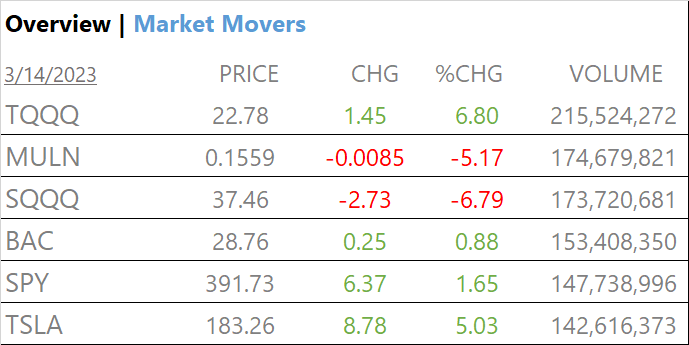

MARKETS TODAY March 14th, 2023 (Vica Partners)

Happy Tuesday!

Yesterday major US indices ended the session mixed with the S&P 500 close to breakeven. The Nasdaq, Fang+ and Tech sector all ended the day higher. The Russell 2000 declined by 1.6%, dropping in-step with the financials.

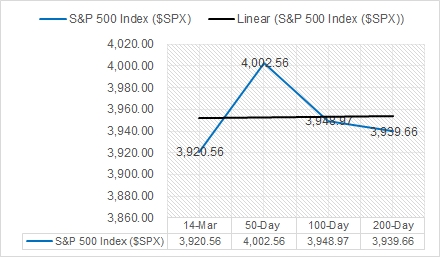

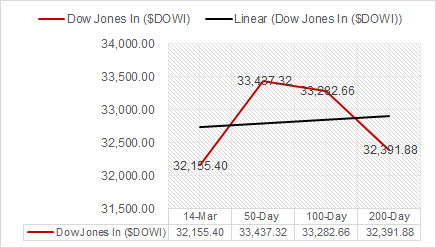

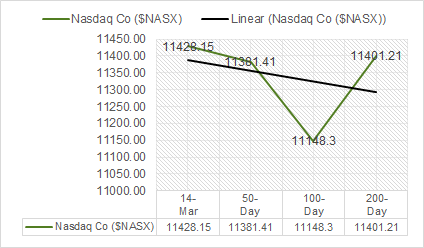

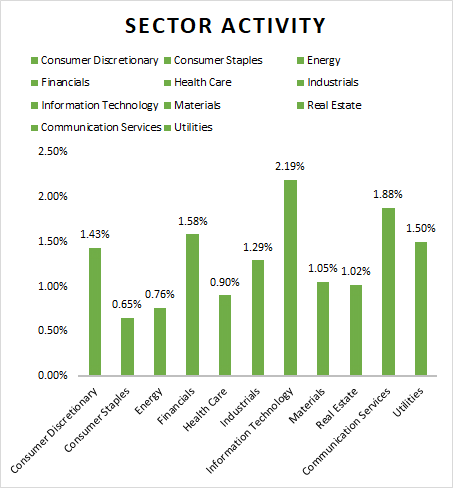

S&P futures were trading higher in premarket on optimism that there might not be interest rate hike next week. Early in session headline CPI and Core annual CPI came in-line with estimates as inflation eased for an eighth straight month in February. At closing, the major Indices finished up, with Nasdaq and NYSE FANG leading. All 11 of the S&P 500 sectors were higher with Information Technology and Communication Services outperforming. Yields reversed from yesterdays trend we sharply up. Bitcoin exceeded $26k at its high today.

Takeaways

- Markets factor in some reprice today on possible hike delay next week

- Headline CPI and Core annual CPI in-line with estimates

- Indexes finished higher, Nasdaq and NYSE FANG lead

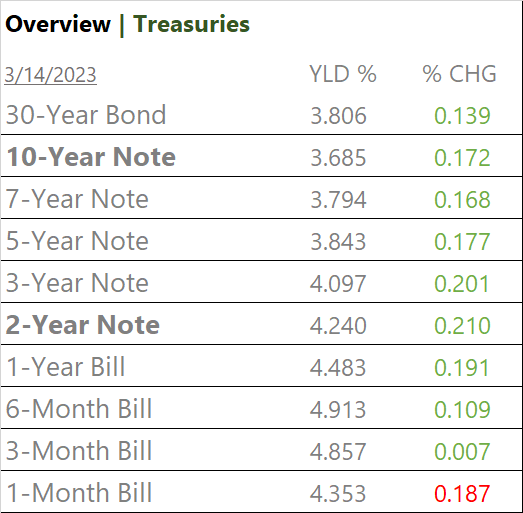

- Yields rise

- All 11 S&500 sectors higher: Information Tech, Communications outperform

- Financial Sector recovers, +1.58%

- Fear & Greed index moderated from Extreme Fear to Fear

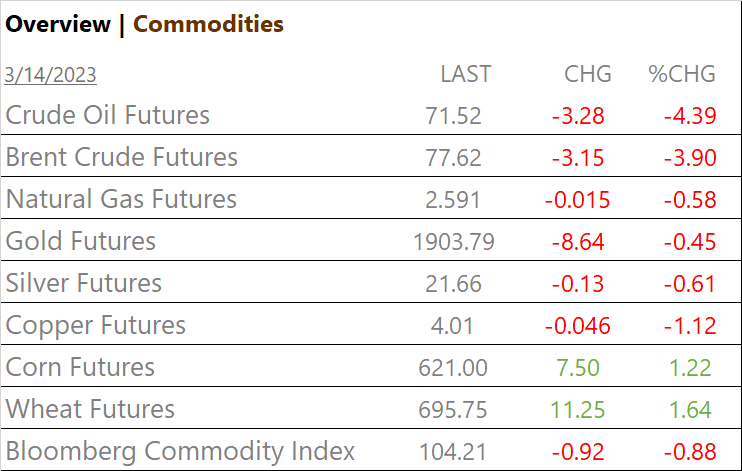

- Bloomberg Commodity Index flat

- Crude Oil Futures down, >3.5%

- Bitcoin, up +20% this week

- USD Index, -down

Last word, Treasury yield rose briskly today, as economists are for sure closely watching the 2/10 spread in inverted curve. We do however have optimism in the markets this Week as inflation worries and Fed hikes diminish- MK

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- All 11 S&P 500 Sectors higher: Information Technology 2.19%, Communication Services 1.88% and Financials 1.58%, outperform/ Consumer Staples 0.65% and Energy 0.76, underperform

Commodities

US Treasuries

Economic Data

US

- NFIB Optimism index; period Feb., act 90.9, fc 90.0, prev. 90.3

- Consumer price index; period Feb., act 0.4%, fc 0.4%, prev. 0.5%

- Core CPI; period Feb., act 0.5%, fc 0.4%, prev. 0.4%

- CPI (year over year); act Feb., act 6.0%. fc 6.0%, prev. 6.4%

- Core CPI ((year over year); period Feb., act 5.5%, fc 5.5%, prev. 5.6%

Summary – Inflation eased for an eighth straight month in February as a slowing rise in food costs offset gasoline prices and rent. Consumer prices increased 6% from a year earlier, down from 6.4% in January and a 40-year high of 9.1% in June, the smallest annual gain since September 2021.

Tomorrow; Retail sales, PPI, Manufacturing and Inventories

News

Company News

- Exclusive: Semiconductor manufacturer Infinera explores sale – Reuters

- JPMorgan, other big U.S. banks flooded with new clients post SVB collapse- Reuters

- Novo Nordisk to slash US insulin prices, following move by Eli Lilly – Reuters

Central Banks/Inflation/Labor Market

- Wall Street ends green as inflation cools, bank jitters ebb – Reuters

- U.S. Treasury says record FDIC cash draw won’t affect debt ceiling ‘X-date – Reuters

Energy

- Energy Chief Defends Allowing Alaska Oil Drilling – Bloomberg

- Crude Oil Inventories Build But Products Take A Tumble – Oilprice.com

China

- China reopening borders to foreign tourists for first time since Covid erupted – BBC

Market Outlook and updates posted at vicapartners.com