“Empowering Financial Success” Vica Partners Financial Group

MARKETS TODAY – September 13th, 2023 (Vica Partners)

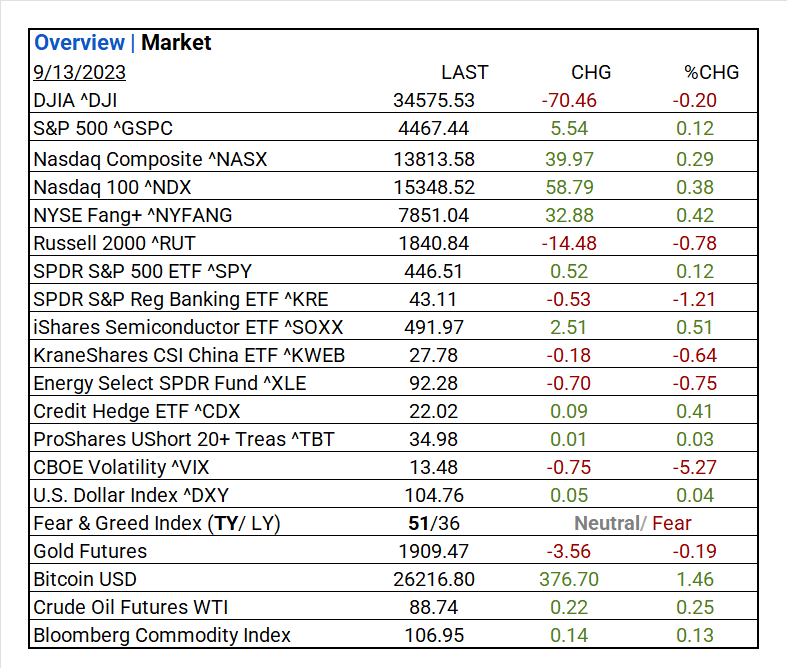

Global Markets Snapshot

- Asian markets ended the day in negative territory, with China’s Shanghai Composite leading the decline, down 0.45%. Japan’s Nikkei 225 and Hong Kong’s Hang Seng also saw losses, dropping 0.21% and 0.09% respectively.

- In the US, S&P futures opened trading w/ 0.02% moderate gain above fair value.

- European markets closed today, with France’s CAC 40 leading the decline, dropping 0.42%. Germany’s DAX fell 0.39%, while London’s FTSE 100 slipped by 0.02%.

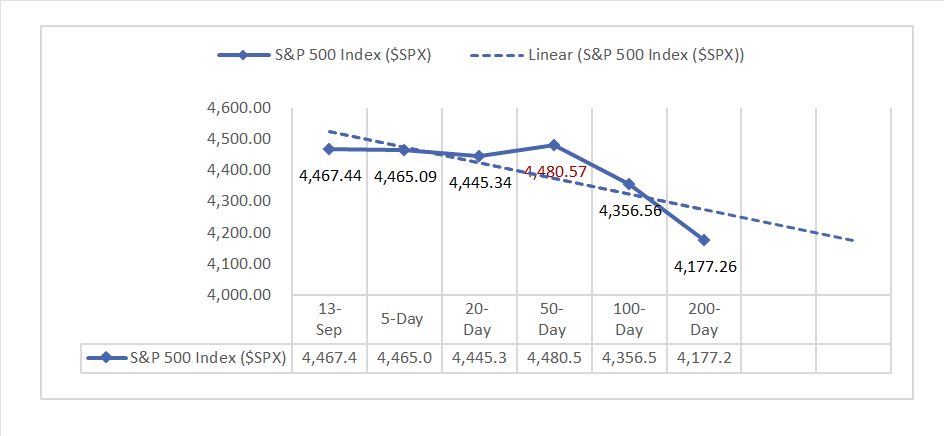

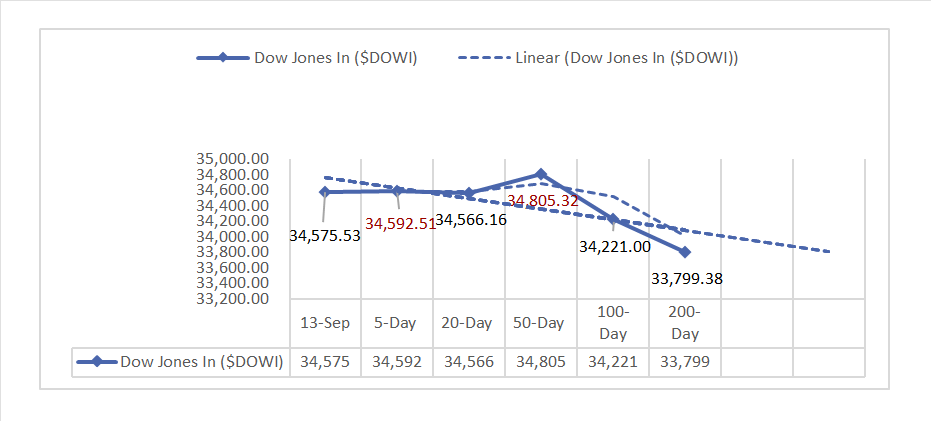

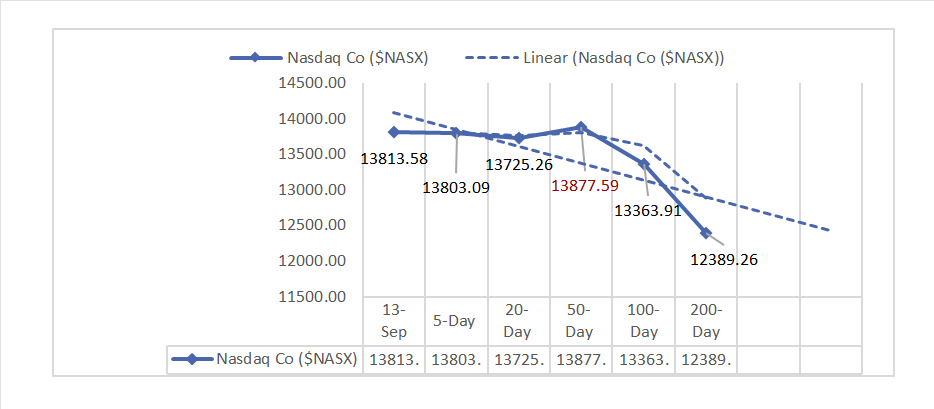

US Markets

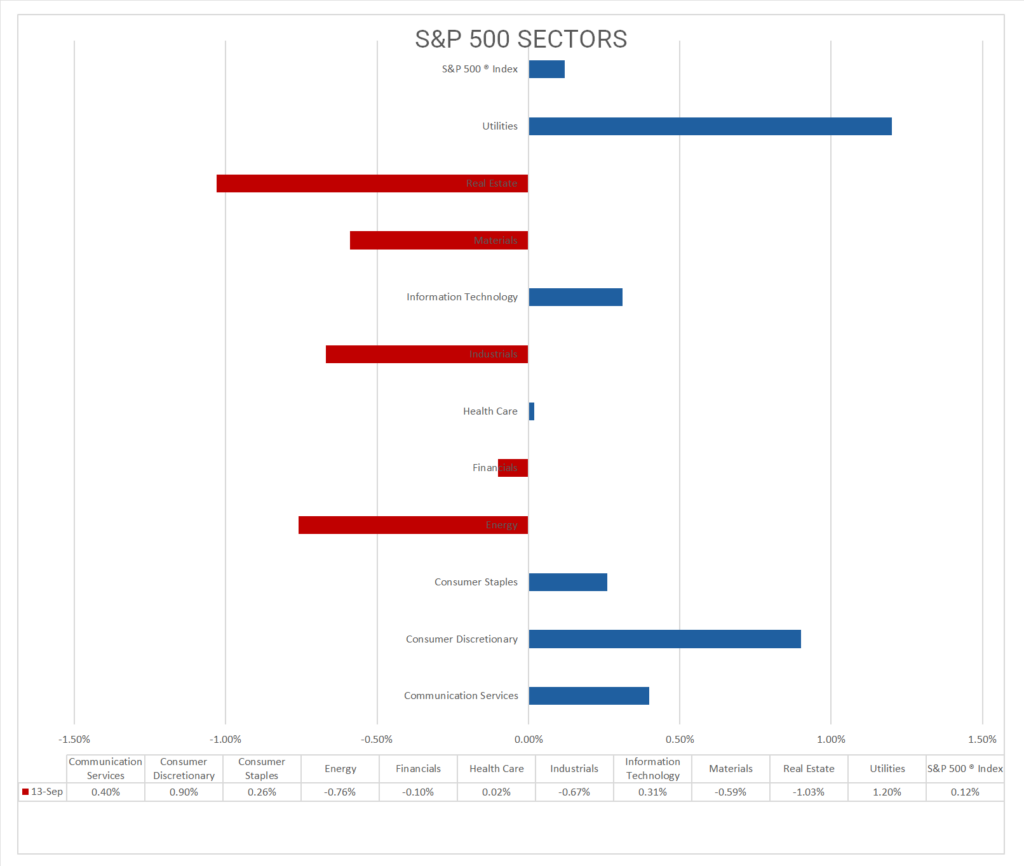

- US markets showed mixed results today. The NASDAQ rose by 0.29%, the S&P 500 increased by 0.12%, while the DOW declined by 0.20%. The NYSE Fang+ gained 0.42%, Growth Stocks outperformed. Among the 11 S&P 500 sectors, 6 advanced, with the Utilities sector leading with a +1.20% gain, while Real Estate lagged with a -1.03% decrease. Notable exchange-traded funds that advanced included SPDR S&P 500 ETF (^SPY), iShares Semiconductor ETF (^SOXX), and Credit Hedge ETF (^CDX). Other gainers included the USD Index, WTI Oil, and the Bloomberg Commodity Index.

- In August, economic activity saw the Consumer Price Index (CPI) rise by 0.6%, with Core CPI (excluding food and energy) increasing by 0.3%. Year-over-year, CPI registered a 3.7% increase, while Core CPI showed a 4.3% rise.

Key Takeaways

- In August, the Consumer Price Index (CPI) rose by 0.6%, with Core CPI (excluding food and energy) up by 0.3%.

- US markets showed mixed results, with the Nasdaq outperforming. Growth Stocks were a driving factor in the market.

- Among the 11 S&P 500 sectors, 6 saw gains, with the Utilities sector leading.

- Notable industry performers included Broadline Retail (+2.51%), Personal Care Products (+1.66%), and various Utilities, including Electric, Water, and Gas.

- Top-performing exchange-traded funds (ETFs) included SPDR S&P 500 ETF (^SPY), iShares Semiconductor ETF (^SOXX), and Credit Hedge ETF (^CDX).

- Bitcoin exhibited an upward trend, while both Oil and the Bloomberg Commodity Index increased in the commodities market.

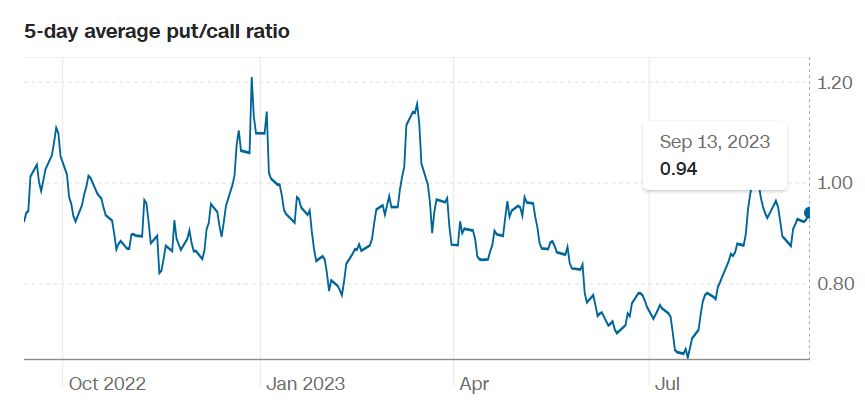

Pro Tip: When the put-to-call ratio is on the rise, it typically indicates that investors are becoming increasingly apprehensive. A ratio exceeding 1 is commonly interpreted as a bearish signal.

Indices, Sectors, Factors, and Treasuries

S&P Sectors

- S&P 500 Sector Update (as of September 11, 2023):

-

- 6 out of 11 S&P 500 sectors saw gains.

- Utilities performed best, rising by +1.20%.

- Real Estate declined by -1.03%.

- Top-Performing Industries for the Day: Notable industries for the day included Broadline Retail (+2.51%), Personal Care Products (+1.66%), and others in the Utilities Sector, such as Electric, Water, and Gas Utilities, all showing positive gains.

- Performance Over the Past Month (as of September 12, 2023):

-

- The Energy Sector led with a +3.04% gain.

- Information Technology followed with a +2.38% increase.

- Communication Services also gained +1.67%.

- Year-to-Date (YTD) S&P 500 Leaders (as of September 12, 2023):

-

- Communication Services (+43.45%)

- Information Technology (+38.81%)

- Consumer Discretionary (+34.77%)

- The S&P 500 has a notable gain of 16.21% YTD.

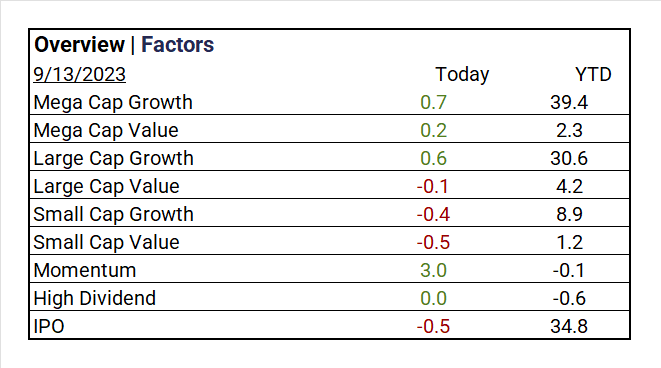

Factors

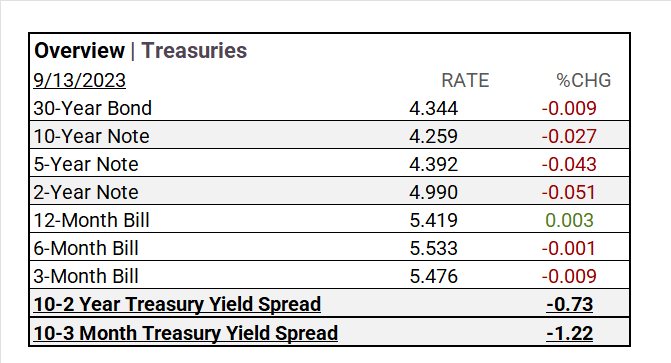

US Treasuries

Earnings

- In Q1 ’23, 79% of companies beat analyst estimates by an average of 6.5%.

- The Q2 Forecast predicted a decline of <7.2%> in S&P 500 EPS, with Fiscal year 2023 EPS remaining flat YoY. Q2 Seasonal Actuals are yet to be reported.

Notable Earnings Today

- +Beat: Semtech (SMTC)

- -Miss: Burford (BUR), Cracker Barrel Old (CBRL)

Economic Data

US

- Consumer price index for Aug: Up 0.6%

- Core CPI for Aug: Up 0.3%

- CPI year-over-year: 3.7%

- Core CPI year-over-year: 4.3%

- U.S. federal budget for Aug: $89B deficit

“Navigating September 2023: Vica Partners Insights”

- Our aim with this report is to provide you with a comprehensive overview of the prevailing trends that are shaping financial markets.

Key Trends

- Growth stocks tend to perform well during economic optimism.

- ^NYFANG new defensive’s Index as “bigger allows for more capital to scale.”

- AI and Semiconductor Equipment will continue to outperform.

- Market had a Factor regression from Growth to Value stocks in the past 45 days.

- Energy is August Sector leader and look for further ’23 opportunity here.

- Health Care +Health Care REITs and Materials undervalued.

- Current economic signals are mixed with deflation concerns.

- August/September historically have lower ROI.

“Vica Partners: Navigating the Economic Landscape – 2023 Economic Forecast

- As of September 2023, the Federal Reserve no longer predicts a recession. However, Vica Partners disagrees and forecasts a potential recession starting as early as Q4 ’23 and extending into ’24. This projection is based on factors including Fed tightening, rising oil prices, overvalued stock markets, and a strong dollar. Vica Partners believes that market bottoms typically occur amid negative news and deflationary signals. Rising interest rates and their impact on the real estate market, coupled with historical highs in consumer debt, are significant concerns. Vica Partners also notes the shift from Growth to Value stocks and the moderation of the Information Technology sector correction occurred.

Key Points

- The Federal Reserve’s power to control inflation is limited, and traditional economic principles may not be effective in today’s highly automated global economy.

- A 2% inflation target may not be realistic today, and a base rate exceeding 3% could fund wage increases, energy transition, operational efficiency improvements, and protection against deflation.

News

Company News/ Other

- Trucker Estes Raises Stakes in Bidding War for Yellow Properties – WSJ

- Arm IPO: What to Know About the Circuit Designer and Its Market Debut – WSJ

- Apollo Is Among Suitors for IGT’s Global Slot-Machine Unit – Bloomberg

Energy/ Materials

- Shell Urges Gas Investment: Australia Briefing – Bloomberg

- The Rise of Solar and Batteries Is Upending Our Renewable Future – Bloomberg

Real Estate

- Property Brokers Slump With High Borrowing Costs Weighing on Deals – Bloomberg

Central Banks/Inflation/Labor Market

- U.S. Inflation Accelerated in August as Gasoline Prices Jumped – WSJ

- US Core CPI Picks Up, Keeping Another Fed Hike in Play This Year – Bloomberg

Asia/ China

- China’s top-500 list of private firms is missing some big names, as profits fell and property developers tanked – SCMP