VICA Partners | Op-Ed

The Past Is No Guide: Why Financial Markets Have Outgrown Santayana’s Warning

(Excerpted and adapted for the VMSI Institutional Confidence Indicator, Nov 2025 Edition)

1. From Cycles to Systems — The Architecture Behind VMSI™

The VMSI framework is not built on “economic cycles.”

It’s built on system dynamics — the structural mechanics of a post-liquidity regime.

The table “The Evolution of Market Structure: From Cycles to Systems” illustrates this transformation:

| Dimension | Old Market (Pre-1980s) | Mid-Market (1980–2023) | New Market (Post-2024) |

|---|---|---|---|

| Policy Role | External and reactive | Coordinated but distinct | Fully merged — continuous liquidity management |

| Market Logic | Supply–demand equilibrium | Credit expansion with resets | Reflexive feedback loop — liquidity defines structure |

| Money Creation | Centralized, controlled | Hybrid (policy + private credit) | Endogenous, perpetual via balance sheets |

| Fiscal Dynamics | Deficits funded by growth | Deficits offset by accommodation | Deficits structural, monetized through coordination |

| Monetary Tools | Rates and reserves | QE + forward guidance | Balance sheet policy as baseline |

| Value Driver | Productivity | Financialization | Liquidity flow + narrative reflexivity |

| Risk Profile | Volatility from scarcity | Leverage risk | Fragility from stability |

| Market Function | Price discovery | Policy-guided correction | Policy transmission mechanism — market as infrastructure |

| Investor Behavior | Fundamental allocation | Momentum/carry | Reflexive positioning and narrative trading |

| Framework | Classical / Keynesian | Hybrid Keynesian-Monetarist | Post-liquidity regime — reflexive, continuous |

This is the environment the FORCE-12.2 model and VMSI Index were engineered to quantify.

They measure how liquidity and torque replace productivity and cycles as the dominant market physics.

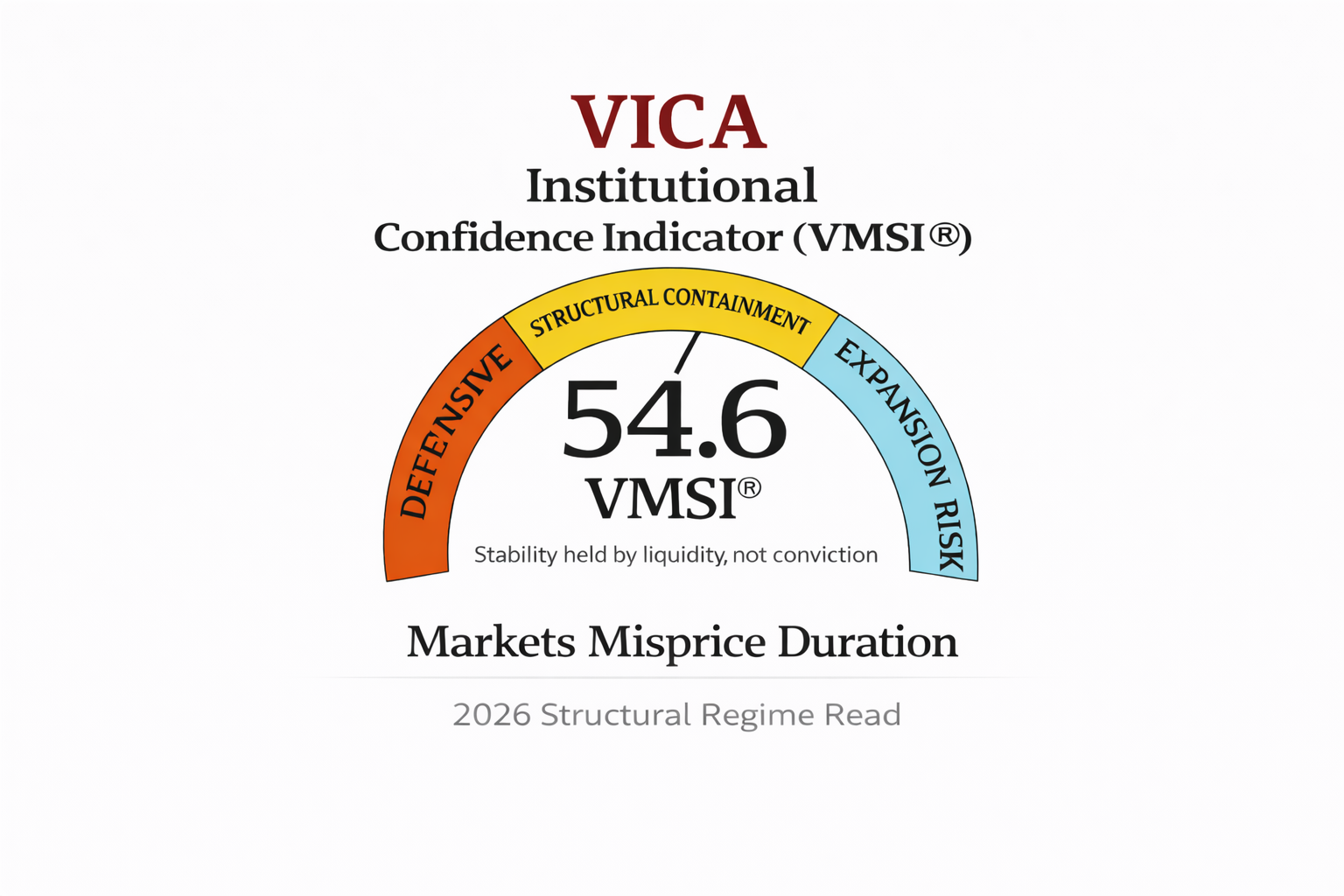

2. VMSI as Structural Barometer

-

Legacy macro models interpret liquidity as policy choice.

-

FORCE-12.2 treats liquidity as structural constant.

-

VMSI™ translates that constant into a measurable signal of institutional confidence versus torque.

The index doesn’t forecast “bull” or “bear.” It measures the efficiency of liquidity transmission — how belief, credit, and execution convert into persistence. When VMSI holds above the 58 compression threshold, liquidity still absorbs risk. When it decays toward 55 or below, liquidity begins transmitting it.

3. The Bubble as Policy Instrument

Liquidity is no longer discretionary easing — it’s systemic adaptation.

Central banks are no longer choosing to add liquidity; they are maintaining solvency within a market architecture that cannot absorb sovereign issuance without balance-sheet expansion.

QE and QT have fused into a continuous feedback loop linking fiscal deficits, reserves, and risk assets. Financial-asset inflation has become the quiet instrument of fiscal balance.

In this regime, bubbles are not anomalies — they are how the system breathes.

Policy is no longer easing into a bubble; the bubble itself is policy.

That is the new monetary-fiscal equilibrium — the foundation the VMSI measures.

4. Why the Past No Longer Predicts

Traditional frameworks — Keynesian, Monetarist, or Supply-Side — assumed scarcity, control, and exogenous policy. Today’s market is reflexive, policy-embedded, and continuous.

It references itself: balance sheets finance, validate, and reinforce their own valuations.

The VMSI™ Indicator is designed for this feedback world. It doesn’t look backward for cycles; it reads forward for structure. It treats liquidity flow, torque efficiency, and crowding inertia as the real economic variables — the physics that explain persistence and fragility.

5. Closing Insight

Santayana’s warning has inverted. Those who cling to the past are condemned not to repeat it — but to misread the present. In this system, the future prices the past first. That’s what the VMSI watches: when structure, liquidity, and confidence synchronize, the system endures;

when they diverge, the system transmits stress.