MARKETS TODAY August 24th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished higher, Hong Kong’s Hang Seng gained 2.05%, Japan’s Nikkei 225 up 0.87% and China’s Shanghai Composite up 0.12%. S&P futures opened trading at 0.43% above fair value.

European markets finished mixed, London’s FTSE 100 gained 0.18%. Germany’s DAX down 0.68% and France’s CAC 40 down 0.44%.

Today US Markets finished lower, the NASDAQ lost 1.87%, the S&P 500 down 1.35% and DOW down 1.08%. All 11 S&P 500 sectors declining: Financials -0.24% outperforms/ Information Technology -2.15% lags. Trending Industries: Insurance, Diversified Telecommunication Services, Tobacco, Banks. On the upside, SPDR S&P Banking ETF ^KRE, KraneShares CSI China Tech ETF ^KWEB, ProShares UShort 20+ Treas ^TBT, Treasury Yields, U.S. Dollar Index, Bloomberg Commodity Index.

In US economic news, Initial claims came in soft and continuing claims in-line. Durable goods orders in July missed consensus and indicated contraction.

Takeaways

- Fed Powell Friday Jackson Hole meeting weighs on market

- SQQQ Ultra Short ETF +6.7%

- Durable goods orders in July sharply missed estimates and indicated contraction

- NYSE Fang+ ^NYFANG falls 3.04%

- All 11 S&P 500 sectors declining: Financials -0.24% outperforms/ Information Technology -2.15% lags

- Trending Industries: Insurance +0.46%, Diversified Telecommunication Services +0.30%, Tobacco +0.06%

- SPDR S&P Banking ETF ^KRE +0.46%

- KraneShares CSI China Tech ETF ^KWEB +0.44%

- ProShares UShort 20+ Treas ^TBT +1.32%

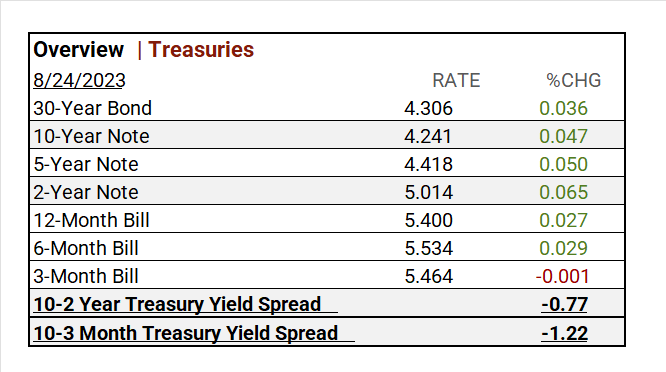

- Treasury Yields and the U.S. Dollar Index ^DXY rise

- Bloomberg Commodity Index up

- Workday (WDAY), Affirm Holdings (AFRM) with solid after-market earnings beats

Pro Tip: McClellan Volume Summation Index measure volume of shares on the NYSE that are advancing compared to the number of shares that are declining.

Sectors/ Commodities/ Treasuries

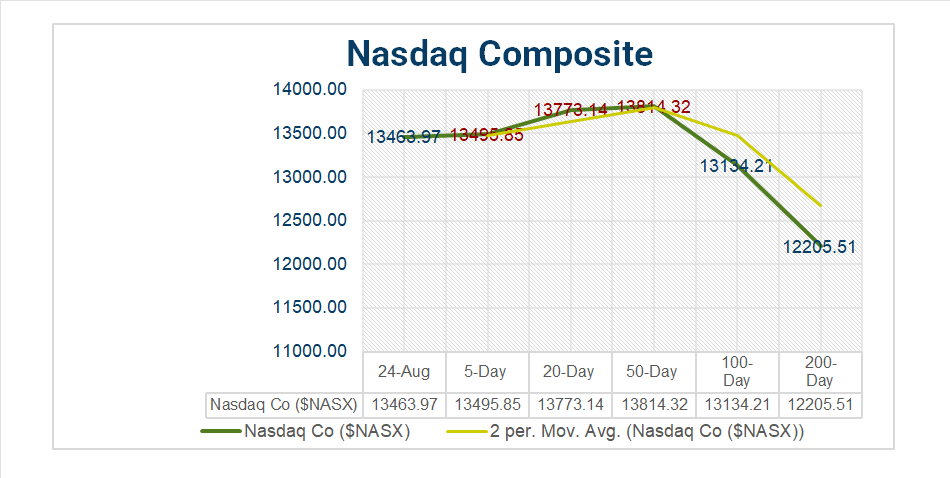

Key Indexes (5d, 20d, 50d, 100d, 200d)

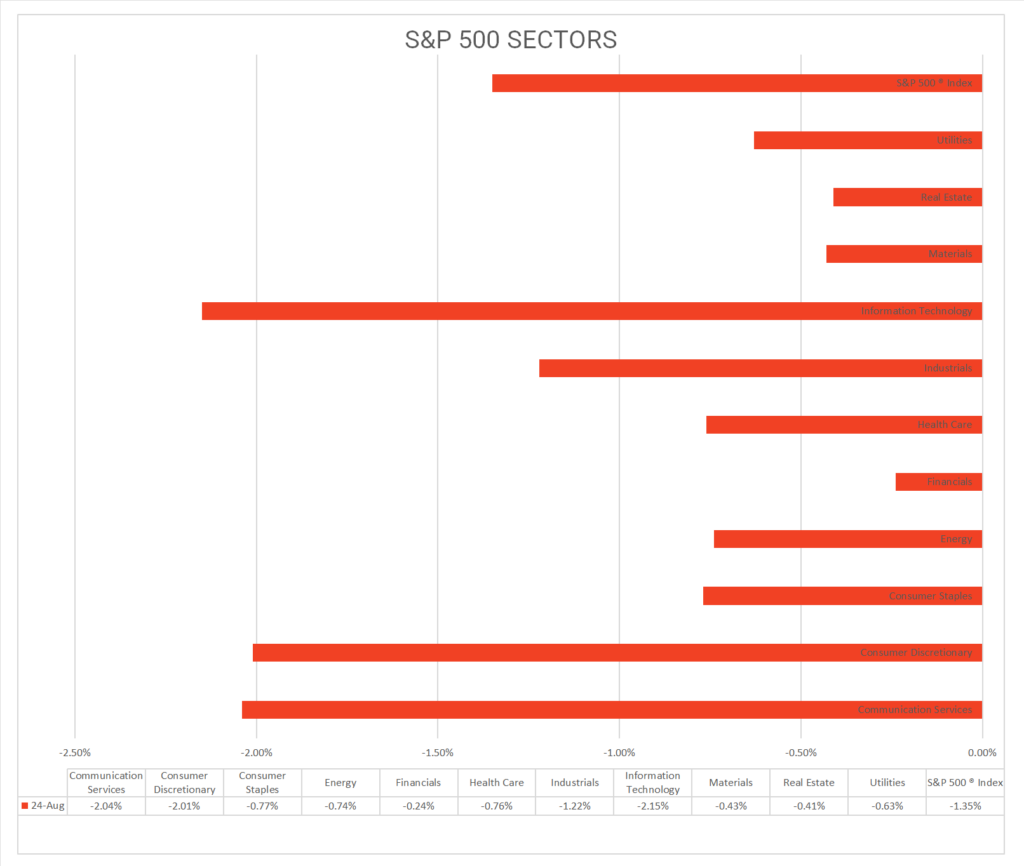

S&P Sectors

- All 11 S&P 500 sectors declining: Financials -0.24% outperforms/ Information Technology -2.15% lags.

- Trending “on the Day” Insurance +0.46%, Diversified Telecommunication Services +0.30%, Tobacco +0.06%, Banks +0.02%, Containers & Packaging +0.01%

- *1 Month Leaders: Communication Services +4.23%, Energy +2.95%,

- *YTD Leaders: Communication Services +41.21%, Information Technology +39.80%, Consumer Discretionary +30.32%

- *S&P 500 +15.54% *as of Aug-23-2023

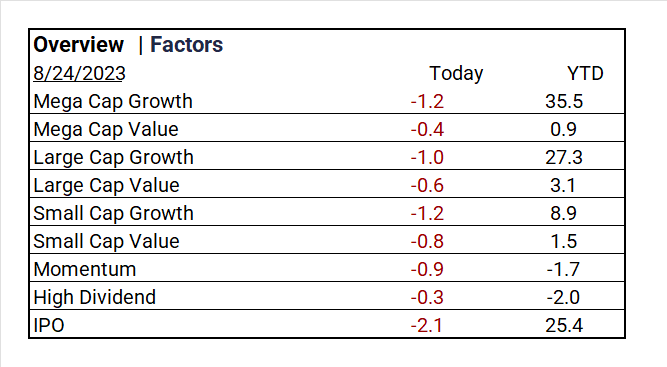

Factors

US Treasuries

Earnings

Q2 ’23 Top Line Top Line

- Q1 ’23 Actual: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 Forecast: S&P 500 EPS was expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

Q2 Seasonal Actual (TBA)

Notable Earnings Today

- +Beat: Intuit (INTU), RBC (RY), Workday (WDAY), Marvell (MRVL), Dollar Tree (DLTR), Ulta Beauty (ULTA), Huazhu (HTHT), Burlington Stores (BURL), Futu (FUTU), Affirm Holdings (AFRM), Frontline (FRO), OSI Systems (OSIS), Petco Health and Wellness (WOOF)

- – Miss: Toronto Dominion Bank (TD), Meituan (MPNGF), NetEase (NTES), Braskem A (BAK), Gap (GPS), Weibo Corp (WB), Nordstrom (JWN), AAC Technologies Holdings Inc (AACAY), Opera (OPRA)

Economic Data

US

- Initial jobless claims Aug. 19: act 230,000, fc 240,000, prior 239,000

- Continuing claims Aug. 19: act 1.702m, fc 1.69m, prior 1.702m

- Durable-goods orders July: act -5.2%, fc -4.1%, prior 4.4%

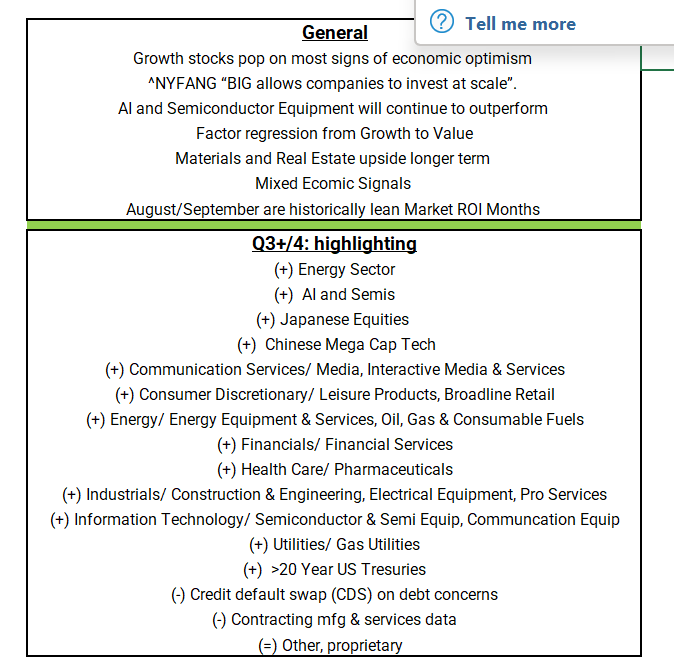

Vica Partners Guidance

Vica Partners Economic Forecast

The Federal Reserve as of August 2023 was no longer predicting Recession; to quote Investor Jeremy Grantham “the Federal Reserve record on predicting recessionary cycles is guaranteed to be wrong! Pundits can all agree that the Fed has never called any recession in-kind.

So why don’t we support the soft-landing scenario…

- Vica forecasts that the US will have a Recession, starting as early as Q4 ’23 and deep into ’24: the combination to date of Fed tightening, surging oil prices, stock market overvaluations and a strong dollar will shortly give us our bottom.

- Market bottoms are made on bad news and with deflationary signals: economic reports are currently mixed and arguably too much focus placed on product prices and weekly jobs. Our biggest concern is rising interest rates and the depressing slow-moving effect it has on the Real Estate market. And… all with Consumer debt rising to historical highs.

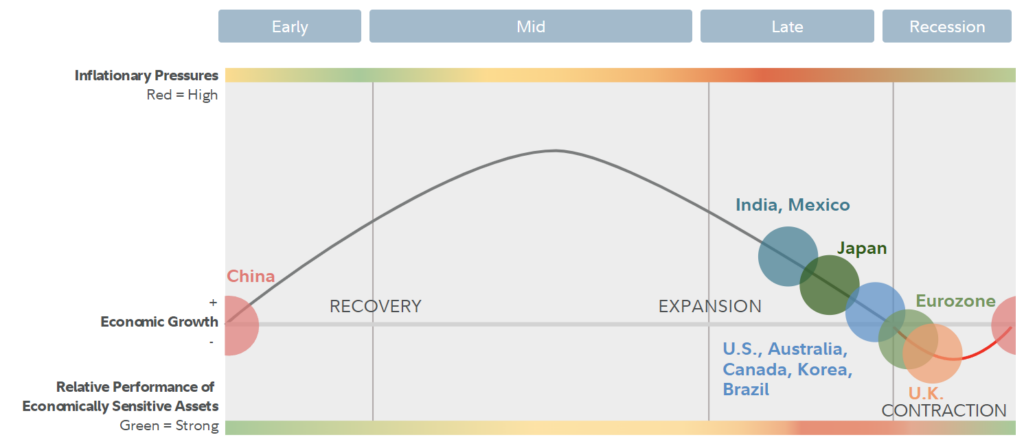

- Current S&P 500 Sector Metrics support contraction: strong trends in the Energy sector indicate the US is in a late business cycle (see chart below).

- A correction in excessive market asset valuations: the current shift from Growth to Value stocks and the Information Technology sector pullback are both underway.

And why…

- The Federal Reserve has limited power in controlling inflation: applying old school economic principles is ineffective in a highly automated and expanding global economy. By simply raising rates to counter jobs (1.6 jobs available for every job seeker) will NOT moderate on demands.

- A 2% inflation target is not realistic today: perhaps a >3% base rate could help fund a) appropriated wages for skilled workers and training b) an executable and efficient energy transition c) improving operational efficiencies across the economy d) and most importantly (look at China today) protection from deflation!

News

Company News/ Other

- Shein Strikes Deal With Forever 2 – WSJ

- Nike’s Slump Was Foretold by Its Key Taiwan Shoe Supplier – Bloomberg

- Rolex to Buy Watch Retailer Bucherer – WSJ

Energy/ Materials

- France Extends Coal Plant Waiver Into 2024 to Back Power Supply – Bloomberg

- India Needs $13 Trillion to Hit Net Zero Emissions by 2050 – Bloomberg

Real Estate

- Mortgage Rates Hit 7.23%, Highest Since 2001 – WSJ

- Zillow Offers 1% Down Payment to Lure Struggling Homebuyers – Bloomberg

Central Banks/Inflation/Labor Market

- Didn’t Get Invited to the Fed’s Mountain Retreat? Here’s What to Watch – WSJ

- Fed Officials See Rates Close to Peak, Differ on How Close – Bloomberg

- Arizona Labor Spat Signals Challenges for U.S. Chip Manufacturing – WSJ

Asia/ China

- US-China relations: Gina Raimondo’s ‘reality check’ in China seen paving way for Xi-Biden meeting as tensions persist – South China Morning Post