What Is an Economic Cycle?

The term economic cycle refers to the fluctuations of the economy between periods of expansion (growth) and contraction (recession). Factors such as gross domestic product (GDP), interest rates, total employment, and consumer spending, can help to determine the current stage of the economic cycle. Understanding the economic cycle can help investors and businesses understand when to make investments and when to pull their money out, as it has a direct impact on everything from stocks and bonds, as well as profits and corporate earnings.

Article contents

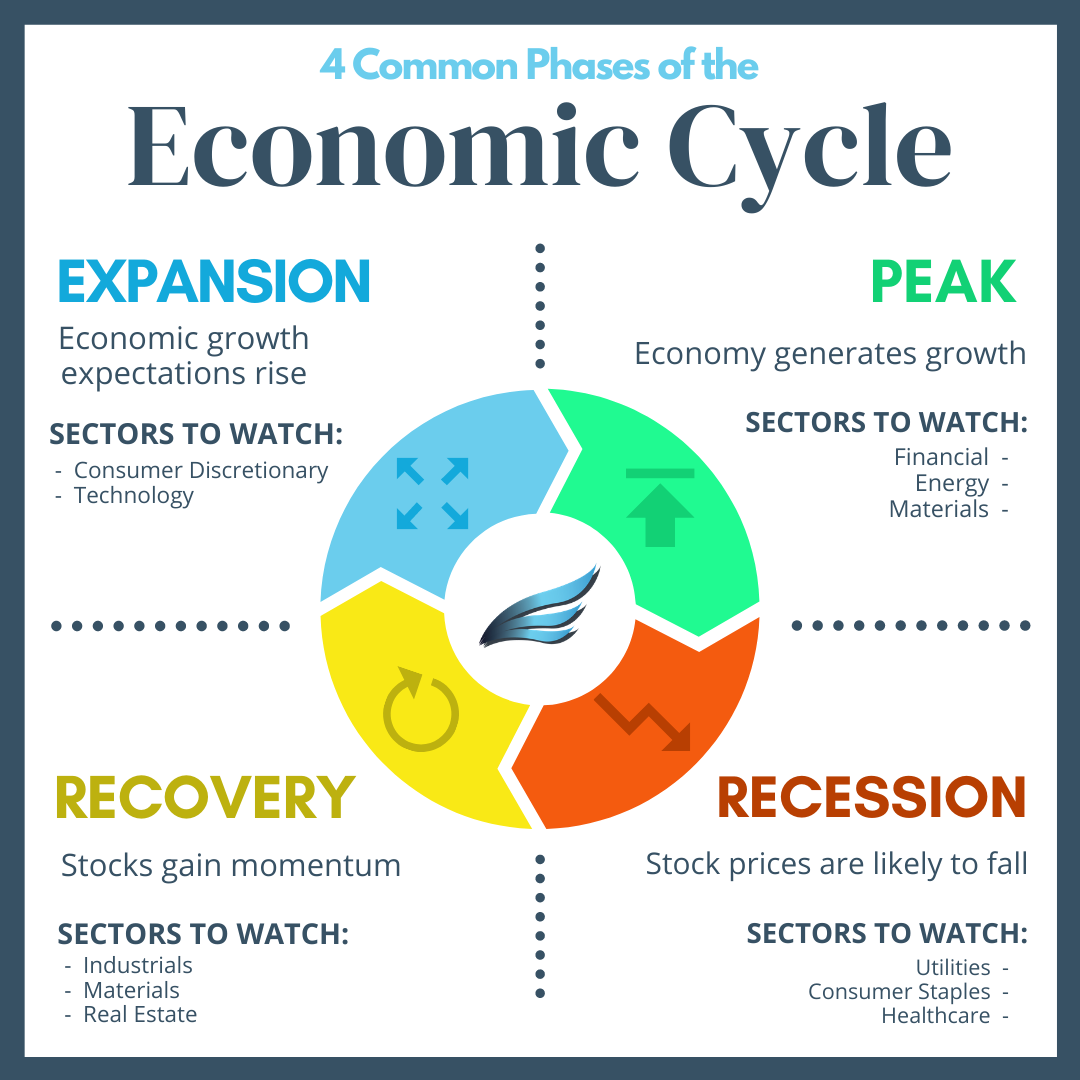

- An economic cycle is the overall state of the economy as it goes through four stages in a cyclical pattern.

- The four stages of the cycle are expansion, peak, contraction, and trough.

- Factors such as GDP, interest rates, total employment, and consumer spending, can help determine the current stage of the economic cycle.

- Insight into economic cycles can be very useful for businesses and investors.

- The exact causes of a cycle are highly debated among the different schools of economics.

4 Stages of the Economic Cycle

How the Economic Cycle Works

An economic cycle, which is also known as a business cycle, is the circular movement of an economy as it moves from expansion to contraction and back again. Economic expansion is characterized by growth. A contraction, on the other hand, sees it go through a recession, which involves a decline in economic activity that spreads out over at least a few months.