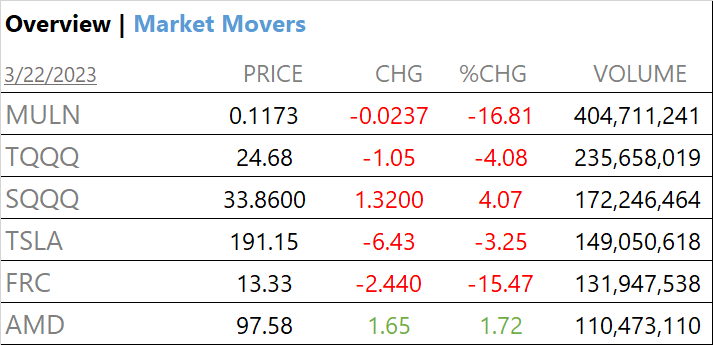

MARKETS TODAY March 22nd, 2023 (Vica Partners)

A good Wednesday afternoon!

Yesterday, US equities closed higher for a second consecutive day with the S&P 500 up 2.2% for the week and recovering from the level it was trading prior to SVB bank failure. Tech/ mega-cap rallied with NYSE FANG+ up 2.30% and re-testing February highs. Strength in the Financial and Energy sector boosted investor confidence and contributed to the rally.

Overnight, Asian markets finished higher today with shares in Japan leading the region. The Nikkei 225 up 1.93% while Hong Kong’s Hang Seng up 1.73% and China’s Shanghai Composite up 0.31%. European markets were higher today with shares in London leading the region. The FTSE 100 up 0.53% while France’s CAC 40 up 0.47% and Germany’s DAX up 0.44%. While S&P futures were unchanged overnight/ premarket awaiting the Fed interest rate decision today.

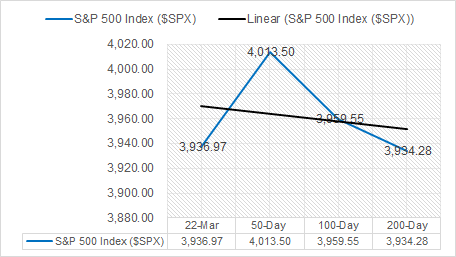

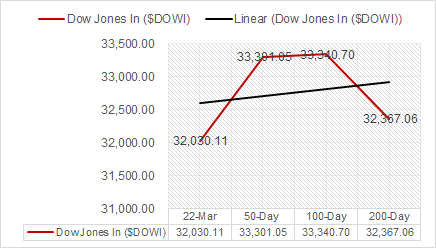

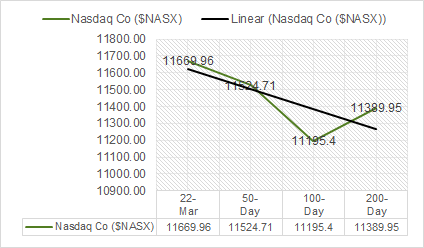

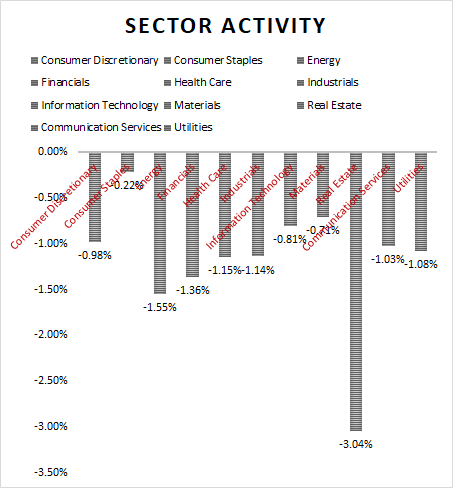

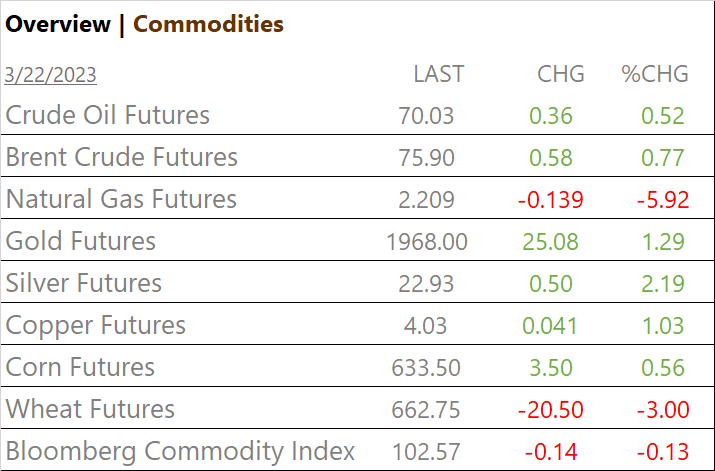

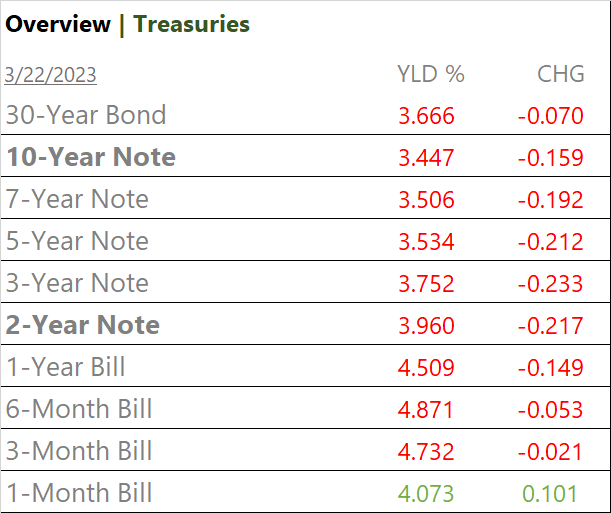

The Federal Reserve raised interest rates by 25bps today however, Janet Yellen’s Wednesday comment to a Senate committee that she’s not considering expanding the FDIC’s insurance limit of $250,000 was “unexpected“. US Indices ended sharply lower as the the S&P 500 closed at 3937, below its important 4k level, wiping out its weekly gains. All 11 of the S&P 500 sectors were lower with Real Estate -3.04% and Energy -1.55% as the biggest decliners. Yields fell, Bitcoin pulled back below $27.5, and the USD Index dropped. Oil futures were modestly up while Gold rose.

In other economic news, Gasoline stocks fell by 6.4 million barrels as compared with analysts’ expectations for a 1.7 million-barrel drop and Mortgage Application volume rose 3% week-on-week but dropped 36% for comp week one year ago.

Takeaways

• As “expected” the Fed raised interest rates today 25bps

• Yellen’s FDIC limits profoundly troubled the market

• Key Indices close sharply lower

• Yields decline across the curve

• All 11 S&P sectors lower: Real Estate falls >3%

• Fear & Greed index rating = Fear

• Bloomberg Commodity Index, flat

• Crude Oil Futures rise

• Bitcoin closes below $27.5k

• Gold/ Silver, up

• USD Index, down

Last word, Janet Yellen’s comments to a Senate committee today that she’s not considering expanding the FDIC’s insurance limit of $250,000 in the midst of the banking crises was damaging. Hey I respect Jay Powell, but don’t you think we might all benefit if the Fed consistently communicated his central message to the Market?

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

• All 11 of the S&P 500 sectors were lower, Real Estate -3.04%, Energy -1.55%, underperform/ Consumer Staples -0.22%, Materials -0.71%, outperform

Commodities

US Treasuries

Economic Data

US

- Mortgage apps: period March, actual +3%, refinance +5% while 30-year fixed-rate mortgages decreased to 6.48% from 6.71%

- Oil Inventories; period March 17, Crude 481.1m barrels +1.1m, fc -1.6m, drop, Gas 229.6m barrels -6.4m barrels, fc -1.7m, Distillate stockpiles 116.4m -3.3m barrels, fc -1.5m.

- FOMC Rate; the Federal Reserve raised interest rates today by a .25 or a quarter of a percentage point.

Summary: The Federal Reserve raised interest rates today by a quarter of a percentage point, its ninth increase within the year. The central bank suggested that end to rate hikes is near with only more increase remaining as officials see slower economic growth in 2023 than they did a year ago. Chairman Powell also addressed the turmoil in the U.S. banking sector, saying the issues were limited to a few banks and emphasized the broader financial system was “sound and resilient.”

Total Mortgage Applications volume rose 3% last week compared with the previous week and 36% lower comp week one year ago. Applications to refinance a home loan increased 5% and were 68% lower comp week one year ago.

Oil Inventories, Gasoline stocks fell by 6.4 million barrels to 229.6 million barrels, as compared with analysts’ expectations for a 1.7 million-barrel drop. Distillate stockpiles, which include heating oil, fell by 3.3 million barrels in the week to 116.4 million barrels, versus expectations for a 1.5 million-barrel drop.

Tomorrow; Jobless Claims, New Home Sales

News

Company News/ Other

- EV charger makers brace for slowdown as new Made In America rules kick in – Reuters

- GameStop soars on short squeeze after swinging to profit, meme stocks rally – Reuters

- Analysis: What’s behind bitcoin’s latest surge? – Reuters

Central Banks/Inflation/Labor Market

- UK inflation surprise pressures BoE to raise rates again – Reuters

China

- A ‘wasted trip’ or ‘good news’? Chinese President Xi Jinping heads home after Russia visit – South China Morning Post

Market Outlook and updates posted at vicapartners.com