Procedural Framework for Policy Assessment in Modern Capital Markets

Abstract

Traditional monetary policy assessment frameworks rely heavily on realized macroeconomic outcomes—employment, inflation, output—to evaluate transmission effectiveness. While essential, these variables are frequently lagging confirmations rather than real-time transmission indicators. In modern capital markets, policy expectations and implementation transmit first through volatility regimes, hedging costs, liquidity conditions, and credit risk premia, which can tighten financial constraint before macro endpoints reflect deterioration. This paper proposes a procedural sequencing framework for measuring monetary transmission as a staged constraint process. Using observable public indicators, the framework emphasizes lead-lag structure: market-based risk constraint emerges first, credit and firm-level adjustment follows, and labor-market confirmation occurs last. The objective is not policy prescription, but measurement timing discipline.

Why I’m Publishing This

Modern monetary transmission is increasingly measured at the wrong point in the process.

In today’s reflexive, market-driven system, tightening transmits first through volatility pricing, hedging costs, liquidity conditions, and credit constraint—often well before labor and inflation data confirm stress. By the time traditional macro indicators validate tightening, the adjustment cycle is frequently already embedded.

I’m publishing this framework to propose a procedural measurement lens for real-time transmission assessment. It is descriptive, not prescriptive, and is intended to improve clarity around where financial constraint becomes binding in modern capital markets.

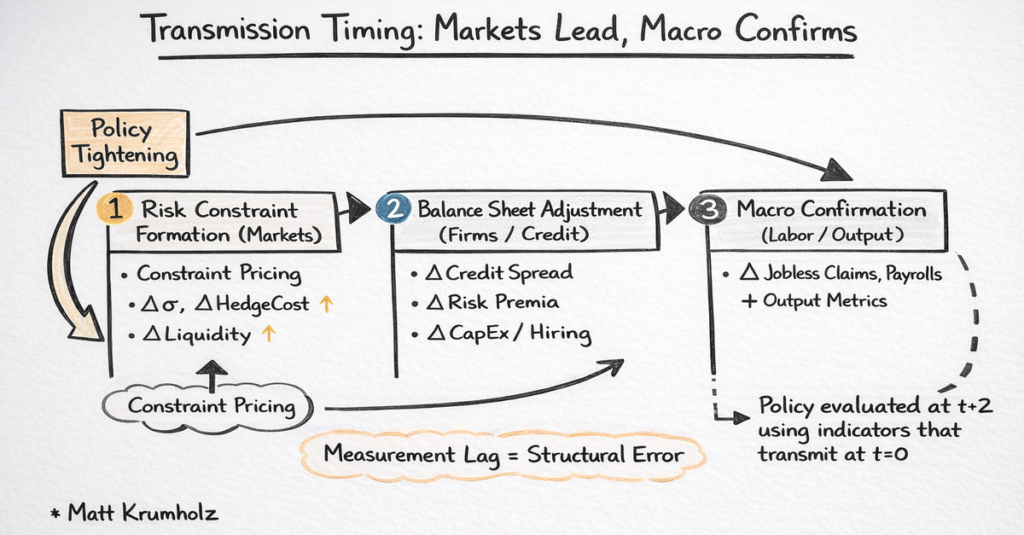

Figure 1: Conceptual Transmission Sequencing

The diagram below summarizes the core sequencing problem: monetary transmission begins through market-imposed risk constraint, propagates into credit and corporate adjustment, and confirms later through labor-market and macroeconomic endpoints.

1. Definition: Transmission as a Constraint Process

In this framework, monetary transmission is defined as the process by which monetary policy expectations and implementation alter financial constraints, funding conditions, and real-economy behavior through time.

The core premise is that transmission should be evaluated where constraint first binds—within capital markets—rather than exclusively through lagging macro confirmation.

2. The Measurement Problem

The central challenge facing modern monetary and fiscal authorities is no longer a lack of information, but a structural misalignment between where policy transmits and where policy effectiveness is measured.

Traditional policy evaluation relies primarily on realized macro outcomes—employment, inflation, wages, output. These variables remain essential, but they are endpoints. They confirm the effect of tightening only after constraint has already propagated through financial markets and firm-level behavior.

In modern capital markets, repricing occurs continuously. Balance sheets adjust in real time. Risk is managed dynamically. Yet policy assessment remains anchored to slower-moving macro indicators that respond only after constraint has already been internalized.

This produces systematic timing error: the tightening cycle is frequently identified only after it has become economically binding.

3. Why Legacy Frameworks Underweight Capital-Market Constraint

The post–Global Financial Crisis environment differs fundamentally from the system in which many legacy policy models were developed.

In modern markets, transmission occurs first through channels that are not always visible in headline macro indicators:

-

volatility regimes and hedging costs

-

collateral constraints and margin sensitivity

-

liquidity premia and risk premia repricing

-

convexity dynamics in rate-sensitive positioning

-

credit spread widening and refinancing conditions

-

institutional positioning shifts and defensive rotation

These channels are not secondary. They increasingly represent the first-order mechanism by which policy is transmitted into the real economy.

4. Reflexivity: Why Transmission Is Not Linear

A defining feature of the modern system is that transmission is reflexive.

Markets do not merely respond to policy—they continuously price expected reaction functions. Tightening may therefore emerge through market-imposed constraint even before policy decisions fully materialize. This introduces endogeneity into traditional measurement: financial conditions are not merely downstream outputs of policy, but active intermediaries translating expected policy paths into immediate funding conditions.

This framing is consistent with the broader literature on financial conditions indexes, shadow-rate frameworks, and risk-premia transmission models, which treat market pricing as an early constraint mechanism (e.g., Bernanke & Gertler, 1995; Gilchrist & Zakrajšek, 2012; Wu & Xia, 2016).

In practical terms, policy may transmit into the system at t = 0, while policymakers may observe confirmation only at t + 2. That gap is structural.

5. Hypothesis: A Sequenced Transmission Ordering

This paper proposes a testable sequencing hypothesis:

H1: Market-based risk constraint indicators lead credit and firm adjustment indicators, which in turn lead labor-market confirmation indicators.

The claim is not that volatility or spreads mechanically cause labor deterioration. Rather, these variables serve as observable state indicators capturing the system’s marginal risk constraint, which labor and output typically reflect later.

6. A Procedural Framework for Modern Monetary Transmission

Transmission can be evaluated as a three-stage process:

Stage 1: Risk Constraint Formation (Markets Lead)

Transmission begins when financial markets impose marginal constraint on risk-taking.

This is expressed through volatility pricing, hedging demand, liquidity conditions, and convexity cost. Indicators such as VVIX (implied volatility of volatility) can serve as real-time proxies for institutional hedging pressure and regime instability.

At this stage, macro data may remain stable. However, the marginal cost of risk rises, liquidity becomes selective, and positioning becomes defensive.

Stage 2: Balance Sheet Adjustment (Credit and Firms Respond)

As market constraint rises, firms and credit markets respond rationally.

This typically appears through tightening credit conditions, repricing of refinancing risk, widening spreads, reduced marginal lending capacity, and higher hurdle rates. Spread widening often reflects the point at which constraint becomes visible across funding channels.

This stage is where tightening becomes economically consequential: capex slows, forward hiring intent weakens, inventory posture tightens, and corporate risk appetite declines.

Stage 3: Macro Confirmation (Labor Confirms Last)

Labor-market deterioration typically confirms transmission last.

Initial jobless claims, payroll deceleration, and unemployment stress tend to emerge only after firms have exhausted flexibility. By the time labor confirms tightening, transmission is no longer forming—it is embedded.

This is why labor data is best interpreted as confirmation rather than early transmission.

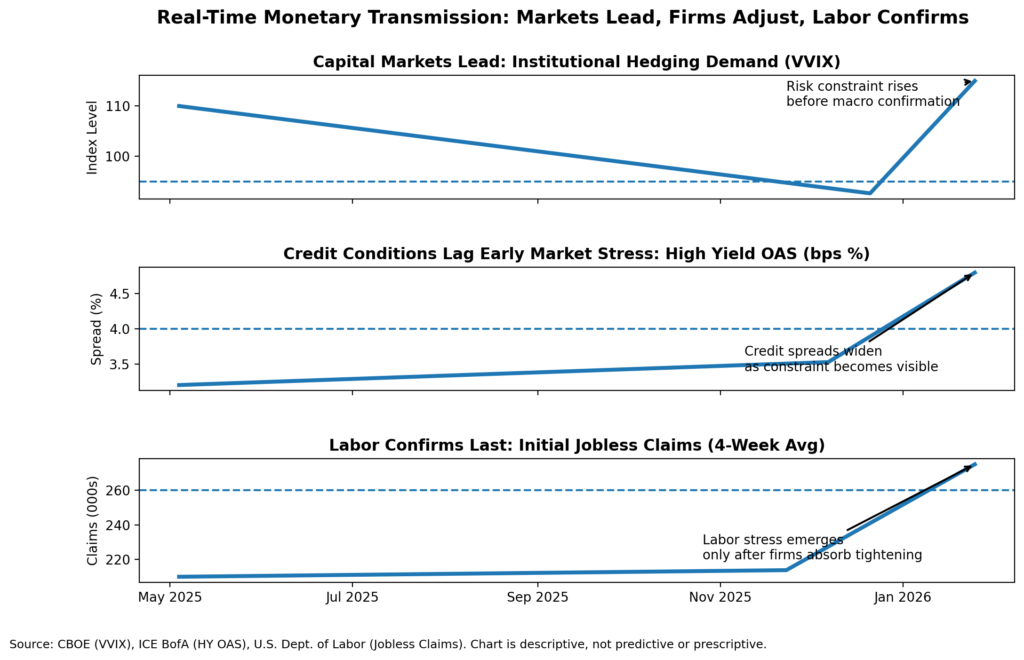

7. Empirical Illustration: Public Indicators Exhibit the Sequencing

The chart below operationalizes the framework using observable public indicators:

-

VVIX as a proxy for institutional hedging demand and volatility regime constraint

-

High Yield Option-Adjusted Spread (HY OAS) as a proxy for credit tightening and refinancing risk repricing

-

Initial Jobless Claims (4-week average) as a proxy for labor-market confirmation

The purpose of this exhibit is to illustrate sequencing relationships rather than provide a forecasting model. Magnitudes are not directly comparable across panels; ordering is emphasized.

8. Interpretation: The Ordering Is the Signal

The sequencing itself is the core insight.

When volatility-based constraint rises, tightening often begins to bind. When credit spreads widen, constraint becomes visible in financing conditions. When jobless claims rise, tightening has moved from financial repricing into labor-market confirmation.

This implies that evaluating transmission primarily through labor and inflation data risks systematic lag. In a reflexive system, the earliest binding constraint is often visible first in risk pricing and funding channels.

9. Policy Implications: Measurement Discipline Without Prescription

This framework does not prescribe policy action. It does not argue for easing or tightening. It proposes a procedural measurement improvement: evaluating monetary transmission as a staged constraint process rather than relying primarily on lagging outcome confirmation.

In practical terms, it can function as a diagnostic overlay to existing policy models by clarifying whether constraint is currently volatility-driven, credit-driven, or labor-confirmed. This does not replace mandate-based indicators; it strengthens timing discipline.

Improved timing measurement reduces reliance on narrative inference, strengthens reaction function consistency, and reinforces institutional independence through process rather than assertion.

10. Institutional Capital Implications

This sequencing is equally relevant for institutional capital allocation.

Markets frequently tighten before macro data deteriorates and recover before macro data improves. This is consistent with forward discounting, liquidity repricing, and positioning dynamics.

For allocators, the most critical signal is often not the macro print itself, but the upstream regime shift occurring in hedging demand, liquidity conditions, and credit repricing.

In this sense, monetary transmission is not only a policy topic. It is a market structure topic.

11. Limitations and Future Work

This framework is intended as a measurement lens rather than a complete econometric model.

Future work may include:

-

formal lead-lag estimation across regimes

-

multivariate filtering of risk constraint state variables

-

incorporation of dealer balance sheet constraints and repo funding measures

-

cross-validation against historical tightening cycles

Conclusion

Modern monetary systems require modern measurement.

By treating transmission as a staged process—beginning in volatility and hedging constraint, progressing through credit and firm-level adjustment, and confirming through labor outcomes—this framework offers a repeatable, non-directive approach to assessing policy impact with improved timing precision.

If further developed, this work naturally extends into an operational policy playbook focused on stress-testing procedures, sequencing diagnostics, and implementation pathways consistent with institutional mandates.

In a reflexive system, transmission is not revealed at the end of the chain.

It is revealed at the point where risk becomes constrained.

Source Note

The attached charts are descriptive, not predictive or prescriptive. They reflect observable sequencing behavior in public market and macro indicators. Sequencing is emphasized; magnitudes are not directly comparable across panels.

References (Selected Anchors)

Bernanke, B. & Gertler, M. (1995). Inside the Black Box: The Credit Channel of Monetary Policy Transmission. Gilchrist, S. & Zakrajšek, E. (2012). Credit Spreads and Business Cycle Fluctuations. Wu, J. C. & Xia, F. (2016). Measuring the Macroeconomic Impact of Monetary Policy at the Zero Lower Bound.