MARKETS TODAY June 30th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, China’s Shanghai Composite 0.62%, Japan’s Nikkei 225 -0.14%, Hong Kong’s Hang Seng -0.09%. European markets finished higher, Germany’s DAX +1.26%, France’s CAC 40 +1.19%, London’s FTSE 100 +0.80%. S&P futures were trading at 0.2% above fair-value.

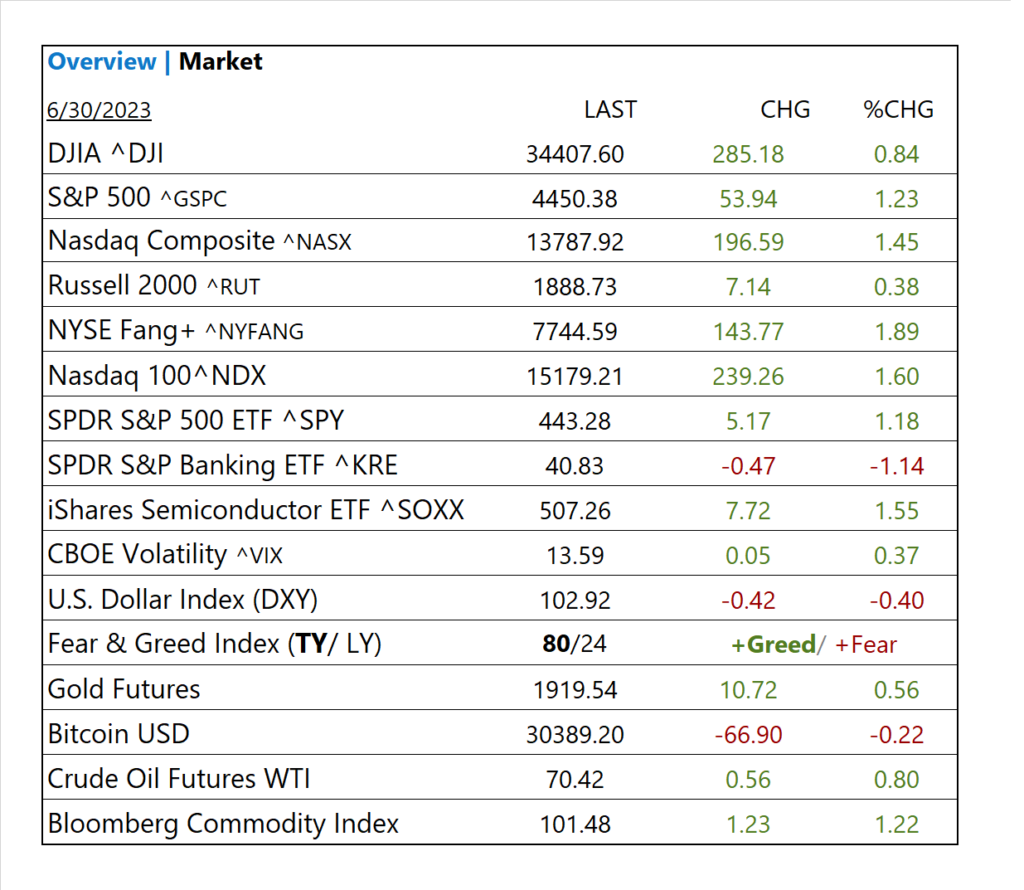

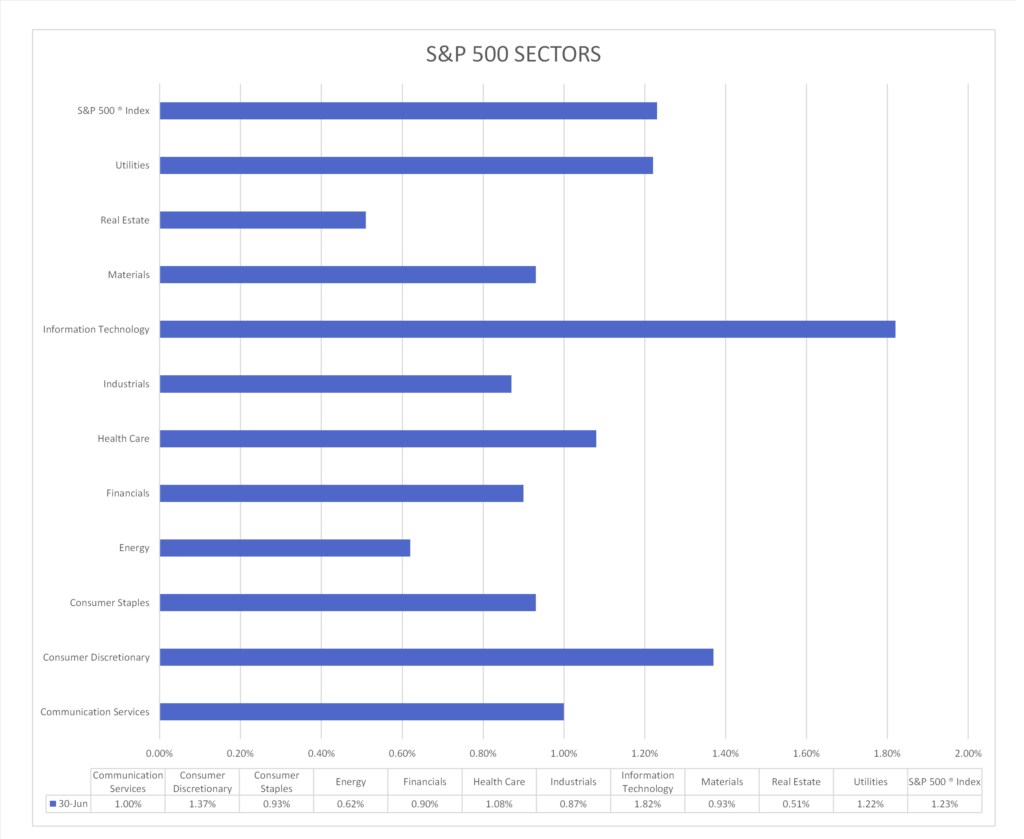

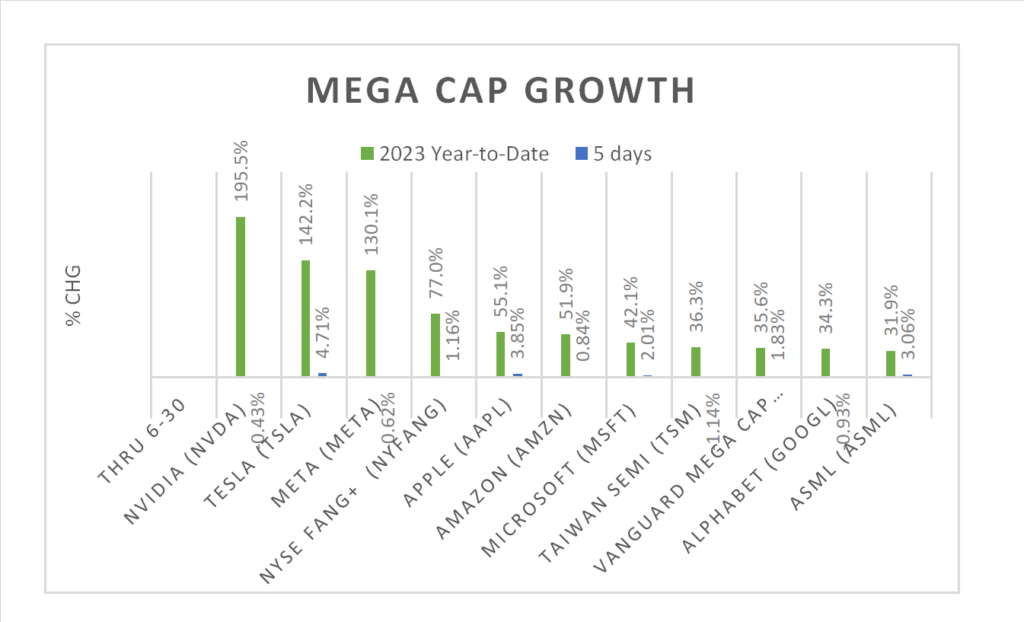

Today US Markets finished higher, S&P 500 +1.23%, DOW +0.84%, NASDAQ +1.45%. All 11 of the S&P 500 sectors advancing: Information Technology +1.82% outperforms/ Real Estate +0.51% lags. On the “big” upside, Nasdaq, Mega Cap Growth, Semiconductor ETF (SOXX), Crude Oil Futures, Bloomberg Commodity Index. In economic news, US personal income in line with estimates, spending missed. Headline PCE beat estimates, the lowest level since April 2021 and Core-PCE in line. Consumer sentiment beats, Chicago Business Barometer misses.

Takeaways

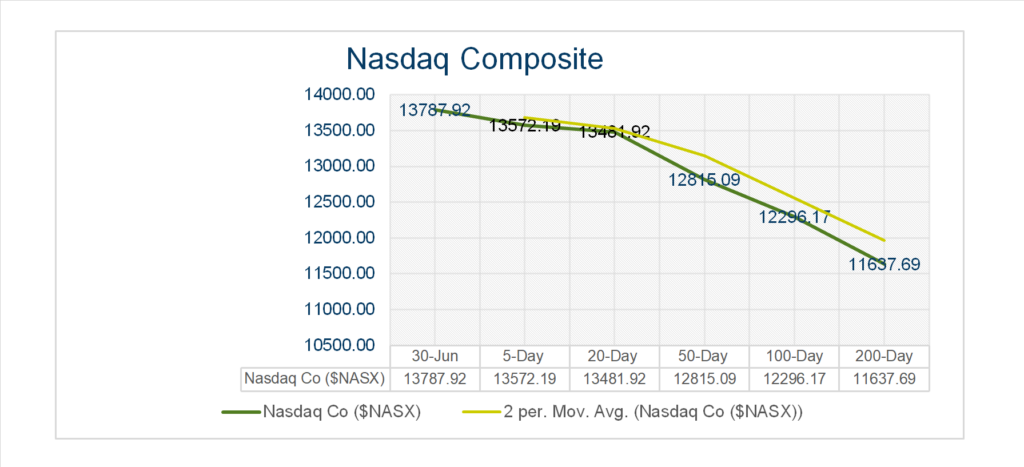

- Nasdaq YTD best performance in 40 years

- Headline PCE beat estimates, Core-PCE in line

- Nasdaq, FANG+, lead Indices

- All 11 of the S&P 500 sectors advancing: Information Technology +1.82% outperforms/ Real Estate +0.51% lags

- Semiconductor ETF (SOXX) +>1.5%

- Constellation Brands A (STZ) solid earnings beat

Vica Partner Guidance: Q1 2024/ expect economy pullback, Q3 2023/ credit default swap (CDS) will pick-up, Nasdaq 100^NDX 14,500 level is buying opportunity.

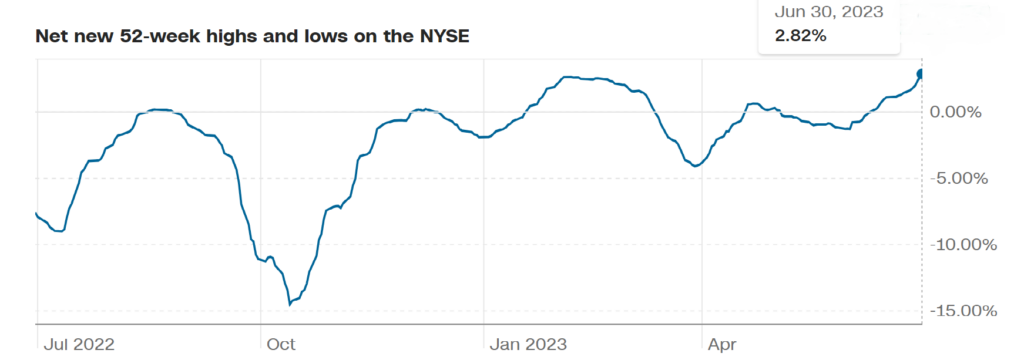

Pro Tip: This chart shows number of stocks on the NYSE at 52-week highs compared to those at 52-week lows. When more highs than lows, that’s a bullish signal.

STOCK PRICE STRENGTH

Sectors/ Commodities/ Treasuries

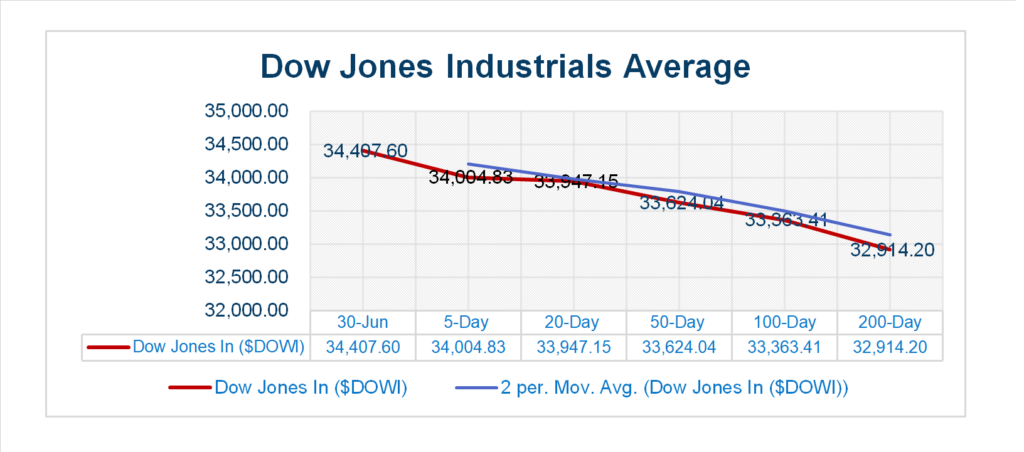

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- All 11 of the S&P 500 sectors advancing: Information Technology +1.82%, Consumer Discretionary +1.37% outperform/ Real Estate +0.51%, Energy 0.62% lag.

Factor/ Mega Cap Growth

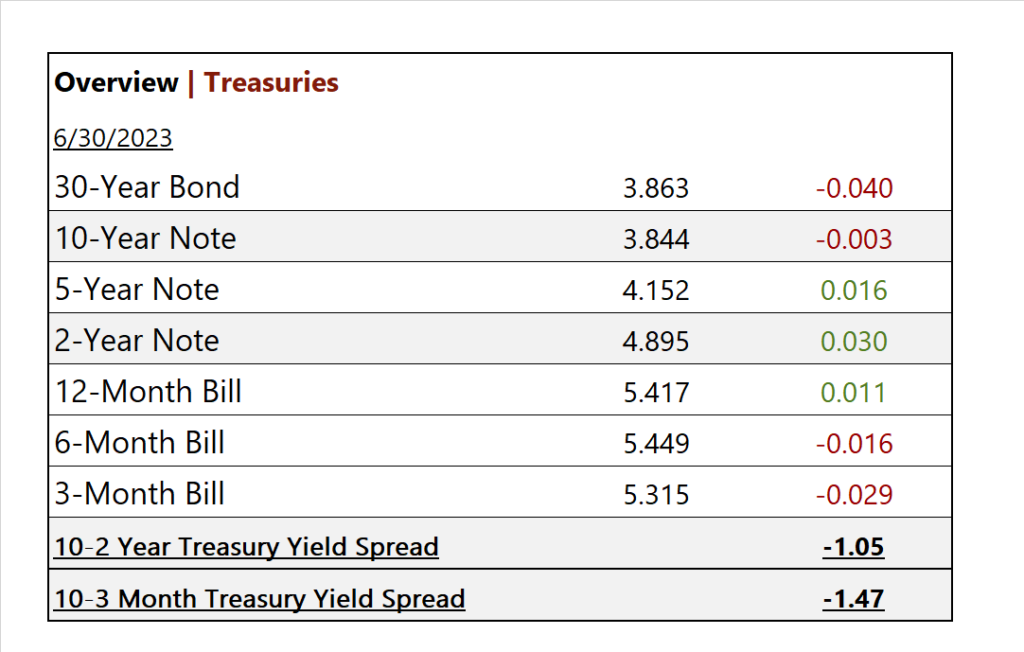

US Treasuries

Notable Earnings Today

Notable Earnings Today

- +Beat: Constellation Brands A (STZ)

- – Miss: Nike (NKE) on 6-29

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom Inc (AVGO), Intel (INTC)

Economic Data

US

- Personal income (nominal); period May, act 0.4%, fc 0.4%, prior 0.4%

- Personal spending (nominal); period May, act 0.1%, fc 0.2%, prior 0.8%

- PCE index; period May, act 0.1%, fc 0.1%, prior 0.4%

- Core PCE index; period May, act 0.3%, fc 0.4%, prior 0.4%

- PCE (year-over-year); act 3.8%, fc 3.8%, prior 4.4%

- Core PCE (year-over-year); act 4.6%, fc 4.7%, prior 4.7%

- Chicago Business Barometer; act June, act 41.5%, fc 43, prior 40.4

- Consumer sentiment (final); period June, act 64.4%, fc 64.0, prior 63.9

News

Company News/ Other

- Carnival Stock Has Room to Run Even After Record Month, Jefferies Says – Bloomberg

- Goldman Is Looking for a Way Out of Its Partnership With Apple – WSJ

- JPMorgan, Wells Fargo to Pay Higher Dividends After Stress Tests – Bloomberg

Energy/ Materials

- With Plenty of Clean Energy, Brazil Aims for Green Hydrogen Export Market – Bloomberg

- Big Oil Mulls a Slippery Future – WSJ

Central Banks/Inflation/Labor Market

- S. Inflation, Consumer Spending Growth Cooled in May – WSJ

- Supreme Court Strikes Down Biden’s Student-Loan Forgiveness Plan – WSJ

China/ International