MARKETS TODAY June 26th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished lower, China’s Shanghai Composite -1.481%, Hong Kong’s Hang Seng -0.51%, Japan’s Nikkei 225 -0.25%. European markets finished mixed, France’s CAC 40 +0.29%, London’s FTSE 100 -0.11%, Germany’s DAX -0.11%. S&P futures were trading at 0.2% below fair-value.

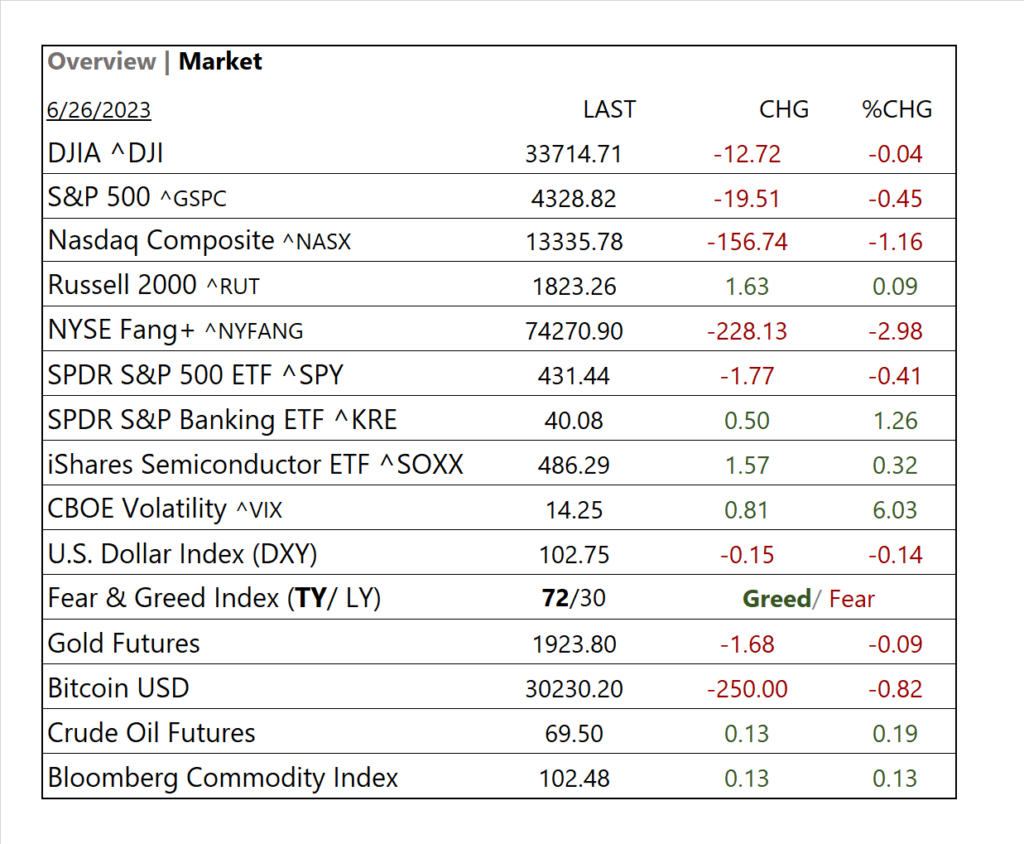

Today US Markets finished lower, S&P 500 -0.45%, DOW -0.04%, NASDAQ -1.16%. 6 of 11 of the S&P 500 sectors declining: Real Estate +2.21% outperforms/ Communication Services -1.88% lags. On the upside, Russell 2000 (RUT), S&P Banking ETF (KRE), Oil, Bloomberg Commodity Index. No economic releases today.

Takeaways

- FANG+ 5 days <4.14%>

- Russell Reconstitution Friday sparks R2k rally today

- 6 of 11 of the S&P 500 sectors declining: Real Estate +2.21% outperforms/ Communication Services -1.88% lags

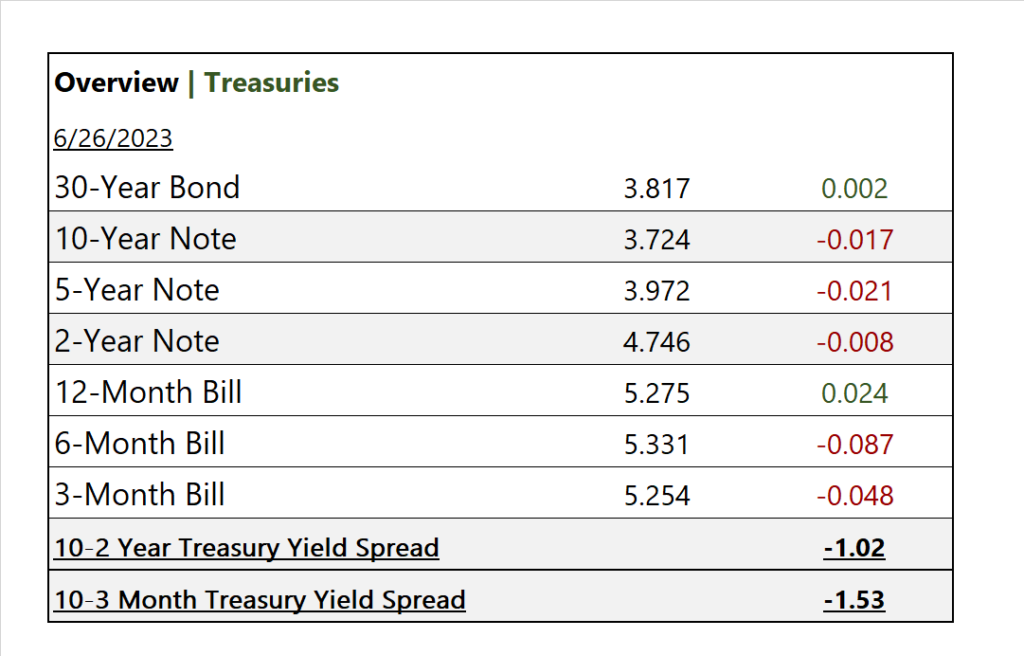

- Yields moderately lower

- S&P Banking ETF (KRE) +1.26%

- Oil and Bloomberg Commodity Index gain

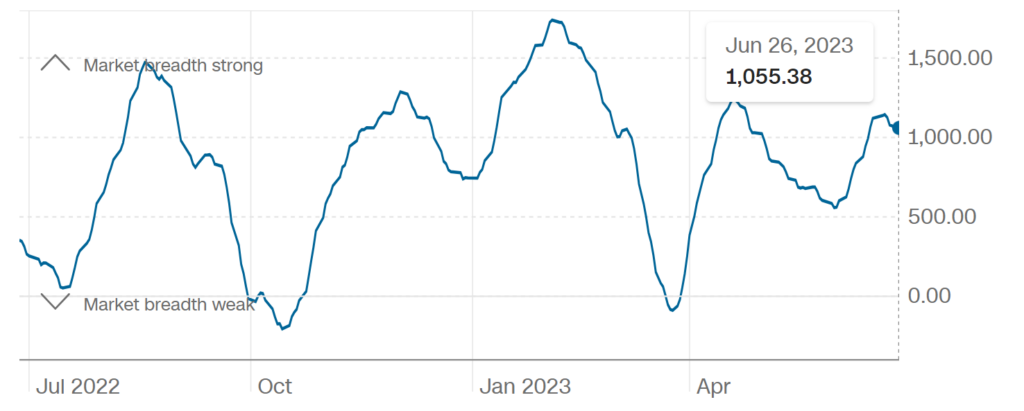

Pro Tip: The McClellan Volume Summation Index measures the volume, of shares on the NYSE that are rising compared to the number of shares that are falling. A low/ negative number is a declining sign.

McClellan Volume Summation Index

Sectors/ Commodities/ Treasuries

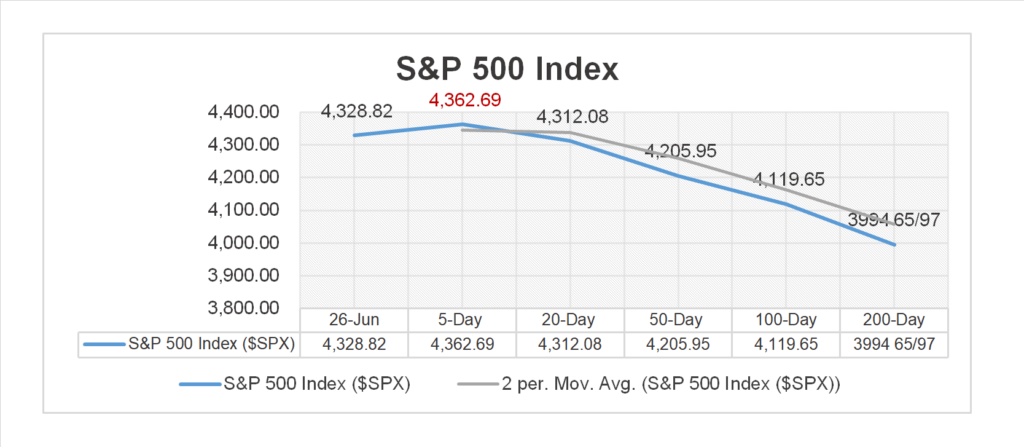

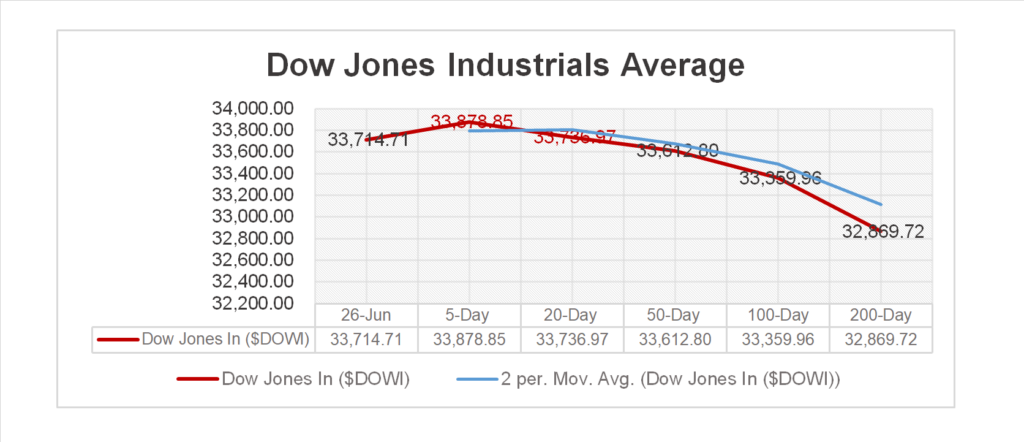

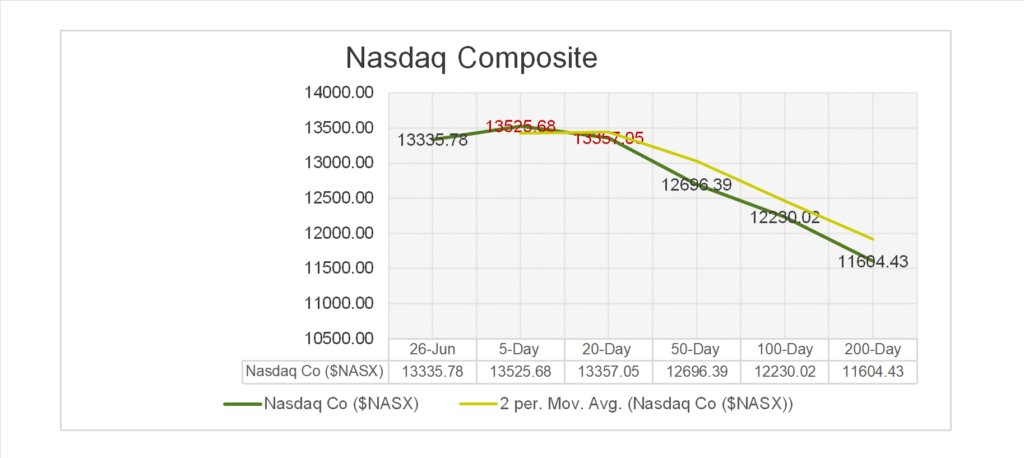

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 6 of 11 of the S&P 500 sectors declining: Real Estate +2.21%, Energy +1.71%, outperforms/ Communication Services -1.88%, Consumer Discretionary -1.25% lag.

US Treasuries

Notable Earnings Today

- +Beat: Carnival Corp (CCL)

- – Miss:

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom Inc (AVGO), Intel (INTC)

Economic Data

US

- None scheduled

News

Company News/ Other

- Apollo Leads $2 Billion Private Financing for Semiconductor Firm Wolfspeed – Bloomberg

- Ford Venture Gets Record $9.2 Billion Government Loan for EV Batteries – WSJ

- Buy Now, Pay Later Programs Are Booming. Here’s Why Their Profits Aren’t – WSJ

Energy/ Materials

- OPEC Woos Guyana, Tiny Nation That Sits Atop Massive Oil Field – WSJ

- China’s GAC Unveils World’s First Ammonia Car Engine – Bloomberg

Central Banks/Inflation/Labor Market

- Why Economies Haven’t Slowed More Since Central Banks Hit the Brakes – WSJ

- Homebuilding Set to Boost US Economy After Two-Year Contraction – Bloomberg

China/ International