“Empowering Your Financial Success”

Daily Market Insights: September 20th, 2023

Global Markets Summary:

Asian Markets:

- China’s Shanghai Composite: (-0.52%)

- Hong Kong’s Hang Seng: (-0.62%)

- Japan’s Nikkei 225: (-0.66%)

US Futures:

- S&P Futures: opened @4,452.81 (+0.20%)

European Markets:

- Germany’s DAX: (+0.75%)

- France’s CAC 40: (+0.67%)

- London’s FTSE 100: (+0.26%)

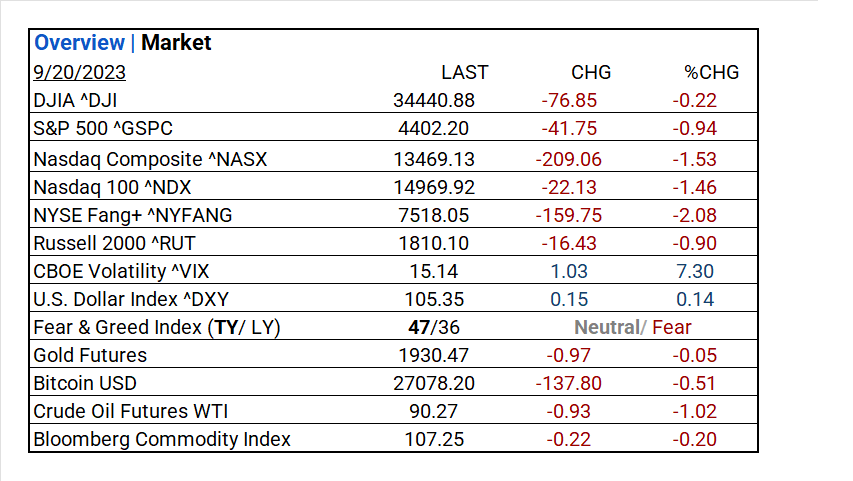

US Market Snapshot:

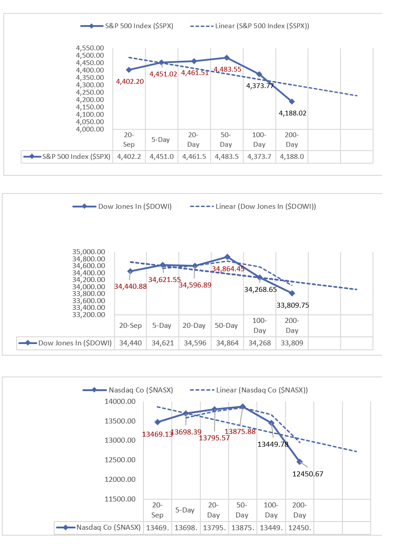

Key Stock Market Indices:

- DJIA ^DJI: 34440.88 (-76.85, -0.22%)

- S&P 500 ^GSPC: 4402.20 (-41.75, -0.94%)

- Nasdaq Composite ^NASX: 13469.13 (-209.06, -1.53%)

- Nasdaq 100 ^NDX: 14969.92 (-22.13, -1.46%)

- NYSE Fang+ ^NYFANG: 7518.05 (-159.75, -2.08%)

- Russell 2000 ^RUT: 1810.10 (-16.43, -0.90%)

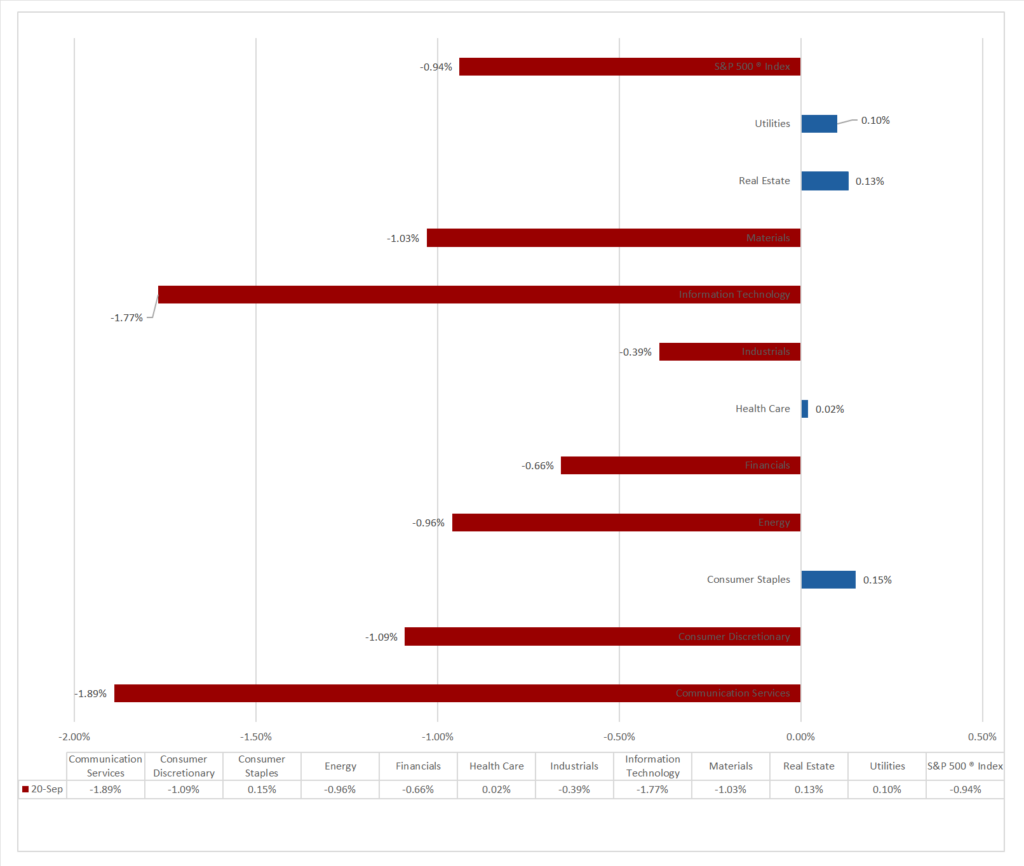

Market Insights: Performance, Sectors, and Trends:

Market Insights: Performance, Sectors, and Trends:

- Major indices (DJIA, S&P 500, Nasdaq, Nasdaq 100, NYSE Fang+, Russell 2000) fell.

- Notable sector gains: Health Care Providers & Services (+1.52%), Health Care REITs (+1.36%), Diversified Telecommunication Services (+1.31%).

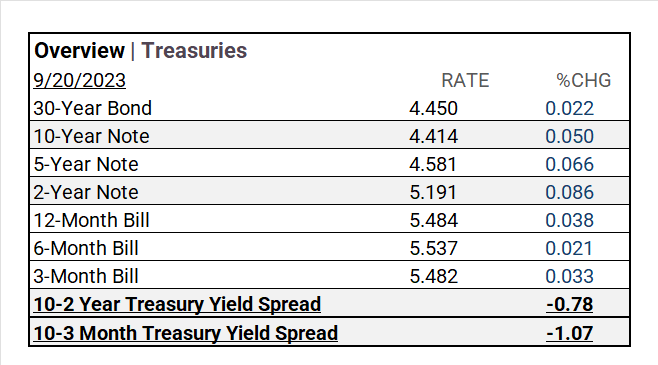

- Treasury yields fluctuated: 30-Year Bond at 4.450%, 10-Year Note at 4.414%, 2-Year Note at 5.191%. Yield spreads: -0.78% (10-2 Year), -1.07% (10-3 Month).

- U.S. Dollar Index ^DXY: 105.35 (+0.15, +0.14%)

- CBOE Volatility ^VIX: 15.14 (+1.03, +7.30%)

- Fear & Greed Index (TY/LY): 47/36 (Shift to fear)

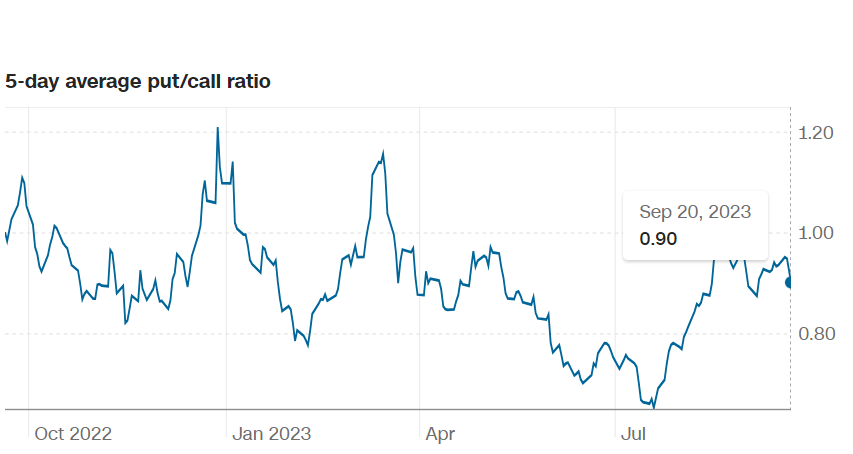

- 5-Day Average Put/Call Ratio: 0.90

- Commodity markets mixed: Gold Futures down, Bitcoin USD lower, Crude Oil Futures WTI declined, Bloomberg Commodity Index decreased.

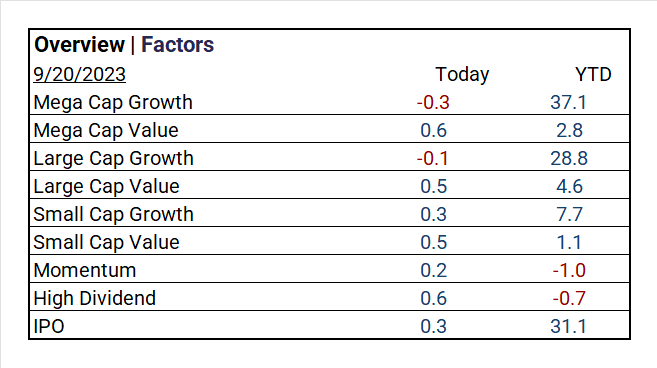

- Top performers: Mega Cap Value, Large Cap Value, Small Cap Value, High Dividend.

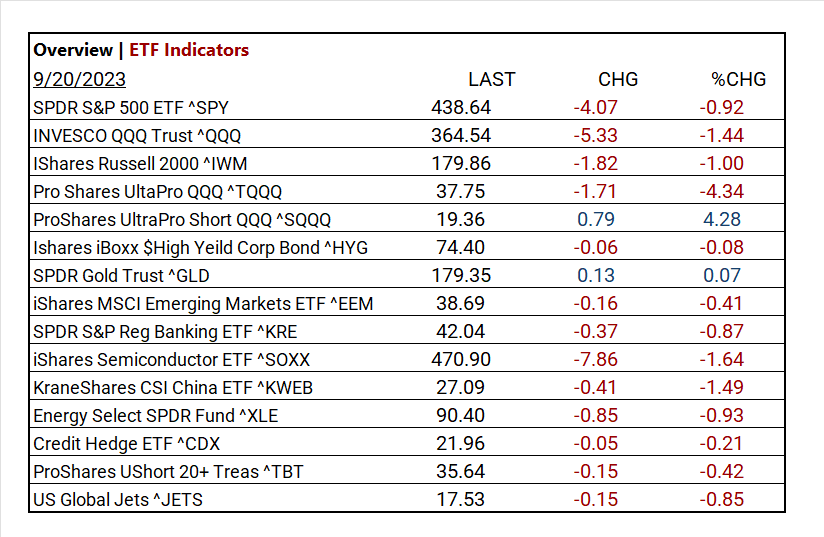

- ETF top performers: ProShares UltraPro Short QQQ ^SQQQ (+4.28%), with Pro Shares UltaPro QQQ ^TQQQ as a worst performer (-4.34%).

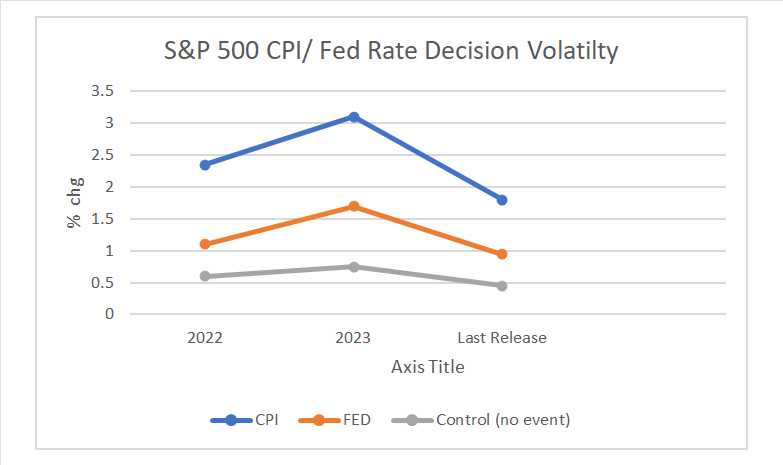

- Fed Chief Powell noted a tightening labor market, easing inflation pressures. Fed raised rates 11 times since March 2022, holding key rate steady in past three meetings, indicating a moderated stance against inflation.

Treasury Yields and Currency:

- Treasury yields fluctuated. The 30-Year Bond increased by 0.022% to 4.450%, while the 10-Year Note rose by 0.050% to 4.414%. Shorter maturities also saw increases, with the 2-Year Note gaining 0.086% to reach 5.191%. The yield spreads indicated a -0.78% for the 10-2 Year Treasury Yield Spread and -1.07% for the 10-3 Month Treasury Yield Spread, reflecting current interest rate dynamics.

- U.S. Dollar Index ^DXY: 105.35 (+0.15, +0.14%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 15.14 (+1.03, +7.30%)

- Fear & Greed Index (TY/LY): 47/36 (Neutral/Fear)

- 5-Day Average Put/Call Ratio: 0.90

Commodities:

- Gold Futures: 1930.47 (-0.97, -0.05%)

- Bitcoin USD: 27078.20 (-137.80, -0.51%)

- Crude Oil Futures WTI: 90.27 (-0.93, -1.02%)

- Bloomberg Commodity Index: 107.25 (-0.22, -0.20%)

Factors:

- Today’s top performers: Mega Cap Value +0.6%, Large Cap Value +0.5%, Small Cap Value +0.5%, and High Dividend +0.6%.

ETF Performance:

Top Performers:

- ProShares UltraPro Short QQQ ^SQQQ: +4.28%

- Pro Shares UltaPro QQQ ^TQQQ: -4.34%

- ProShares UShort 20+ Treas ^TBT: -0.42%

Worst Performers:

- INVESCO QQQ Trust ^QQQ: -1.44%

- iShares Semiconductor ETF ^SOXX: -1.64%

- KraneShares CSI China ETF ^KWEB: -1.49%

US Economic Data

- Fed Chief Powell noted today that a tight labor market, with supply and demand moving toward balance. This labor market rebalancing is seen as easing inflation pressures. The Fed has raised rates 11 times since March 2022. In the past three meetings, they’ve held the key rate steady, signaling a moderated stance against inflation amid reduced price pressures.

Earnings:

Q1 Insights:

- Q1 ’23: 79% of companies beat analyst estimates.

Q2 Insights:

- Q2 Forecast: Predicted decline of <7.2%> in S&P 500 EPS , Fiscal year 2023 EPS remained flat YoY.

Notable Earnings Today:

- Beat: General Mills (GIS), KB Home (KBH)

- Miss: FedEx (FDX), Lifezone Metals (LZM)

Resources:

News

Investment and Growth News

- FedEx Earnings Rise Despite Weakened Demand – WSJ

- OpenAI Says Next Iteration of Dall-E Coming in October – Bloomberg

- Huawei heir-apparent Meng Wanzhou sets AI as the Chinese giant’s business focus in the next decade – SCMP

Infrastructure and Energy

- Sunak’s Green U-Turn Angers Tories, Casts Doubt on Net Zero – Bloomberg

- SEC Rule Cracks Down on Misleading ESG, Growth Fund Label – Bloomberg

Real Estate Market Updates

- America’s Biggest Landlords Can’t Find Houses to Buy Either – WSJ

Central Banking and Monetary Policy

- Fed Holds Rates Steady but Pencils In One More Hike This Year – WSJ

- Oil Nearing $100 Is Red Flag for Central Banks’ Inflation Fight – Bloomberg

International Market Analysis (China)

- China factories with Asean aspirations are lining up for a look at Vietnam, and industrial parks are cashing in – SCMP