TECHNICAL ANALYSIS

The US Dollar has nose-dived and spiked off the recent highs after prices pulled up just shy of the long-term monthly targets outlined in the last update at 11676/11939. The current intraday high print is 11477, set last Wednesday, and since then the market has swooned…retracing over 62% of the rally off the mid-September bottom of 10768. Right now, the hourly chart is deeply oversold but price action remains near-term bearish. The big question is, could we be looking at an intermediate and perhaps even longer term high in the US Dollar? One indicator is that there was critical timing indicated for September 23rd to the 26th for all the financial markets…and stocks, bonds and the dollar met extremes just a couple days after this critical timing point. For now, we must view the recent extremes as critical and pivotal areas on the daily charts based solely on the powerful timing point that recently occurred.

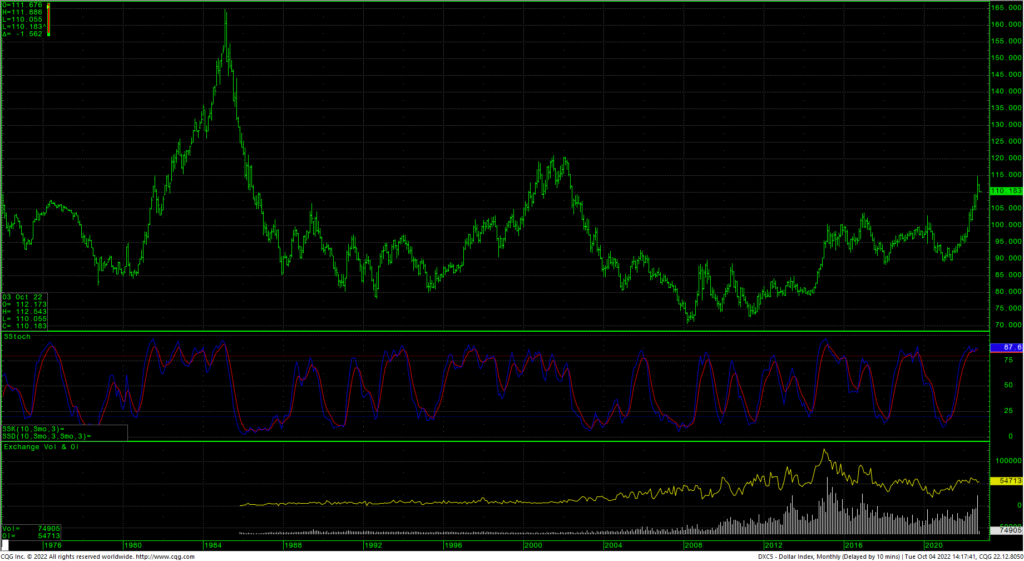

US Dollar Monthly

Back to the short-term charts. Support for the DXC is now key at 10970 with a big pivotal area located at 10950/10935. Critical short-term support is 10850/10840. A breakdown with closes under the 10840 area suggests that the 11477 high is important and can lead to a test of 10768 to 10703. Closes under 10703 opens counts back to the 10500/10495 area. That level now represents intermediate-term support for the Dollar and a breakdown under 10495 could easily carry prices back to 10200 with a shot at 9897/9890.

Short-term resistance is 11117. A drive back over 11117 can test 11204. Resistance is key at 11242 and pivotal against the 11297/11305 level. Closes back over 11305 will open counts to 11360 with potential back to the highs last week at 11477. Daily closes over 11477 are bullish and minimally set up 11679 with potential for the DXC to carry to 11939 and 12102.

Charts courtesy of CQG, Inc.