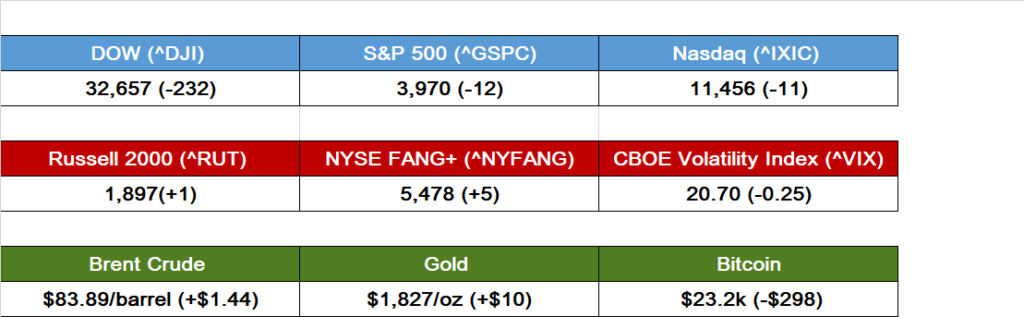

MARKETS TODAY Feb 28 (Vica Partners)

Session Overview

- Economic data mostly soft and better than expected

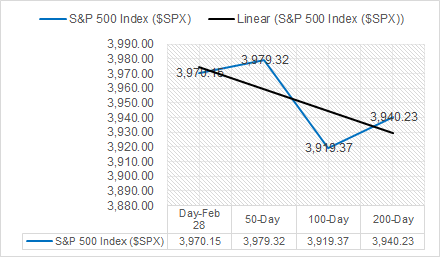

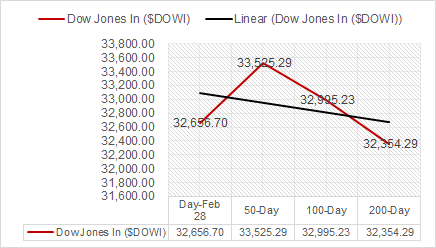

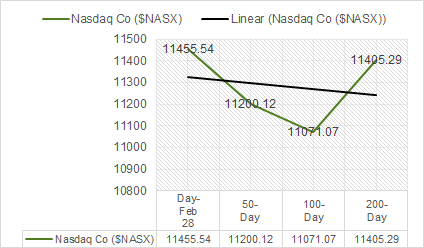

- Indexes fall as they give back early session gains, Dow leads decliners

- Yields rise

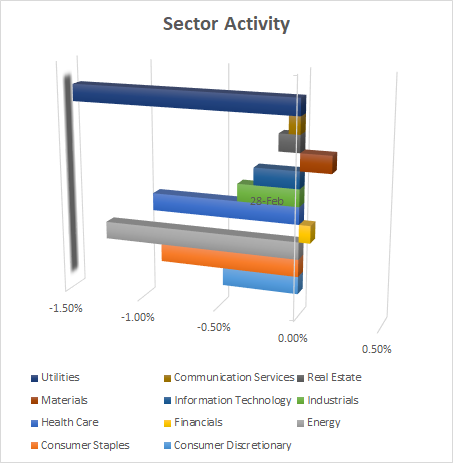

- 9 of 11 S&P sectors lower: Utilities and Energy underperformed/ Materials and Financials outperformed

- Target (TGT), Bayer AG PK (BAYRY), AutoZone (AZO) with solid earning beats

- Greed Index Rating 59/ Greed

- US dollar index rises

- Oil and Natural gas up

- Metals markets were mostly higher

- Bitcoin declines

- Mortgage rates closing in on 7%

Index Charts (50d, 100d, 200d)

Sectors

- 9 of 11 S&P sectors lower: Utilities and Energy underperformed, down 1.44% and 1.24% respectively. Materials and Financials outperformed, up 0.19% and 0.07% respectively

Other Asset Classes:

- US Treasury: 2yr to 4.822%+, 5yr to 4.189%+, 10yr to 3.928%+, 30yr to 3.923%+

- USD index: +0.29 to $104.97

- Oil prices: Brent: +1.75% to $83.89, WTI: +1.63% to $76.91, Nat Gas: +1.06% to $2.760

- Gold: +0.53% to $1,826.85, Silver: +1.33% to $20.90, Copper: +1.61% to $4.08

- Bitcoin: -1.27% to $23.2k

Notable Company Earnings

- Beats/ Target (TGT), Bayer AG PK (BAYRY), AutoZone (AZO), JM Smucker (SJM), Builders FirstSource (BLDR), Advance Auto Parts (AAP)

- Misses/ Bank of Montreal (BMO), Bank of Nova Scotia (BNS), Sempra Energy (SRE), Jones Lang LaSalle (JLL), Nexstar (NXST)

U.S Economic News

Topline

U.S. Trade Balance in Goods came in lower month over month, but better than expected. Advance Retail Inventories for January came in lighter than expected, Advance Wholesale Inventories for the same month reached a negative -0.4%. December Case-Shiller Home Price Index data as prices +5.8% year over year, down from November’s +7.6% as mortgage rates now averaging close 7%. Finally, Consumer Confidence came in below estimates, however inflation survey numbers improving.

Reports

- Advanced U.S. trade balance in goods: period Jan., act -$90.5B, prev. -$89.7B

- Advanced retail inventories: period Jan., act 0.3%, prev. 0.4%

- Advanced wholesale inventories: period Jan., act -0.4%, fc 0.05%, prev. 0.1%

- S&P Case-Shiller home price index: period Dec., act 4.6%, fc 5.2%, prev. 6.8%

- Chicago Business PMI: period Feb., act 43.6, fc 45, prev. 44.3

- Consumer Confidence: period Feb., act 102.9, fc 108.5, prev.106

Business News

- Chevron CEO does not rule out consolidation among oil majors reuters

- Visa, Mastercard pause crypto push in wake of industry meltdown – sources reuters

- Intel releases software platform for quantum computing developers reuters

- Goldman Sachs mulls ‘strategic alternatives’ for consumer business after shortfall reuters

International Related News and Political

- Biden to require chips companies winning subsidies to share excess profits reuters

- Fed might raise policy rates to 6% – BofA reuters reuters

- Oil rebounds almost 2% on China growth hopes reuters

Vica Momentum Stock Report

- Tesla Inc (TSLA) $TSLA (Momentum B-) (Value B) (Growth A+), moving averages/ 50-Day +32.35%, 100-Day -16.80%, 200-Day -15.18%, Year-to-Date +68.47%

Strong Growth Buy Rating

Tesla Inc. operates as a multinational automotive and clean energy company. The Company designs and manufactures electric vehicles, battery energy storage from home to grid-scale, solar panels and solar roof tiles, and related products and services. Tesla owns its sales and service network and sells electric power train components to other automobile manufacturers.

Market Outlook and updates posted at vicapartners.com