Reports: September Nonfarm Payroll in the United States

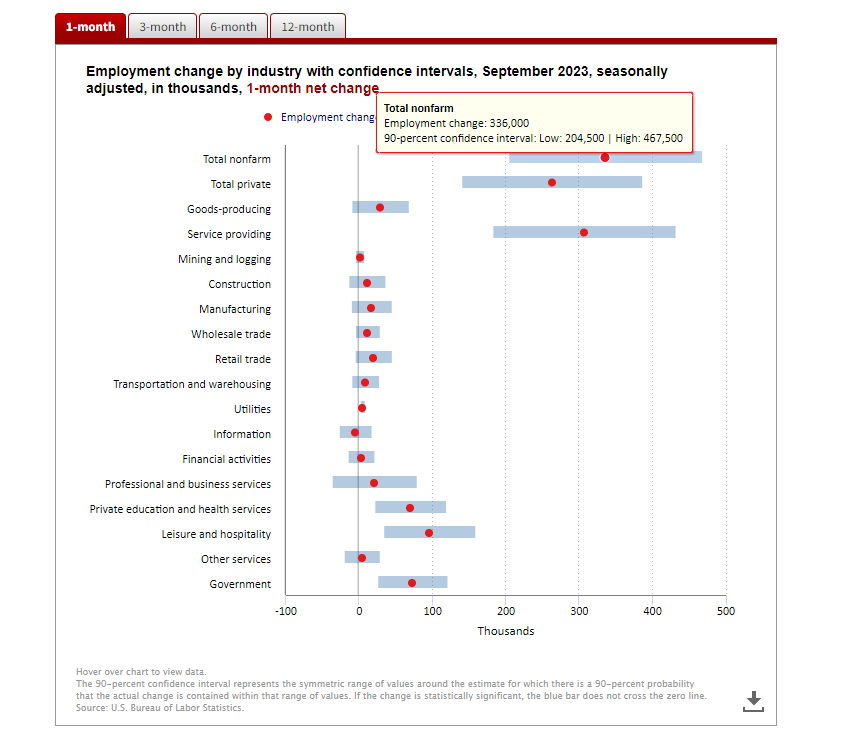

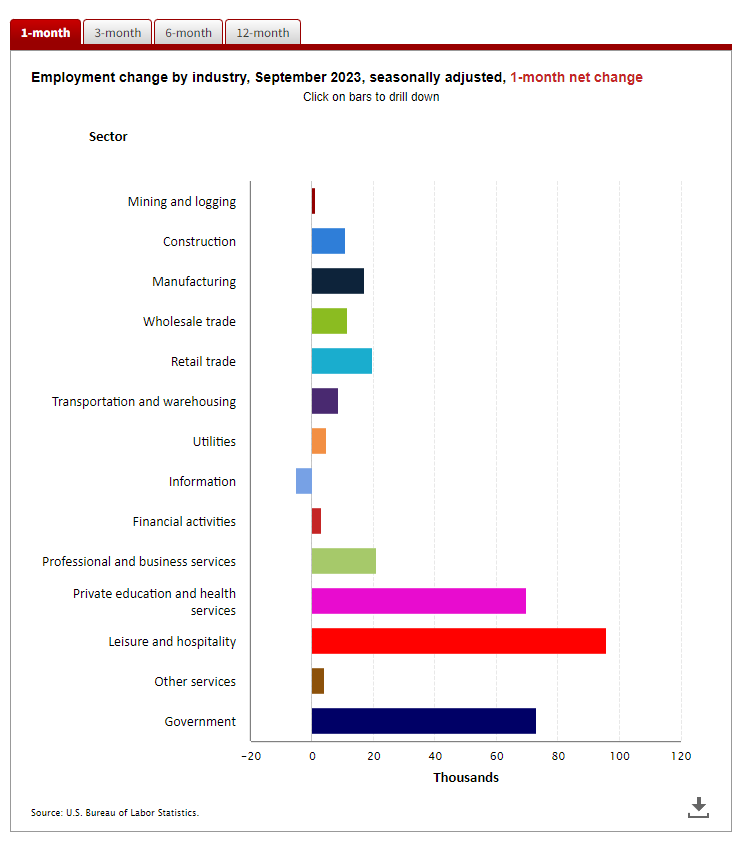

In September, the U.S. employment report unveiled a noteworthy increase of 336,000 jobs, notably exceeding the anticipated range of 170,000 to 227,000 positions.

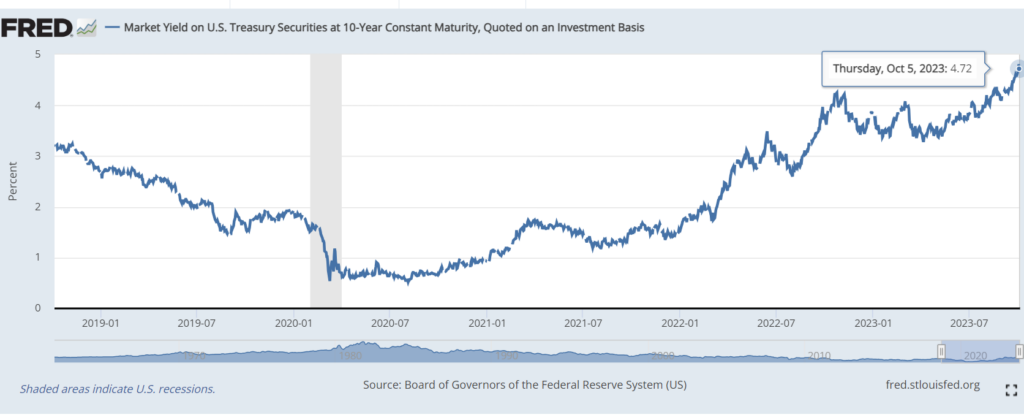

In an unexpected twist, the U.S. nonfarm payroll report for September unveiled a noteworthy increase of 336,000 jobs, notably exceeding the anticipated range of 170,000 to 227,000 positions. This has spurred increased momentum in U.S. bond yields, causing further concerns across financial markets.

The prevailing sentiment now leans toward a more optimistic outlook for the labor market, suggesting that the Federal Reserve might maintain elevated interest rates for an extended period.

While the resilience of the job market is certainly reason for optimism, a curious shift in market psychology has emerged. Investors seem to be taking a cautious stance towards “good news,” particularly when it originates from the labor sector. The bond market, in particular, appears wary of data suggesting potential overheating. his unexpected development, amid the Federal Reserve’s aggressive interest rate hikes and some economic weaknesses, has raised concerns about the labor market’s ability to sustain such robust growth over the long term.

From a market perspective, there is some relief in the moderation of wage growth, albeit falling slightly short of expectations. However, given the recent resurgence in U.S. job openings and the lack of a substantial increase in the labor force participation rate, the Federal Reserve likely remains cautious about underlying inflationary pressures on the economy.

Numerous challenges continue to affect U.S. consumers, including diminished savings, the burden of student loan repayments, and higher debt servicing costs. Nevertheless, the ongoing positive growth in real wages provides a degree of resilience against a potential economic downturn.

Remarkably, traders have responded swiftly to these developments, adjusting their expectations in kind. The likelihood of another interest rate hike by the Federal Reserve before the year’s end has surged from a mere one-third chance to approximately 50%, all in response to this surprising report. These are undoubtedly dynamic times in the world of finance, where the complex interplay of economic data and market sentiment can pave the way for significant shifts in policy and investor behavior.