MARKETS TODAY July 12th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished mixed, Hong Kong’s Hang Seng +1.08%, Japan’s Nikkei 225 -0.81%, China’s Shanghai Composite -0.78%.

European markets finished broadly higher, London’s FTSE 100 +1.93%, France’s CAC 40 +1.69%, Germany’s DAX +1.54%. S&P futures were trading at +0.6% above fair value.

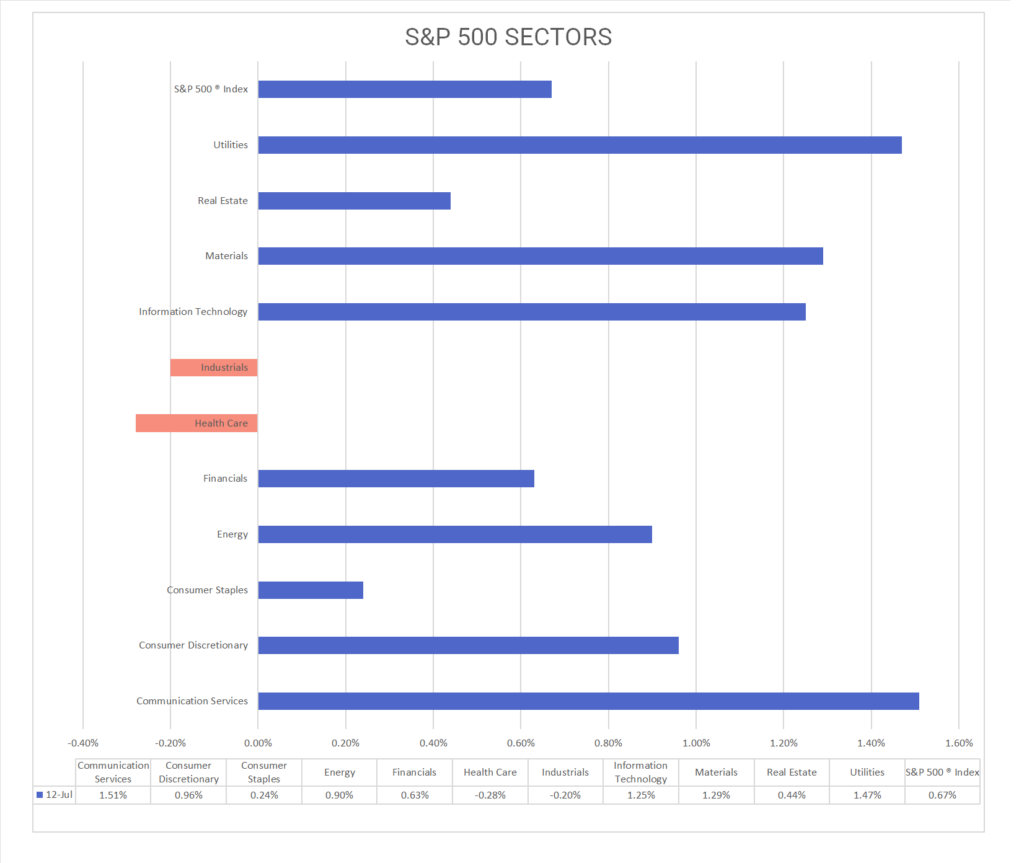

Today US Markets finished higher, S&P 500 +0.74%, DOW +0.25%, NASDAQ +1.15%. 9 of 11 S&P 500 sectors advancing: Communication Services +1.51% outperforms/ Health Care -0.28% lags. On the upside, NASDAQ leads majors, NYSE Fang+ bounces, S&P Banking ETF ^KRE, Semiconductors, Small Caps, Mega Cap Tech, Gold, Bloomberg Commodity Index. In economic news, Headline and Core inflation was better than analysts expected.

Takeaways

- Headline core inflation easily beats consensus @27 month low

- Nasdaq +1.15% leads majors, NYSE Fang+ bounces back +1.74%

- 9 of 11 S&P 500 sectors advancing: Communication Services +1.51% outperforms/ Health Care -0.28% lags

- SPDR S&P Banking ETF ^KRE +>2%

- Semiconductor & Semiconductor Equipment +2.37%

- Gold, Oil and Bloomberg Commodity Index gain

- Q2 earnings kick off Friday (topline info below)

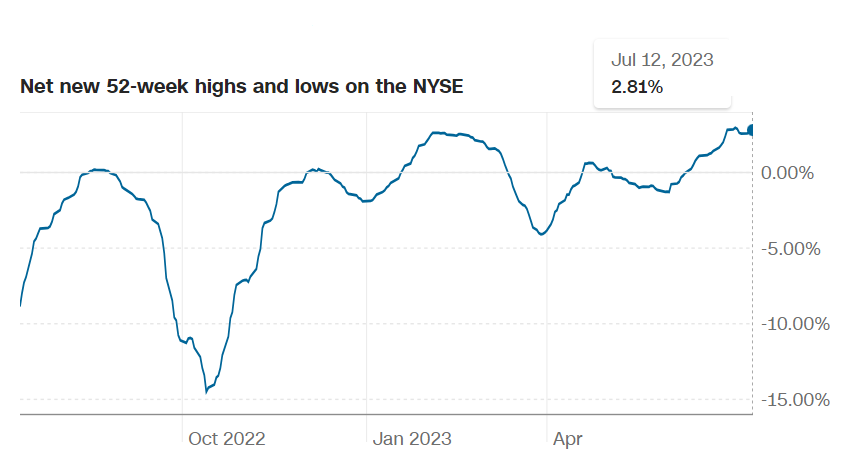

Pro Tip: Stock Price Strength, the Chart below shows the number of stocks on the NYSE at 52-week highs compared to those at 52-week lows.

Sectors/ Commodities/ Treasuries

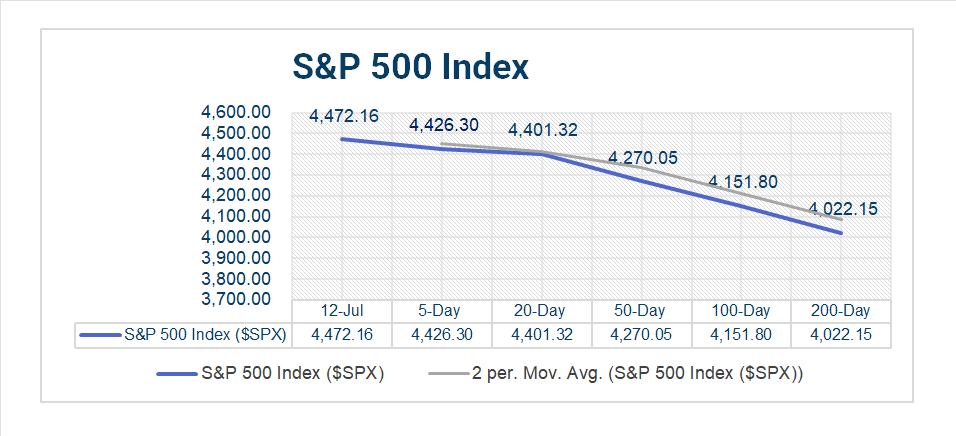

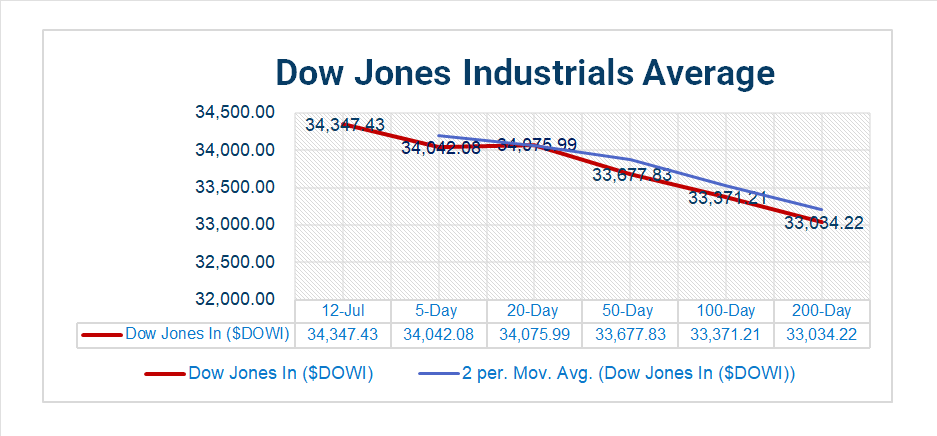

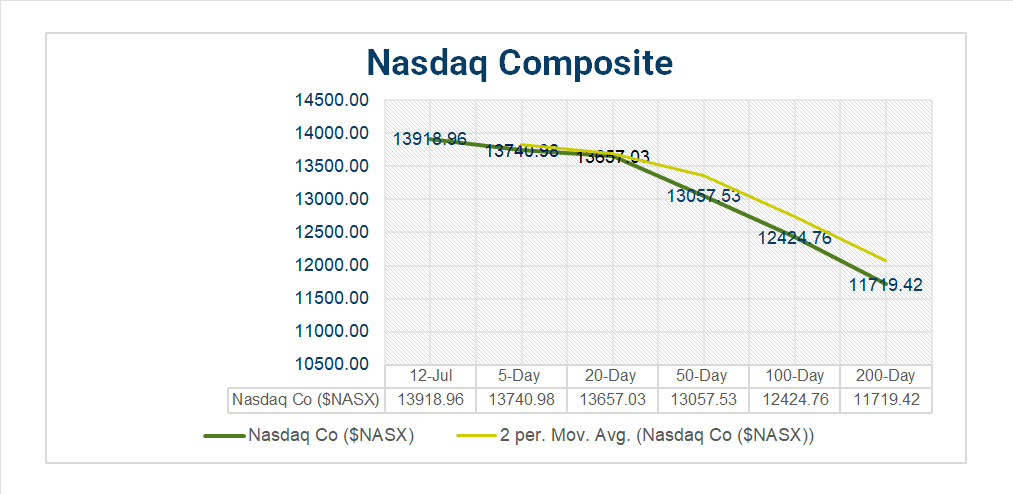

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 9 of 11 S&P 500 sectors advancing: Communication Services +1.51%, Utilities +1.47% outperform/ Health Care -0.28% lags.

- Communications/ Sub Interactive Media & Services +2.30%, Utilities/ Sub Water +2.04%, Other/ Metals & Mining +2.20%, Semiconductor & Semiconductor Equipment +2.37%, Household Durables 2.23%, Automobile Components +1.83%,

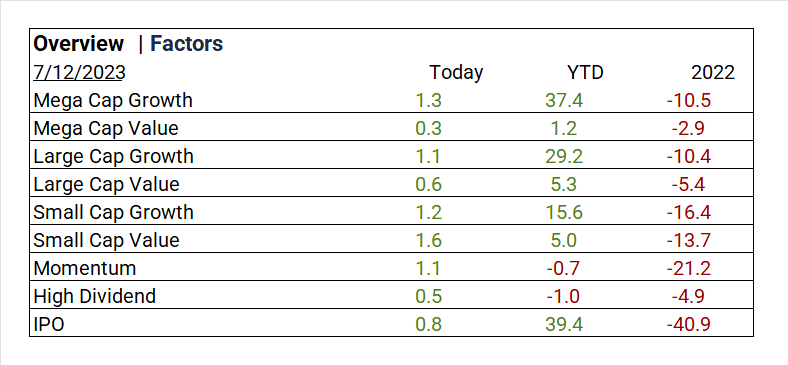

Factors

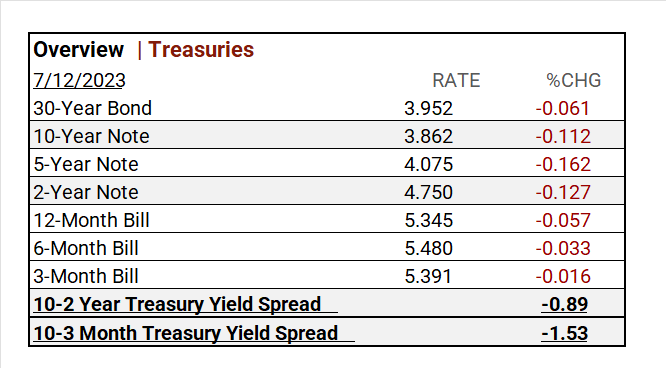

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

Notable Earnings Today

- +Beat: nothing notable

- – Miss: Aeon ADR (AONNY)

Economic Data

US

- Consumer price index; period June, act 0.2%, fc 0.3%, prior 0.1%

- Core CPI; period June, act 0.2%, fc 0.3%. prior 0.4%

- CPI year over year; act 3.0%, fc 3.1%, prior 4.0%

- Core CPI year over year; act 4.8%, fc 5.0%, prior 5.3%

Vica Partner Guidance July ‘23: Mega and Large Cap Growth continues to look attractive in early Q3. Highlighting Lithium Miners. Nasdaq 100^NDX 14,500 level is a buying opportunity. Undervaluation of Japanese equities, upside for Chinese Mega Cap Tech. Q3/4 2023/ credit default swap (CDS) will pick-up. We continue to emphasize business *quality and strength of balance sheet for all investments.

* Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Sociedad Quimica y Minera (SQM)

News

Company News/ Other

- Intel and Nvidia continue to push AI chips in China despite US restrictions –

- Elon Musk Launches xAI, His New Artificial-Intelligence Company – WSJ

- Influencer Backlash Is the Latest Threat to Fast-Fashion Giant Shein’s IPO Plans – Bloomberg

Energy/ Materials

- Big Automakers Grab $1 Billion Deal for Urgently Needed Battery Metals – WSJ

- NextDecade Will Move Ahead With $18.4 Billion Texas LNG Project – Bloomberg

Central Banks/Inflation/Labor Market

- Fed’s Neel Kashkari Ponders ‘High-Inflation Stress Test’ for Banks – WSJ

- S. Takes Third Shot at Shoring Up Money-Market Funds – WSJ

Asia/ China