“Empowering Your Financial Success”

Daily Market Insights: October 5th, 2023

Global Markets Summary:

Asian Markets:

- Nikkei 225 (Japan): +1.80%

- Hang Seng (Hong Kong): +0.13%

- Shanghai Composite (China): +0.10%

US Futures:

- S&P Futures: opened @ 4259.31 (-0.10%)

European Markets:

- FTSE 100 (London): +0.55%

- CAC 40 (France): +0.02%

- DAX (Germany: -0.20%

US Market Snapshot:

Key Stock Market Indices:

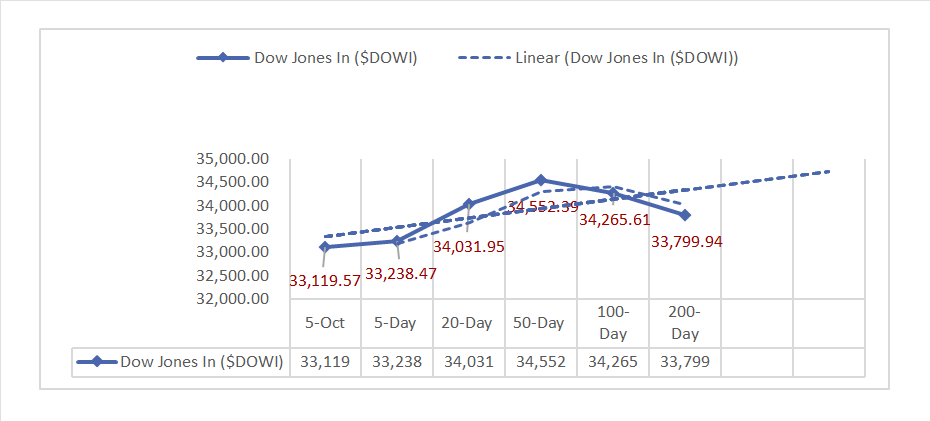

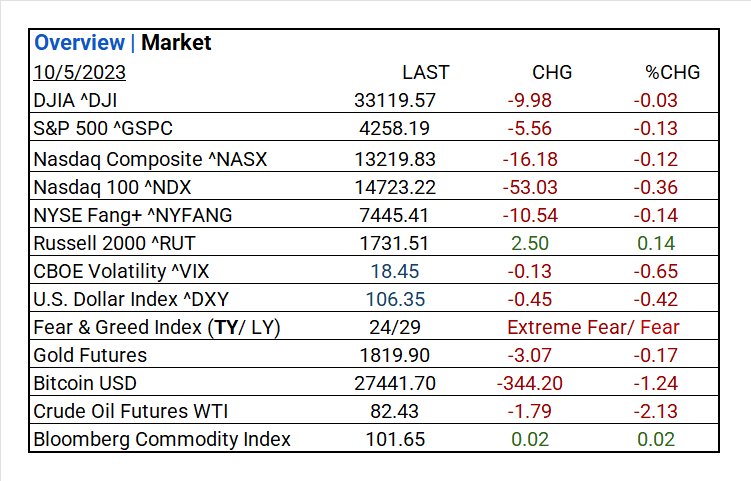

- DJIA ^DJI: 33,119.57 (-9.98, -0.03%)

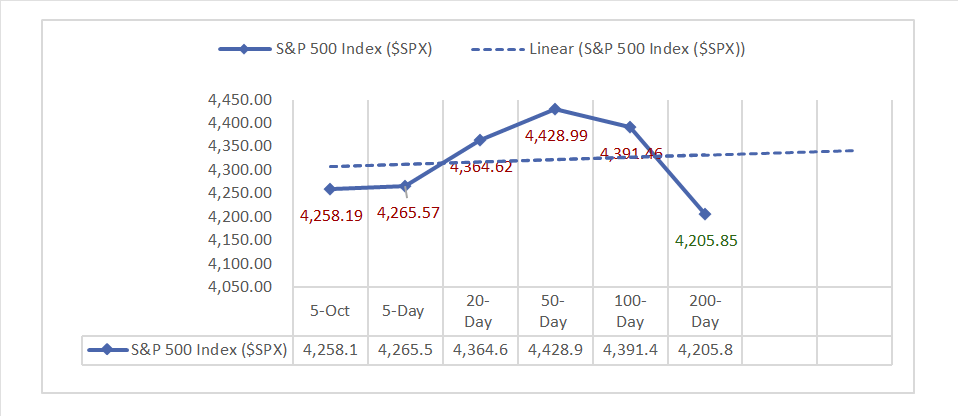

- S&P 500 ^GSPC: 4,258.19 (-5.56, -0.13%)

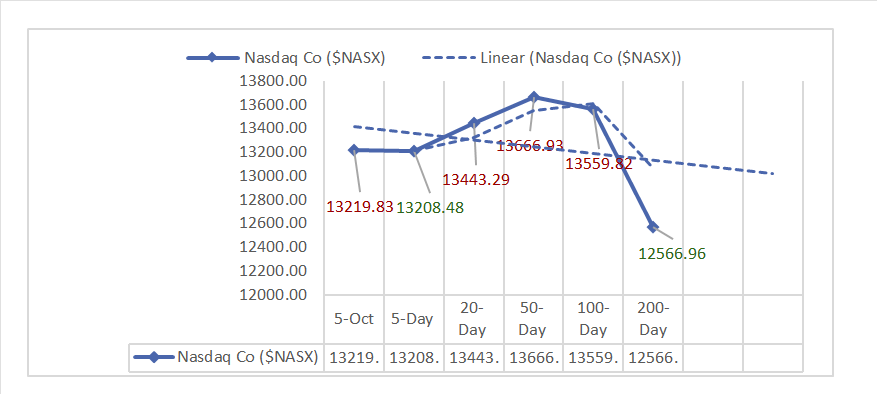

- Nasdaq Composite ^NASX: 13,219.83 (-16.18, -0.12%)

- Nasdaq 100 ^NDX: 14,723.22 (-53.03, -0.36%)

- NYSE Fang+ ^NYFANG: 7,445.41 (-10.54, -0.14%)

- Russell 2000 ^RUT: 1,731.51 (+2.50, +0.14%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: The US trade deficit for August was -$58.3 billion, less than the consensus -$59.51 billion but more than July’s -$64.7 billion. September 30, US initial jobless claims were 207,000, below the consensus of 210,000 but above the previous week’s 205,000.

- Market Indices: U.S. indices mostly pullback: Nasdaq Composite and Nasdaq 100 declined by 1.35% and 0.36%, S&P 500 dropped by 0.13%, DJIA saw a slight decrease of 0.03%, NYSE Fang+ declined by 0.14%, while Russell 2000 had a minor uptick of 0.14%.

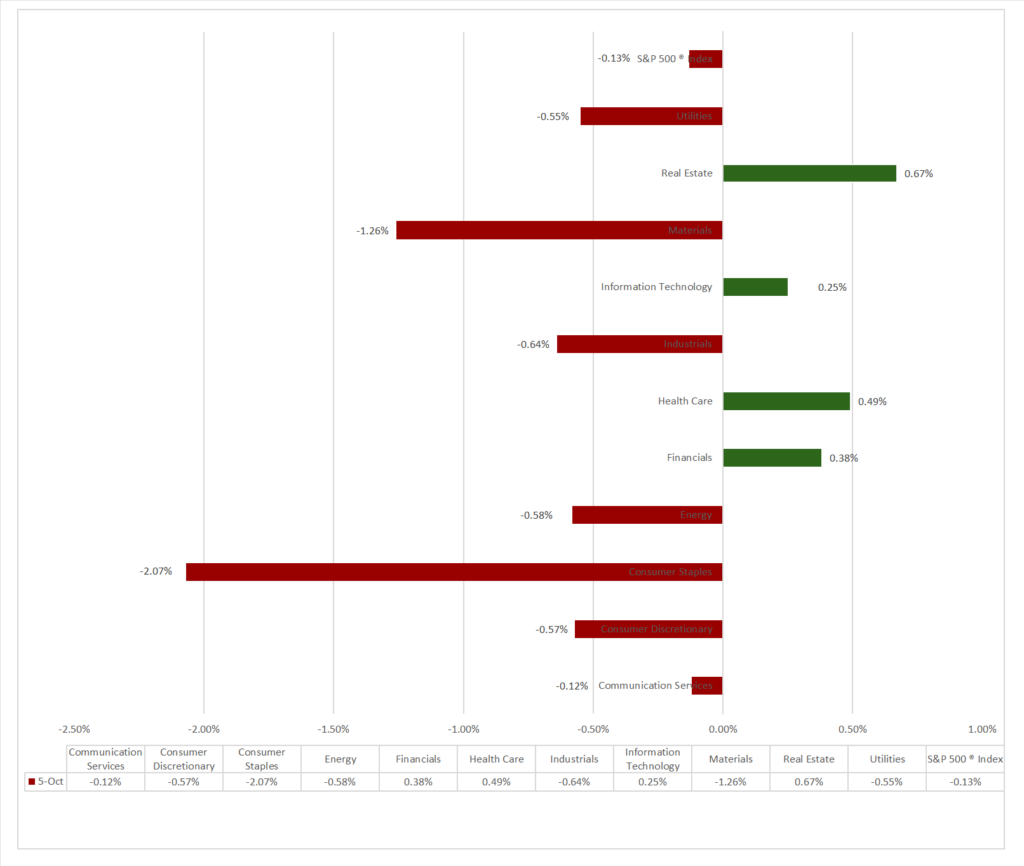

- Sector Performance: 7 of 11 sectors declined, Real Estate outperformed (+0.67%), while Consumer Staples (-2.07%) lagged. Top Industry: Real Estate Management & Development (+3.00%).

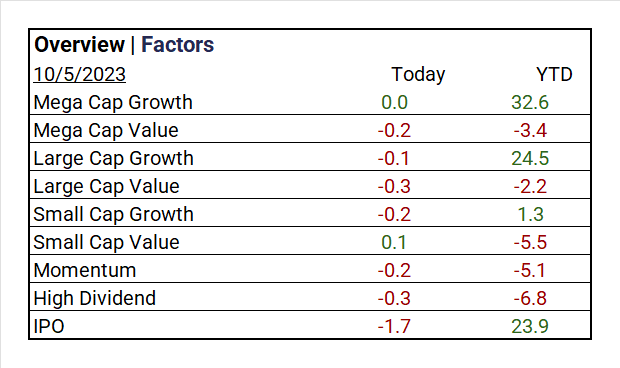

- Factors: Small Cap Value, Mega Cap Growth outperform.

- Top ETF: United States Natural Gas Fund, LP ^UNG (+6.16%).

- Worst ETF: United States Oil ETF ^USO (-2.12%).

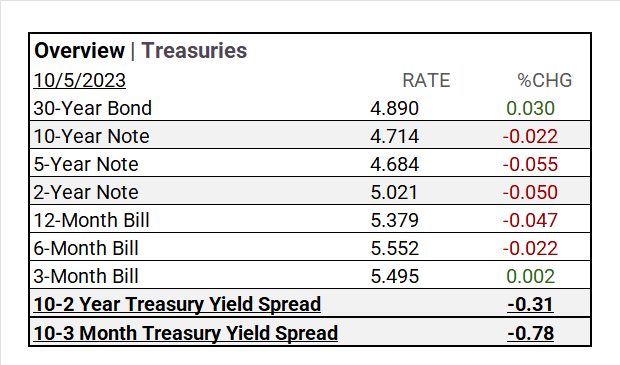

- Treasury Markets: Yields varied: 30-Year Bond rose to 4.890%, 10-Year Note dipped to 4.714%, and 5-Year Note fell to 4.684%.

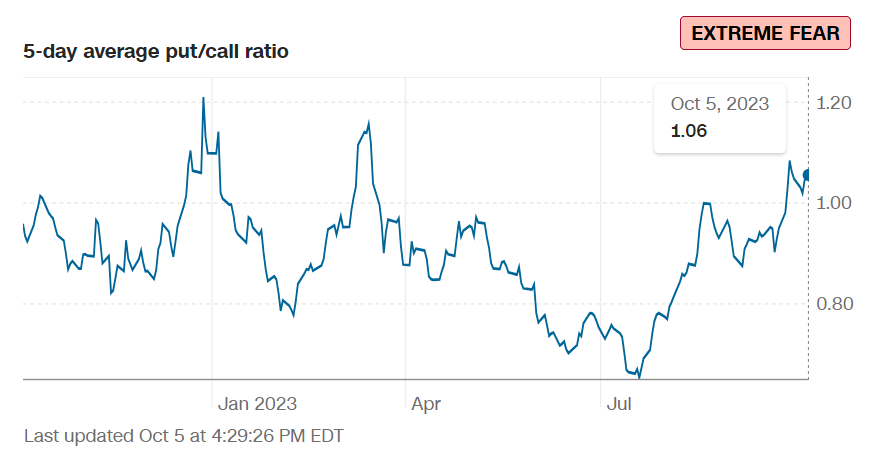

- Currency and Volatility: The U.S. Dollar Index declined, CBOE Volatility fell 0.65%, and the Fear & Greed reading: extreme fear.

- Commodity Markets: Gold, Crude Oil Futures WTI and Bitcoin fell, the Bloomberg Commodity gained.

Sectors:

- 7 of 11 sectors declined, Real Estate outperformed (+0.67%), while Consumer Staples (-2.07%) lagged. Top Industry: Real Estate Management & Development (+3.00%), Hotel & Resort REITs (+1.26%), Pharmaceuticals (+1.10%), and Gas Utilities (+1.06%).

Treasury Yields and Currency:

- In Treasury markets, the 30-Year Bond rose to 4.890%, the 10-Year Note dipped to 4.714%, and the 5-Year Note fell to 4.684%. Shorter-term yields also shifted. The yield curve flattened, with 10-Year/2-Year contracting -0.31 and 10-Year/3-Month contracting -0.78.

- The U.S. Dollar Index ^DXY: 106.35 (-0.45, -0.42%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 18.58 (-1.20, -6.07%)

- Fear & Greed Index (TY/LY): 19/27 (Extreme Fear/Fear).

Commodities:

- Gold Futures: 1819.90 (-3.07, -0.17%)

- Bitcoin USD: 27441.70 (-344.20, -1.24%)

- Crude Oil Futures WTI: 82.43 (-1.79, -2.13%)

- Bloomberg Commodity Index: 101.65 (0.02, 0.02%)

Factors:

- Small Cap Value, (+0.1%), IPO’s decline (1.7%).

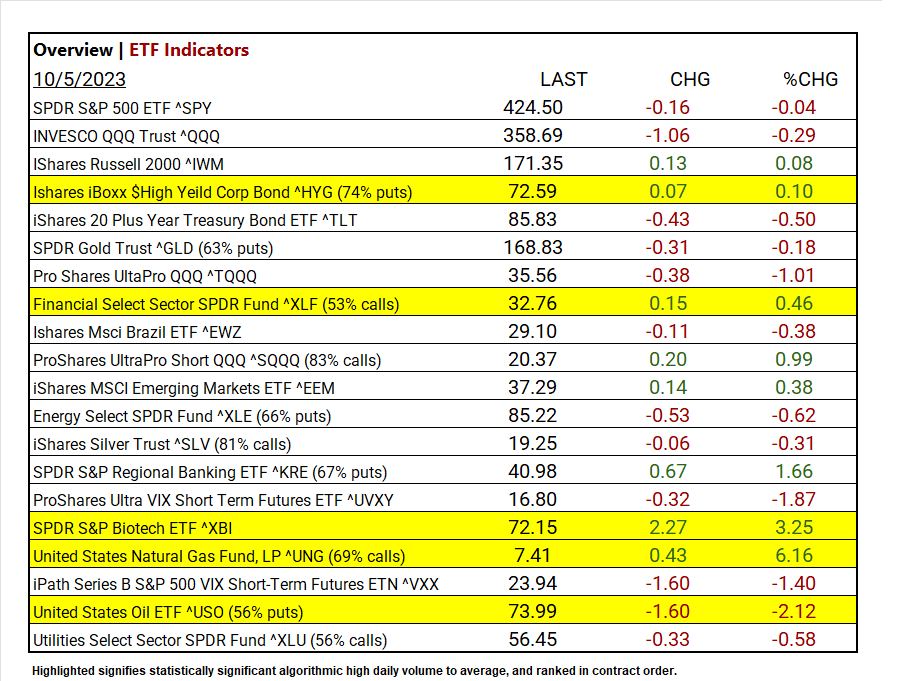

ETF Performance:

Top 3 Best Performers:

- United States Natural Gas Fund, LP ^UNG +6.16%

- SPDR S&P Biotech ETF ^XBI +3.25%

- SPDR S&P Regional Banking ETF ^KRE +1.66%

Top 3 Worst Performers:

- United States Oil ETF ^USO -2.12%

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -1.87%

- iPath Series B S&P 500 VIX Short-Term Futures ETN ^VXX -1.40%

US Economic Data

August

- U.S. Trade Deficit: -$58.3B (Consensus -$59.51B, Previous -$64.7B)

September

- Initial Jobless Claims (September 30): 207,000 (Consensus 210,000, Previous 205,000)

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are anticipated to experience earnings declines.

Notable Earnings Today:

- Beat: Constellation Brands A (STZ), Lamb Weston Holdings (LW), Aehr Test Systems (AEHR)

- Miss: ConAgra Foods (CAG), Levi Strauss A (LEVI)

Resources:

- What’s Expected in October (10-6 update TBD)

- Vica Partners Economics Forecast

News

Investment and Growth News

- Constellation Benefits From Bud Light’s Troubles — But Not as Much as Investors Hope – Bloomberg

- Amazon Is Offering Free Grocery Delivery on Orders Exceeding $100 – Bloomberg

Infrastructure and Energy

- Blackout Risk Pushes Brazil to Diesel as Amazon Drought Worsens – Bloomberg

- OPEC+ Output Cuts Are Already Destroying Oil Demand – Bloomberg

Real Estate Market Updates

- The Apartment Market Is Hitting a Construction Lull – WSJ

Central Banking and Monetary Policy

- Rising Interest Rates Mean Deficits Finally Matter – WSJ

- Bond Selloff Might Force Fed to Rethink Shedding Assets – WSJ

- Fed’s Bid to Avoid Recession Tested by Yields Nearing 20-Year Highs – Bloomberg

- US Trade Deficit Shrinks to $58.3 Billion, Smallest Since 2020 – Bloomberg

- US Jobless Claims Tick Up Slightly, Remain Historically Low – Bloomberg

International Market Analysis (China)

- China’s economic malaise boils down to ‘a failure to reform’ the system, Pathfinder report warns – SCMP