MARKETS TODAY April 18th, 2023 (Vica Partners)

Good Tuesday afternoon!

Yesterday, Russell 2000 leads Indices, up +1.2% while NY FANG+ lagged -0.25% and continued underperformance by tech. The Regional banking ETF KRE +3%, M&T Bank up >7.5% on earnings top. 9 of 11 of the S&P 500 sectors higher, Real Estate outperformed. Empire Manufacturing beats, Market priced in 25-basis-point May hike.

Overnight, Asian markets finished mixed, the Nikkei 225 gained 0.51%, the Shanghai Composite + 0.23% and the Hang Seng lost 0.63%. Premarket, European markets finished higher with Germany leading the region, the DAX + 0.59%, France’s CAC 40 + 0.47% and London’s FTSE 100 + 0.38%. S&P 500 US futures were trading .03% above fair value prior to the opening bell.

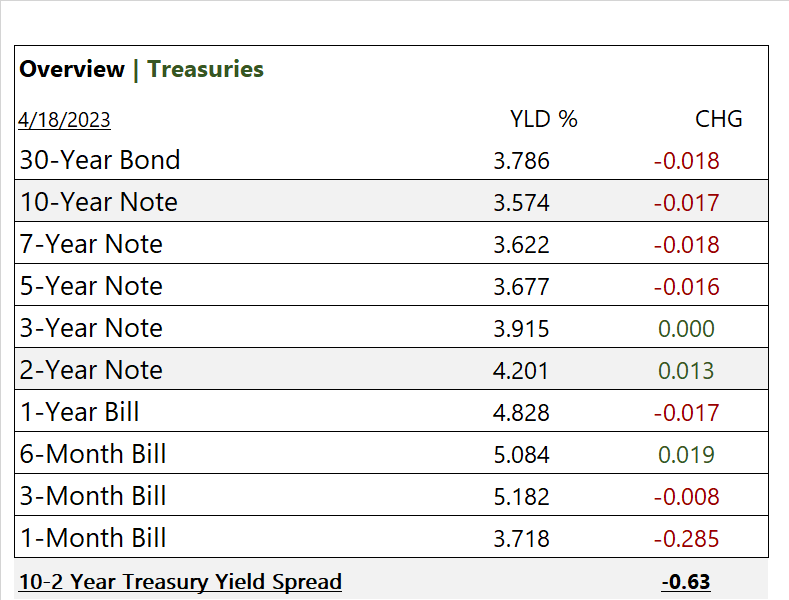

US markets today, key Indices mixed and close moderately lower with S&P 500 and FANG+ leading. 7 of 11 of the S&P 500 sectors finish higher, Materials outperforms /Health Care lags. Yield mostly decline across the curve, 2/10 inversion increasing. Bloomberg Commodity Index, Bitcoin and Gold all gaining. In economic news, overall housing starts declined 0.8%; permits sharply decline 8.8%. However U.S single-family homebuilding starts and permits in March increased.

Takeaways

- Bank of America’s earnings top expectations, Goldman misses

- S&P 500 holds gains

- 7 of 11 of the S&P 500 sectors finish higher, Materials outperforms

- iShares Semiconductor ETF ^SOXX +0.43%

- SPDR S&P Banking ETF ^KRE -2.16%

- Bloomberg Commodity Index on the upswing

- Bitcoin jumps 2.8%

- Fed’s Bullard promotes more rate hikes, expects soft landing

Pro Tip: Artificial Intelligence: The increasing adoption of artificial intelligence (AI) in various industries, such as healthcare, finance, and manufacturing, is expected to drive significant growth in the AI market. Vica forecast the global AI market to grow from USD 58 billion in 2021 to USD 309 billion by 2026, at a CAGR of >39% during the forecast period.

Sectors/ Commodities/ Treasuries

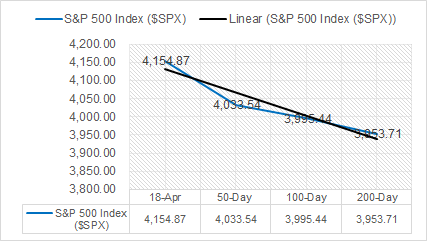

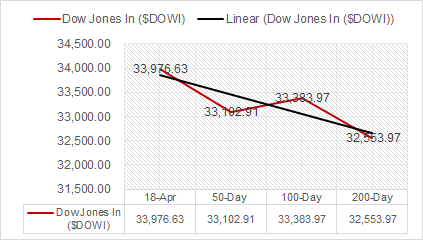

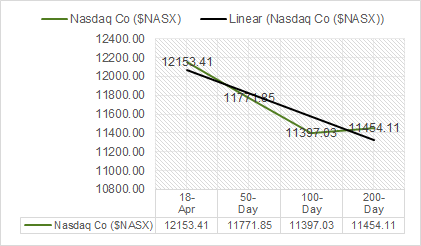

Key Indexes (50d, 100d, 200d)

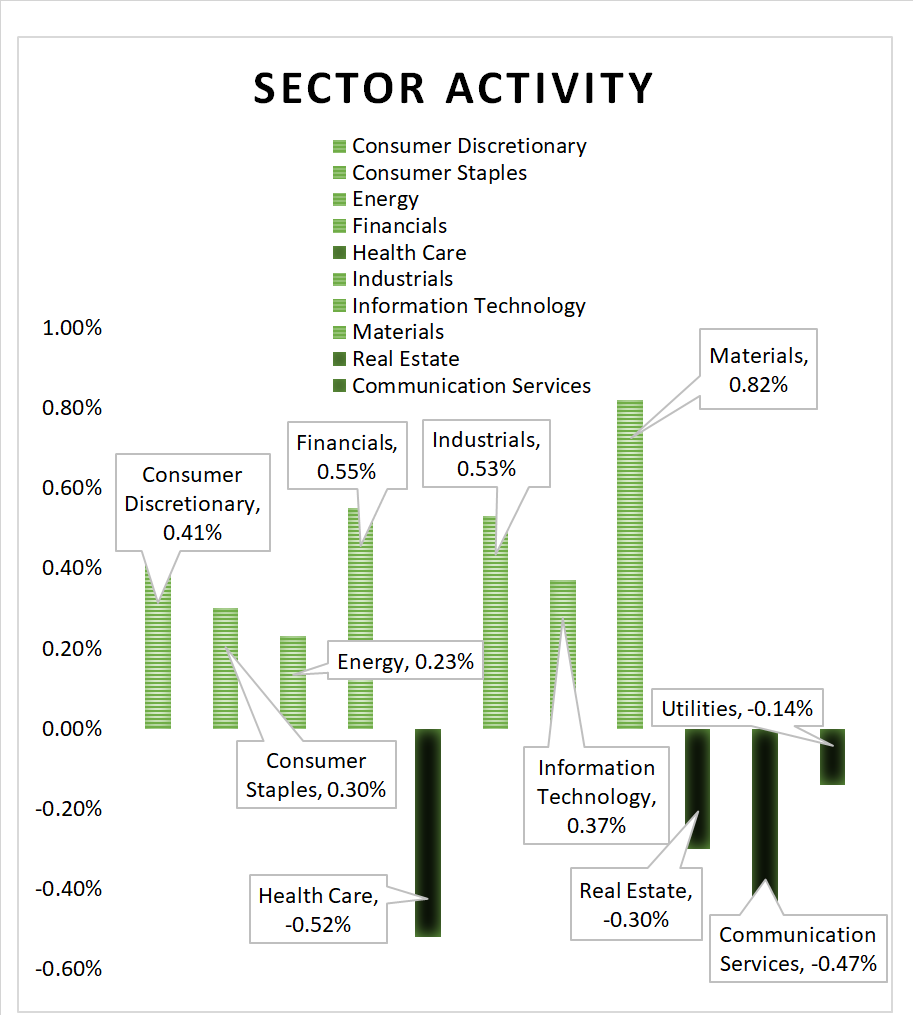

S&P Sectors

- 7 of 11 of the S&P 500 sectors finish higher, Materials +0.82% and Financials +0.55% outperform/ Health Care -0.52% and Communication Services -0.47% underperform

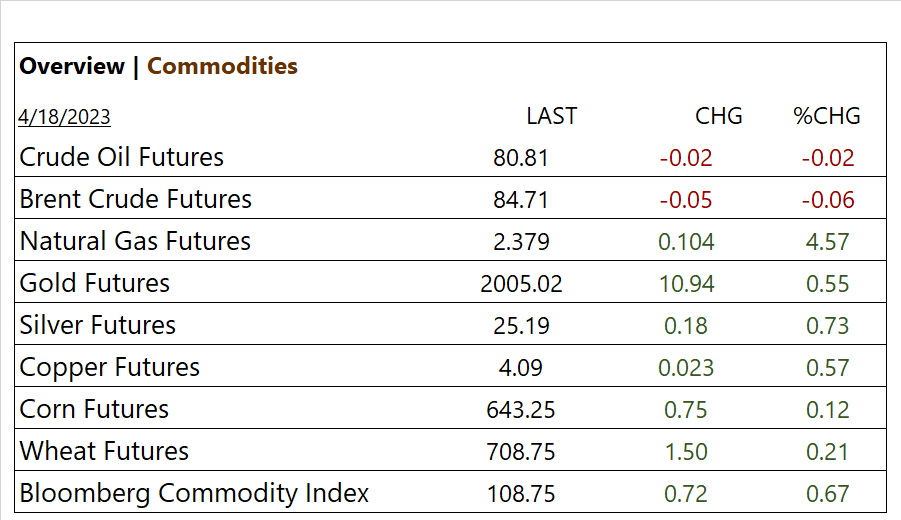

Commodities

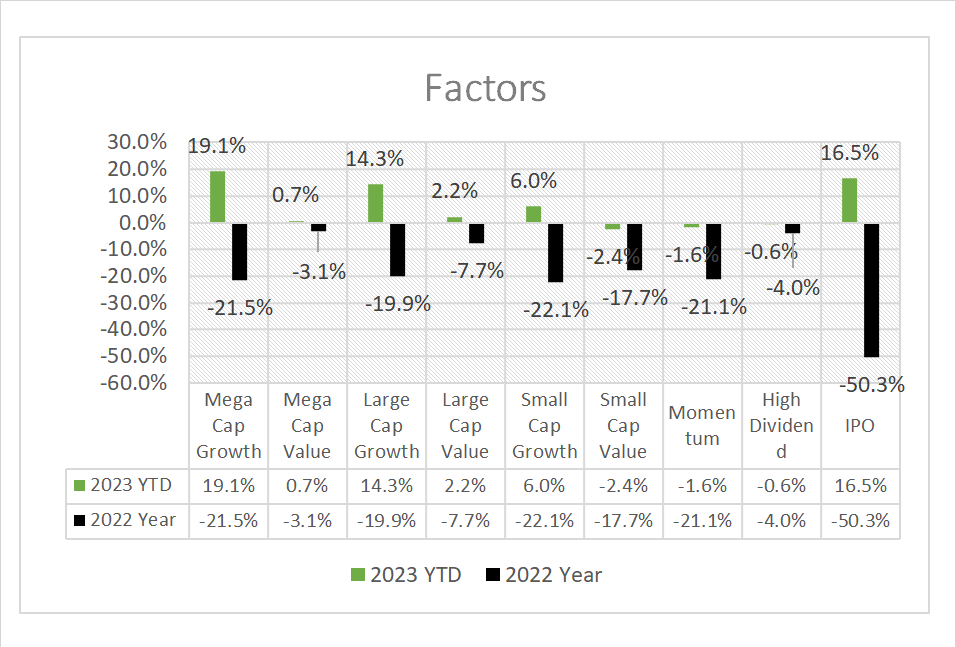

Factors

US Treasuries

Notable Weekly Earnings

- + M&T Bank (MTB), J&J (JNJ), Bank of America (BAC), Lockheed Martin (LMT), Prologis (PLD), Bank of NY Mellon (BK)

- – Charles Schwab (SCHW), State Street (STT), JB Hunt (JBHT), Equity Lifestyle (ELS), Goldman Sachs (GS), LM Ericsson B ADR (ERIC)

Highlights, Bank of America’s first-quarter earnings and revenue topped expectations on higher interest rates, profit rose 15%. Goldman Sachs Group (GS) reported a bigger-than-expected 69% drop in fourth-quarter profit on private equity, a drop in asset and wealth management revenue and it booked losses at its consumer business. Netflix misses in after hours.

- * Strong support – Berkshire Hathaway (BRK-B) Sociedad Quimica y Minera (SQM), Citigroup (C), Morgan Stanley (MS), BlackRock (BLK), Albermarie (ALB), Alpha Metal Res (AMR) NVIDIA (NVDA) Wells Fargo (WFC), China Auto (CAAS)

Economic Data

US

- Housing starts; period March, act 1.42m, fc 1.4m, prev. 1.43m

- Building permits; period March, act 1.41m, fc 1.45 m, prev. 1.55m

- Fed’s Bullard promotes more rate hikes, expects soft landing

Summary, overall housing starts decline 0.8%; permits sharply decline 8.8%. U.S. single-family homebuilding in March increased as Single-family housing starts + 2.7% and Single-family building permits + 4.1%.

News

Company News/ Other

- China’s electric car drive, led by BYD, leaves global brands behind – Reuters

- Apple opens first India store as fans show off vintage devices, take selfies – Reuters

- AI could replace equivalent of 300 million jobs – report – BBC

Central Banks/Inflation/Labor Market

- Exclusive: Fed’s Bullard discounts recession talk, favors more rate hikes – Reuters

- European Central Bank to Lift Deposit Rate to 3.75% Peak in July, Survey Shows – Bloomberg

China