Stay Informed and Stay Ahead: Economic Information, March 14th, 2024.

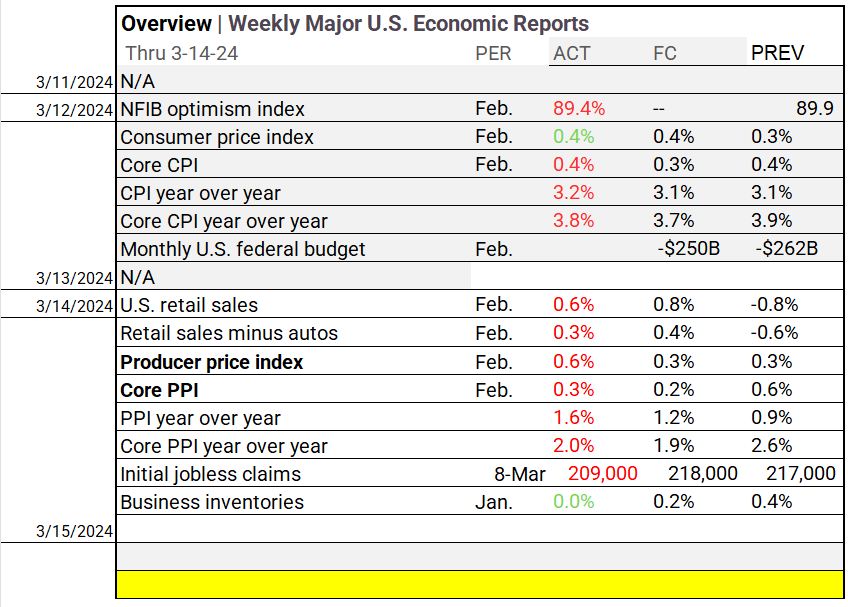

Weekly Major U.S. Economic Reports 3-14-24

There was a downturn in retail sales, while initial jobless claims remained relatively stable. Both the Producer Price Index (PPI) and Core PPI saw slight upticks in February, bolstering year-over-year expansion, with PPI showing a moderate increase and Core PPI demonstrating a more pronounced rise.

Markets continue to price in the path of rate cuts in 2024

The latest inflation data remains sticky, however market estimates for changes in monetary policy are still on track to cut in the near term. The first cut is expected for the June 12 FOMC meeting, according to Fed funds futures, which are currently pricing in a roughly 77% probability for easing on that date.

By contrast, the futures market anticipates that no changes in the target rate are likely at the March 20 and May 1 meetings.