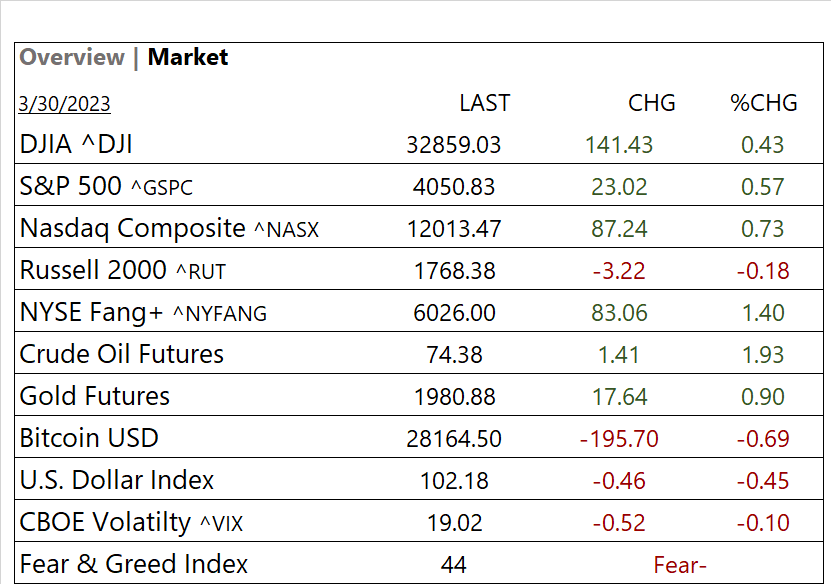

MARKETS TODAY March 30th, 2023 (Vica Partners)

Good Thursday Afternoon,

Yesterday, key Indices closed higher with Nasdaq/FANG+ leading advancers. All 11 of the S&P 500 sectors were higher/ Information Technology and Real Estate out preformed/ defensives lagged.

Overnight, Asian markets finished mixed, the Shanghai Composite gained 0.65%, Hang Seng rose 0.49% and the Nikkei 225 lost 0.36%. Premarket, European markets finished higher today with shares in Germany leading the region. The DAX up 1.35% while France’s CAC 40 up 1.17% and London’s FTSE 100 up 0.78%. S&P futures were trading at 0.6% above fair-value.

US markets, Key Indices closed higher with Nasdaq/FANG+ leading advancers for the 2nd consecutive day. All 11 of the S&P 500 sectors were higher/ Real Estate and Consumer Discretionary outperform, Financials lagged. Yields were mixed while Bloomberg Commodity Index, Oil futures, and Gold were all up. USD Index and Bitcoin down. In economic news, US initial claims came in moderately higher, continuing claims lower. Q4 GDP growth revised down and Fed speakers today suggested a final rate hike in May is possible.

Takeaways

- KRE S&P Regional Banking ETF down about 1%

- Nasdaq/FANG+ mega cap growth lead rally 2nd consecutive day

- Tech outperforms while Financials lag

- Shorter term Yields (10-2 yield spread rising -0.58)

- Fear & Greed Index rating moderating = 44/ Mild Fear

- Bloomberg Commodity Index rises

Pro Tip, Overall, the search engine sector in China is highly competitive and rapidly evolving in the search engine sector, with two major players dominating the market: Baidu and Sogou. Baidu is the largest with a market share of over 70% with expertise in advanced AI technology. Sogou has market share of around 15% and known for its innovative language input technology and recently been acquired by Tencent.

Sectors/ Commodities/ Treasuries

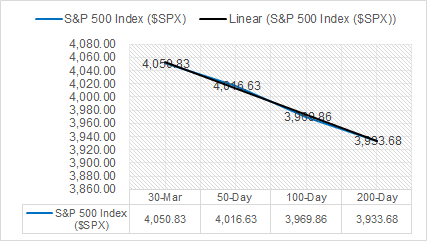

Key Indexes (50d, 100d, 200d)

S&P Sectors

- All 11 of the S&P 500 sectors were higher. / Real Estate +1.26% and Consumer Discretionary 1.21%/ Financials +0.33%, Consumer Staples +0.36% underperform.

Commodities

US Treasuries

Notable Earnings This Week (bold denotes today)

- + BioNTech (BNTX), Walgreens Boots (WBA), McCormick&Co (MKC), Carnival Corp (CCL), PVH (PVH), Cintas (CTAS), Lululemon Athletica (LULU), Paychex (PAYX)

- – Anhui Conch Cement Co (AHCHY), Huazhu (HTHT), Micron (MU), Constellation Software (CNSWF), Concentrix (CNXC)

- * Strong support – Baidu Inc (BIDU), Sociedad Quimica y Minera de Chile (SQM), Alibaba Group Holdings (BABA), Qualcomm (QCOM), Vale (VALE), Rio Tinto (RIO), Analog Devices (ADI)

Economic Data

US

- GDP (2nd revision); period Q4, act 2.6%, fc 2.7%, prev. 2.7%

- Initial jobless claims; period March 25, act 198,000, fc 195,000. prev. 191,000

- Continuing jobless claims; period March 18, act 1.69m, fc 1.70m, prev. 1.69m

- Fed Speakers suggested a final rate hike in May is possible.

- Tomorrow; PCE, PCE Core index, PCE, Core (year-over-year), U Mich consumer sentiment, Chicago Business Barometer

News

Company News/ Other

- Exclusive: Google says Microsoft cloud practices are anti-competitive – Reuters

- Ford in $4.5 bln deal for EV battery materials plant – Reuters

- Starbucks’ Howard Schultz denies chain is against unions – BBC

Central Banks/Inflation/Labor Market

- Signs of pain as easy cash era ends are growing – Reuters

- Closest Stock and Bond Correlation Since 1997 Hinders Diversity – Bloomberg

- FDIC Considers Forcing Big Banks to Pay Up After $23 Billion Hit – Bloomberg

China