VICA Institutional Confidence Indicator (VMSI®) Report | December 19, 2025 Condensed Structural Read

VMSI™ FORCE-12.3 | VICA Research

Editorial Note (Holiday Format)

This report is presented in a temporary condensed format due to the year-end holiday period. Full-length VMSI reports — including expanded component analysis, sector matrices, and institutional positioning tables — will resume immediately following the holidays.

Looking ahead to 2026, VICA will also launch a dedicated VMSI Index site, providing public access to the index framework, historical data, and ongoing weekly updates. This platform will serve as the permanent home for the VICA Institutional Confidence Indicator (VMSI®) and its evolving institutional signal set.

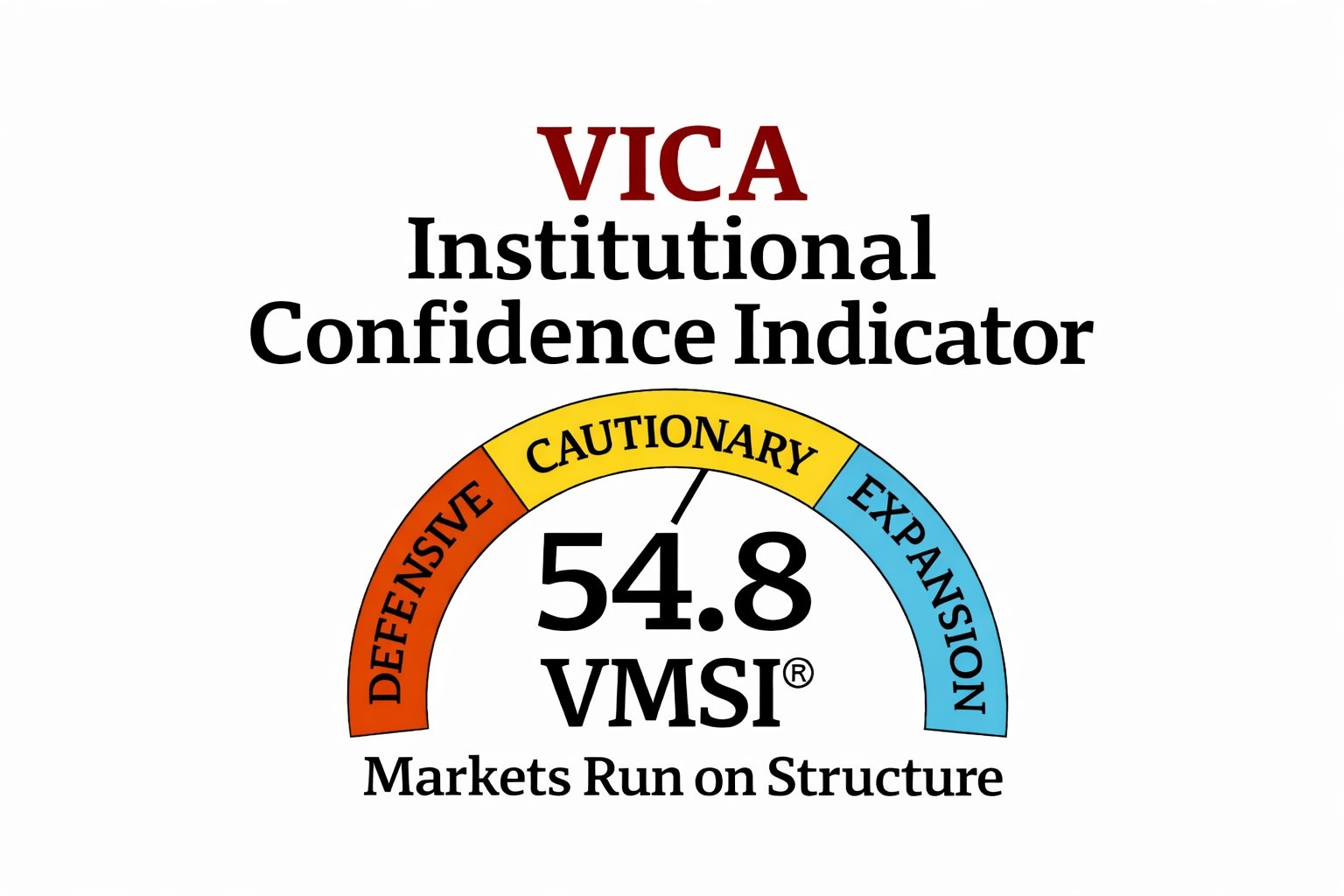

VMSI Composite: 54.8 — Cautionary Optimism

Stability persists, but the system is tightening rather than improving.

Executive Summary

Equity markets continue to rise, but the source of those gains has narrowed materially. Stability is no longer being reinforced by broad participation or accelerating momentum. Instead, it is being maintained through concentrated leadership, selective sector strength, and deliberate risk management.

Sector data makes this clear. Year-to-date performance is dominated by Information Technology (+23.1%), Communication Services (+30.7%), Industrials (+17.9%), Financials (+13.1%), and Health Care (+12.2%). Outside these groups, participation weakens meaningfully. Real Estate (-1.2% YTD), Energy (+2.6% YTD, negative over 1–3 months), and Consumer Staples (+2.1% YTD) continue to lag on intermediate horizons.

Breadth has stabilized at the index level, confirmed by the NYSE Composite holding above all major moving averages. However, trend strength remains subdued and dispersion elevated. This is not a market expanding through demand — it is one being supported through structure.

This is not a breakdown regime. But it is no longer an organically expanding one.

Stability persists through design, not conviction.

VMSI Component Breakdown

Momentum: 53.1

Momentum remains positive but selective. While the S&P 500 is up over 16% year-to-date, leadership is concentrated in a narrow subset of sectors. Short-term and medium-term performance across defensives and cyclicals remains inconsistent, confirming a drift regime rather than an impulse phase. Gains continue, but momentum is no longer self-reinforcing.

Liquidity: 54.9

Liquidity remains functional, but increasingly concentrated. Financials and Industrials continue to absorb capital efficiently, while weaker participation in Real Estate, Energy, and Staples confirms declining breadth. Execution capacity remains intact, but scaling efficiency continues to fall. The system moves — but does not broaden.

Volatility & Hedging: 56.4

Surface volatility remains suppressed, but internal hedging signals persist. Elevated equity put/call ratios, firm skew, and compressed volatility-of-volatility indicate that investors are actively managing downside while remaining invested. Risk has shifted location — not disappeared.

Safe Haven Demand: 58.9

Defensive positioning remains elevated but orderly. Persistent demand for the 7–10 year Treasury belly, alongside relative strength in Utilities (+11.7% YTD) and Health Care (+12.2% YTD), confirms hedging against growth and policy risk rather than systemic stress. Safe-haven behavior remains deliberate.

Structural Signals That Matter

-

Sector dispersion widened, reinforcing corridor-only participation

-

Leadership remains concentrated in Technology, Communication Services, Industrials, and Financials

-

Defensives outperform selectively, not universally

-

Real Estate and Energy lag, confirming rate and growth sensitivity

-

Duration demand persists, centered in the Treasury belly

Volatility is not resolved — it is being absorbed.

Sector Positioning (Condensed)

Overweight / Structural Corridors

-

Communication Services — durable leadership, strong multi-horizon returns

-

Information Technology — AI remains the primary structural spine

-

Industrials — balance-sheet quality and consistent participation

-

Health Care — defensive convexity with improving medium-term momentum

-

Select Financials — credit-anchored carry and liquidity density

Underweight

-

Consumer Discretionary — late-cycle sensitivity and uneven demand

-

Consumer Staples — low momentum, limited upside participation

-

Materials — mixed trends and fading torque

-

Energy — negative intermediate-term momentum and volatility sensitivity

Predictive Outlook

Continuation remains possible, but only through precision and liquidity density.

-

45% — Liquidity-Led Continuation Narrow, corridor-based grind supported by stable credit and suppressed volatility

-

40% — Divergence Drift Momentum fades further, dispersion increases, and sleeve-selection risk rises

-

15% — Convexity Shock Low probability, but structurally rising risk as hedging converts into repricing

Two conditions continue to define regime stability:

-

High Yield must remain contained

-

Volatility of volatility must remain suppressed

A breach in either forces repricing, not collapse.

Tactical Focus

This is not a broad-beta market. It is a corridor-only regime.

Maintain exposure only where:

-

Liquidity density is high

-

Balance sheets are strong

-

Duration support reinforces equity stability

Treat upside as conditional, not momentum-driven.

Conclusion

The VMSI at 54.8 confirms a market that remains stable — but increasingly engineered. Index-level breadth has stabilized, yet participation continues to narrow. Volatility is suppressed, but protection demand is elevated. Liquidity corridors and duration demand are doing the work that broad momentum no longer can.

Stability holds. Efficiency declines. Precision matters.

This is a market held together by design, not conviction.

Source: VICA Partners Research © VICA Research – Proprietary Market Intelligence

About the VICA Institutional Confidence Indicator Index (VMSI®)

The VMSI is VICA Research’s proprietary sentiment gauge designed to track institutional risk behavior, liquidity dynamics, volatility structure, and defensive rotation. It is engineered for tactical capital positioning — not headline emotion.

This report is for informational and educational purposes only and does not constitute investment advice. Unauthorized reproduction or redistribution is prohibited.