MARKETS TODAY June 13th, 2023 (Vica Partners)

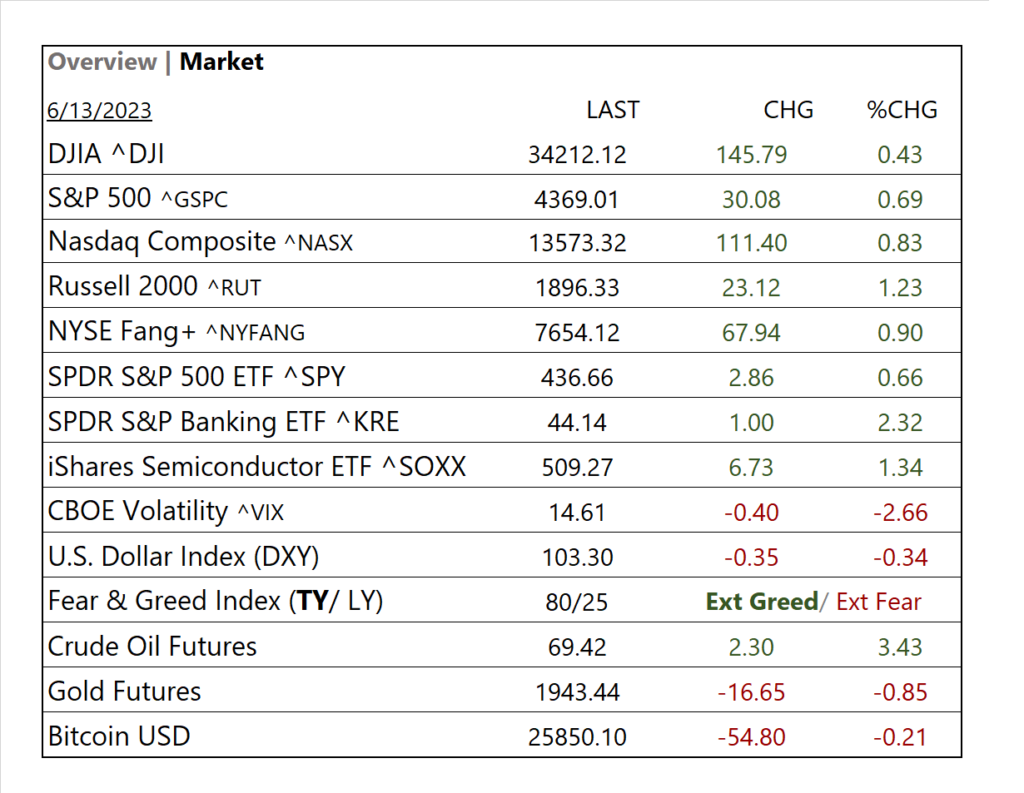

On Monday, US markets finished higher, S&P 500 +0.93%, DOW +0.56% and the Nasdaq +1.53%. 8 of 11 of the S&P 500 sectors advancing: Information Technology +2.07% outperforms/ Energy -0.97% lags. On the upside, NY FANG+, iShares Semiconductor ETF (SOXX) and the USD Index. In economic news scheduled today, the Federal deficit for the month of May was mostly in line with estimates.

Overnight/US Premarket, Asian markets finished higher, Japan’s Nikkei 225 +1.80%, Hong Kong’s Hang Seng +0.60% and China’s Shanghai Composite +0.15%. European markets finished higher, Germany’s DAX +0.83%, France’s CAC 40 +0.56% and London’s FTSE 100 +0.46%. US S&P futures were trading at 0.5% above fair value.

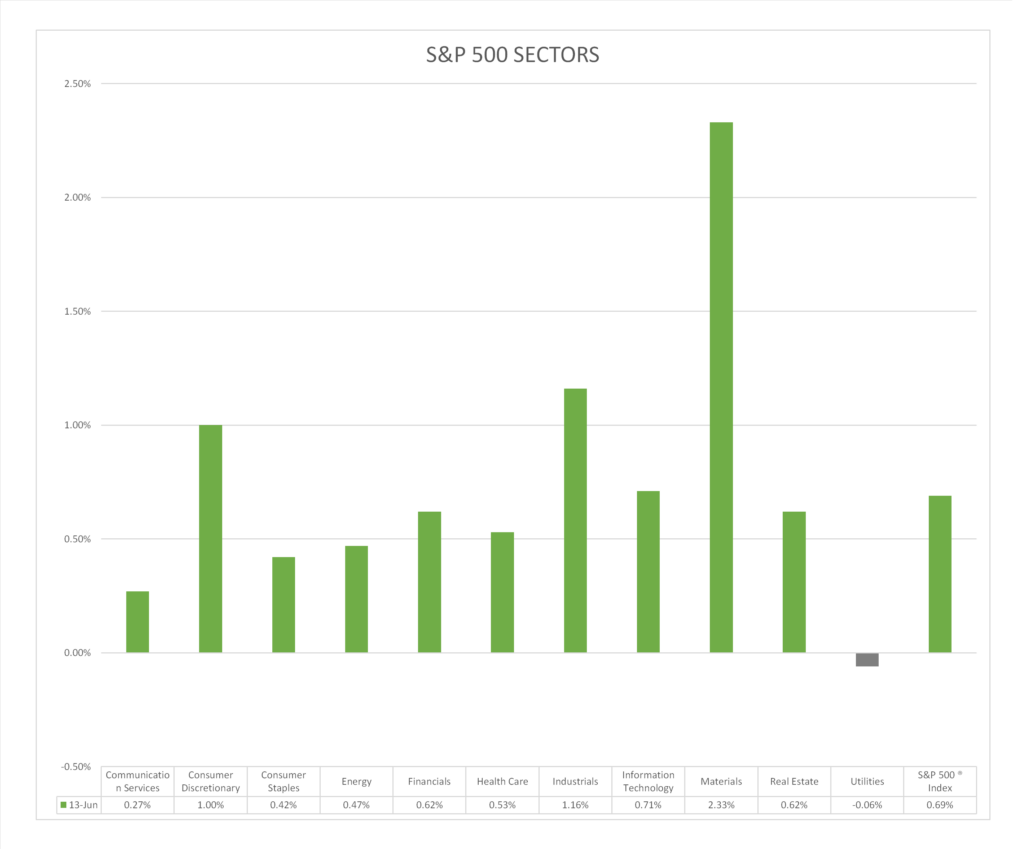

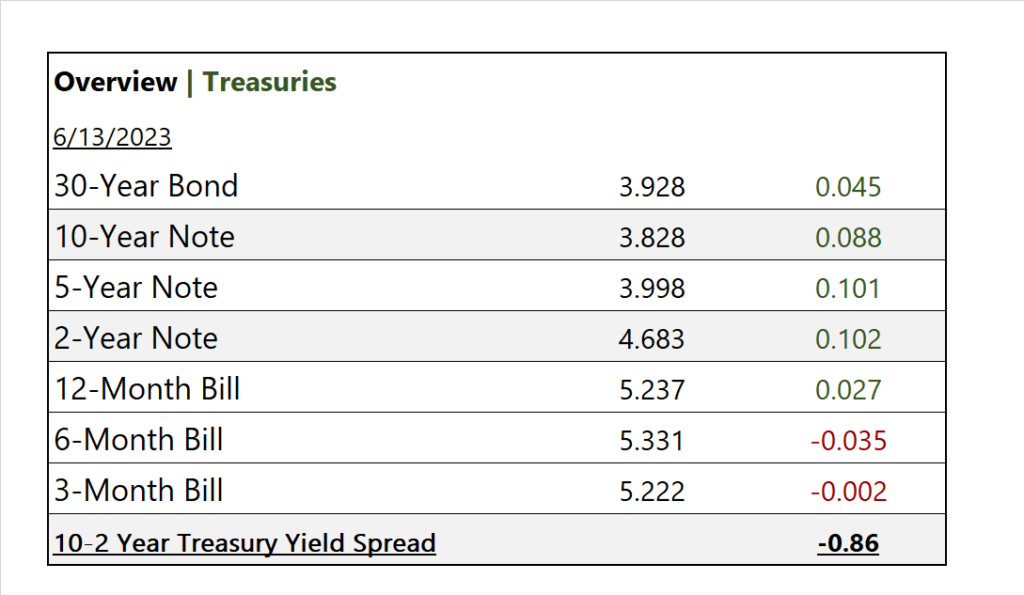

Today US Markets finished higher, S&P 500 +0.69%, DOW +0.43% and the Nasdaq +0.83%. 10 of 11 of the S&P 500 sectors advancing: Materials +2.33% outperforms/ Utilities -0.06% lags. On the upside, Russell 2k, SPDR S&P Banking ETF (KRE), Treasury Yields, Oil and the Bloomberg Commodity Index. In economic news, Headline CPI showed significant deceleration on both a monthly and annual basis while Core-CPI was no was inline with estimates.

Takeaways

- Headline CPI showed sharp deceleration

- Russell 2000 (RUT) +1.23%, Small Cap stocks deliver

- SPDR S&P Banking ETF (KRE), up 2.3%

- Materials leads upside on China stimulus news

- 10 of 11 of the S&P 500 sectors higher: Materials +2.33% outperforms/ Utilities -0.06% lags.

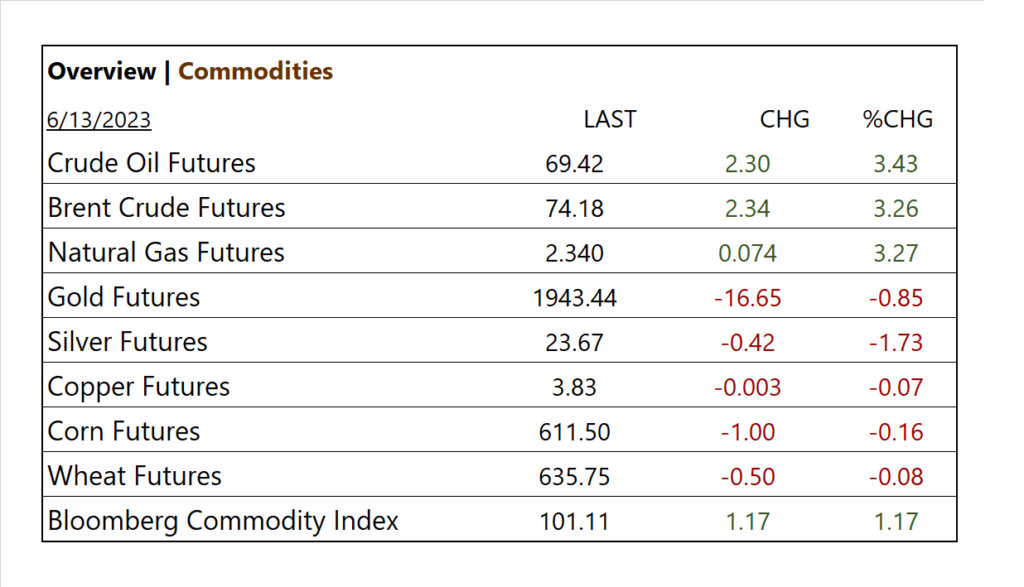

- Oil Futures jump >3%

- Fed 0% chance of June rate hike

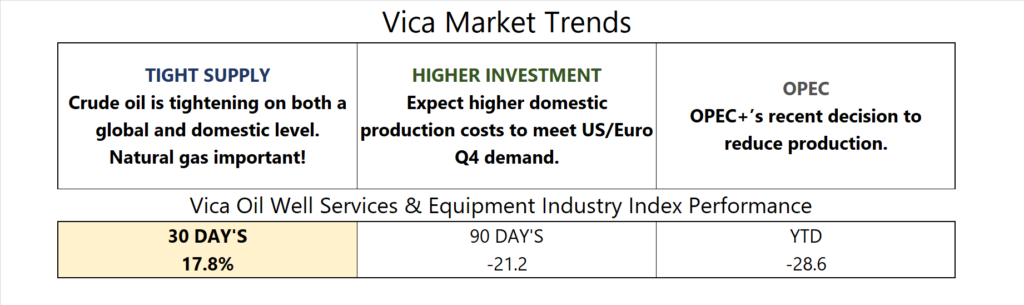

Pro Tip: The global oilfield services and equipment rental market is great demand had one of its most profitable years in 2022. Vica is forecasting double digit sector growth in Q3/4.

Sectors/ Commodities/ Treasuries

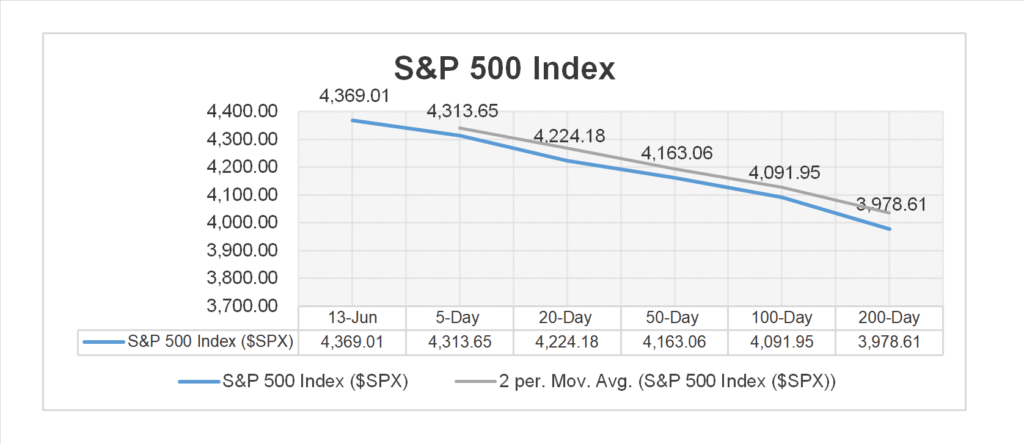

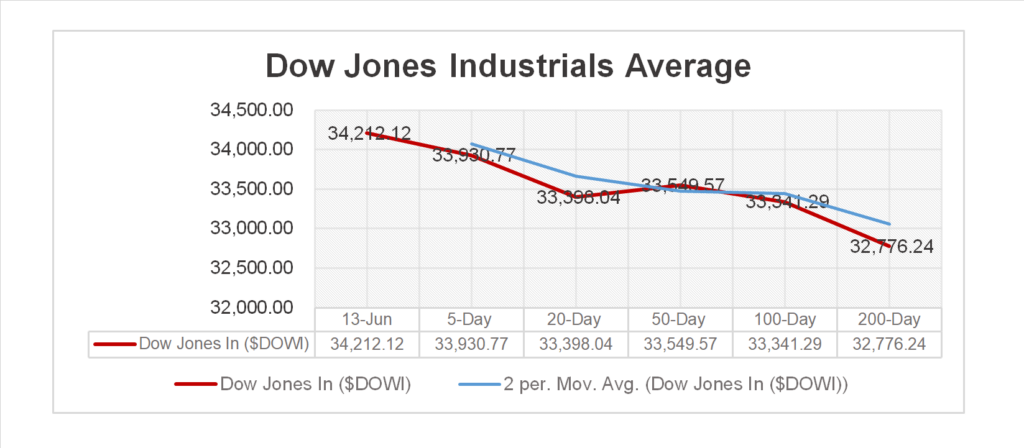

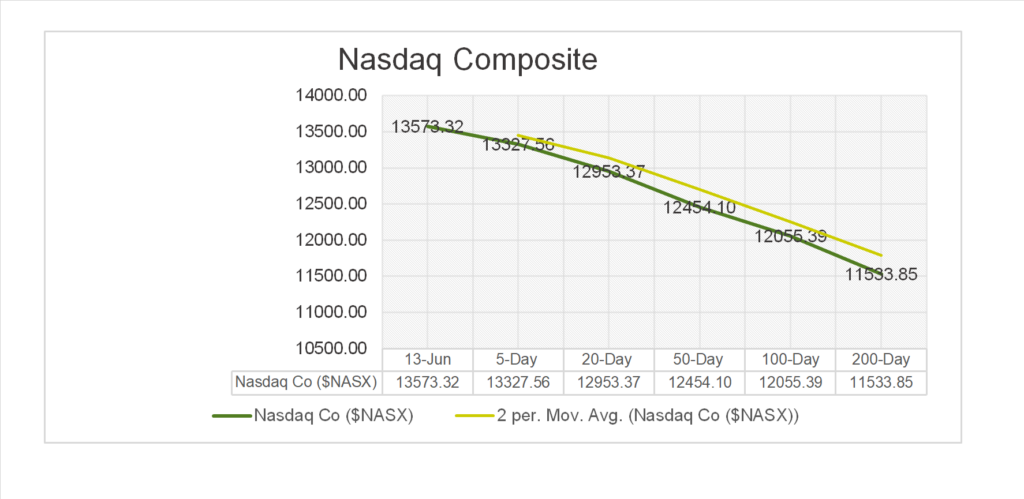

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 10 of 11 of the S&P 500 sectors higher: Materials +2.33%, Industrials +1.16% outperform/ Utilities -0.06% lags.

Commodities

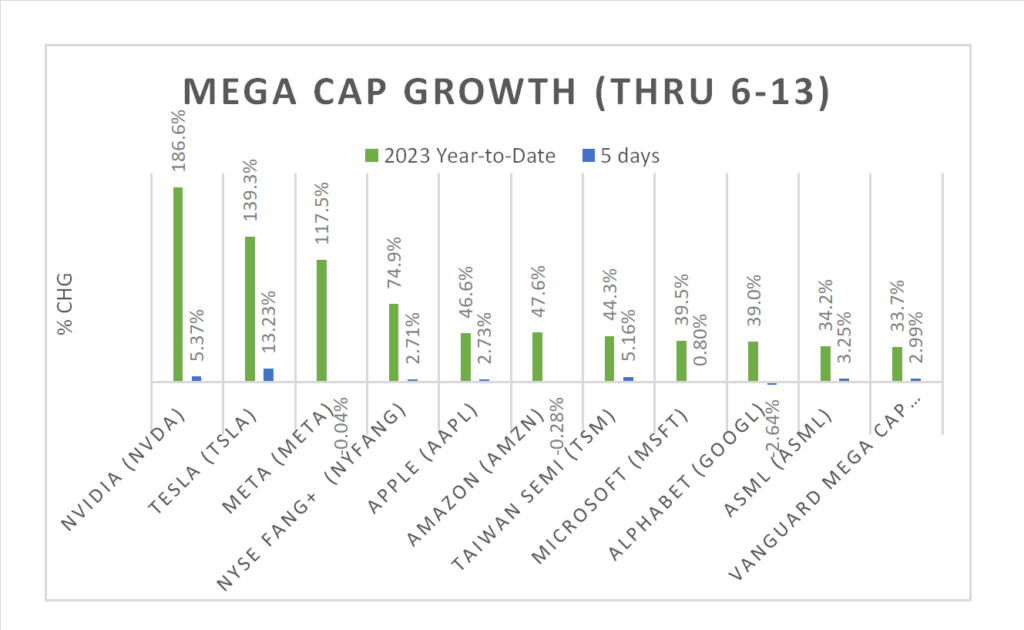

Factor/ Mega Cap Growth Chart (YTD)

US Treasuries

Notable Earnings Today

- +Beat: Burford (BUR)

- – Miss:

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML). UI Path Inc. (PATH)

Economic Data

US

- NFIB optimism index; period May, act 89.4, fc 88.3. prior 89

- Consumer price index; period May. act 0.1%, fc 0.1%, prior 0.4%

- Core CPI; period May, act 0.4%, fc 0.4%, prior 0.4%

- CPI year over year; act 4.0%, fc 4.0%. prior 4.9%

- Core CPI year over year; act 3%, fc 5.3%, prior 5.5%

- Fed rate decision Wednesday

News

Company News

- Binance Emergency Fund Dwindles as SEC Takes Aim at the Crypto Exchange – WSJ

- Arm Courts Intel as Anchor Investor in Upcoming IPO – Bloomberg

- BlackRock’s Japan ETF Lures $1 Billion as Nikkei Rally Powers On – Bloomberg

Energy/ Materials

- OPEC Crude Production Slumps as Voluntary Cuts Bite – WSJ

- UK’s Centrica Warns More Gas Storage Needed for Energy Security – Bloomberg

Central Banks/Inflation/Labor Market

- CPI Report Shows Inflation Has Been Cut in Half From Last Year’s Peak – WSJ

- Asian Stocks Primed to Rise as US Inflation Slows: Markets Wrap – Bloomberg

China/ Asia