MARKETS TODAY May 18th, 2023 (Vica Partners)

Yesterday US Markets finished higher, S&P 500 +1.19%, DOW +1.24% and the Nasdaq +1.28%. 8 of 11 of the S&P 500 sectors higher, Energy +1.63% and Industrials +1.58% outperform/ Utilities -0.54% lags. Russel 2000 +2.21%. Treasury Yields. USD Index, Oil and Bitcoin gain. In economic news, Housing Starts/building permits were in line.

Overnight/Premarket Asian markets finished higher, Japan’s Nikkei 225 +1.60%, Hong Kong’s Hang Seng +0.85% and the Shanghai Composite +0.40%. European markets finished higher, Germany’s DAX +1.33%, France’s CAC 40 +0.64% and London’s FTSE 100 +0.25%. US futures were trading at 0.1% below fair value.

Today US Markets finished broadly higher, S&P 500 +1.19%, DOW +1.24% and the Nasdaq +1.28%. 7 of 11 of the S&P 500 sectors higher, Information Technology +2.06% outperforms/ Real Estate -0.68% lags. On the upside, Greed Index, Treasury Yields and USD Index gain. In economic news, data was better than expected as Initial claims came in lower and the Philly Fed survey beat consensus.

Takeaways

- Economic news, data was better than expected

- Key Market Indices all finish higher

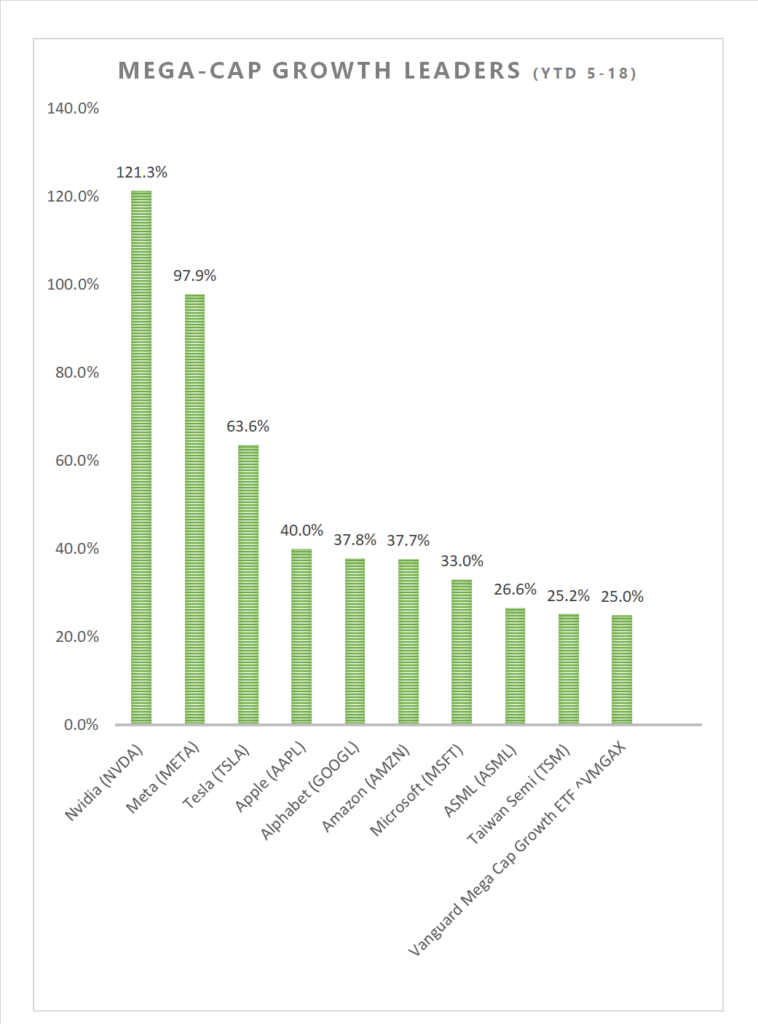

- Big Tech leads Thursdays rally as NYFANG+, up 3.45%

- 7 of 11 of the S&P 500 sectors higher, Information Technology outperforms/ Real Estate lags

- iShares Semiconductor ETF (SOXX) +>3%

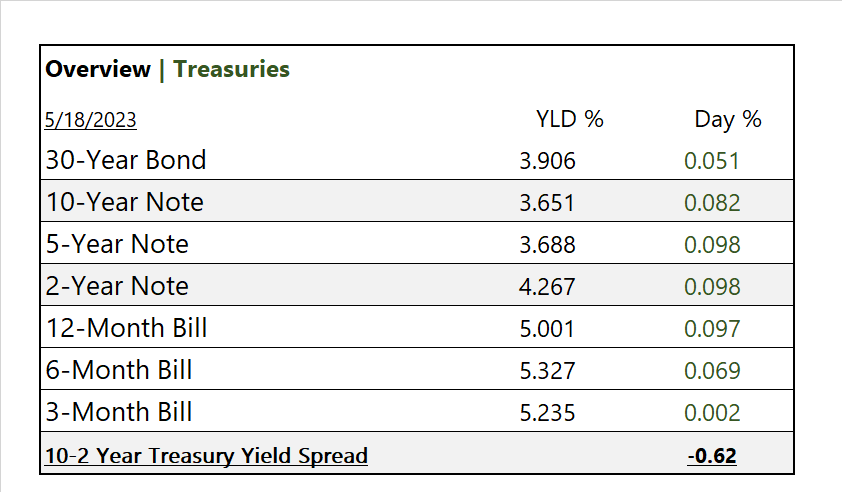

- Yields rise. Is the Fed keeping rates higher for longer?

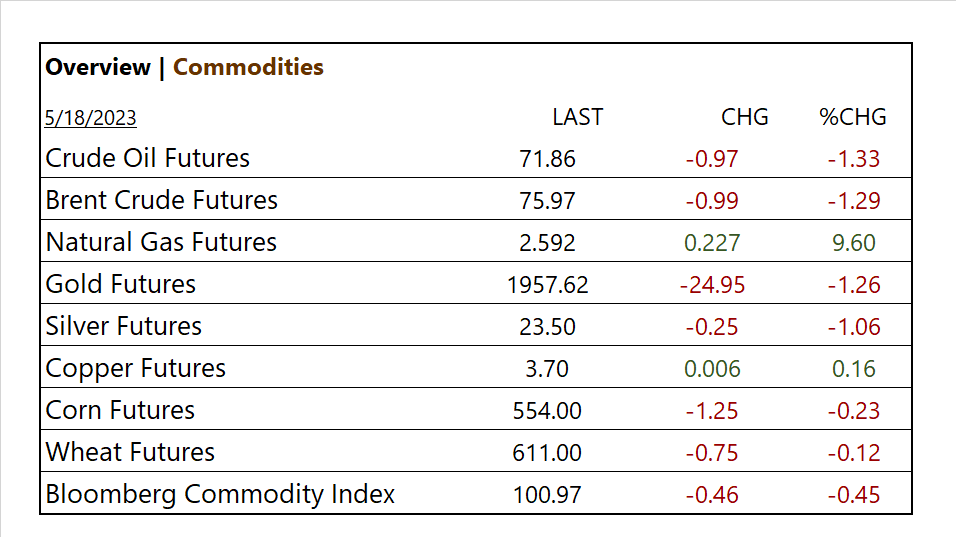

- Commodities lower

- Walmart (WMT) beats, : Alibaba ADR (BABA) misses on earnings

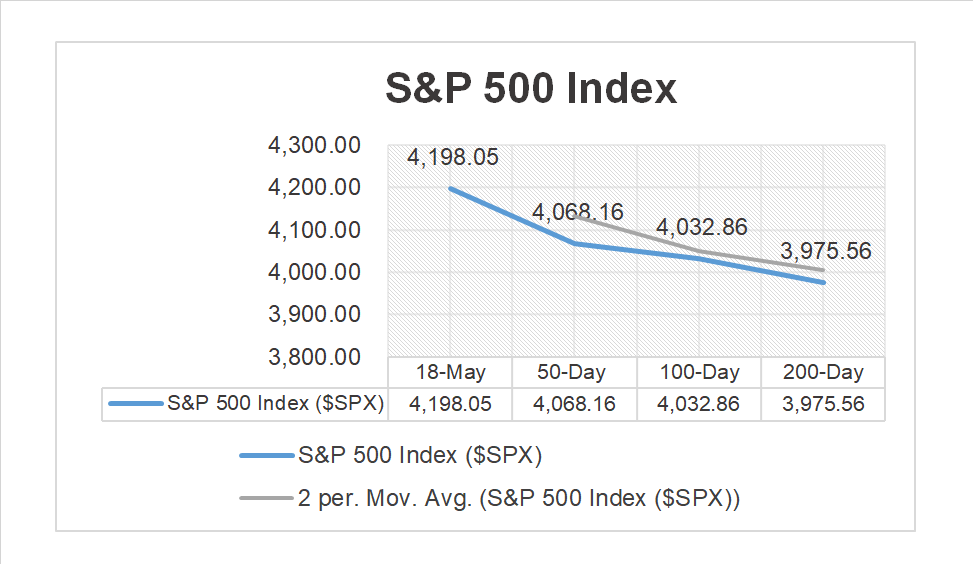

- Watch S&P 500, resistance range @4,175 – 4,200

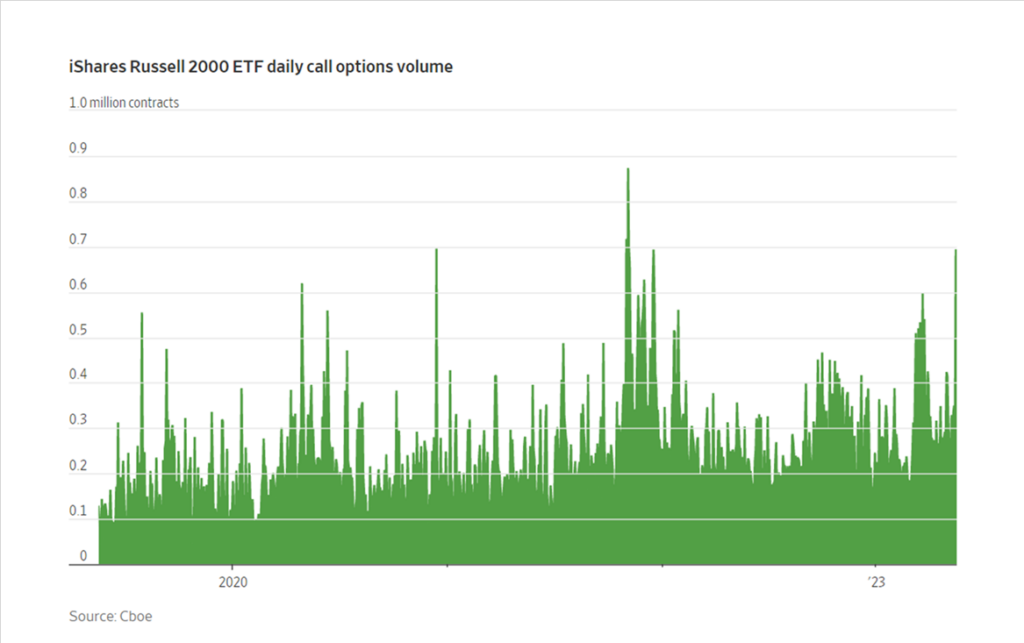

Pro Tip: Options Traders look to be positioning the Russel 2000 for a breakout as 700,000 call options on the iShares Russell 2000 ETF traded on Wednesday. The ^RUT has a high statistical correlation with Regional Banking Sector.

Sectors/ Commodities/ Treasuries

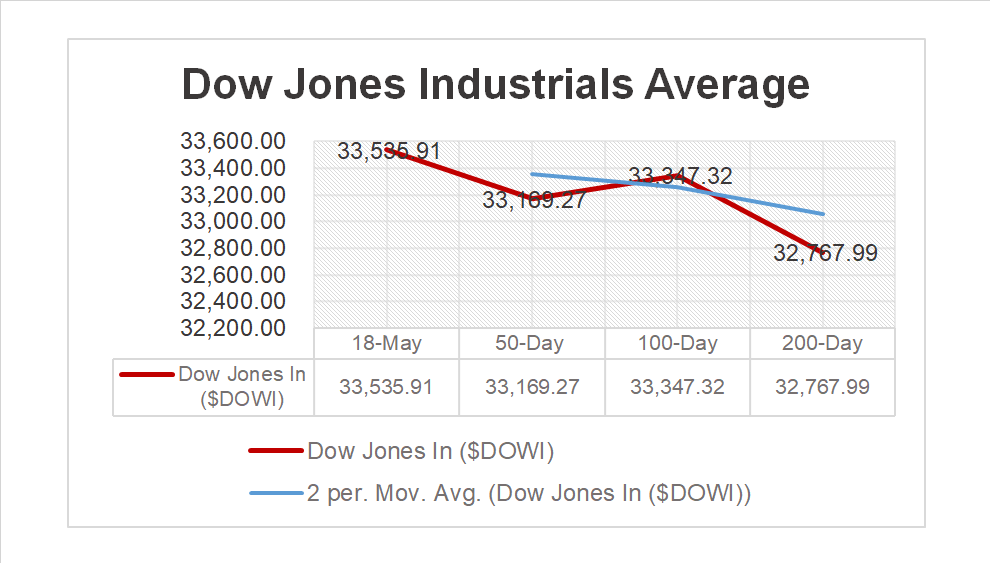

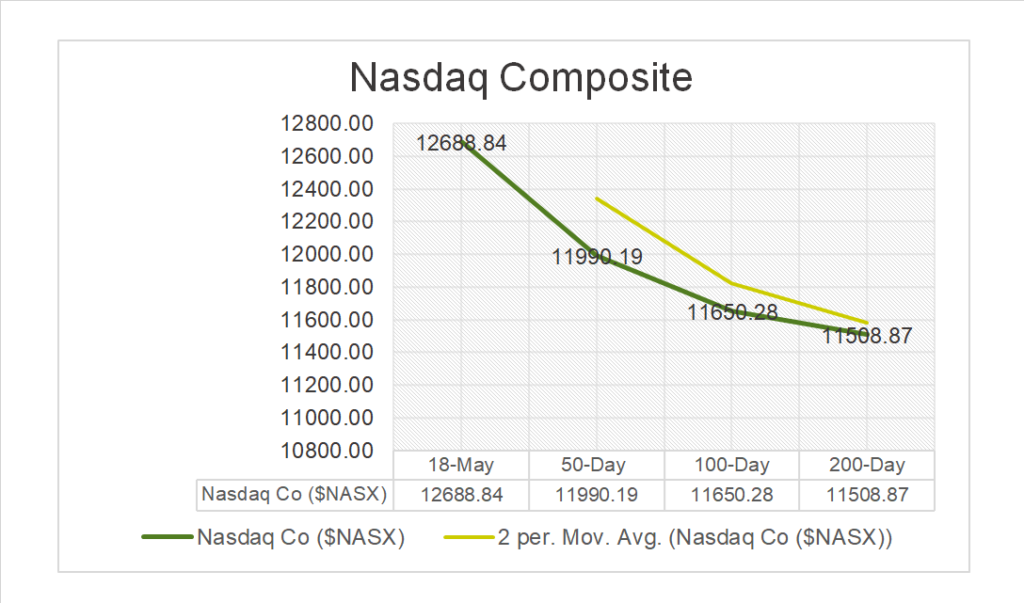

Key Indexes (50d, 100d, 200d)

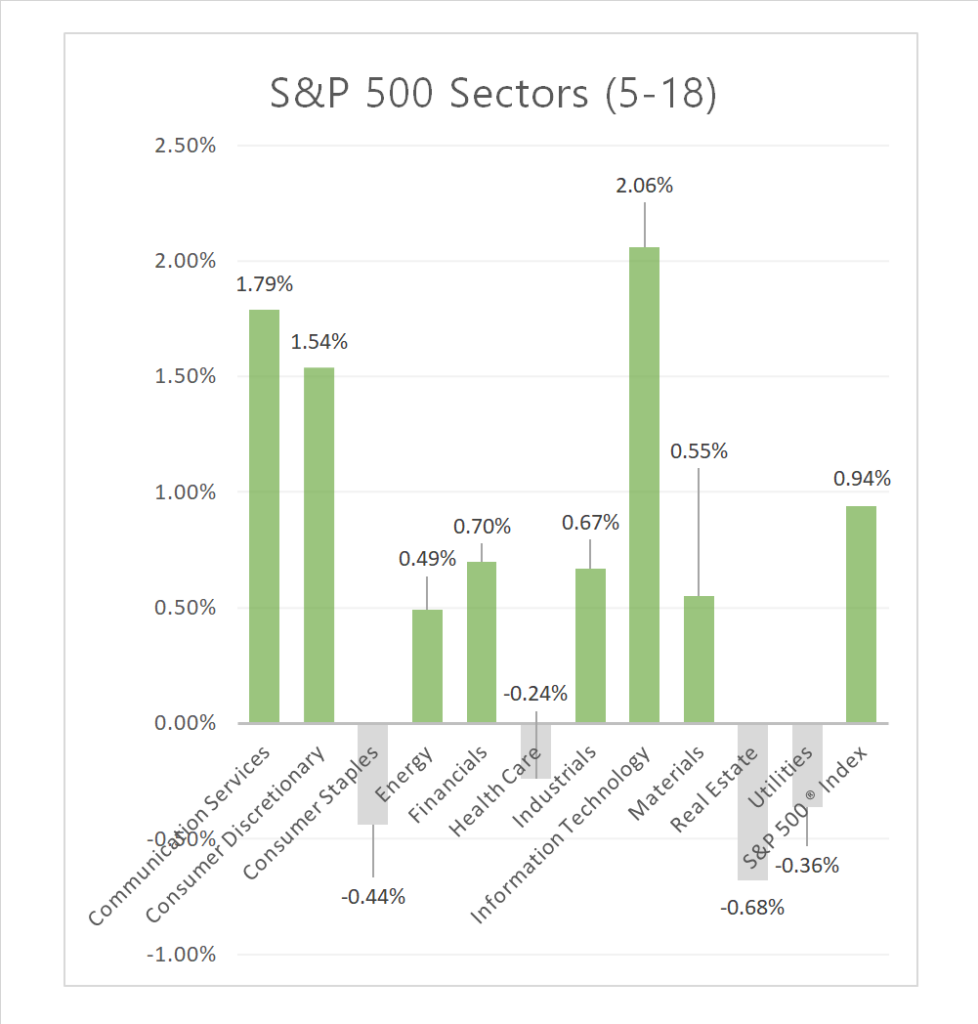

S&P Sectors

- 7 of 11 of the S&P 500 sectors higher, Information Technology +2.06%, Communication Services +1.79 outperform/ Real Estate -0.68% and Consumer Staples -0.44% lag.

Commodities

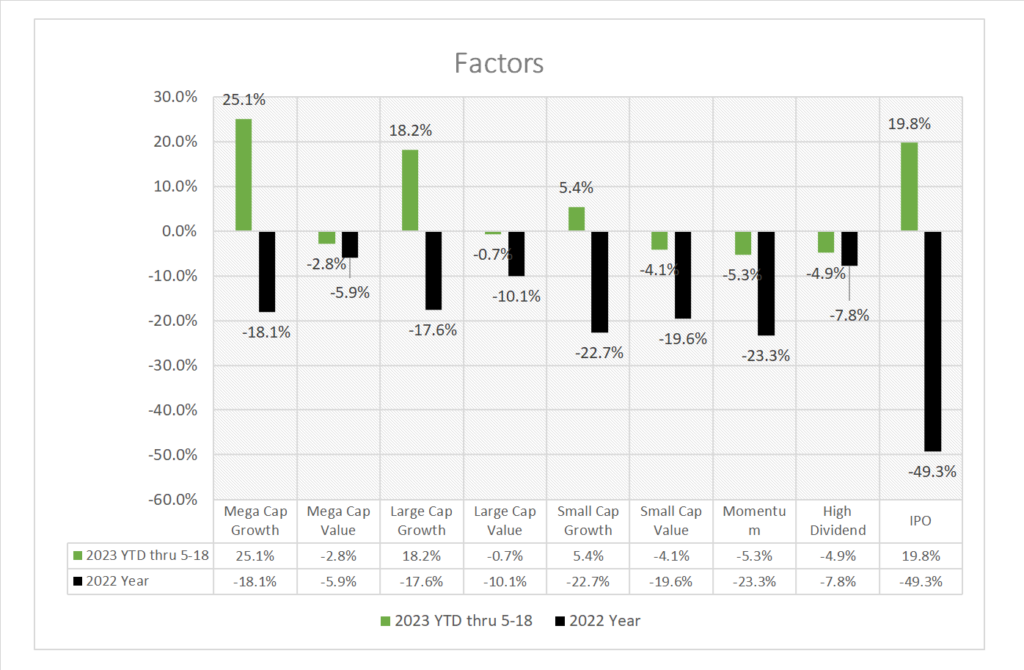

Factors (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Walmart (WMT), Ke Hldg (BEKE), Bath & Body Works (BBWI), ADS (WMS), Eagle Materials (EXP)

- – Miss: Alibaba ADR (BABA), Soquimich B ADR (SQM), Legend Bio (LEGN), Brady (BRC)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Baidu (BIDU), Nu Holdings (NU)

Economic Data

US

- Philadelphia Fed factory survey; period May, act -10.4, fc -20, prev. -31.3

- Initial jobless claims; period May 13, act 242,000, fc 255,000, prev. 264,000

- Existing home sales; period April, act 4.28m, fc 4.26m, prev. 43m

- US. leading economic indicators; period April, act -0.6%, fc -0.6%. prev. -1.2%

News

Company News/ Other

- Alibaba misses revenue estimate, approves cloud unit spinoff – Reuters

- Teva Plans to Cut Back Generic Drug Production Even As Shortages Intensify – Bloomberg

- Walmart stock gains after raising its full-year outlook; Target shares fall, bond yields rise – WSJ

Central Banks/Inflation/Labor Market

- US weekly jobless claims fall; labor market defying recession fears – Reuters

- Home Prices Posted Largest Annual Drop in More Than 11 Years in April – WSJ

- The True Cost of an Extended US Debt-Ceiling Standoff – Bloomberg

China

- China Puts Spymaster in Charge of U.S. Corporate Crackdown – WSJ

- Analysis: As China’s yuan drops through 7 again, the dollar is in the driver’s seat – Reuters

Education

- Extrapolation Bias or Recency Effect (click here)