MARKETS TODAY June 2nd, 2023 (Vica Partners)

Yesterday, US Markets finished higher, S&P 500 +0.99%, DOW +0.47% and the Nasdaq +1.28%. 9 of 11 of the S&P 500 sectors higher: Information Technology +1.33% outperforms/ Utilities -0.78% lags. The NY FANG+, Gold, Oil and the Bloomberg Commodity Index gained. In economic news, the ADP job survey well ahead of estimates, claims data was in line with estimates, Manufacturing PMI and ISM manufacturing survey were just below estimates.

Overnight/US Premarket, Asian markets finished higher, Hong Kong’s Hang Seng +4.02%, Japan’s Nikkei 225 +1.21 and China’s Shanghai Composite is +0.79%. US S&P futures were trading at 0.5% above fair value. European markets finished higher, France’s CAC 40 +1.87%, London’s FTSE 100 +1.56% and Germany’s DAX is +1.25%.

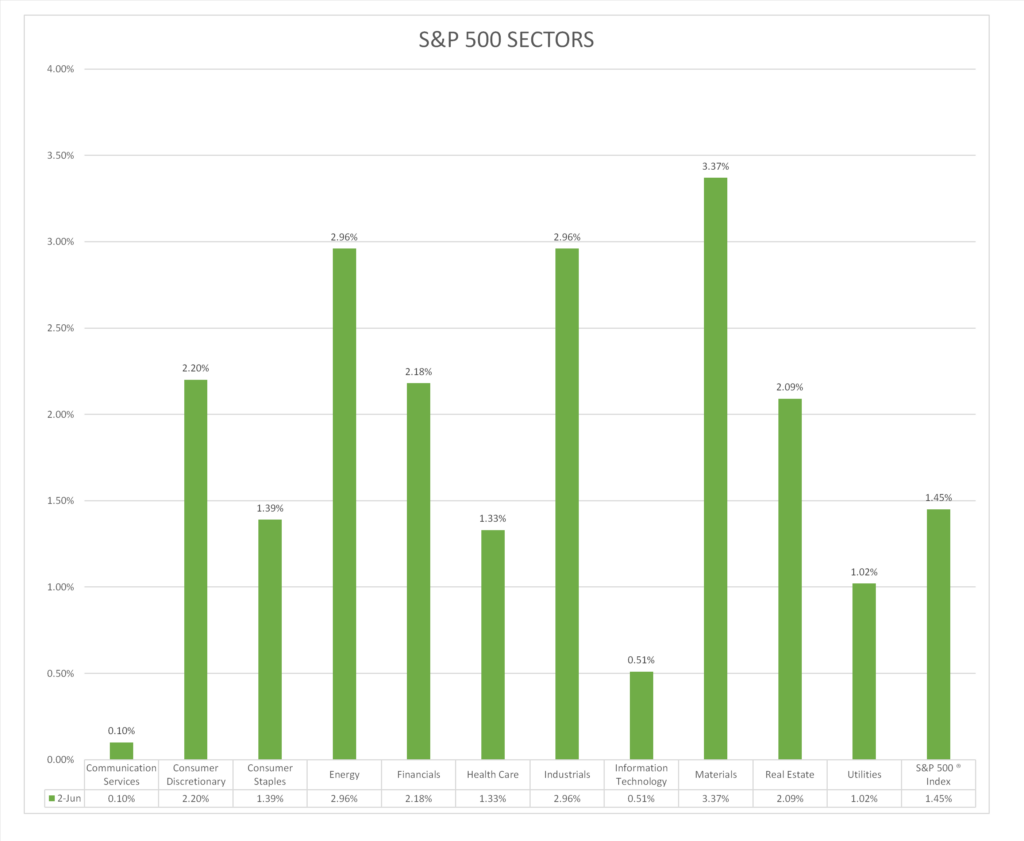

Today US Markets finished sharply higher, S&P 500 +1.45%, DOW +2.12% and the Nasdaq +1.07%. All 11 of the S&P 500 sectors higher: Materials +3.37% outperforms/ Communication Services +0.10% lags. On the upside, Russell 2k Treasury Yields, USD Index, Oil and Bitcoin. In economic news, headline Jobs numbers easily beat forecasts, the unemployment rate missed while wages showed deceleration.

Takeaways

- Pre-market Hong Kong’s Hang Seng +>4%, 3 month high % day change

- DOW >+700 points, Nasdaq lags

- Russel 2k +>3.5%,

- All 11 of the S&P 500 sectors higher: Materials +3.37% outperforms/ Communication Services +0.10% lags.

- SPDR S&P Banking ETF (KRE) +>6%

- Mixed economic news out today, muted impact on market

- Commodities and Oil rise

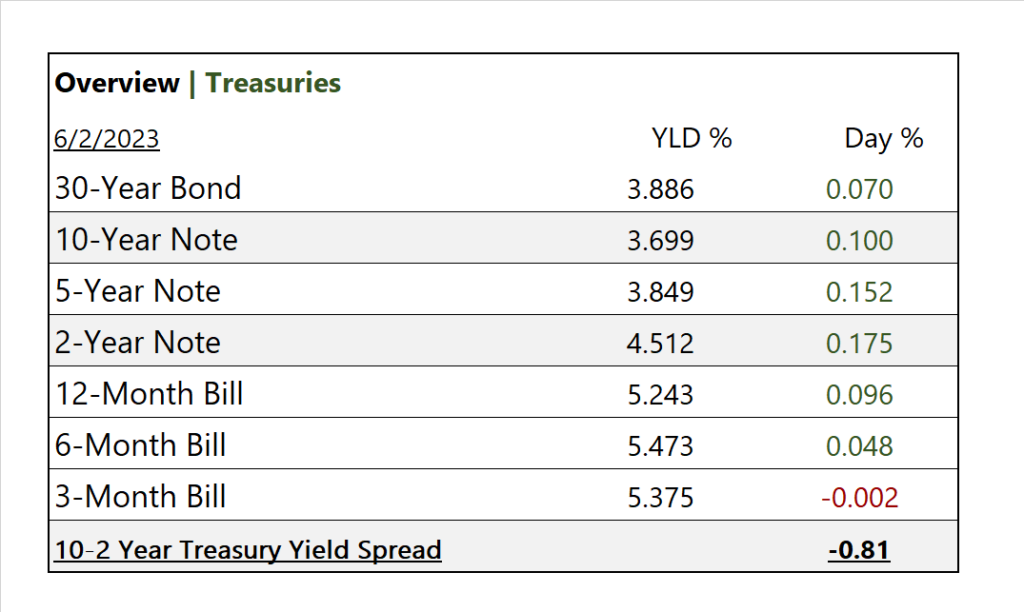

- Yields rise

- Probability of a June Fed hike <5%

Pro Tip: As noted on 5-18, Options Traders were positioning the Russel 2000 for a breakout as 700,000 call options on the iShares Russell 2000 ETF traded on Wednesday 5-17. The ^RUT has a high statistical correlation with regional banking sector. +Watch S&P 500 as resistance range @4,175 – 4,200. Update 6-2 Russel 2k +>3.5% and SPDR S&P Banking ETF (KRE) +>6%.

Sectors/ Commodities/ Treasuries

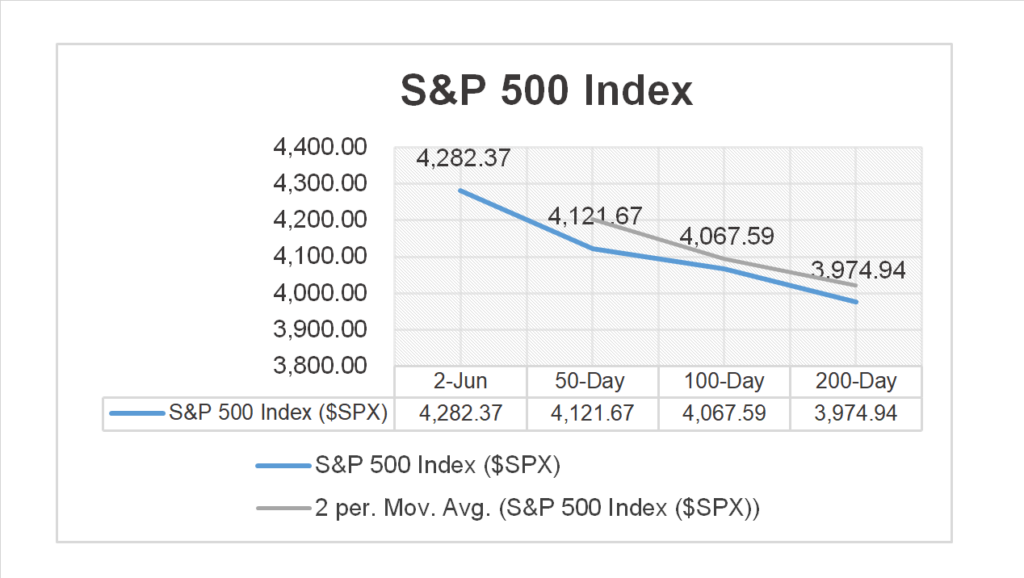

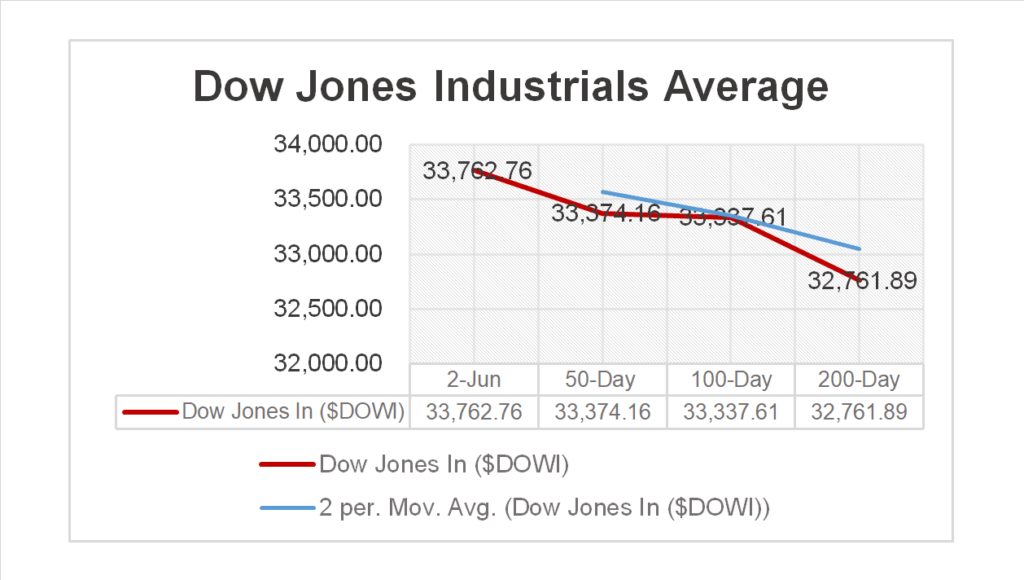

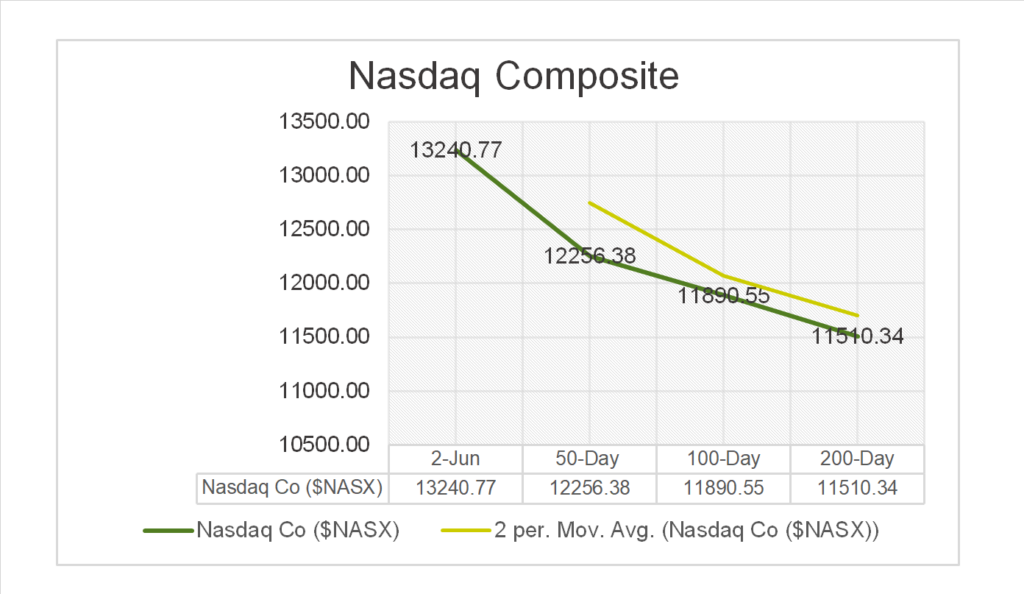

Key Indexes (50d, 100d, 200d)

S&P Sectors

- All 11 of the S&P 500 sectors higher: Materials +3.37%, Industrials +2.96% and Energy +2.96% outperform/ Communication Services +0.10% lags.

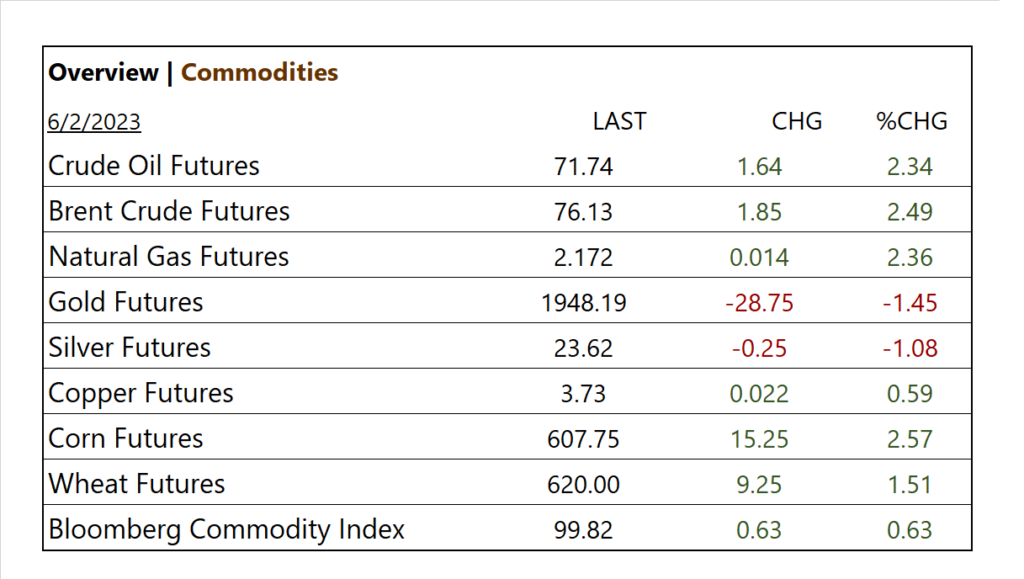

Commodities

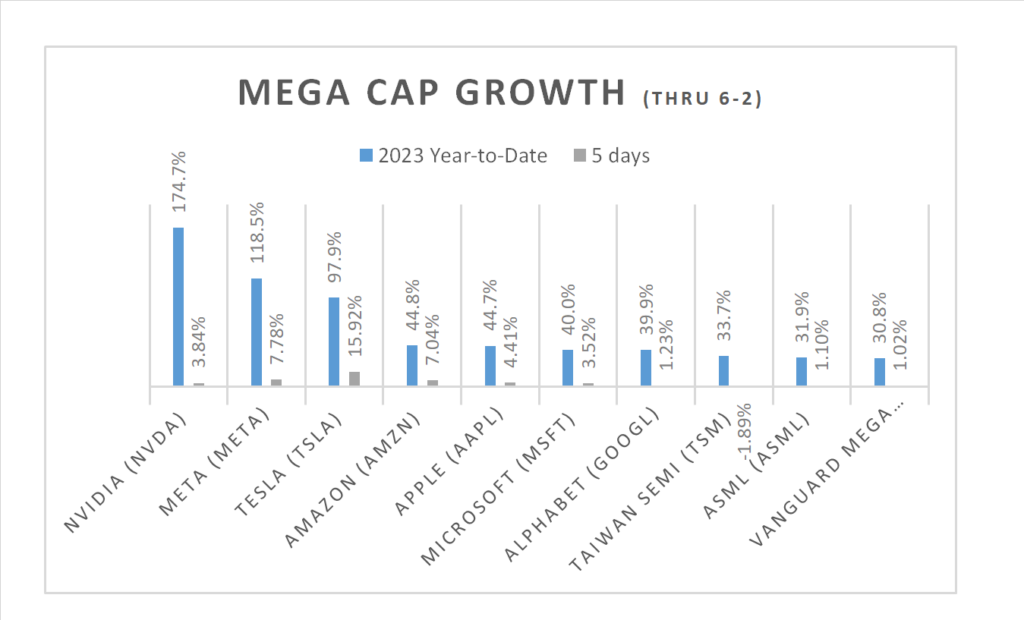

Factor/ Mega Cap Growth Chart (YTD)

US Treasuries

Notable Earnings Today

- +Beat: nothing notable today

- – Miss: nothing notable today

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), UI Path (PATH)

Economic Data

US

- US. employment report; period May, act 339,000, fc 190,000, prev. 294,000

- US. unemployment rate; period May, act 3.7%, fc 3.5%, prev. 3.4%

- US. hourly wages’; period May, act 0.3%, fc 0.3%, prev. 0.5%

- Hourly wages year over year ; period May, act 4.3%, fc 4.4%, prev. 4.4%

News

Company News

- Norfolk Southern Decides to Take a Different Track – Bloomberg

- Nvidia Is Still a ‘Buy’ to Wall Street Analysts – WSJ

Energy/ Materials

- US-China Green Energy Rivalry ‘Great for World,’ Forrest Says – Bloomberg

Central Banks/Inflation/Labor Market

- US. Labor Market Shows Resilience With Strong May Hiring – WSJ

China