MARKETS TODAY March 6 (Vica Partners

Overview

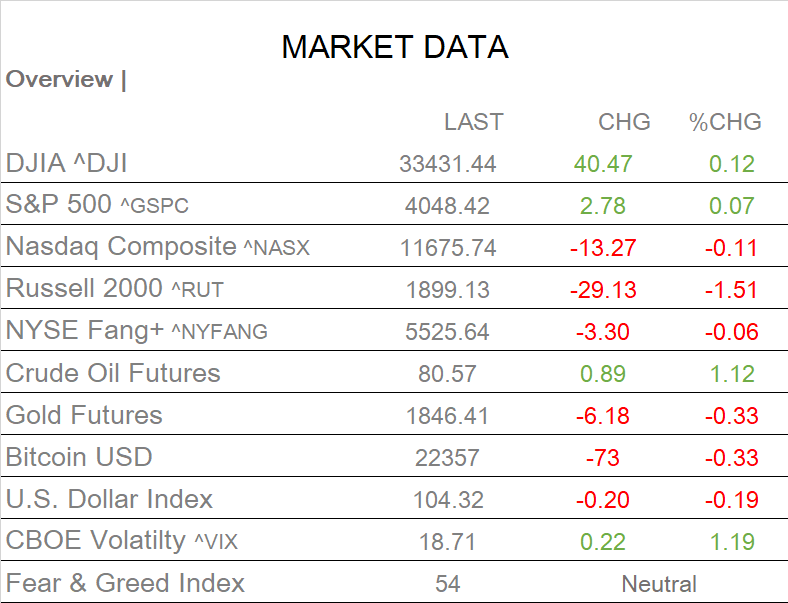

Through the first week of March the three major US indexes finished with gains on average of 2%, boosted by strong business/ services activity. Over the weekend global markets reacted positively as China set a 5% yearly GDP target. The Fed Team reiterated it’s 2% inflation target and need for hikes.

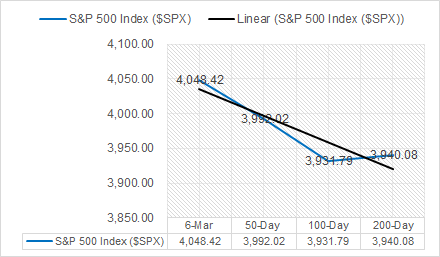

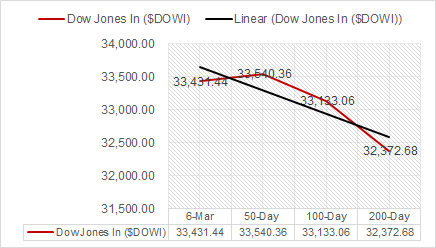

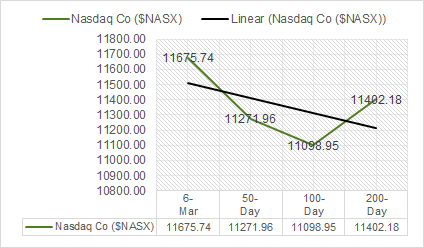

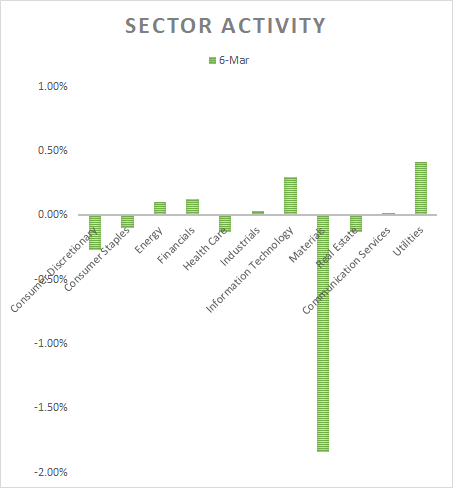

Going into Monday’s session S&P futures were trading +0.25%, right above the 20d ma with Yields steady. In economic news, new orders for U.S.-manufactured goods beat analyst estimates as machinery and other production suggested better than expected results. As for equites, 6 of 11 S&P sectors higher today however Materials lead decliners, down 1.84%. The Dow and S&P500 closed the session higher as the Nasdaq lost.

- Indexes mixed, Dow on a four session win streak

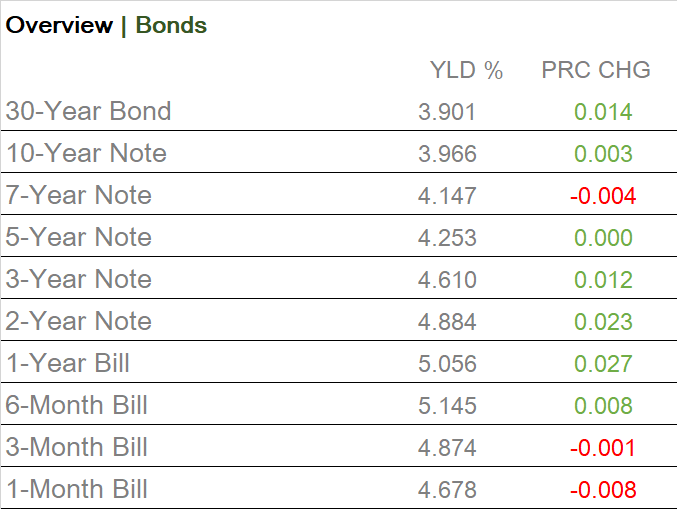

- Yields “muted” rise

- 6 of 11 S&P sectors higher: Utilities and Information Technology outperformed/ Materials and Consumer Discretionary underperformed

- Ciena Corp (CIEN) with a solid earnings beat

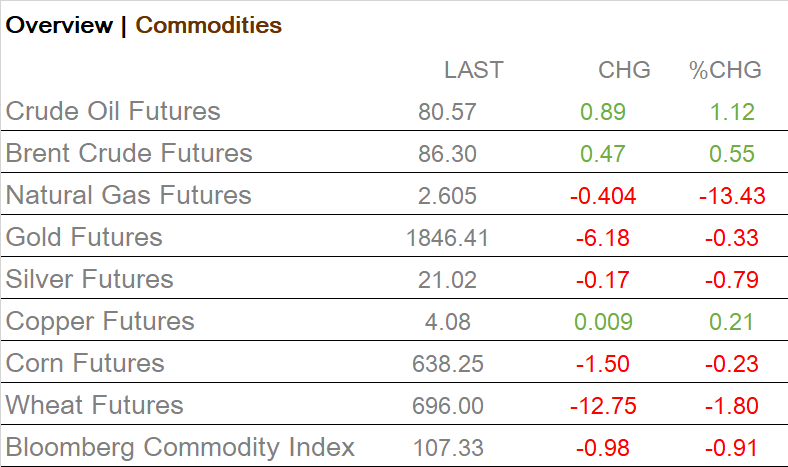

- Crude Oil Futures +up

- USD Index, down

- Bitcoin, lower

Later this Week; Tues/ Weds Fed Chair Powell’s speaks to the Senate and House on monetary policy Weds/ employment data, JOLTS. On Thursday, President Biden will outline his budget proposal for the upcoming fiscal year to Congress. Fri/ February jobs reports. Keep in mind that better than expected February employment numbers could setback Indexes on future hike worries.

Earnings Today:

- Post-Market: AVAV, GWRE, TCOM, TDUP, WW

- Pre-Market: BNED, CIEN, CVGI, DKS, DOLE, FWRG, MANU, SE, SEAT, SQSP, THO

- Post-Market: BASE, CASY, CRWD, SEE, SFIX

Indexes

Sectors/ Commodities/ Treasuries

- 6 of 11 S&P sectors higher: Utilities, +0.41% and Information Technology, +0.30% outperformed/ Materials, -1.84% and Consumer Discretionary, -0.27% underperformed.

Economic Data

- Factory orders: period Jan., act 1.6%, forecast -1.8%, prev. 1.8%. Summary: factory orders dropped 1.6% after increasing 1.7% in December. Analysts had forecast orders declining 1.8%. Orders rose 4.3% on a year-on-year basis in January.

Business News

- California to not do business with Walgreens over abortion pills issue, Governor says – Reuters

- Microsoft integrates AI behind ChatGPT to more developer tools – Reuters

- Tesla cuts U.S. Model S and Model X prices between 4% and 9% – Reuters

Central Banks/Inflation/Labor Market

- S&P 500 ekes out gain, Treasury yields turn higher on eve of Powell testimony – Reuters

Energy

- Oil edges higher on supply tightness, China demand hopes – Reuters

- Exclusive: Russian crude oil heads to UAE as sanctions divert flows – Reuters

China

- Analysis: China’s chip sector needs more than state money to dull impact of US restrictions – Reuters

Market Outlook and updates posted at vicapartners.com