MARKETS TODAY May 4th, 2023 (Vica Partners)

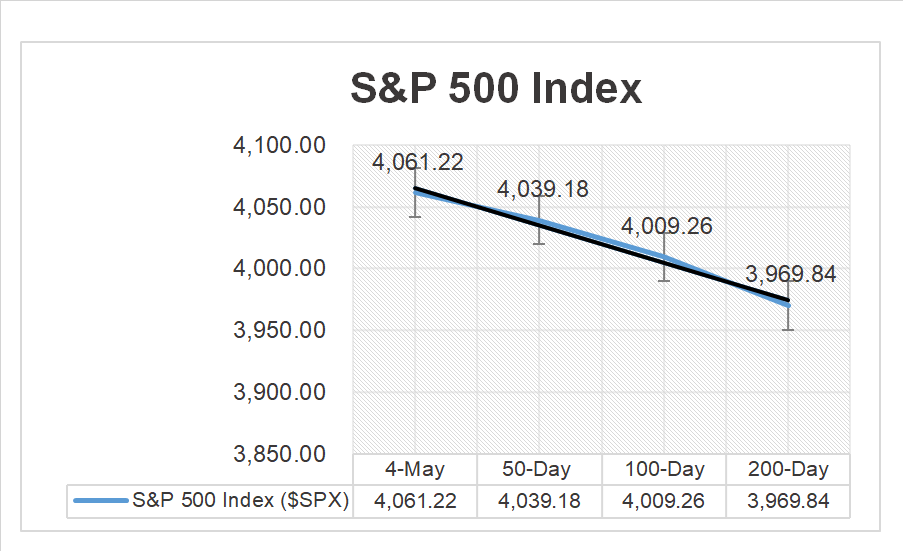

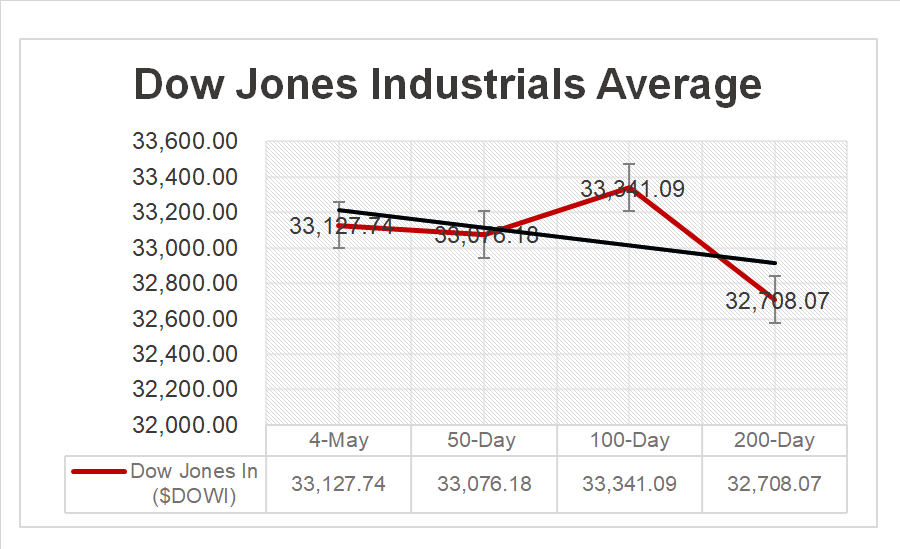

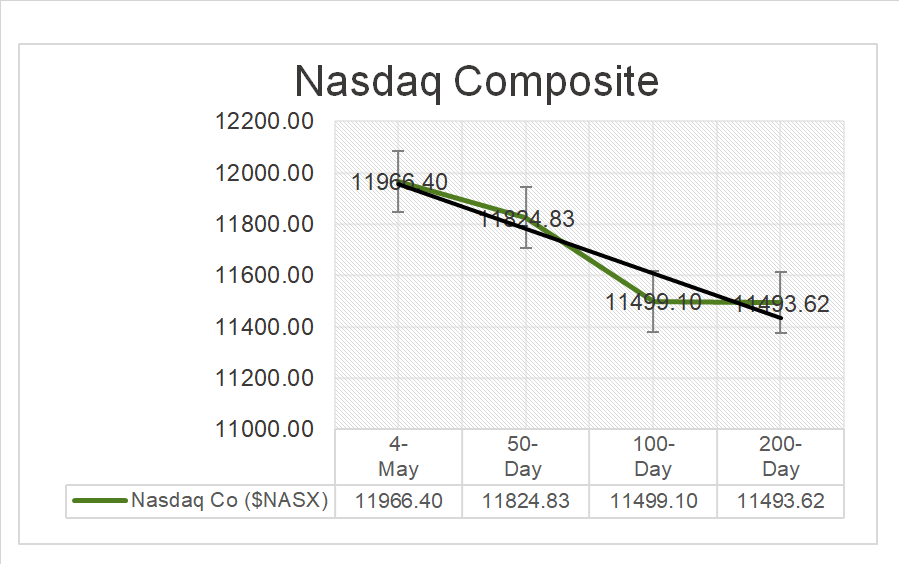

Yesterday, US Markets finished lower, the S&P 500 -0.70%, DOW -0.80%, Nasdaq -0.46%. 9 of 11 of the S&P 500 sectors finished lower, Energy -1.50% led decliners/ Healthcare outperformed. Gold +1.7% and Bitcoin +1.5 while Yields moved lower. The Fed hikes by 25bps to 5.25% but acknowledged inflation was moderating.

Overnight/Premarket, Asian markets finished higher today, Hong Kong Hang Seng +1.37%, China’s Shanghai Composite +0.82% and Japan’s Nikkei 225 +0.12%. European markets finished Germany’s DAX +%, France’s CAC 40 +% and London’s FTSE 100 +%. US futures were trading at 0.5% below fair-value.

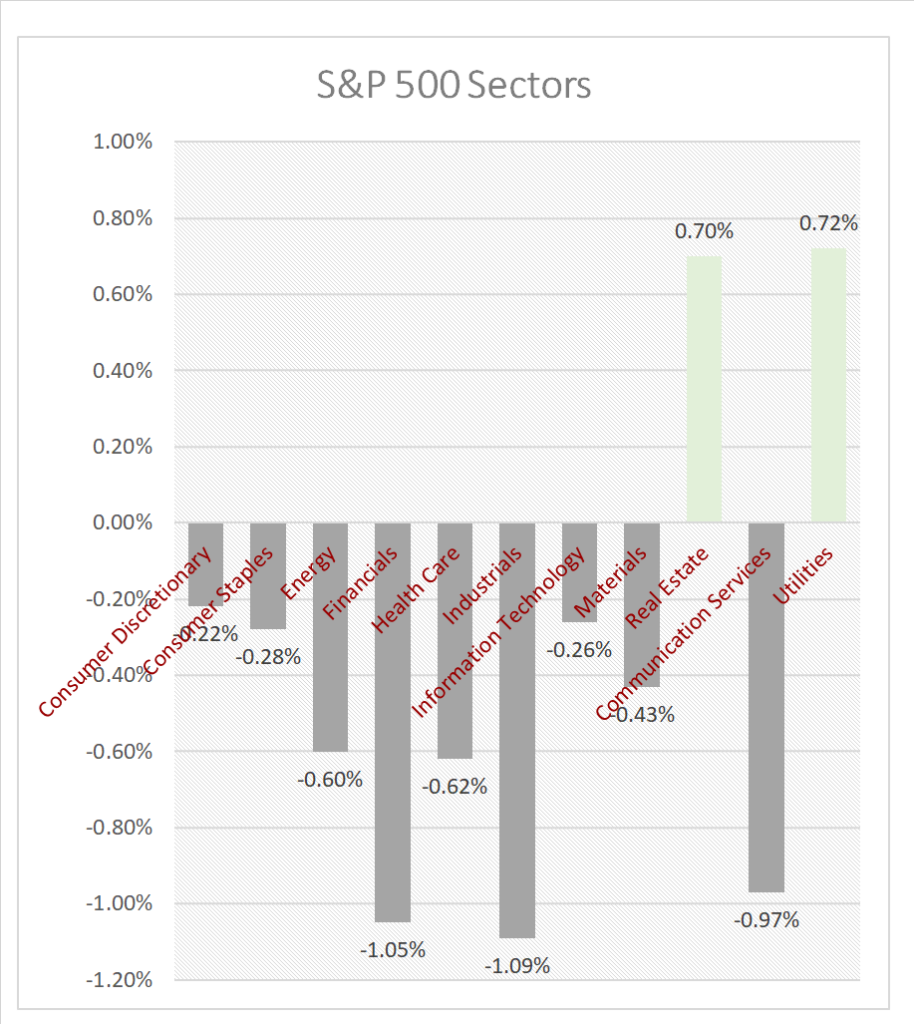

Today, US Markets finished lower, the S&P 500 -0.72%, DOW -0.86%, Nasdaq -0.49%. 9 of 11 of the S&P 500 sectors finished lower, Industrials and Financials led decliners/ Utilities outperformed. On the upside, Yields rise and Oil and Bitcoin had modest gains. In economic news, Weekly Initial Jobless Claims increased more than expected and Continuing Claims fell slightly. US Productivity declined more than Forecast and Labor Costs rose.

Takeaways

- Apple (AAPL)! Important for Market after hours earnings beat

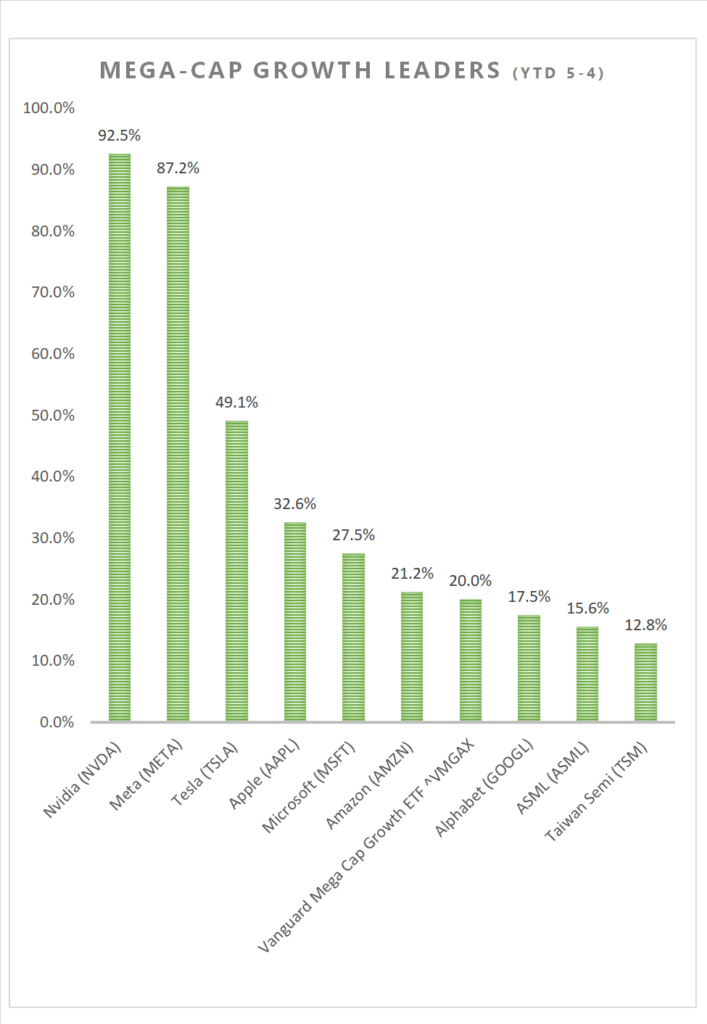

- NY FANG+ leads Indices up 0.95%

- 9 of 11 of the S&P 500 sectors finished lower/ Utilities outperforms

- Regional Banking down, SPDR S&P Banking ETF (KRE) fell 5.45%

- Oil prices stabilize +ConocoPhillips (COP) with solid earnings beats

- Crypto Leaders Block (SQ), Coinbase Global (COIN) rise on earnings

- Gold testing historical highs

- Q1 US Productivity declined more than Forecast and Labor Costs rose

- Business “entertainment” based news, stock picking sites are not ideal resources

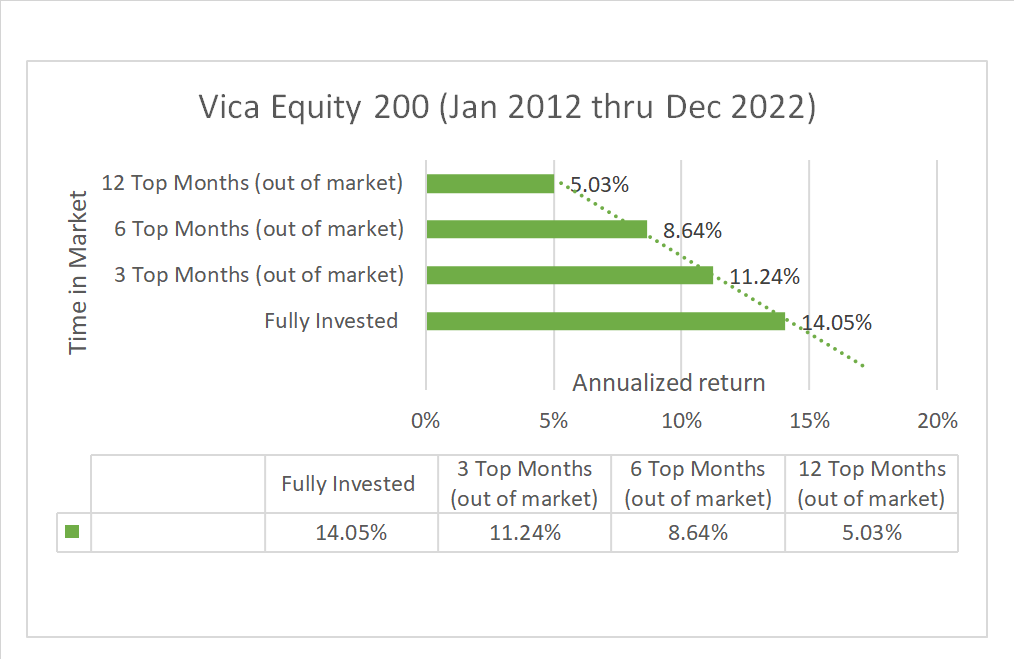

Pro Tip: “It’s about time in the market, rather than timing the market.” – Vanguard’s founder Jack Bogle. An investment in S&P 500 Index (Jan 2012 – Dec 2023) would return on average +290%, or +13% per year. Vica Equity 200 Index in-market time chart below.

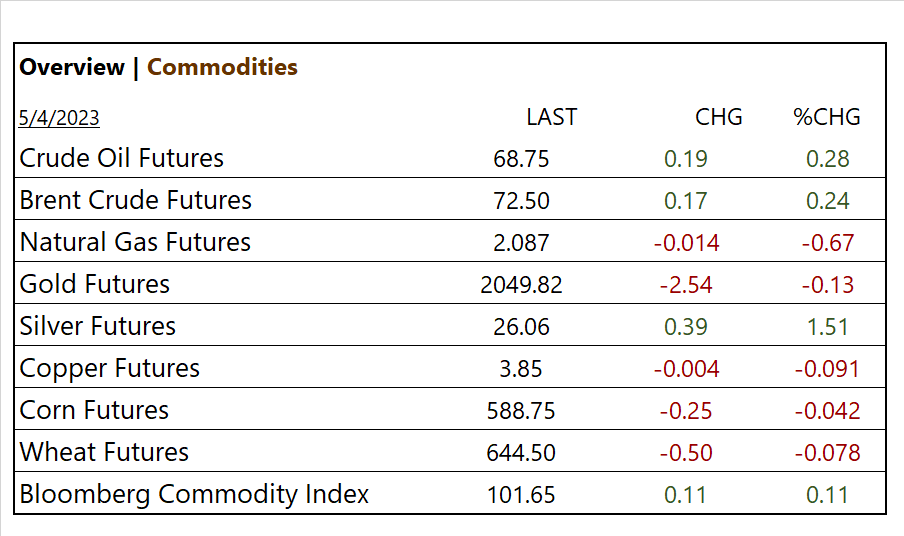

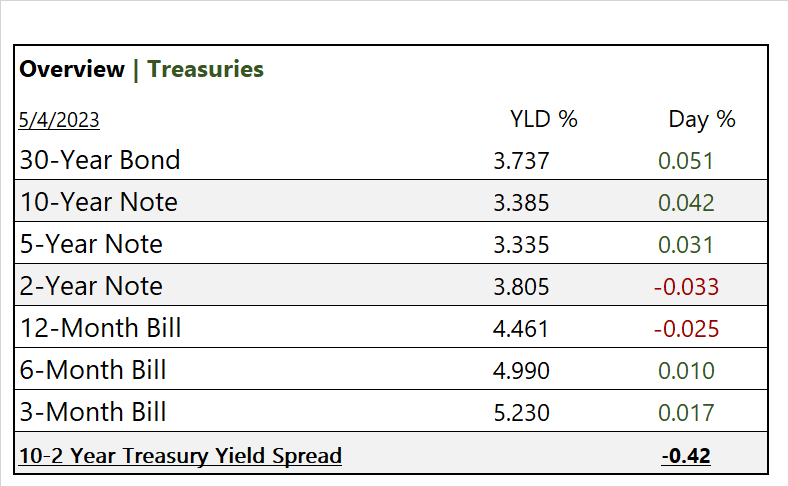

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors finish lower, Industrials -1.09% and Financials -1.05% led decliners/ Utilities 0.72% and Real Estate 0.70% outperformed

Commodities

Mega Caps (YTD)

US Treasuries

Notable Earnings Today

Notable Earnings Today

- +Beat: Apple (AAPL), Novo Nordisk ADR (NVO), Anheuser Busch ADR (BUD), ConocoPhillips (COP), Booking (BKNG), Shopify Inc (SHOP), Volkswagen 1/10 ADR (VWAGY), Regeneron Pharma (REGN), Becton Dickinson (BDX), Kellogg (K), Cardinal Health (CAH), Block (SQ), Coinbase Global (COIN)

- – Miss: Shell ADR (SHEL), Equinor ADR (EQNR), Constellation Energy (CEG), PPL (PPL), Magellan (MMP), Ferrari NV (RACE), Ball (BALL), Rocket (RKT)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Broadcom (AVGO), Citigroup (C), Morgan Stanley (MS), Coca-Cola (KO), Owens Corning (OC), ConocoPhillips (COP), Shopify Inc (SHOP)

Economic Data

US

- US. productivity; period Q1, act -2.7%, fc -1.9%. prev. 1.6%

- US. unit-labor costs; period Q1, act 4.5%, fc 5.5%. prev. 3.3%

- US. trade deficit; period March, act -$64.2B, fc -$63.1B, prev. -$70.6B

- Initial jobless claims; period April 29, act 242,000, fc 236,000, prev. 229,000

- Continuing jobless claims; period April 22, act 1.81m, prev. 1.84m

News

Company News/ Other

- Apple iPhone sales inch up, bolstering results amid shaky economy –Reuters

- Novo Nordisk cuts some US supply of obesity drug Wegovy to cope with demand – Reuters

- Conoco sees ‘light at end of the tunnel’ on Venezuela claims, CEO says – Reuters

Central Banks/Inflation/Labor Market

- European Central Bank Slows Pace of Rate Increases – WSJ

- US interest rates raised to highest level in 16 years – BBC

China

- China’s Tightening Grip on Foreign Firms Risks Hitting Investment – WSJ