MARKETS TODAY May 19th, 2023 (Vica Partners)

Yesterday US Markets finished broadly higher, S&P 500 +1.19%, DOW +1.24% and the Nasdaq +1.28%. 7 of 11 of the S&P 500 sectors higher, Information Technology +2.06% outperformed/ Real Estate -0.68% lagged. On the upside, Greed Index, Treasury Yields and USD Index gain. In economic news, data was better than expected as Initial claims came in lower and the Philly Fed survey beat consensus.

Overnight/Premarket Asian markets finished mixed, Japan’s Nikkei 225 +0.77%, Hong Kong’s Hang Seng -1.40% and the Shanghai Composite -0.42%. European markets finished higher, Germany’s DAX +0.69%, France’s CAC 40 +0.61% and London’s FTSE 100 +0.19%. US futures were trading at 0.2% above fair value.

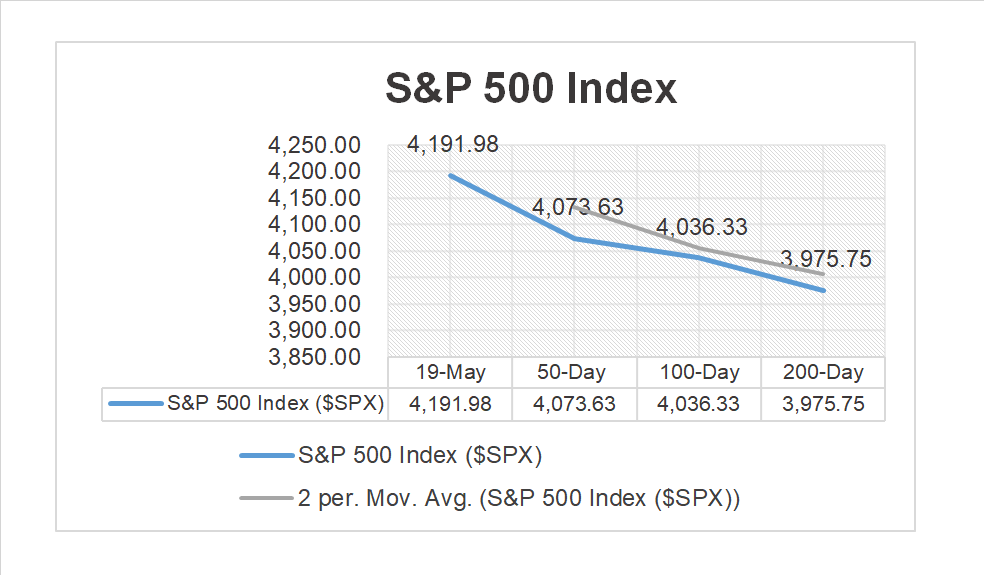

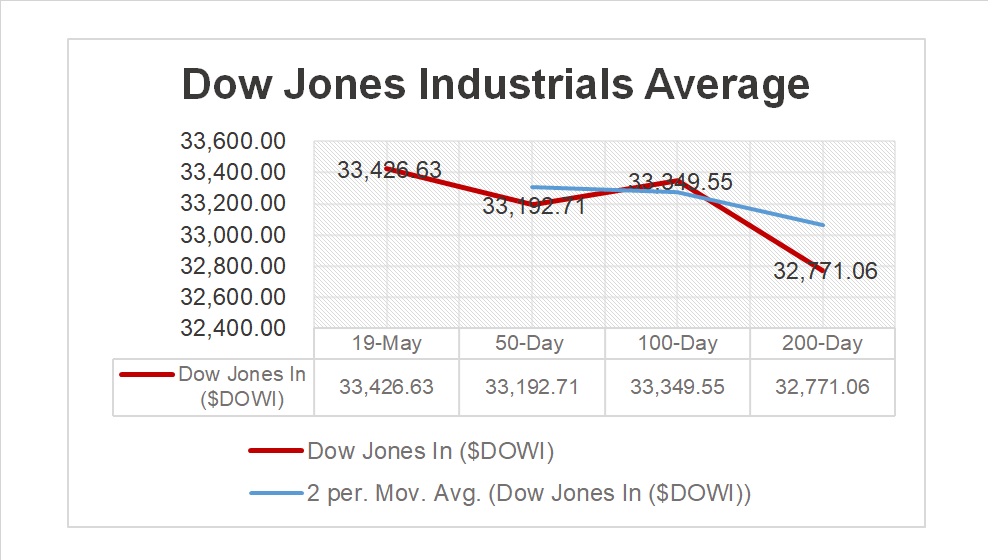

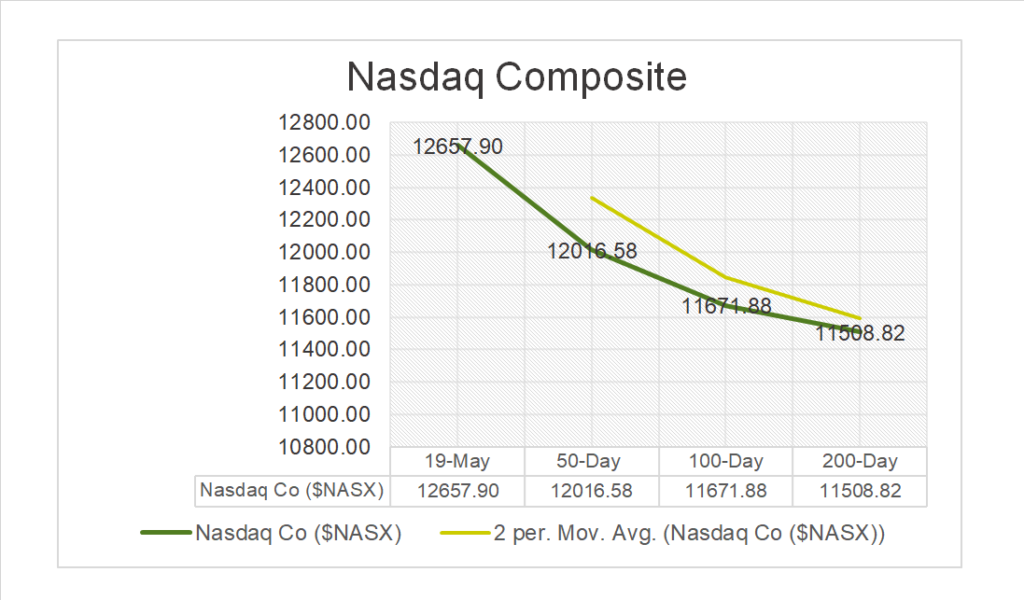

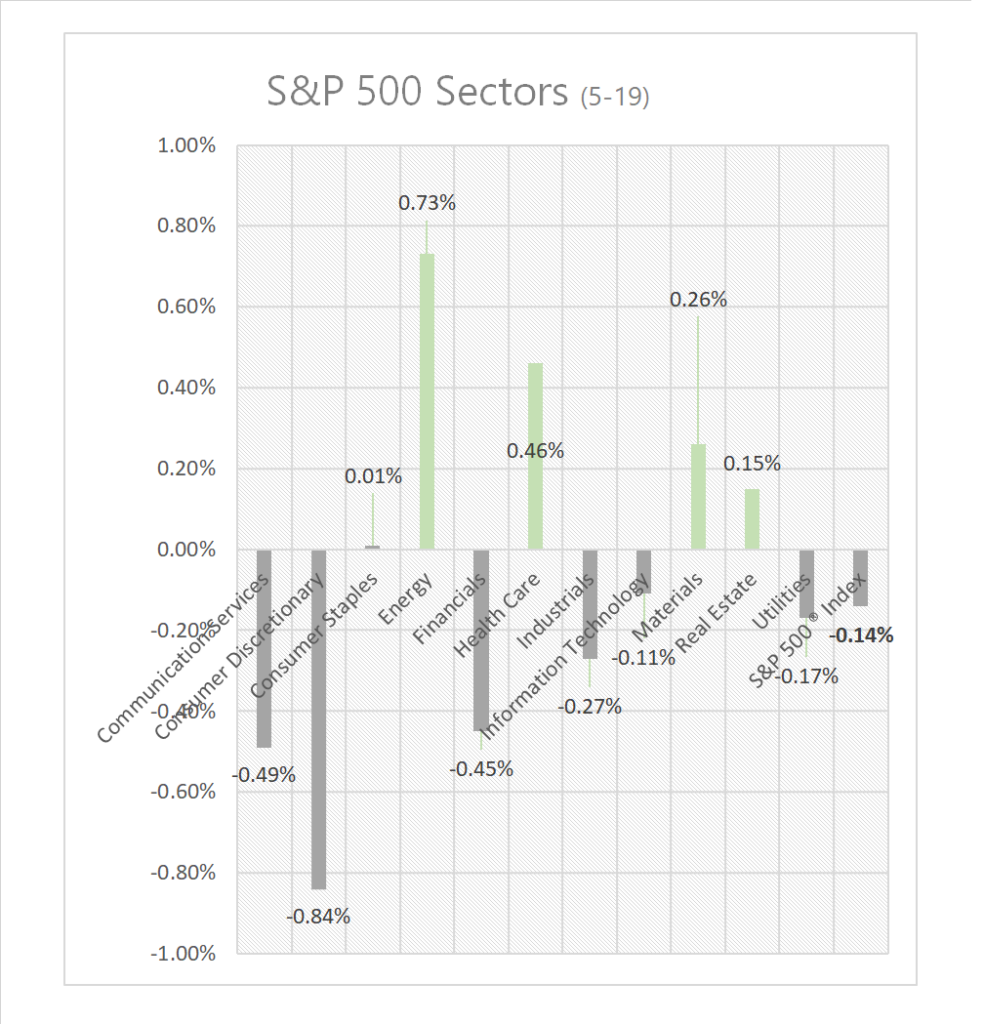

Today US Markets finished broadly lower, S&P 500 -0.14%, DOW -0.33% and the Nasdaq -0.24%. 7 of 11 of the S&P 500 sectors lower: Consumer Discretionary -0.84% underperforms/ Energy +0.73% outperforms. On the upside, Greed Index, Treasury Yields, Gold Bitcoin and Bloomberg Commodity Index all gain. In economic news, Fed Chair Powell said that tightening credit conditions in the banking sector means that the Central Bank may not need to raise its policy rate.

Takeaways

- Options Expiration Week Effect

- WTD/ S&P 500 +1.58%, DOW +0.32%, Nasdaq +2.90% , NYFANG+ 6.06%

- NYFANG+ declines >1% on the day ending streak

- 7 of 11 of the S&P 500 sectors lower: Consumer Discretionary lags/ Energy outperforms

- SPDR S&P Banking ETF (KRE) -1.78%

- John Deere & Company (DE) beats, Foot Locker (FL) misses on earnings

- 93% S&P 500 companies reported Q1 earnings and overall beating consensus

- Yellen says more Bank mergers may be necessary

Pro Tip: Bitcoin has shown correlations with traditional financial assets, such as indices, sectors and currencies. Bitcoin tends to rise when stock markets decline and during periods of stock market volatility. Today, Bitcoin has 29k in options expiring today @ >$780m w/ a 0.81 Put Call Ratio. We predict a short term moderate rise in value.

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d

S&P Sectors

- 7 of 11 of the S&P 500 sectors lower: Consumer Discretionary -0.84% underperforms/ Energy +0.73%, Health Care +0.46% outperform.

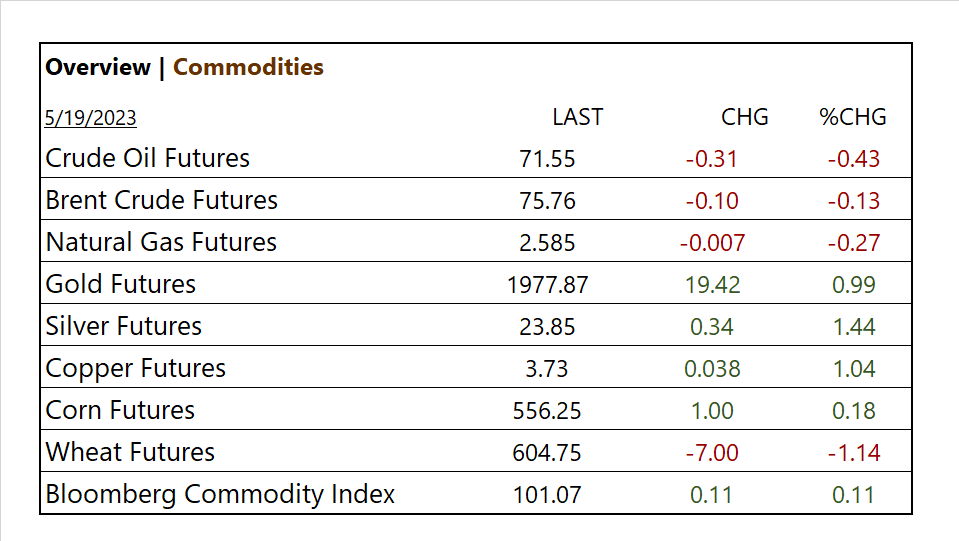

Commodities

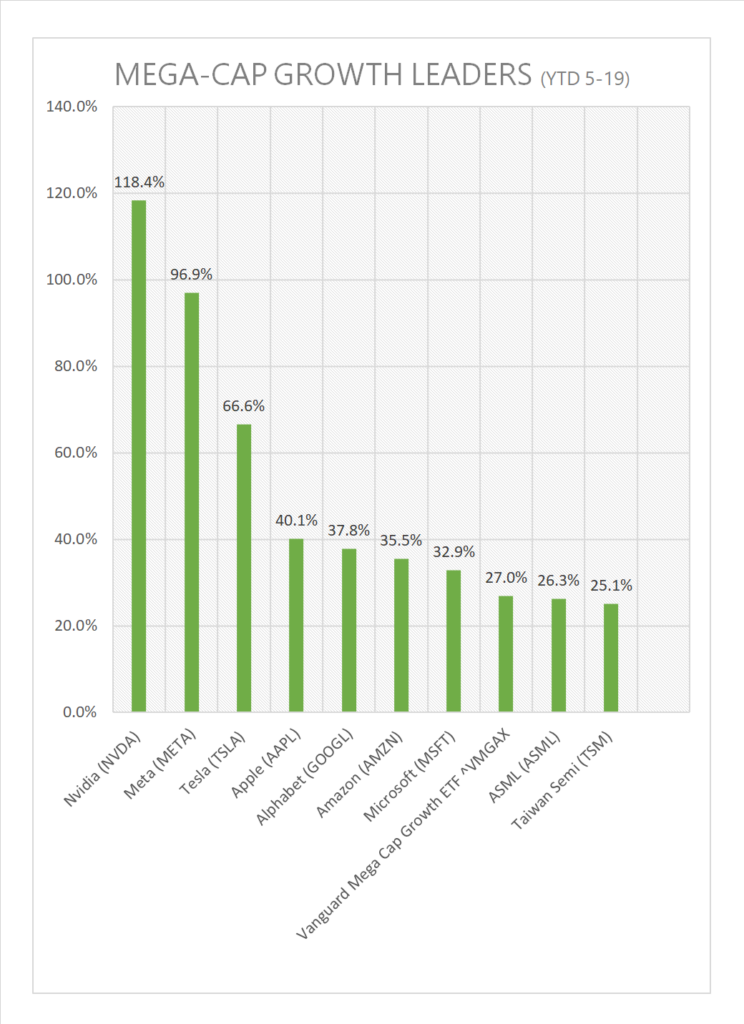

Factors (YTD)

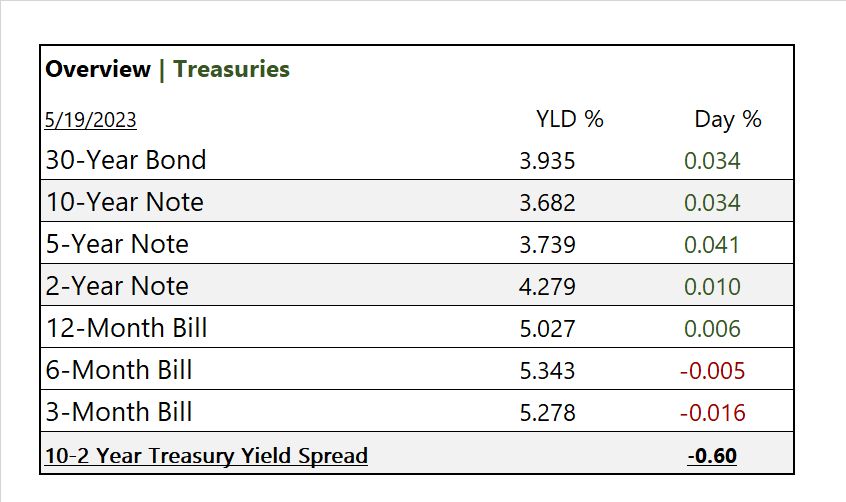

US Treasuries

Notable Earnings Today

- +Beat: Deere&Company (DE)

- – Miss: Regal Beloit (RRX), RBC Bearings (RBC), Foot Locker (FL), Qifu Tech DRC (QFIN)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Baidu (BIDU), Nu Holdings (NU)

Economic Data

US

- Fed Chair Powell said Friday that tightening credit conditions due to stresses in the banking sector mean that the central bank might not need to raise its policy rate as much as it would have otherwise to achieve its goals.

News

Company News/ Other

- Homebuilders Are Booming. There Are Two Big Reasons Why – WSJ

- Bezos’ Blue Origin wins NASA contract to build astronaut lunar lander – Reuters

- Oil Drilling Plunges the Most in Two Years With Shale Producers Pulling Back – Bloomberg

Central Banks/Inflation/Labor Market

- US regional bank stocks fall after Yellen says more bank mergers necessary – Reuters

- Here Are the Key Takeaways From Powell, Bernanke Discussion on Fed Policy – Bloomberg

China

- China’s Tech Giants Signal the First Steps in a Bumpy Recovery – NY Times

Education

- The opposite of “extrapolation bias” or “recency bias” is known as “mean reversion” or “regression to the mean.” Mean reversion suggests that extreme or outlier data points are likely to return to the average or historical norm over time (click here to learn more)