“Empowering Your Financial Success”

Daily Market Insights: September 22nd, 2023

Global Markets Summary:

Asian Markets:

- Hong Kong’s Hang Seng: +2.40%

- China’s Shanghai Composite: +1.51%

- Japan’s Nikkei 225: -0.52%

US Futures:

- S&P Futures: opened @4,341.74 (+0.27%)

European Markets:

- London’s FTSE 100: -0.66%

- Germany’s DAX: -1.33%

- France’s CAC 40: -1.59%

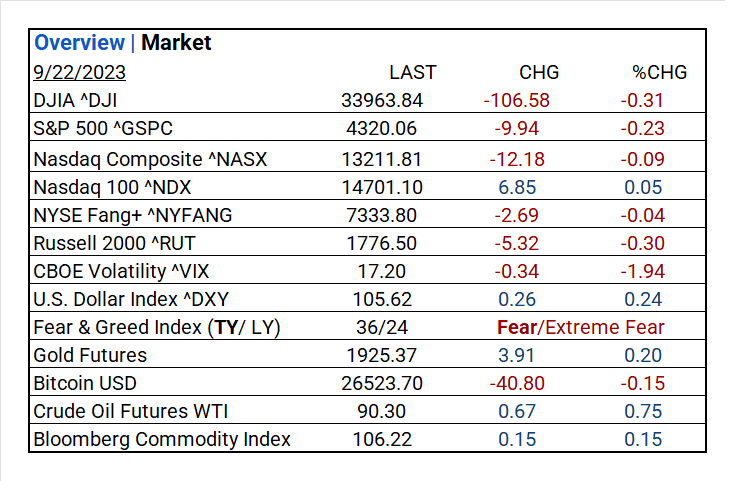

US Market Snapshot:

Key Stock Market Indices:

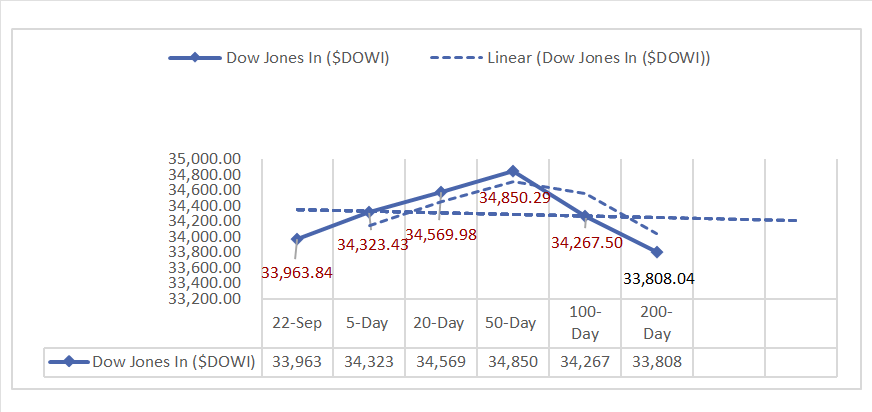

- DJIA ^DJI: 33963.84 (-106.58, -0.31%)

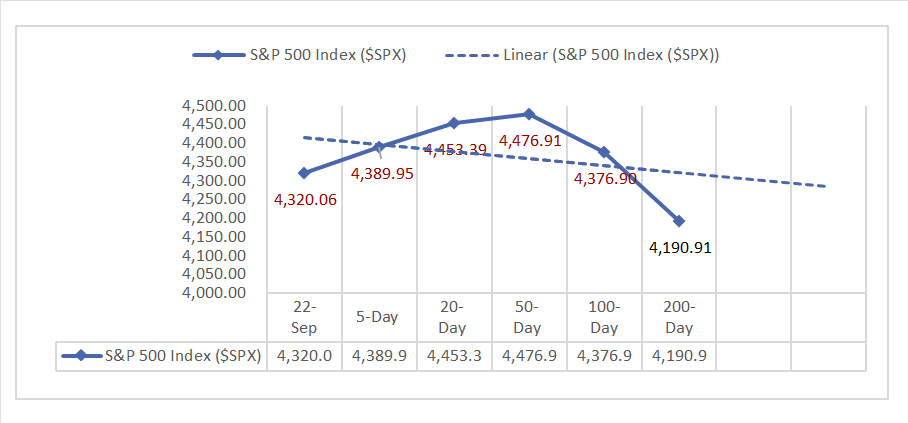

- S&P 500 ^GSPC: 4320.06 (-9.94, -0.23%)

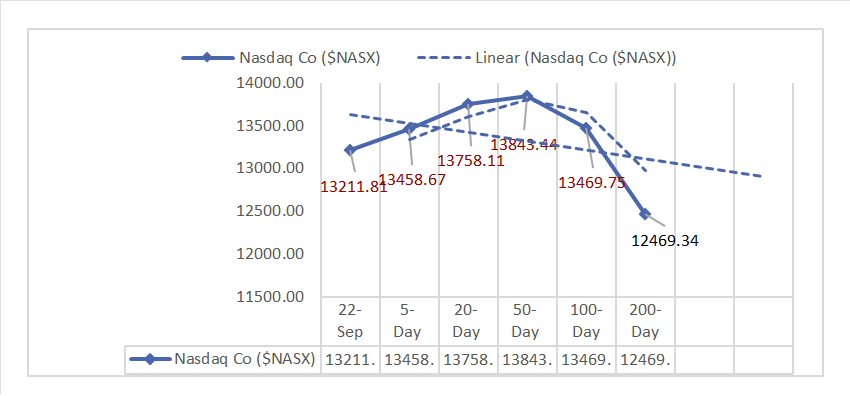

- Nasdaq Composite ^NASX: 13211.81 (-12.18, -0.09%)

- Nasdaq 100 ^NDX: 14701.10 (6.85, 0.05%)

- NYSE Fang+ ^NYFANG: 7333.80 (-2.69, -0.04%)

- Russell 2000 ^RUT: 1776.50 (-5.32, -0.30%)

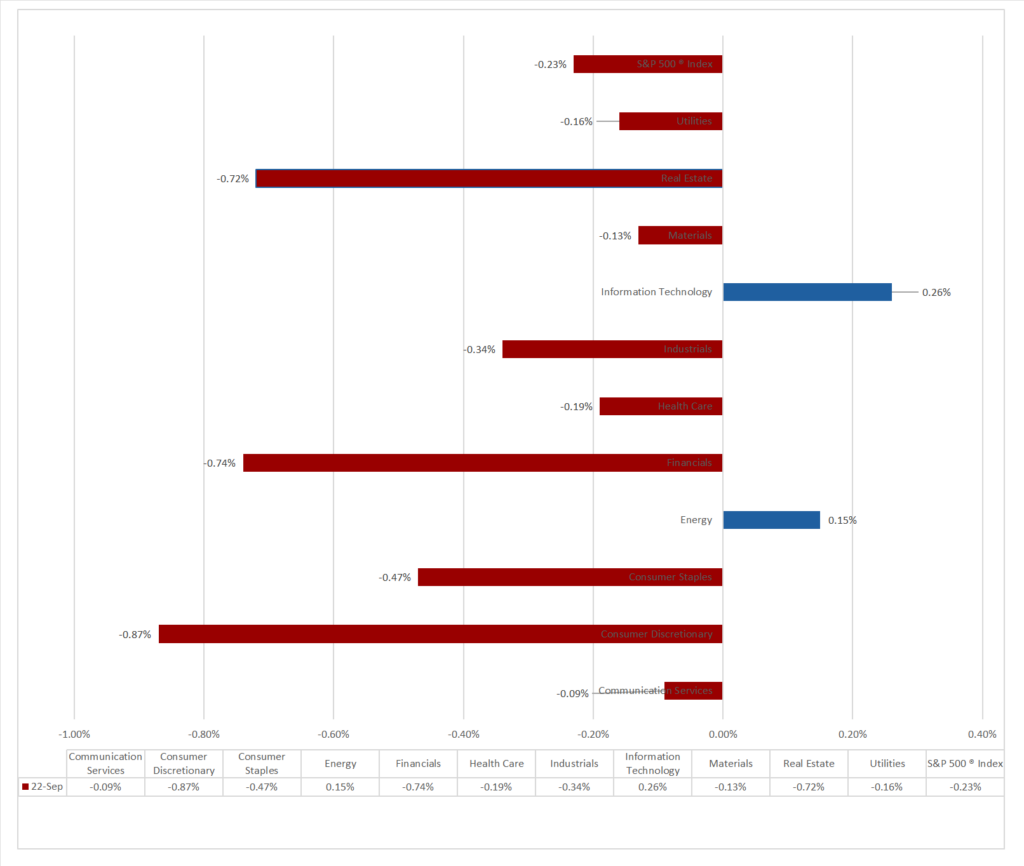

Market Insights: Performance, Sectors, and Trends:

- Economic data: S&P U.S. services PMI at 50.2 (vs. consensus 50.7, prior 50.5) and U.S. manufacturing PMI at 48.9 (vs. consensus 48.3, prior 47.9).

- 9 of 11 sectors declined; Energy led, and Consumer Discretionary lagged. Notable gainers include Construction & Engineering (+1.06%), Electrical Equipment (+0.69%), Automobile Components (+0.44%), and Energy Equipment & Services (+0.35%).

- Major indices, DJIA, S&P 500, Nasdaq, NYSE Fang+, Russell 2000, saw declines.

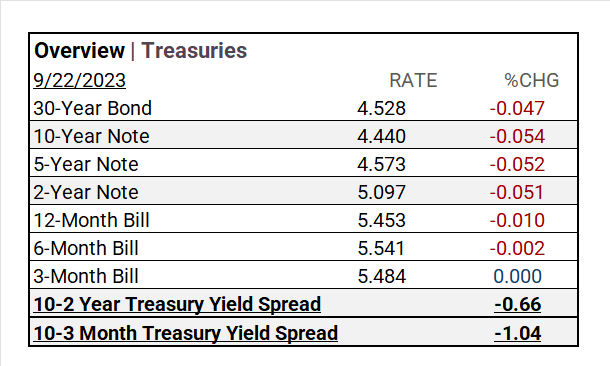

- Treasury markets: 30-Year Bond and 10-Year Note rose; 2-Year Note fell.

- U.S. Dollar Index increased, CBOE Volatility dropped, Fear & Greed Index indicated fear.

- Commodity markets: Gold Futures rose, Bitcoin USD dropped, Crude Oil Futures WTI increased, and Bloomberg Commodity Index gained.

- Notable declines in Commodity markets: Gold Futures, Bitcoin USD, Crude Oil Futures WTI, and Bloomberg Commodity Index.

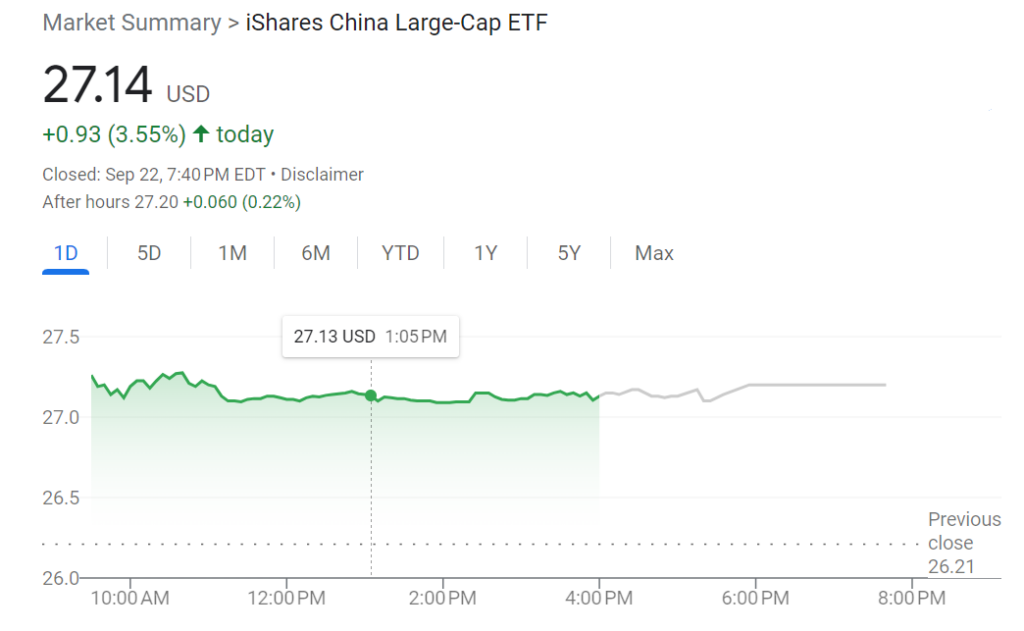

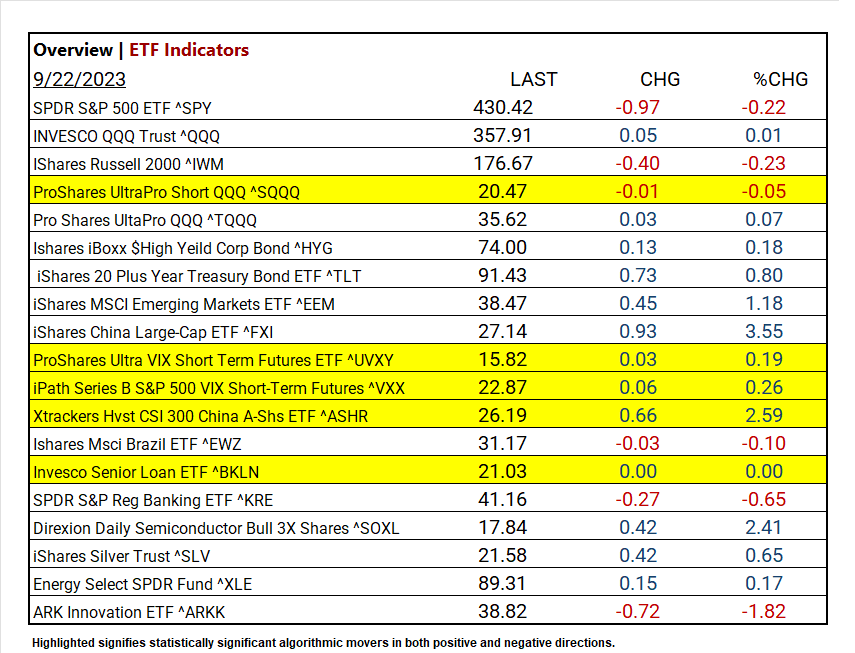

- Top-performing ETFs: iShares China Large-Cap ETF ^FXI, Xtrackers Hvst CSI 300 China A-Shs ETF ^ASHR, iShares MSCI Emerging Markets ETF ^EEM.

- Worst-performing ETFs: ARK Innovation ETF ^ARKK, SPDR S&P Reg Banking ETF ^KRE, iShares Russell 2000 ^IWM.

Treasury Yields and Currency:

- In Treasury markets, the 30-Year Bond and 10-Year Note experienced increases, while the 2-Year Note saw a decline. Yield spreads showed mixed trends.

- The U.S. Dollar Index ^DXY: 105.62 (+0.26, +0.24%)

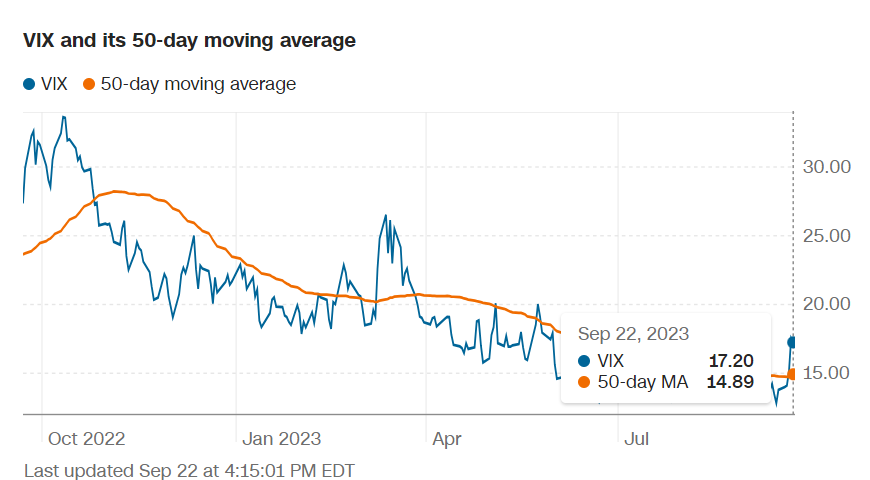

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 17.20 (-0.34, -1.94%)

- Fear & Greed Index: 36/24 (TY/LY) – Fear/Extreme Fear

source: CNN Fear & Greed Index

Commodities:

- Gold Futures: 1925.37 (+3.91, +0.20%)

- Bitcoin USD: 26523.70 (-40.80, -0.15%)

- Crude Oil Futures WTI: 90.30 (+0.67, +0.75%)

- Bloomberg Commodity Index: 106.22 (+0.15, +0.15%)

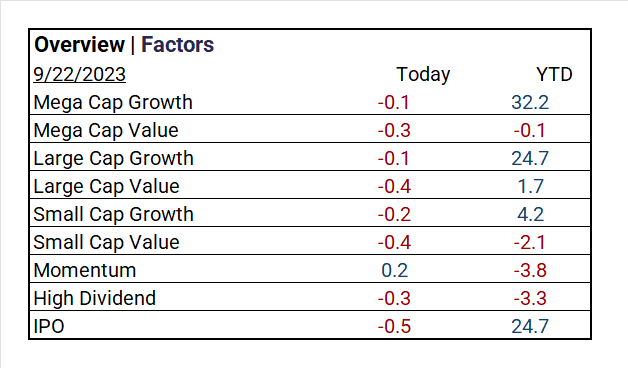

Factors:

ETF Performance:

Top Performers:

- iShares China Large-Cap ETF ^FXI: +3.55%

- Xtrackers Hvst CSI 300 China A-Shs ETF ^ASHR: +2.59%

- iShares MSCI Emerging Markets ETF ^EEM: +1.18%

Worst Performers:

- ARK Innovation ETF ^ARKK: -1.82%

- SPDR S&P Reg Banking ETF ^KRE: -0.65%

- IShares Russell 2000 ^IWM: -0.23%

US Economic Data

- S&P flash U.S. services PMI (Sept.): 50.2 (vs. 50.7 consensus, prior 50.5)

- S&P flash U.S. manufacturing PMI (Sept.): 48.9 (vs. 48.3 consensus, prior 47.9)

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023 results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: S&P 500 to see -0.2% YoY earnings decline, marking 4th consecutive drop. S&P 500’s 12-month P/E ratio is 18.0, below 5-year (18.7%) average but above 10-year (17.5%) average. 74 S&P 500 firms gave negative EPS guidance, 42 exceeded expectations with positive guidance.

Notable Earnings Today:

- Beat: Qantas Airways ADR (QABSY) pending revenue Miss:

Resources:

News

Investment and Growth News

- Tinder Offers $500-a-Month Subscription to Its Most Active Users – Bloomberg

- Microsoft’s Activision Deal Clears Main Hurdle as U.K. Regulator Accepts Changes – WSJ

- Frontier Extends Record Rout as Wall Street Downgrades Pile Up – Bloomberg

- FTC Poised to Sue Amazon for Antitrust Violations Next Week – Bloomberg

Infrastructure and Energy

- Phasing Out Fossil Fuels Is ‘Unrealistic,’ China Climate Envoy Say – Bloomberg

Real Estate Market Updates

- Apollo’s Zelter Sees Opportunity in Commercial Real Estate Lending – Bloomberg

Central Banking and Monetary Policy

- US Economic Reports on Jobs, Inflation Would Be Delayed in Shutdown – Bloomberg

- Japan Waits on Interest-Rate Increases, Although Inflation Runs Above Target – WSJ

- Weak Euro-Area PMI Data Suggest Economy Facing Contraction – Bloomberg

- Canada Retail Sales Drop 0.3% in Sign of Consumer Slowdown – Bloomberg

International Market Analysis (China)

- China and US set up finance and economic discussion channels – SCMP