MARKETS TODAY July 13th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished firmly higher, Hong Kong’s Hang Seng +2.60%, Japan’s Nikkei 225 +1.49%, China’s Shanghai Composite +1.26%. European markets finished higher, Germany’s DAX +0.74%, France’s CAC 40 +0.50%, London’s FTSE 100 +0.32%. S&P futures were trading at +0.4% above fair value.

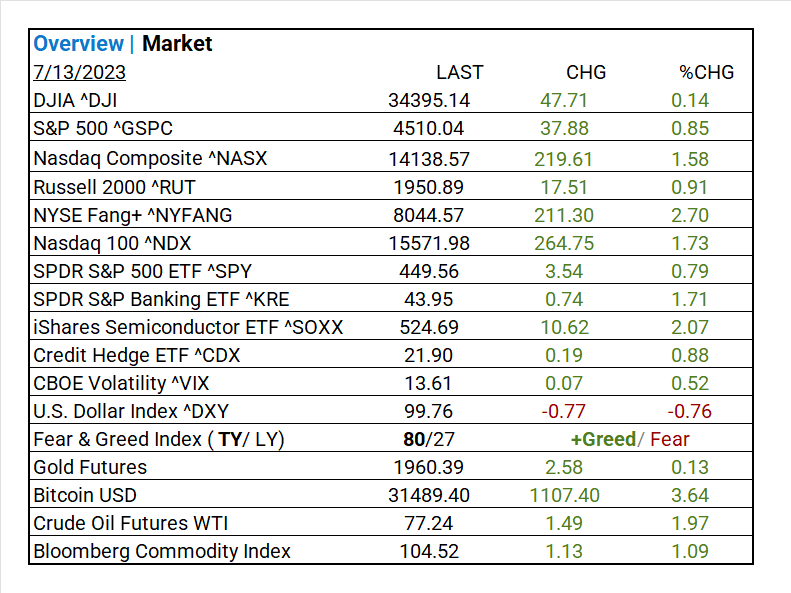

Today US Markets finished higher, S&P 500 +0.85%, DOW +0.14%, NASDAQ +1.58%. 9 of 11 S&P 500 sectors advancing: Communication Services +2.32% outperforms/ Energy -0.45% lags. On the upside, NASDAQ leads majors, NYSE Fang+ jumps, Semiconductor ETF ^SOXX, Mega Cap Tech, Media & Services Companies, Gold, Bitcoin, Oil, the Bloomberg Commodity Index. In economic news, US, PPI beat consensus with both headline and core up by 0.1%. Initial claims were better than expected, with continuing claims in line. China’s trade data missed in premarket.

Takeaways

- Deflationary economic data continues to spark market rally

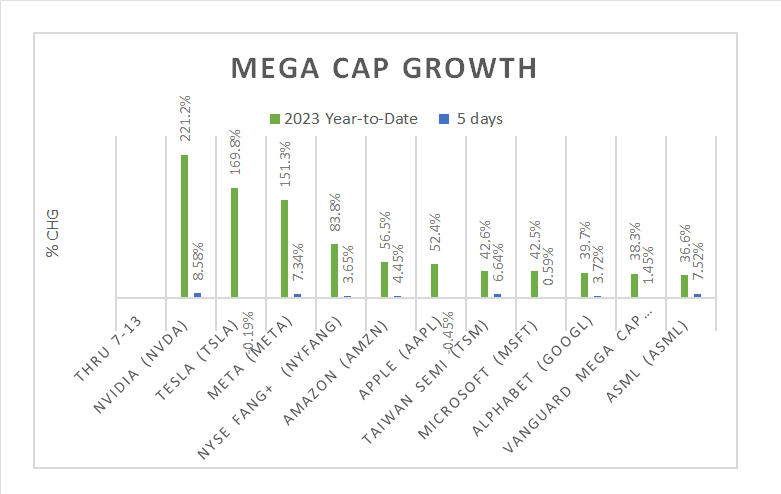

- Nasdaq +1.58% leads majors, NYSE Fang+ jumps 2.70%

- 9 of 11 S&P 500 sectors advancing: Communication Services +2.32% outperforms/ Energy -0.45% lags

- Commucations/ Interactive Media & Services +3.44

- Semiconductor ETF ^SOXX +>2.0%

- Mega Cap Tech BIG day

- Government bond yields pullback

- Gold, Bitcoin soars +$1107

- Oil and Bloomberg Commodity Index gain

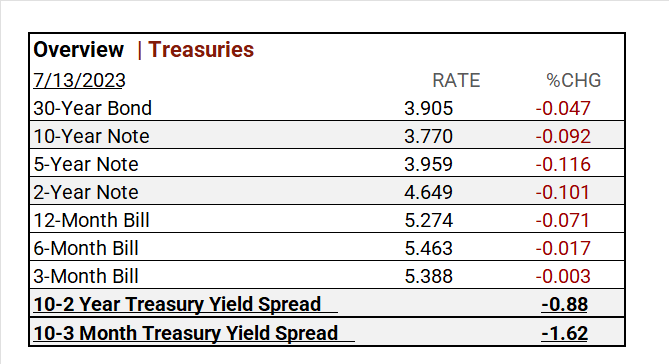

- Government bond yields pullback

- PepsiCo (PEP) and Delta Air Lines (DAL) with solid earning beats

- Q2 earnings kick off Friday (topline info below)

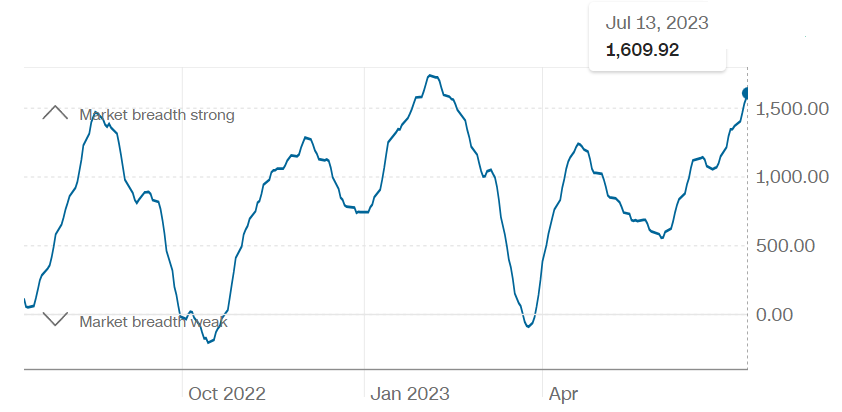

Pro Tip: the McClellan Volume Summation Index looks at the amount, or volume, of shares on the NYSE that are rising compared to the number of shares that are falling. A higher number is a bullish indicator.

Sectors/ Commodities/ Treasuries

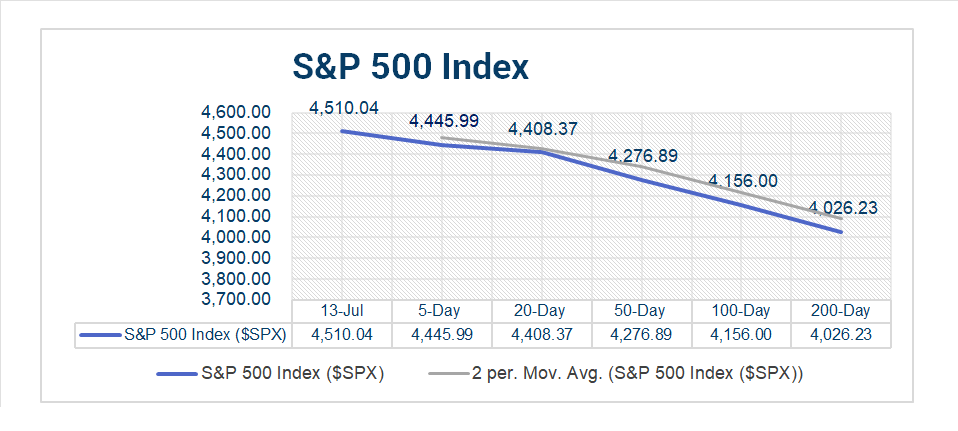

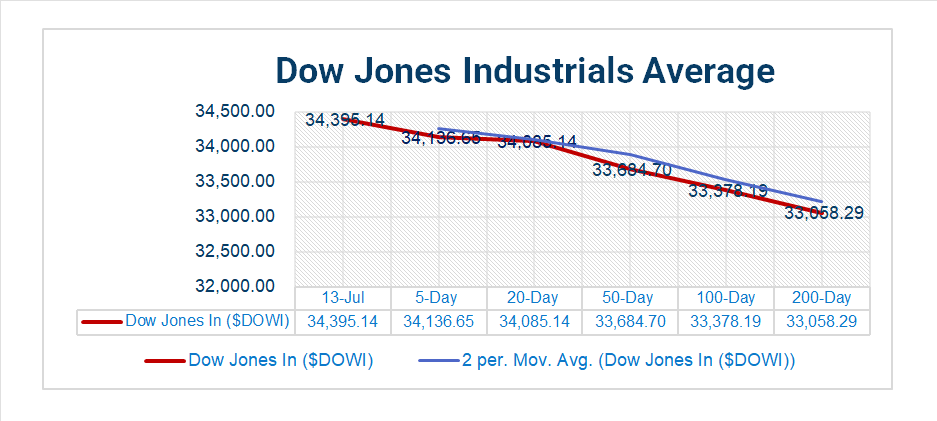

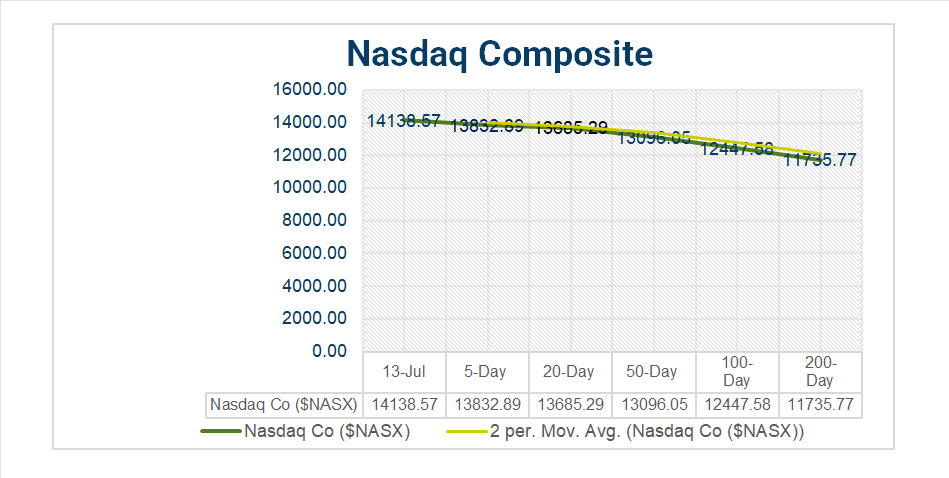

Key Indexes (5d, 20d, 50d, 100d, 200d)

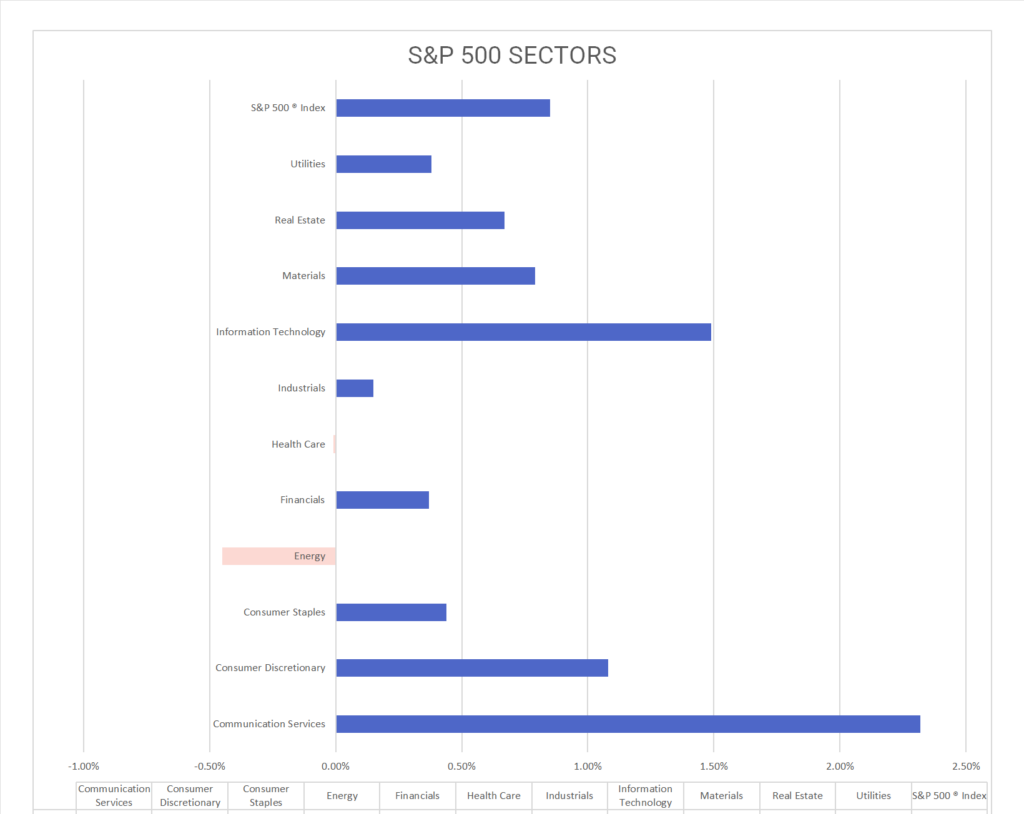

S&P Sectors

- 9 of 11 S&P 500 sectors advancing: Communication Services +2.32% outperforms/ Energy -0.45% lags.

- Communications/ Sub Interactive Media & Services +3.44%, Other/ Semiconductor Equipment +2.62%, Broadline Retail +2.60%, Automobiles +1.88%, Construction Materials +1.69%.

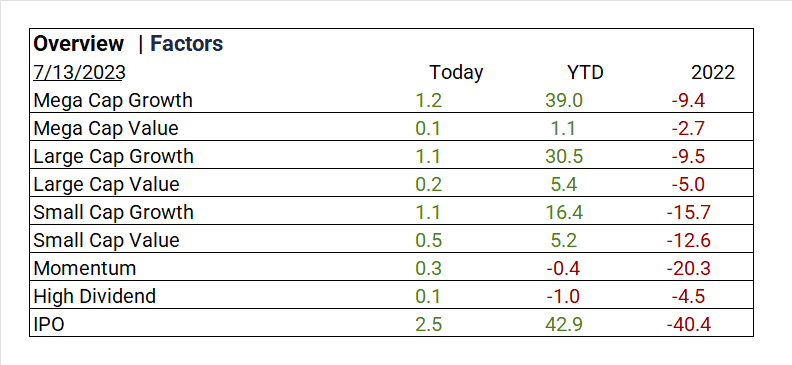

Factors/ Mega Caps

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

Notable Earnings Today

- +Beat: PepsiCo (PEP), Fast Retailing ADR (FRCOY), Cintas (CTAS), Delta Air Lines (DAL),

- – Miss: Progressive (PGR), Seven i ADR (SVNDY), Wipro ADR (WIT), ConAgra Foods (CAG)

Economic Data

US

- Initial jobless claims; period July 8, act 237,000, fc 250,000, prior 249,000

- Continuing Claims; period July 8, 1.729ml, fc 1.728ml, prior 1.72ml

- Producer price index; period June, act 0.1%, fc 0.2%. prior -0.3%

- Core PPI; period June, act 0.1%, fc 0.2%, prior 0.1%

- PPI year over year, act 0.1%, prior 1.1%

- Core PPI year over year, act 2.6%, prior 2.8%

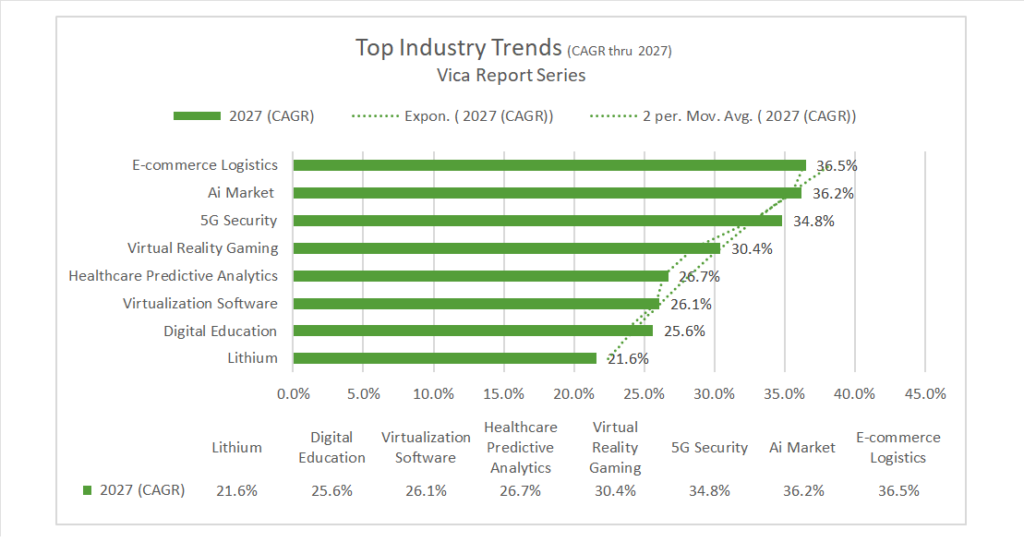

Vica Partner Guidance July ‘23: Mega and Large Cap Growth continues to look attractive in early Q3. Highlighting Metals & Mining, Semiconductor & Semiconductor Equipment, Construction Materials, Energy Services. Nasdaq 100^NDX 14,500 level is a buying opportunity. Undervaluation of Japanese equities, upside for Chinese Mega Cap Tech. Q3/4 2023/ credit default swap (CDS) will pick-up. Important CAGR growth below.

We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO), Sociedad Quimica y Minera (SQM).

News

Company News/ Other

- Amazon Shares Jump 2% After Reporting Record Prime Day Sales – Bloomberg

- Delta Says Travel Boom Drove Record Revenue – WSJ

- PepsiCo Sales and Earnings Rise as Shoppers Keep Spending on Snacks – WSJ

Energy/ Materials

- Exxon Buys Pipeline Operator, Making Big Bet on Carbon – WSJ

- US Consumers See Electric Cars as the Future. Dealers, Not So Much = Bloomberg

Central Banks/Inflation/Labor Market

- Fed’s Daly Says It’s Too Soon to Declare Inflation Victory – Bloomberg

- The Key Number to Watch in U.S. Bank Earnings – WSJ

- Apollo’s Chief Economist Says a ‘Default Cycle’ Has Begun Due to Fed Hikes – Bloomberg

Asia/ China