“Empowering Financial Success” Vica Partners Financial Group

MARKETS TODAY – September 1st, 2023 (Vica Partners)

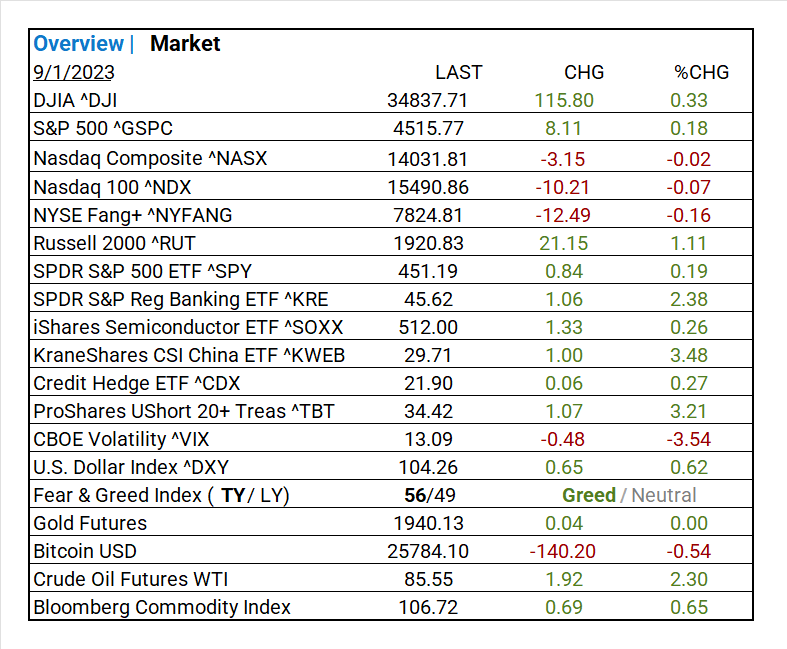

Global Markets Snapshot

- During the overnight session, Asian markets displayed mixed results. The Shanghai Composite posted a 0.43% gain, while Japan’s Nikkei 225 witnessed a 0.28% increase, and Hong Kong’s Hang Seng declined by 0.55%.

- S&P futures started trading just above fair value, indicating a modest uptick of 0.51%.

- European markets exhibited mixed results today. London’s FTSE 100 recorded a 0.34% gain, while Germany’s DAX led the CAC 40 lower with declines of 0.67% and 0.27%, respectively.

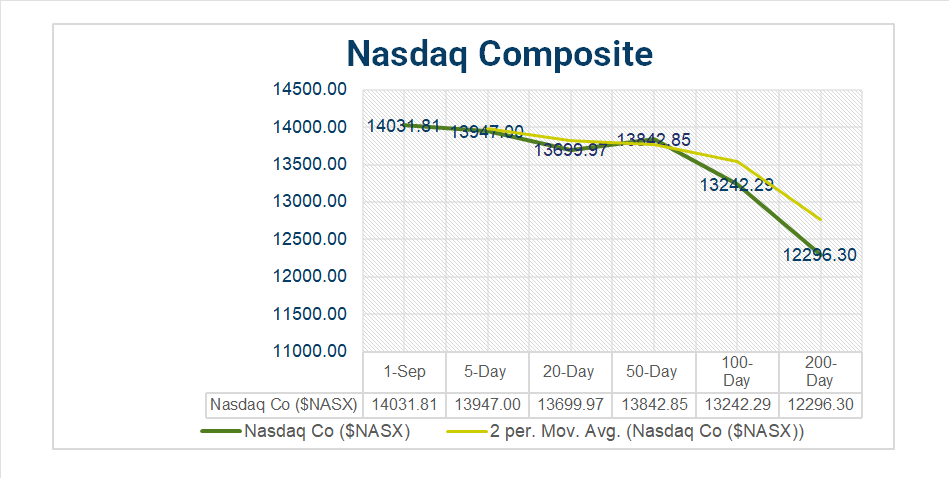

US Markets Today

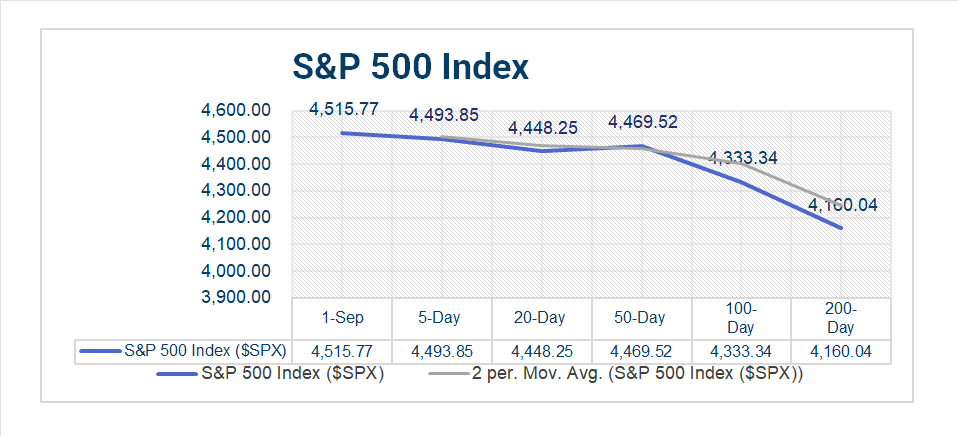

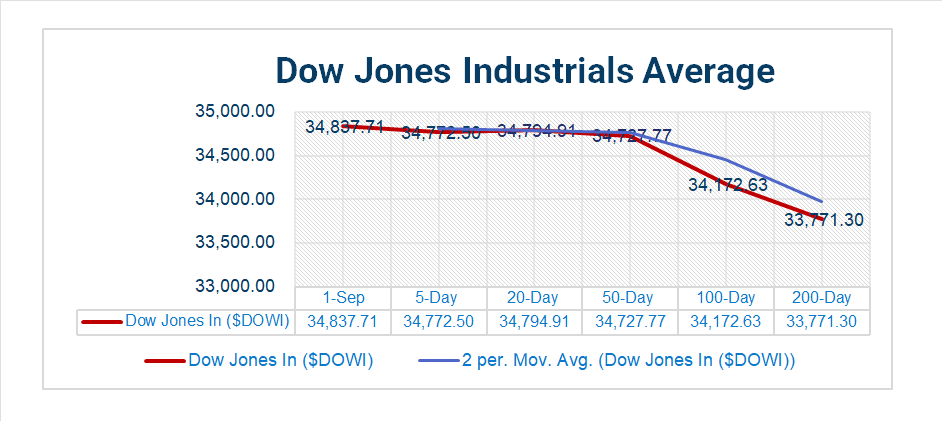

- US markets closed with mixed results. The DOW was up by 0.33%, the S&P 500 up by 0.18%, and the NASDAQ declined by 0.02%. Notably, 5 out of 11 S&P 500 sectors experienced declines. The standout industries of the day were Automobile Components, up by 2.57%, and Construction Materials, up by 2.30%. The S&P Reg Banking ETF ^KRE and the CSI China Tech ETF ^KWEB also saw gains of 2.38% and 3.48%, respectively.

US Economic Highlights

- In economic news, the U.S. unemployment rate increased to 3.8%, up from the previous rate of 3.5%. Meanwhile, average hourly earnings showed a slight decline of 0.2 percentage points, settling at 0.2% month-over-month. Notably, there was an uptick in payrolls within the manufacturing and government sectors. Currently, futures markets are factoring in the possibility of the Federal Reserve refraining from another interest rate hike in 2023.

Key Takeaways

- The U.S. unemployment rate has increased. Notably, there has been a rise in employment in both the manufacturing and government sectors.

- The Russell 2000 (^RUT) gained by 1.11%.

- Trending “on the Day”: Automobile Components (+2.57%), Construction Materials (+2.30%), Energy Equipment & Services (+2.16%).

- The KraneShares CSI China Tech ETF (^KWEB) surged by 3.48%.

- The S&P Regional Banking ETF (^KRE) also saw a notable gain of 2.38%.

- ProShares UltraShort 20+ Treas (^TB) increased by 3.21%.

- The U.S. Dollar Index (^DXY) displayed strength.

- Both Crude Oil Futures WTI and the Bloomberg Commodity Index experienced rises.

- In the futures markets, there is a growing expectation that the Federal Reserve may refrain from implementing another interest rate hike in 2023.

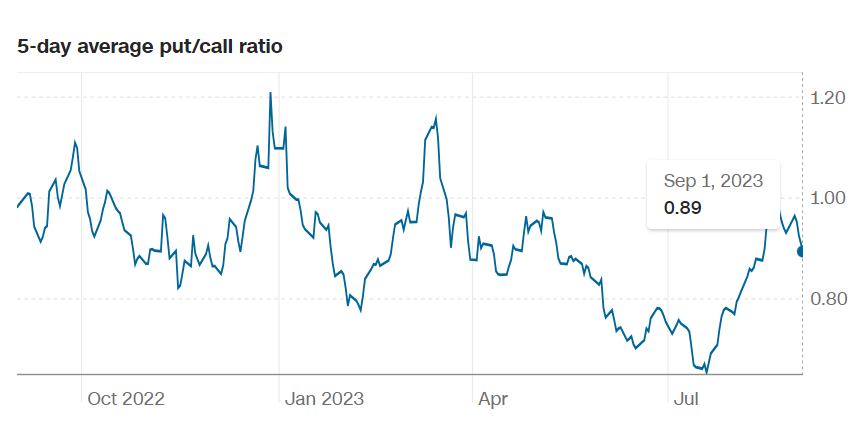

Pro Tip: When the put-to-call ratio is on the rise, it typically indicates that investors are becoming increasingly apprehensive. A ratio exceeding 1 is commonly interpreted as a bearish signal.

Sectors, Commodities, and Treasuries

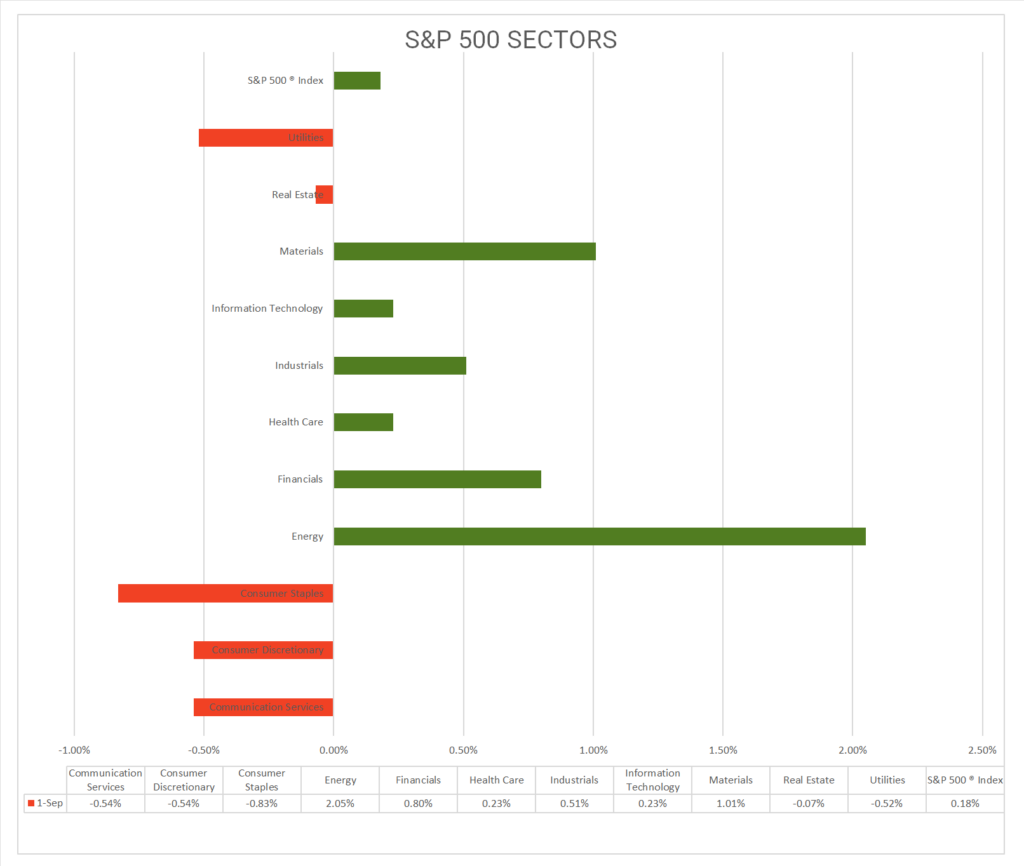

S&P Sectors

- Out of the 11 S&P 500 sectors, 5 declined. Energy led with a +2.05% gain, while Consumer Staples lagged at -0.83%.

- Notable industries “on the Day” included Automobile Components (+2.57%), Construction Materials (+2.30%), Energy Equipment & Services (+2.16%), Oil, Gas & Consumable Fuels (+2.04%), Metals & Mining (+1.62%) Consumer Finance (+1.21%).

- *Performance Leader (1 Month): Energy (+3.30%)

- *Year-to-Date (YTD) Leaders: Communication Services (+44.14%), Information Technology (+43.69%), and Consumer Discretionary (+33.75%).

- *S&P 500 posted a 17.40% gain as of *Aug-30-2023.

Factors

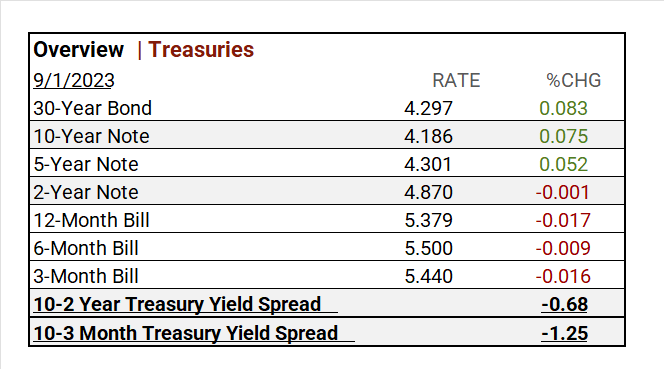

US Treasuries

Earnings

- In Q1 ’23, 79% of companies beat analyst estimates by an average of 6.5%.

- The Q2 Forecast predicted a decline of <7.2%> in S&P 500 EPS, with Fiscal year 2023 EPS remaining flat YoY.

- Q2 Seasonal Actuals are yet to be reported.

Notable Earnings Today

- +Beat: Carl Zeiss Meditec ADR (CZMWY)

- -Miss: Dingdong (DDL)

Economic Data

US

- Nonfarm Payrolls (Aug): 187,000 (Previous: 170,000, Forecast: 157,000)

- Unemployment Rate (Aug): 3.8% (Previous: 3.5%, Forecast: 3.5%)

- Hourly Wages (Aug): 0.2% (Previous: 0.3%, Forecast: 0.4%)

- Hourly Wages Year Over Year: 4.3% (Previous: 4.4%, Forecast: 4.4%)

- U.S. Manufacturing PMI (Aug): 47.9 (Previous: 47.0, Forecast: 47.0)

- ISM Manufacturing (Aug): 47.6% (Previous: 46.6%, Forecast: 46.4%)

- Construction Spending (July): 0.7% (Previous: 0.5%, Forecast: 0.6%).

“Navigating September 2023: Vica Partners Insights”

- Our aim with this report is to provide you with a comprehensive overview of the prevailing trends that are shaping financial markets.

Key Trends

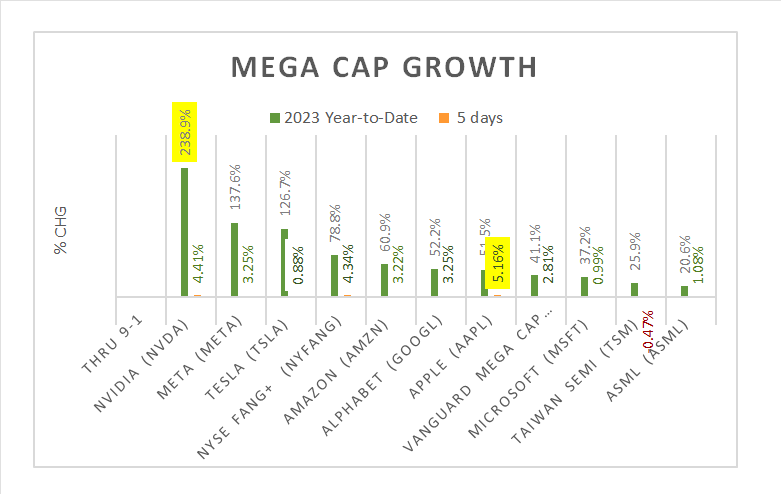

- Growth stocks tend to perform well during economic optimism.

- ^NYFANG new defensive’s Index as “bigger allows for more capital to scale”

- AI and Semiconductor Equipment will continue to outperform.

- Market had a Factor regression from Growth to Value stocks in the past 45 days.

- Energy is August Sector leader and look for further ’23 opportunity here.

- Health Care and Materials undervalued.

- Current economic signals are mixed with deflation concerns.

- August/September historically have lower ROI.

“Vica Partners: Navigating the Economic Landscape – 2023 Economic Forecast

- As of September 2023, the Federal Reserve no longer predicts a recession. However, Vica Partners disagrees and forecasts a potential recession starting as early as Q4 ’23 and extending into ’24. This projection is based on factors including Fed tightening, rising oil prices, overvalued stock markets, and a strong dollar. Vica Partners believes that market bottoms typically occur amid negative news and deflationary signals. Rising interest rates and their impact on the real estate market, coupled with historical highs in consumer debt, are significant concerns. Vica Partners also notes the shift from Growth to Value stocks and the moderation of the Information Technology sector correction occurred.

Key Points

- The Federal Reserve’s power to control inflation is limited, and traditional economic principles may not be effective in today’s highly automated global economy.

- A 2% inflation target may not be realistic today, and a base rate exceeding 3% could fund wage increases, energy transition, operational efficiency improvements, and protection against deflation.

News

Company News/ Other

- Amgen’s $27.8 Billion Deal for Horizon Therapeutics Clears Key Hurdle – WSJ

- Saudi Arabia’s Aramco Considers Selling $50 Billion in Shares – WSJ

- SoftBank Lines Up Apple and Nvidia as Strategic Arm IPO Backers – Bloomberg

Energy/ Materials

- It’s Getting Harder to Find Mining Engineers a Green World Needs – Bloomberg

- How Ending Mine Disasters Could Help China’s Energy Security – Bloomberg

Real Estate

- Weird, Yes, But Housing Really Needs a Slower Economy – Bloomberg

Central Banks/Inflation/Labor Market

- US Payrolls Rise by More Than Forecast While Wage Growth Cools – Bloomberg

- Job Gains Eased in Summer Months; Unemployment Increased in August – WSJ

- Rates Are Up. We’re Just Starting to Feel the Heat. – WSJ

- The US, Allies See Opportunity and Risk in China’s Slowing Economy – Bloomberg

Asia/ China

- China’s factory activity unexpectedly picks up in August, but too early to tell if recovery will last – SCMP