MARKETS TODAY July 31st, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished higher, Japan’s Nikkei 225 gained 1.26%, Hong Kong’s Hang Seng up 0.82% and China’s Shanghai Composite up 0.46%.

European markets finished mixed, France’s CAC 40 was up 0.29%, London’s FTSE 100 up 0.07% and Germany’s DAX lost 0.14%. S&P futures opened trading at 0.06% above fair value.

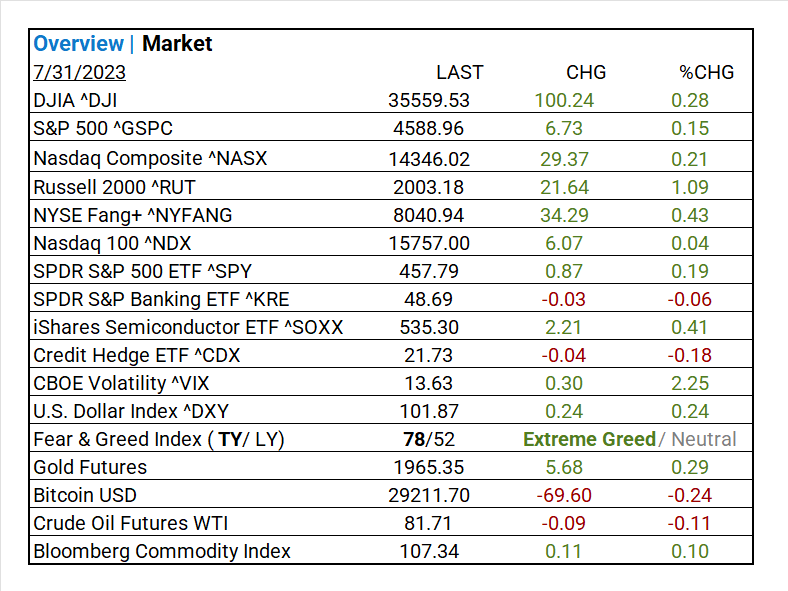

Today US Markets finished higher, the DOW gained 0.28%, NASDAQ up 0.21% and the S&P 500 up 0.15%. 8 of 11 S&P 500 sectors advancing: Energy +2.00% outperforms/ Health Care -0.79% lags. On the upside, Russell 2000 ^RUT, NYSE Fang+ ^NYFANG, Semiconductor ETF ^SOXX, Factors- IPO’s, USD Index, Gold, Bloomberg Commodity Index.

In US economic news, the July Chicago PMI was below forecast marking the 11th consecutive month of contraction.

Takeaways

- July Chicago PMI was below forecast

- DOW leads majors +0.28%

- Russell 2000 ^RUT +1.09%

- 8 of 11 S&P 500 sectors advancing: Energy +2.00% outperforms/ Health Care -0.79% lags

- Sector Subs/ Leisure Products +2.97%, Entertainment +2.20%, Real Estate Management & Development +2.06%, Oil, Gas & Consumable Fuels+2.01%

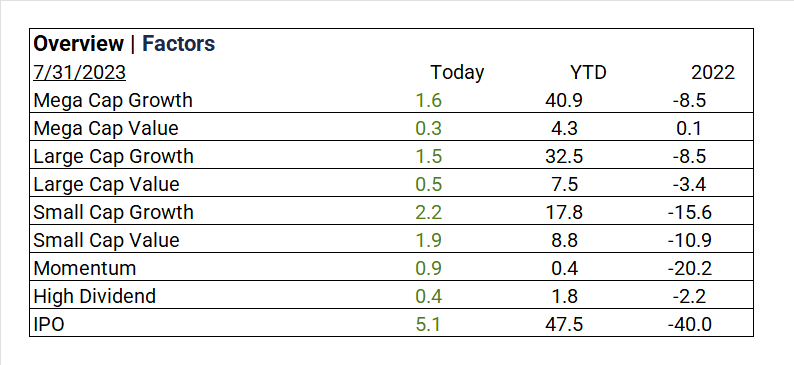

- Factors/ IPO +5.1%, Small Cap Growth +2.2%

- USD Index up

- Bloomberg Commodity Index gains

- Arista Networks (ANET) ON Semiconductor (ON) w/ solid earnings beats

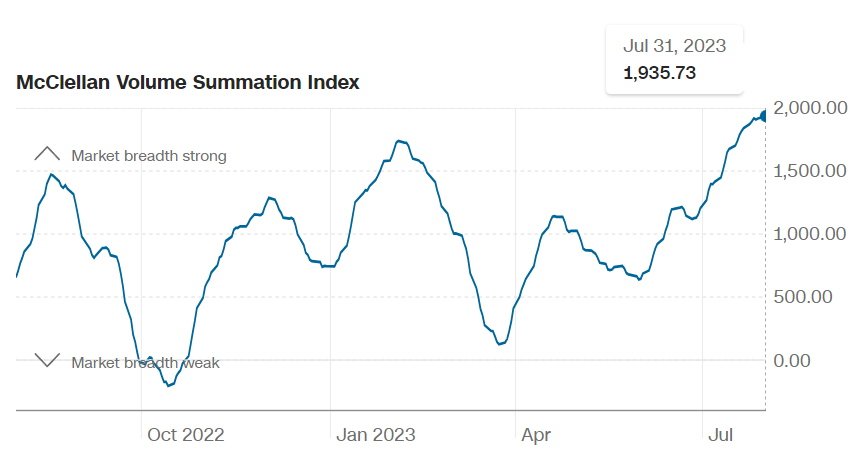

Pro Tip: McClellan Volume Summation Index, measures the volume, of shares on the NYSE that are rising compared to the number of shares that are falling. A higher number is a bullish sign.

Sectors/ Commodities/ Treasuries

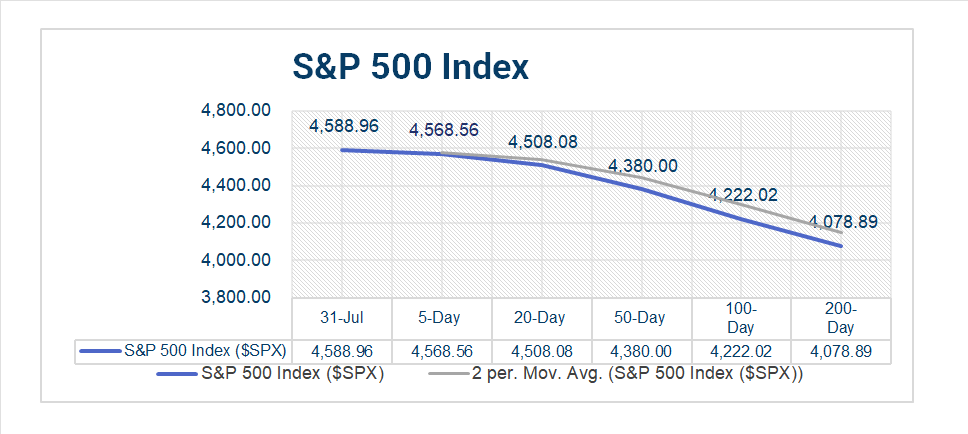

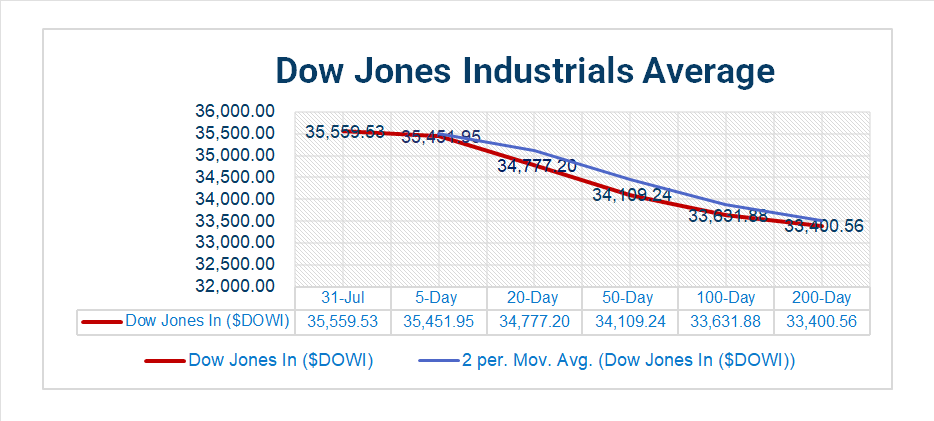

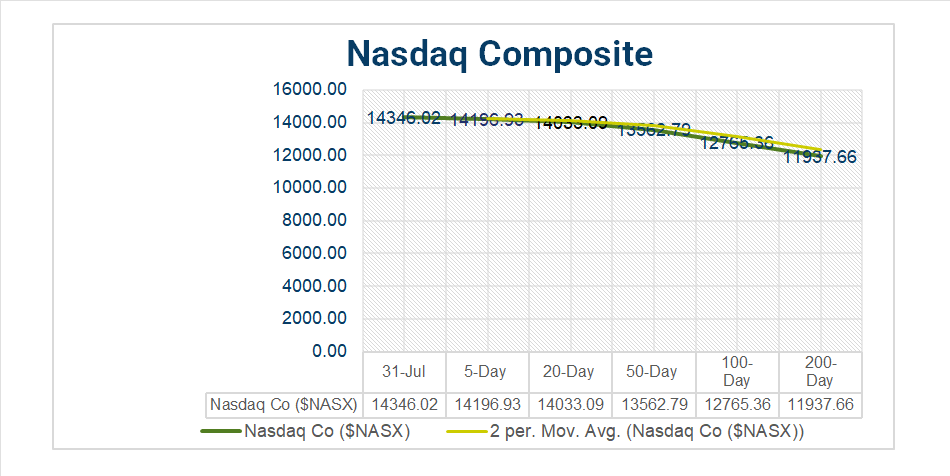

Key Indexes (5d, 20d, 50d, 100d, 200d)

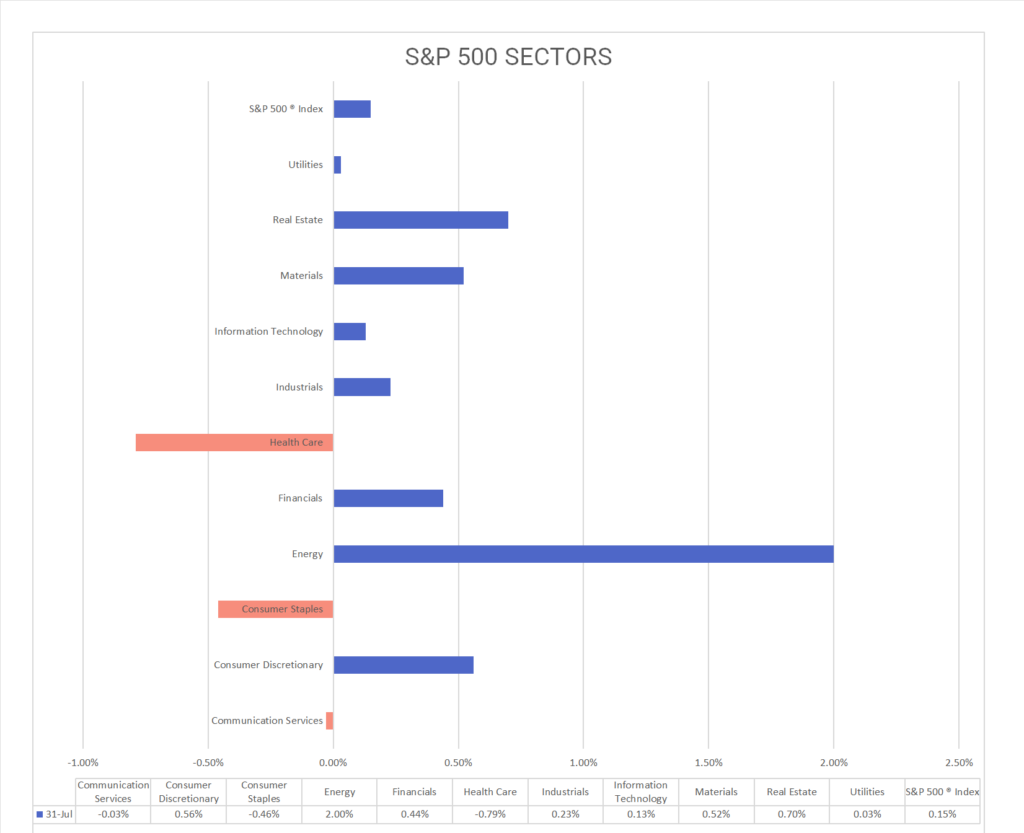

S&P Sectors

- 8 of 11 S&P 500 sectors advancing: Energy +2.00% outperforms/ Health Care -0.79% lag

- Leisure Products +2.97%, Entertainment +2.20%, Real Estate Management & Development +2.06%, Oil, Gas & Consumable Fuels+2.01%, Metals & Mining +1.99%, Energy Equipment & Services +1.91%, Trading Companies & Distributors +1.76%, Consumer Finance +1.68%.

- YTD Leaders: Information Technology +45.62%, Communication Services +44.76%, Consumer Discretionary +34.76%.

Factors

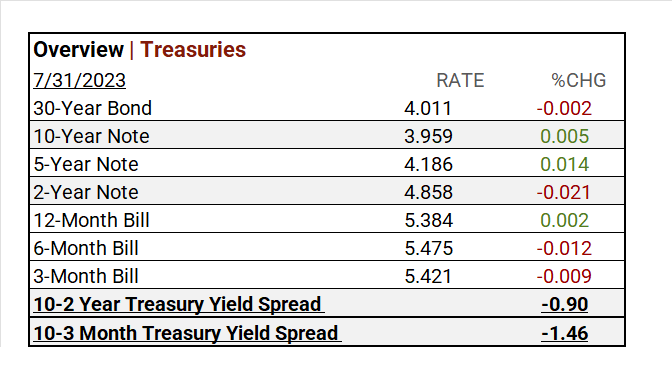

US Treasuries

US Treasuries

Q2 ’23 Top Line Earnings Preview

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

This Week ending 7/28

- >17% of S&P 500 names have reported, 40% more will release earnings this week.

- To date BIG picture, credit resilience, deposit stabilization, travel demand

- Technology sector, mega caps reporting were META, MSFT, GOOGL

Notable Earnings Today

- +Beat: Sumitomo Mitsui Financial ADR (SMFG), Arista Networks (ANET), Republic Services (RSG), ON Semiconductor (ON), Mizuho Financial ADR (MFG), Welltower (WELL), Japan Tobacco ADR (JAPAY), Mitsubishi Electric ADR (MIELY), SBA Communications (SBAC), Hologic (HOLX), Biomarin Pharma (BMRN), Erste Group Bank AG PK (EBKDY), Otsuka ADR (OTSKY), Kyocera ADR (KYOCY), Erste Group Bank AG PK (EBKDY), AerCap Holdings NV (AER), Western Digital (WDC), Lattice (LSCC), SoFi Technologies (SOFI), Makita (MKTAY)

- – Miss: Heineken NV (HEINY), Hoya Corp (HOCPY), Symbotic (SYM), Diamondback (FANG) Symbotic (SYM), Panasonic Corp PK (PCRFY), Legrand ADR (LGRDY), Otsuka ADR (OTSKY), CNA Financial (CNA), Toto (TOTDY)

Economic Data

US

- Chicago Business Barometer: period July, act 42.8, fc 43.3, prior 41.5

Vica Partner Guidance July ’23, (updated 7-31)

- Q3/4 highlighting, Industries: Interactive Media & Services, Household Durables, Broadline Retail, Consumer Finance, Automobiles, Construction & Engineering, Semiconductor & Semiconductor Equipment, Construction Materials, Specialized REITs, Gas Utilities. Other: Undervaluation for Chinese Mega Cap Tech. Japan equities still a better value than US. Look for continued strength in Mega and Large Cap Growth “the new defensives” Expect Energy Sector rally!

- Cautionary, Banks shortly may be overpricing. Current indicators are mixed. Credit default swap (CDS) to pick-up through Q4/Q1.

- Longer Term, NASDAQ 100^NDX/FANG+ ^NYFANG companies will continue to outperform “BIG allows you to invest at scale”. TOP Sector outperform includes AI and Semiconductor Equipment, Key Material like Lithium. Forward looking CAGR growth below:

- Company, we continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

BIG Picture Stuff

- Market bottoms are made on bad news so the current market rally should come as no surprise. The combination of current Fed tightening, higher oil prices and a strong dollar should have given us a final bottom in ’23? As for peak inflation @9%, buying mortgages when housing prices were running up +30% was ludicrous.

- Our biggest concern with the current rally is that the Government is not as effective as Free Markets in managing capital. Stock repurchases are just another way to deploy Capital. Consider that about 65% of the typical business cost is labor. I wholeheartedly trust the Free Market to better spend on CAPEX, R&D, and others to grow portfolio investments.

- As for Bonds as an alternative investment for Stocks, a 10-year bond should have a return that is equal to or exceeds nominal GDP, and that is not the case today.

- The argument for Fed further tightening is not logical. Take into consideration that 63% of the typical business cost is labor and with 1.6 jobs available for every job seeker will NOT moderate on demands. The Fed would benefit by rethinking its 2% target inflation number. A little extra pad like 3% today, protects the economy from Deflation.

News

Company News/ Other

- Trucking Giant Yellow Shuts Down Operations – Wall Street Journal

- Walmart Buys Tiger Global’s Flipkart Stake for $1.4 Billion – Bloomberg

Energy/ Materials

- In the Race to Mine the Seabed, China Takes a Hard Line – Bloomberg

- Why Chile’s New Approach to Lithium Matters Globally – Bloomberg

Central Banks/Inflation/Labor Market

- Mexico’s ‘Super Peso’ Clocks Longest Winning Streak Since 2008 –

- Yellen Says Still Too Early to Rule Out Risk of US Recession – Bloomberg

Asia/ China

- GDP worries, new central bank chief, economic action plans: 7 things you may have missed from China’s economy in July – South China Morning Post

- While Everyone Else Fights Inflation, China Deflation Fears Deepen – Wall Street Journal