MARKETS TODAY May 5th, 2023 (Vica Partners)

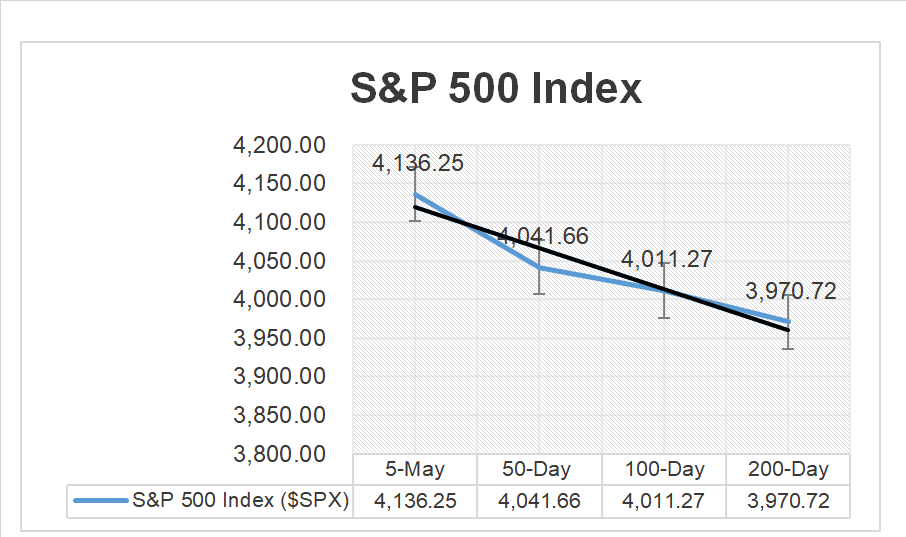

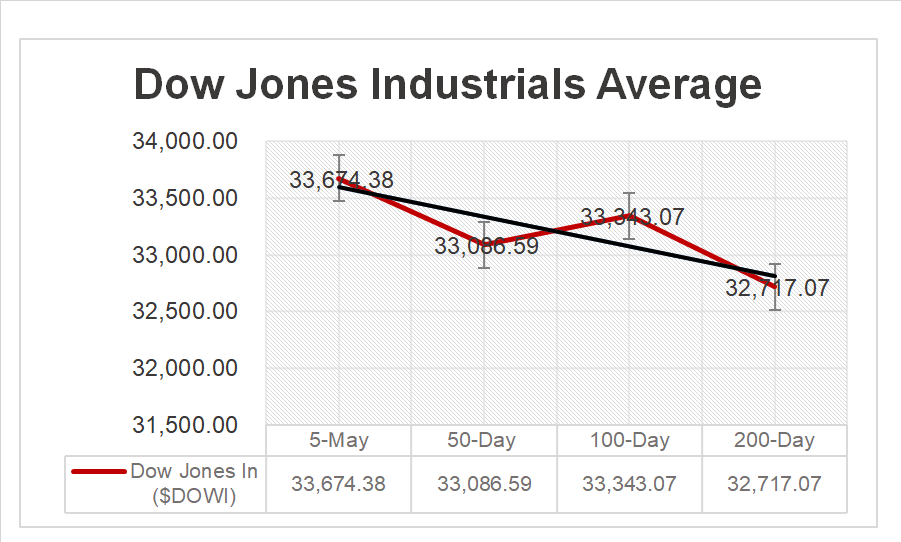

Yesterday, US Markets finished lower, the S&P 500 -0.72%, DOW -0.86%, Nasdaq -0.49%. 9 of 11 of the S&P 500 sectors declines, Industrials and Financials led underperformed/ Utilities outperformed. On the upside, Yields rise and Oil and Bitcoin had modest gains. In economic news, US Productivity declined more than Forecast and Labor Costs rose.

Overnight/Premarket, Asian markets finished mixed, HK Hang Seng +0.50%, Japan Nikkei 225 +0.12%, and the Shanghai Composite -0.48%. European markets finished higher, Germany DAX +1.44%, France’s CAC 40 +1.26% and London’s FTSE 100 +0.98%. US futures were trading at 0.7% above fair-value.

Today, US Markets finished sharply higher, the S&P 500 +1.85%, DOW +1.65%, Nasdaq +2.25%. All 11 of the S&P 500 sectors gained, Energy and Financials outperformed. On the upside, Yields rise and Oil >4% and Bitcoin >2%. In economic news, U.S. job growth picked up in April while wage gains increased. The unemployment rate dropped from 3.5% to 3.4%. US Consumer Credit in March far exceeded analyst estimates.

Takeaways

- Upbeat Jobs data helps boost market rally today

- S&P 500 breaks four-day losing streak

- Nasdaq leads major Indices +2.25%

- All 11 of the S&P 500 sectors finished higher/ Energy outperforms

- Regional Banking SPDR S&P Banking ETF (KRE) rebounds +6.29%

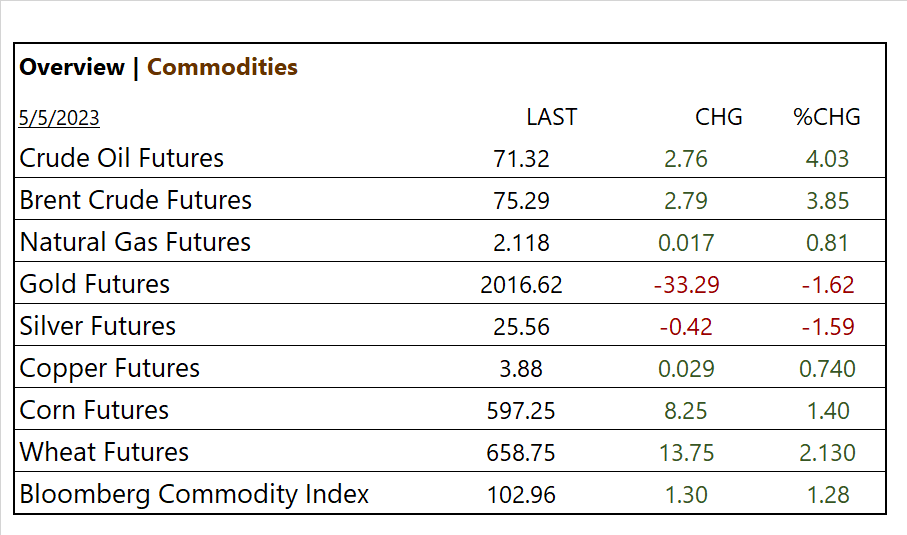

- Oil prices recover >4%

- Bitcoin rises, Gold pullback

- US Consumer Credit reading in March, concerning

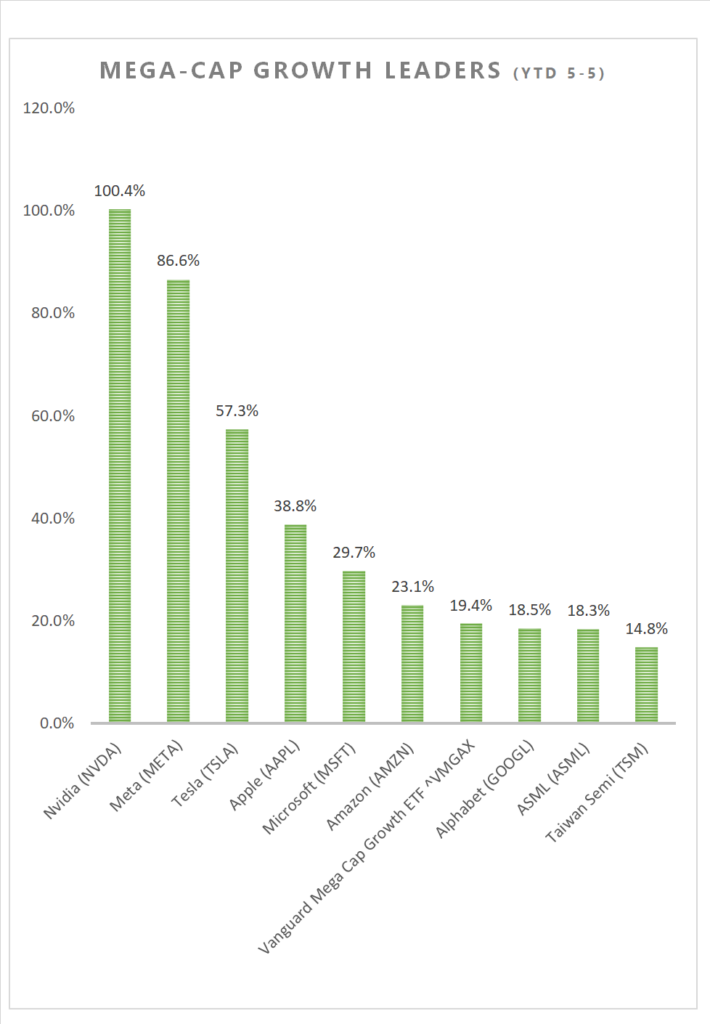

Pro Tip: Investing in mega-cap growth stocks is both defensive and profitable during this bear markets because a) Mcg’s are established companies: that have a strong financial position b) diversification, a broad range of products, services, and geographic locations c) growth potential, they can continue to grow, especially in areas such as technology and healthcare d) attractive valuations, long-term investors can currently purchase shares of high-quality mega-cap companies at a discounted price.

Sectors/ Commodities/ Treasuries

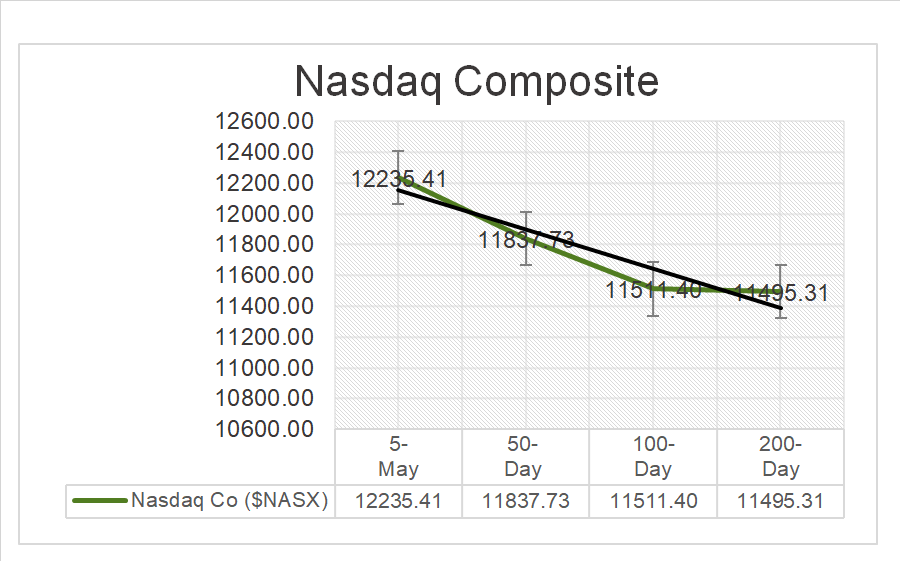

Key Indexes (50d, 100d, 200d)

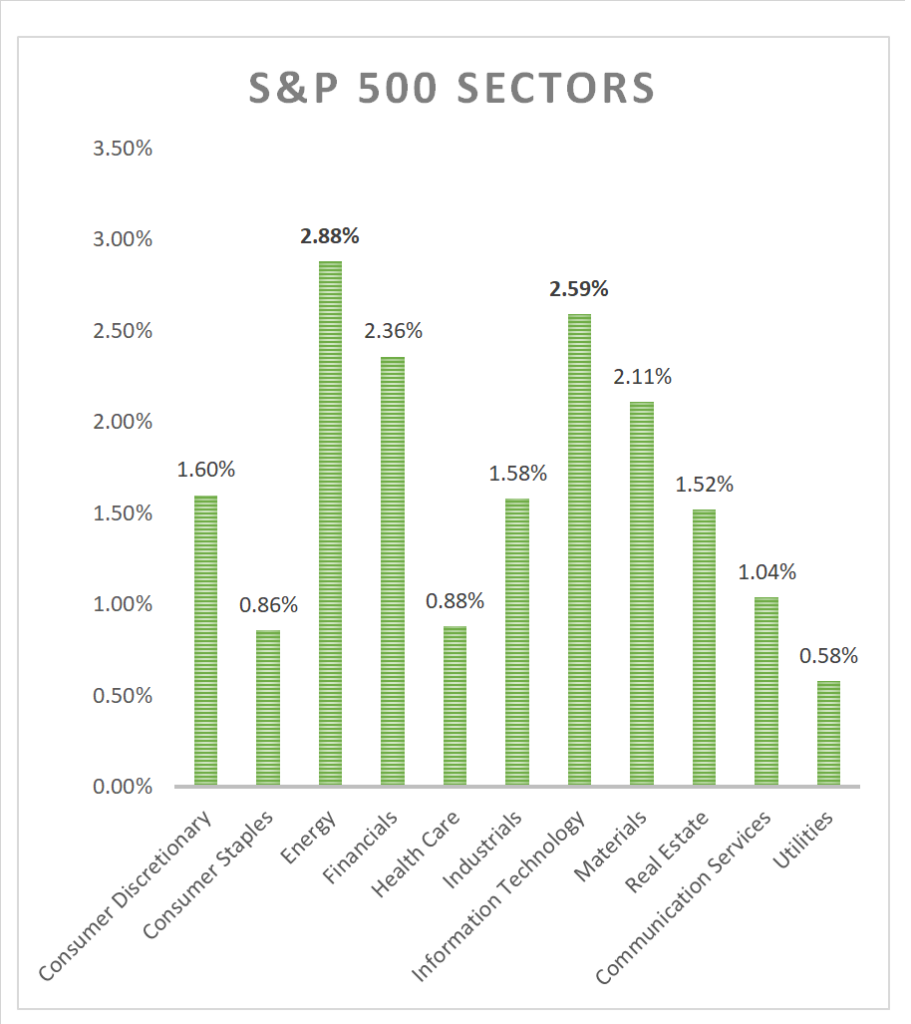

S&P Sectors

- All 11 of the S&P 500 sectors finish higher, Energy +2.88% and Information Technology +2.88% outperformed/ Utilities 0.58% underperformed

Commodities

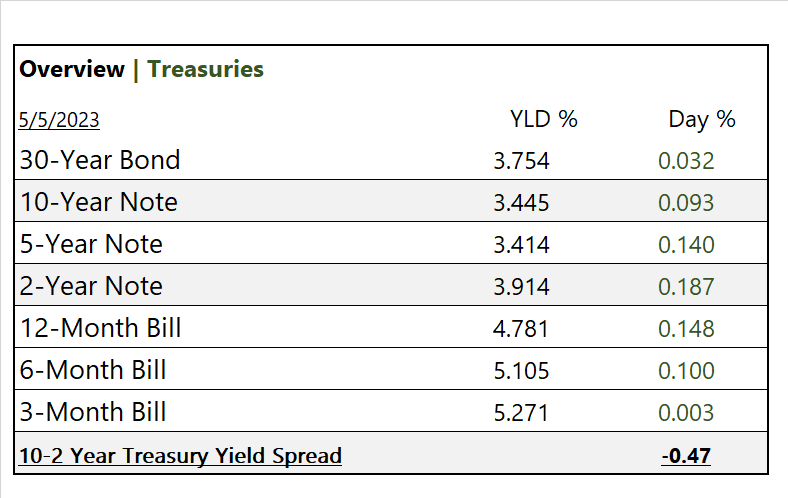

US Treasuries

Notable Earnings Today

- +Beat: Cigna (CI), Dominion Energy (D), Johnson Controls (JCI), Adidas ADR (ADDYY), CNH Industrial NV (CNHI), Evergy (EVRG)

- – Miss: Enbridge (ENB), Warner Bros Discovery (WBD), Liberty Media Formula C (FWONK), Brookfield Renewable (BEP), Ubiquiti (UI)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML)

Economic Data

US

- US. employment report; period April, act 253,000, fc 180,000, prev. 165,000

- US. unemployment rate; period April, act 3.4%. fc 3.6%, prev. 3.5%

- US. hourly wages; period April, act 0.5%, fc 0.3%, prev. 0.3%

- Hourly wages year over year; period April, act 4.5%, fc 4.2%, prev. 4.3%

- Consumer credit; period March, act $26.5b, fc $16.8b. prev. $15.3b

News

Company News/ Other

- Apple’s results send shares surging to nine-month high – Reuters

- Ukraine’s nuclear deal with Canada’s Cameco carries big risks, rewards – Reuters

Central Banks/Inflation/Labor Market

- Exclusive: US officials assessing possible ‘manipulation’ on banking shares – Reuters

- FDIC Plans to Hit Big Banks With Fees to Refill Deposit Insurance Fund – Bloomberg

- Robust Hiring in April Shows U.S. Job Market Remains Hot in Cooling Economy – WSJ

China

- Taiwan trade chief warns against ‘unnecessary fear’ of China – AP