General Trends Report

Introduction: Our objective with this report is to offer you a comprehensive overview of the current trends that are influencing financial markets.

Key Trends: Highlighting the prevailing trends.

Key Trends:

- August/September Seasonality: Historically, these months have exhibited lower returns on investment (ROI).

- Energy Sector Momentum: The energy sector is expected to continue its upward trajectory, especially within the services sub-sector.

- Real Estate REITs Opportunity: Real Estate Investment Trusts (REITs) within the real estate sector are worth considering for investment opportunities.

- Robust Passenger Airlines and Travel Industry: The passenger airline and travel industries are showing resilience and strength.

- Strong NYFANG Index and Mega Cap Tech: The NYFANG Index and Mega Cap Technology stocks are anticipated to maintain their robust performance.

- Mixed Economic Signals and Energy Prices Impact: Current economic indicators are mixed, and rising energy prices are expected to create pricing challenges. Oil futures are predicted to exceed $100 a barrel in the fourth quarter (Q4).

Q3+/4: Highlights

Highlighted Sectors and Factors: Key sectors and factors influencing the third and fourth quarters.

(+++) Energy Sector (++) Utilities Sector (++) Health Care (+) Information Technology (+) Communication Services (+) Consumer Discretionary

Industries

(+++) Utilities, Gas, Water, Electric (+++) Energy Equipment & Services, Oil, Gas & Consumable Fuels (++) Travel/Planes (++) REITs (++) Automobiles (++) Broadline Retail (++) Health Care, Pharmaceuticals (+) AI and Semis (Semiconductors)

Other

(++) >20 Year US Treasuries (++) Credit Default Swap (CDS) Concerns (++) Chinese Mega Cap Tech (+) Japanese Equities

Longer-Term Trends

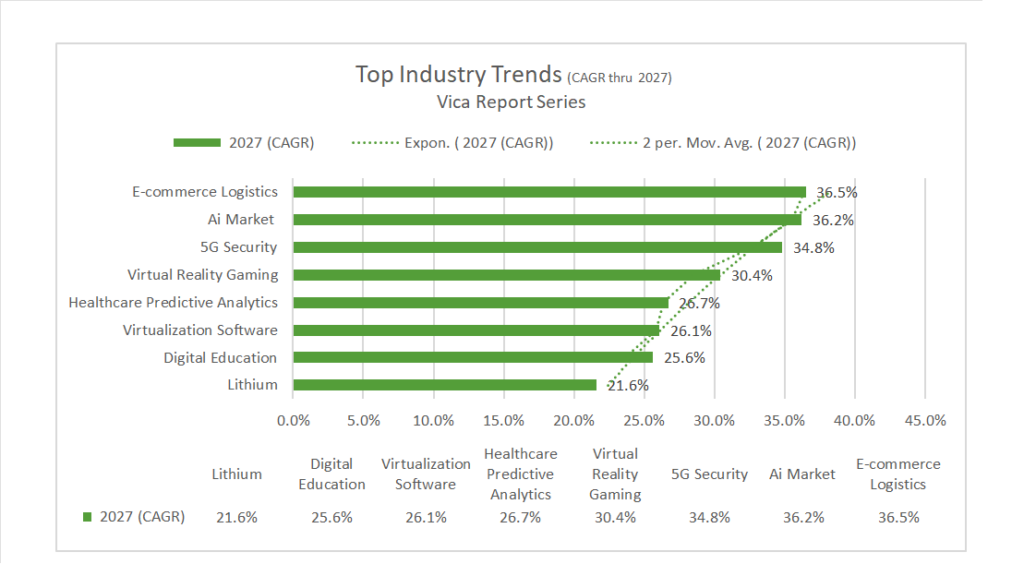

Longer-Term Considerations: Trends expected to persist in the long term.

- NASDAQ 100, FANG+, and NYFANG Outperformance: These companies are likely to continue outperforming in the long term.

- AI and Semiconductor Equipment Strength: AI and semiconductor equipment industries are expected to sustain their strong performance.

- Chinese Mega Cap Tech Growth: Chinese Mega Cap Technology companies are projected to experience robust Compound Annual Growth Rate (CAGR) growth.

- Upside Potential in Key Materials: Materials such as Lithium and Uranium hold potential for growth.

- Real Estate and Builders Growth in 2025: Anticipated growth in the real estate and construction sectors is expected by 2025.

Vica Partners’ investment approach, which prioritizes longer-term investments in companies with strong executive teams and balance sheets, reflects a strategy that emphasizes stability and sustainability in its investment portfolio. Here’s a breakdown of why these factors are important in their approach:

- Longer-Term Investments: Investing with a longer time horizon allows for the potential benefits of compounding returns and reduces the impact of short-term market volatility. It aligns with the idea of holding investments through economic cycles and market fluctuations, with the expectation that the inherent value of the companies will grow over time.

- Strong Executive Teams: A strong executive team can make a significant difference in a company’s performance and its ability to adapt to changing market conditions. Skilled leadership can drive innovation, make strategic decisions, and effectively manage resources. Vica Partners likely believes that investing in companies with capable leadership can lead to sustained growth and profitability.

- Balance Sheets: A strong balance sheet indicates that a company has a healthy financial position with manageable debt levels and ample liquidity. This financial stability provides a cushion during economic downturns and allows a company to seize opportunities for growth or strategic investments. Companies with solid balance sheets are often better positioned to weather economic challenges.

In summary, Vica Partners’ investment philosophy revolves around selecting companies that possess the qualities of stability, capable leadership, and financial strength. While these factors can be important for long-term investors, it’s essential to conduct thorough research and due diligence before making any investment decisions and to align your investment strategy with your specific financial goals and risk tolerance.

Here’s a brief overview of some of our recommended companies and their respective industries:

1. Technology Companies:

- NVIDIA (NVDA): Known for its graphics processing units (GPUs) used in gaming and artificial intelligence applications.

- Meta Platforms (META): The parent company of Facebook, involved in social media and technology services.

- Microsoft (MSFT): A technology giant with a wide range of products and services, including software and cloud computing.

- Alphabet (GOOG, GOOGL): The parent company of Google, dominating the online search and advertising market.

- Amazon (AMZN): A leading e-commerce and cloud computing company.

- Apple (AAPL): Famous for its consumer electronics, including iPhones, iPads, and Macs.

- Tesla (TSLA): An electric vehicle and clean energy company.

- Taiwan Semiconductor (TSM): One of the world’s largest semiconductor manufacturing companies.

- ASML Holding (ASML): A key player in producing advanced semiconductor manufacturing equipment.

2. Healthcare Companies:

- UnitedHealth Group (UNH): A diversified healthcare company.

- Centene (CNC): A healthcare enterprise offering services like managed care and health insurance.

- Elevance Health, Inc. (ELV): A company specializing in healthcare services.

3. Materials and Natural Resources:

- Sociedad Química y Minera de Chile (SQM): A mining company involved in lithium and specialty chemicals.

- Vale (VALE): A global mining company, particularly in iron ore.

- Albemarle Corporation (ALB): A leader in lithium production, a key component in batteries.

- Alpha Metallurgical Resources (AMR): Likely involved in the metallurgical and mining industry.

4. Pharmaceutical Companies:

- Merck & Co Inc (MRK): A pharmaceutical company.

- Eli Lilly & Co (LLY): A pharmaceutical company known for its drugs and treatments.

- Pfizer (PFE): A major player in the pharmaceutical industry.

5. Consumer Goods and Automobiles:

- Coca-Cola Co (KO): A beverage company known for its soft drinks.

- Toyota Motor (TM): A renowned automobile manufacturer.

These companies represent a diverse range of industries, and Vica Partners’ approach suggests a focus on companies with strong leadership and financial stability for long-term investments. Keep in mind that investment decisions should be made based on your financial goals, risk tolerance, and thorough research or consultation with a financial advisor.