TECHNICAL ANALYSIS

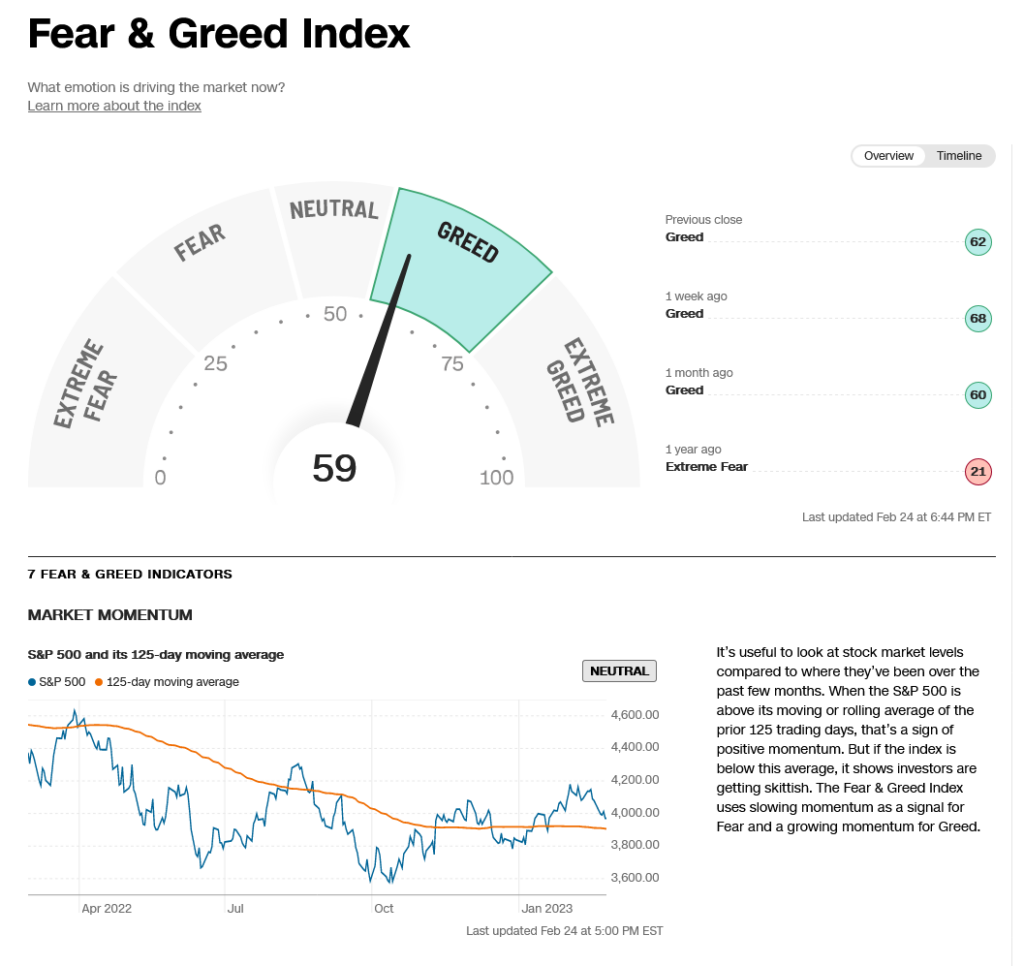

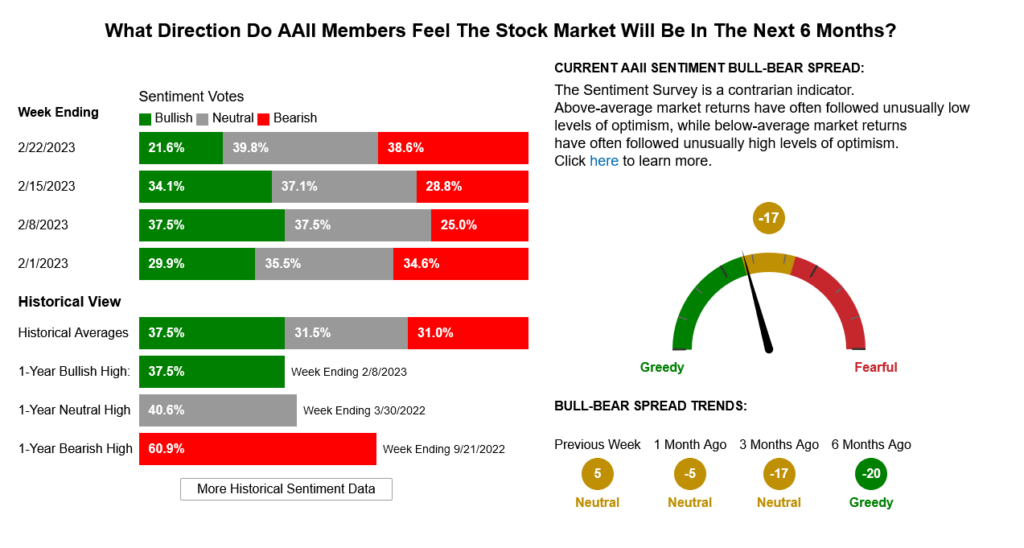

The DJIA opened lower, in a shortened trading week, and never looked back…with prices plunging -2.98% and ending on the bottom of the week’s range at the lowest weekly close since the end of October 2022. On the daily chart, the close is the lowest since December 20, 2022. Overall, the market is now trading the lower 50% of the range that has existed since November 2022, whereby we now have three months of trade basically contained within that month’s H/L. The Dow is down -3.72% on the month with two trading days left in February. The S&P500 followed the Dow with a lower opening on the week and a daily collapse to close on the bottom of the weekly range, down -3.09%. The bearish action shed some of the Bullish/Greed sentiment from investor surveys, leaving the 52-week net new highs and lows at +2.06% (which is still frothy).

Dow Jones Industrial Average Weekly HLC

From a wave count standpoint, the December lows (32573.4) are obviously critical to the chart. With that in mind, a case could be built for a potential “C Wave” objective at 32,192.6 for the Dow. The daily is reaching into slightly oversold conditions with the break while the hourly is flashing a preliminary bullish divergence with Friday’s lows. Prices have taken out critical support at 32860. A further decline under 32860 sets up a move to 32473 and 32400 with the 32573 lows as key. A breakdown under 32400 opens counts to key short-term support of 32192/32170. A breakdown with closes under 32170 sets up 32099 with longer-term potential toward 31727/31686. Closes under 31686 will open counts into the 30972/30960 level with support of 31423 and 31160.

Resistance for the DJIA is 33286 and 33352/33360. Rallies over 33360 can test 33487 with potential to pivotal resistance at 33686/33700. Closes over 33700 open counts to 33909/33933 with potential to carry back toward 34060. A drive above 34060 should retest 34334/34342 with potential to pivotal resistance at 34395/34400. A drive above 34400 opens counts to 34589 and the December swing highs at 34712 and will open potential to a band of long-term resistance at 34879 through 34995/35000.

CNN Fear & Greed Index

AAII Investor Sentiment Survey

Resistance

- 33000 **

- 33041 **

- 33202 **

- 33272/33286 *** ↑

- 33352/33360 *** ↑

- 33487 ***

- 33686/33700 *** ↑

- 33800

- 33900/33933 *** ↑

- 34060 **

- 34160 **

- 34207 **

- 34334/34342 *** ↑

- 34395/34400 ** ↑

Support

- 32800 **

- 32643 **

- 32600/32573 *** ↓

- 32473 ***

- 32400 *** ↓

- 32192/32170 *** ↓

- 32147 **

- 32099 ***

- 32033 **

- 31876 **

- 31727 *** ↓

- 31686 *** ↓

- 31575

- 31423 ***

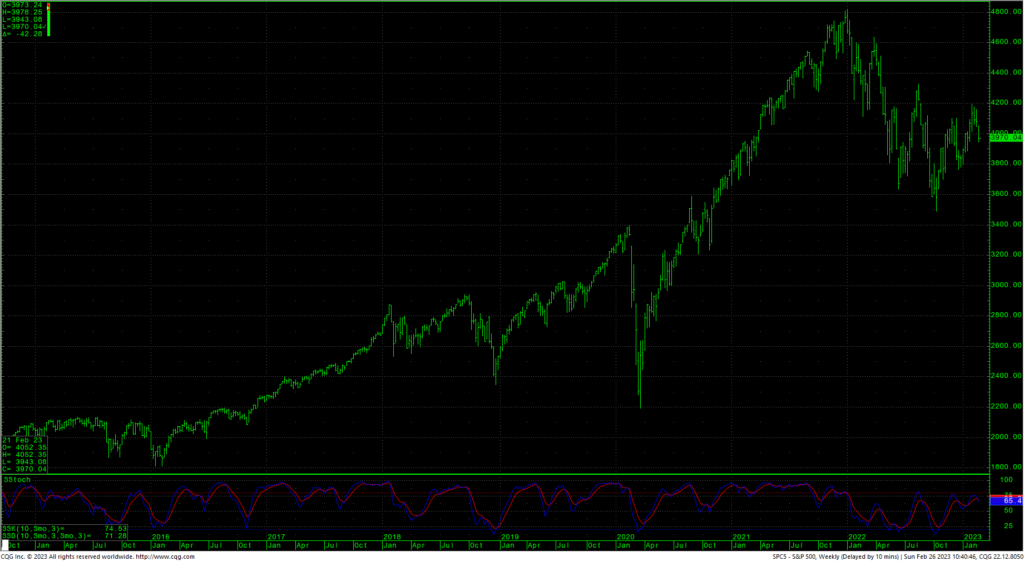

S&P 500 Cash Index

S&P 500 Index Daily HLC

As mentioned above, the S&P index closed down -3% on the week in the bottom of the weeks range. The daily is reaching into slightly oversold conditions and Friday’s close was in the top of the intraday range (while still showing a bearish candle). Another interesting note is that the decline has now carried prices below the trendline on the daily chart…only a few weeks after they pierced the downtrend line in late January. Support is near-term pivotal at 3929/3920. A continued breakdown with closes under 3920 open counts to 3760/3750 with support at 3843 and 3799/3797. Under 3750 sets up a move to 3657 and full potential back to critical support of 3500/3491.

S&P 500 Index Weekly HLC

Resistance is 4002 and 4039/4040. A drive above 4040 can test 4070 with counts to pivotal resistance at 4099/4105. A breakout over the 4105 level gives counts to 4132/4135 with full potential to the gap area at 4203 to 4218 and longer-term counts to critical resistance of 4311/4315. Daily closes over 4315 open counts to 4385 with full potential to long-term critical resistance of 4486/4505. Closes over 4505 can carry to 4593 with full potential toward 4637.

Resistance

- 3978 **

- 4002 **

- 4039/4040 *** ↑

- 4070 **

- 4099/4105 *** ↑

- 4132/4135 *** ↑

- 4203/4218 ***

- 4311/4315 *** ↑

- 4350 **

- 4385 *** ↑

- 4430 **

Support

- 3943 **

- 3929/3920 *** ↓

- 3843/3840 **

- 3810 **

- 3799/3797 *** ↓

- 3760/3750 *** ↓

- 3667/3657 *** ↓

- 3584 **

- 3500/3491 *** ↓