MARKETS TODAY April 19th, 2023 (Vica Partners)

Good Wednesday afternoon!

Yesterday, the Cboe Volatility Index declined for a sixth consecutive session, remaining below 17. Bank of America topped earnings expectations while Goldman missed. Indices closed broadly lower. 7 of 11 of the S&P 500 sectors finished higher, Materials outperformed /Health Care lagged. Yields declined with the Bloomberg Commodity Index, Bitcoin and Gold all gaining. In economic news, overall housing starts/ permits fell.

Overnight, Asian markets finished lower with Hong Kong leading. The Hang Seng was down 1.37%, China’s Shanghai Composite off 0.68% and Japan’s Nikkei 225 down 0.18%. European markets finished mixed, the CAC 40 up 0.21%, DAX up 0.08% and the FTSE 100 down 0.13%. S&P 500 US futures were trading .05% below fair value prior to the opening bell.

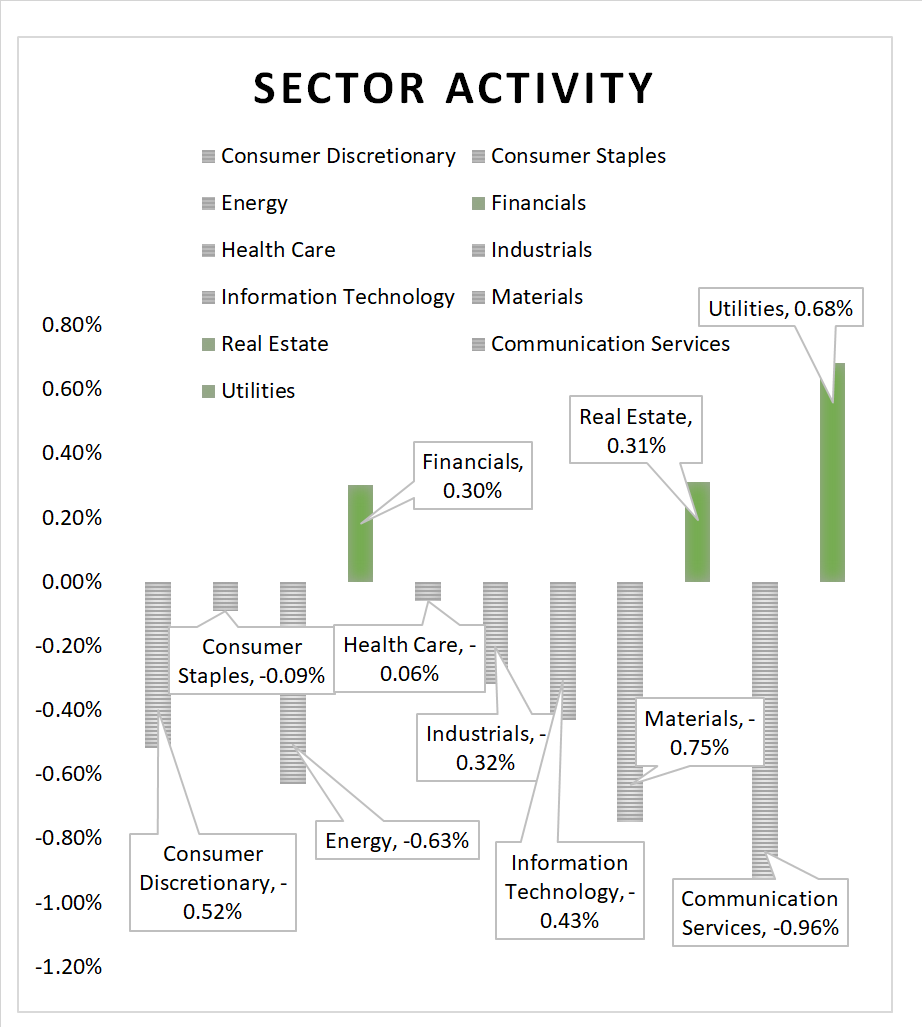

US markets today, Indices mixed and close broadly lower with the Nasdaq and Russell 2000 leading gainers. 8 of 11 of the S&P 500 sectors finish lower, Utilities outperforms /Communication Services lags. The Cboe Volatility Index declined for a seventh consecutive session, closing at 16.46 today. Yields rise while most Materials, Oil, Bitcoin and Gold drop. In economic news, the Fed Beige Book reported Banks have tightened their lending standards since last month’ as lending volumes and all loan demand declined.

Takeaways

- Morgan Stanley (MS), U.S. Bancorp (USB) earning beats

- SPDR S&P Banking ETF ^KRE up 3.94% today

- Consensus/ M&A activity to pick when the Fed backs off interest rate hikes

- Tech earnings coming in soft

- 8 of 11 of the S&P 500 sectors finish lower, Defensive Utilities outperforms

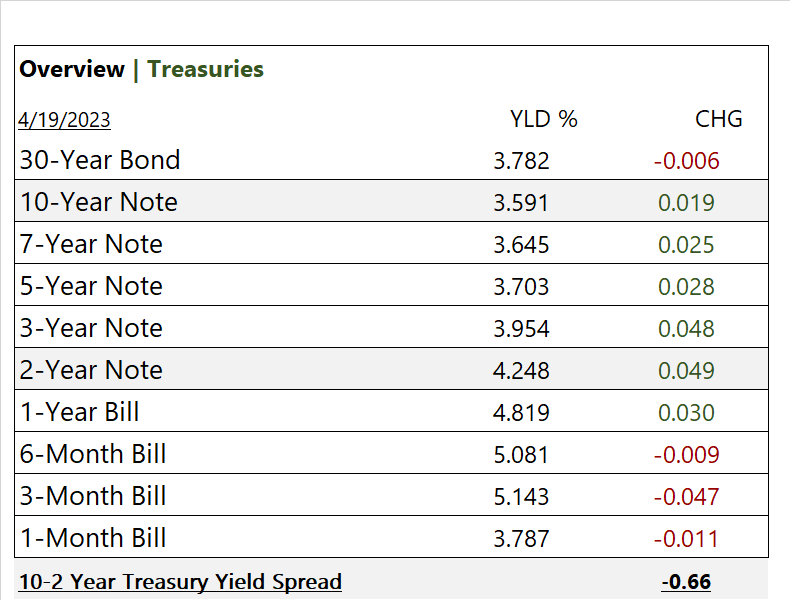

- 10/2 Treasury Yield spread is at -0.66 today “reliable recession marker”

- Fed beige book reports Banks tightened their lending standards

Pro Tip: Renewable Energy sector: The renewable energy sector has been growing rapidly in response to climate change concerns and the need for cleaner energy sources. The CAGR for the renewable energy sector has been around 25% over the last five years.

Sectors/ Commodities/ Treasuries

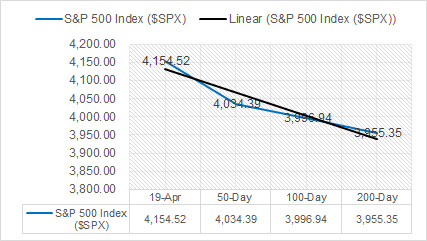

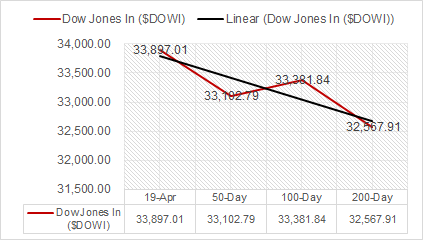

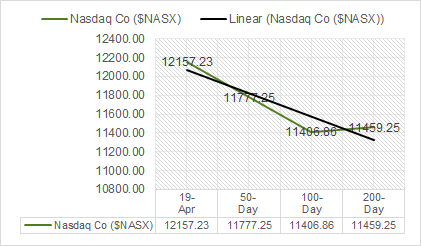

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 8 of 11 of the S&P 500 sectors finish lower, Communication Services -0.96% and Materials -0.75% underperform/ Utilities +0..68% outperforms

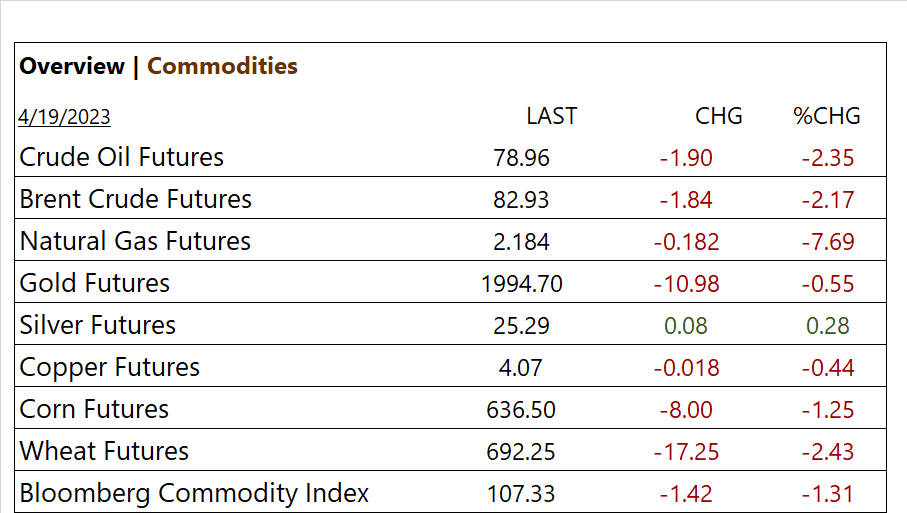

Commodities

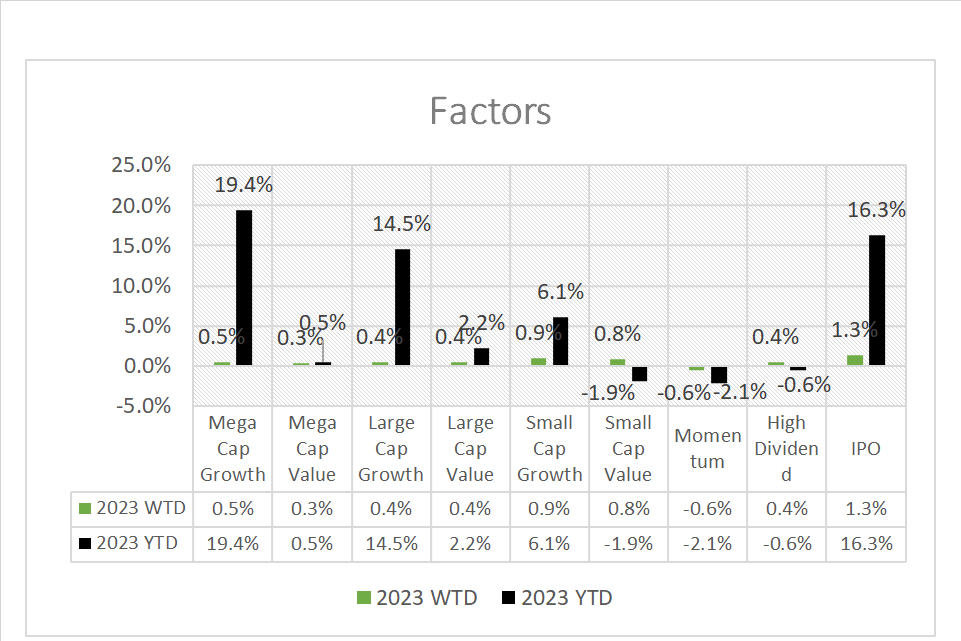

Factors

US Treasuries

Notable Weekly Earnings

- + M&T Bank (MTB), J&J (JNJ), Bank of America (BAC), Lockheed Martin (LMT), Prologis (PLD), Bank of NY Mellon (BK), Abbott Labs (ABT), Morgan Stanley (MS), Elevance Health (ELV), U.S. Bancorp (USB), Travelers (TRV), Baker Hughes (BKR), Las Vegas Sands (LVS)

- – Charles Schwab (SCHW), State Street (STT), JB Hunt (JBHT), Equity Lifestyle (ELS), Goldman Sachs (GS), LM Ericsson B ADR (ERIC), Netflix (NFLX), ASML ADR (ASML), Citizens Financial Group Inc (CFG), Synchrony Financial (SYF), Tesla (TSLA), IBM (IBM), Discover (DFS), Alcoa (AA)

- * Strong support – Berkshire Hathaway (BRK-B) Sociedad Quimica y Minera (SQM), Citigroup (C), Morgan Stanley (MS), BlackRock (BLK), Albermarie (ALB), Alpha Metal Res (AMR) NVIDIA (NVDA) Wells Fargo (WFC), China Auto (CAAS)

Economic Data

US

- Mortgage apps; period April 14, act -8.8%, prior 5.3%;

- Fed Beige Book; banks tightened their lending standards

Summary, the Market Composite Index for the week ended April 14 was down 8.8 percent from one week earlier – Refinance Index decreased 6.0%, Purchase Index down 10.0%. Fed Beige Book, banks have tightened their lending standard with lending volumes and loan demand generally declined across consumer and business loan types.

News

Company News/ Other

- Tesla cuts US prices for sixth time this year ahead of quarterly results – Reuters

- Oil slides as interest rate expectations eclipse Chinese data – Reuters

Central Banks/Inflation/Labor Market

- Treasury Bets Are Diverging on Uncertainty Over the Fed’s Rate Path – Bloomberg

China

- China’s economic growth accelerates with consumption boost – AP