“Empowering Your Financial Success”

Daily Market Insights: October 11th, 2023

Global Markets Summary:

Asian Markets:

- Hang Seng (Hong Kong): +1.55%

- Nikkei 225 (Japan): +0.57%

- Shanghai Composite (China): +0.17%

US Futures:

- S&P Futures: opened @ 4366.59 (+0.19%)

European Markets:

- DAX (Germany): +0.24%

- FTSE 100 (London): -0.11%

- CAC 40 (France): -0.44%

US Market Snapshot:

Key Stock Market Indices:

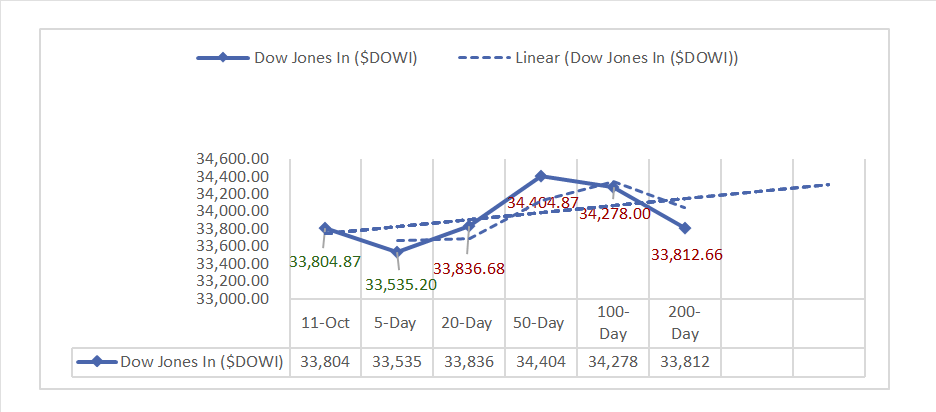

- DJIA ^DJI: 33,804.87 (+65.57, +0.19%)

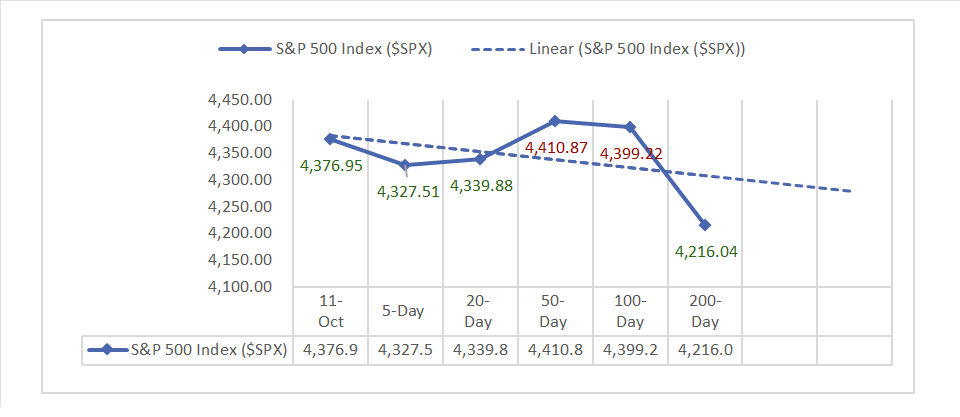

- S&P 500 ^GSPC: 4,376.95 (+18.71, +0.43%)

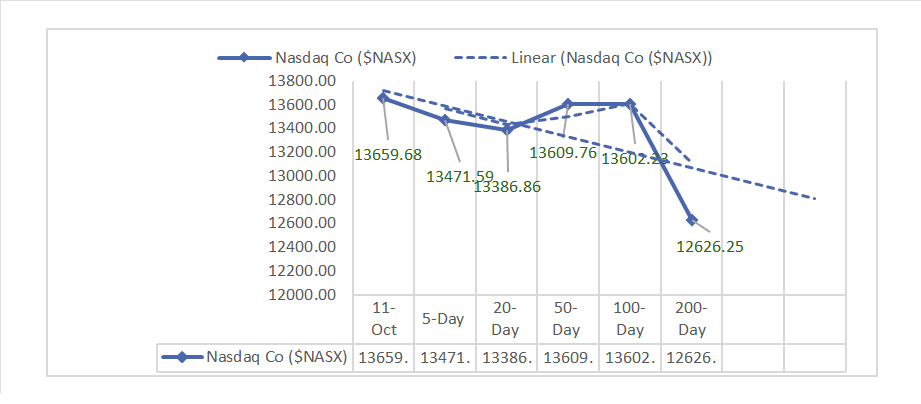

- Nasdaq Composite ^NASX: 13,659.68 (+96.88, +0.71%)

- Nasdaq 100 ^NDX: 15,241.12 (+109.62, +0.72%)

- NYSE Fang+ ^NYFANG: 7,761.31 (+76.14, +0.99%)

- Russell 2000 ^RUT: 1,773.30 (-2.65, -0.15%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: In September, PPI exceeded expectations, rising 0.5% MoM and 2.2% YoY. Core PPI also increased more than anticipated, up 0.3% MoM and 2.7% YoY.

- Market Indices: U.S. stock indices mostly advanced, DJIA, S&P 500 and Nasdaq Composite up, Nasdaq 100 up 0.72%, NYSE Fang+ up 0.99%, Russell 2000 down.

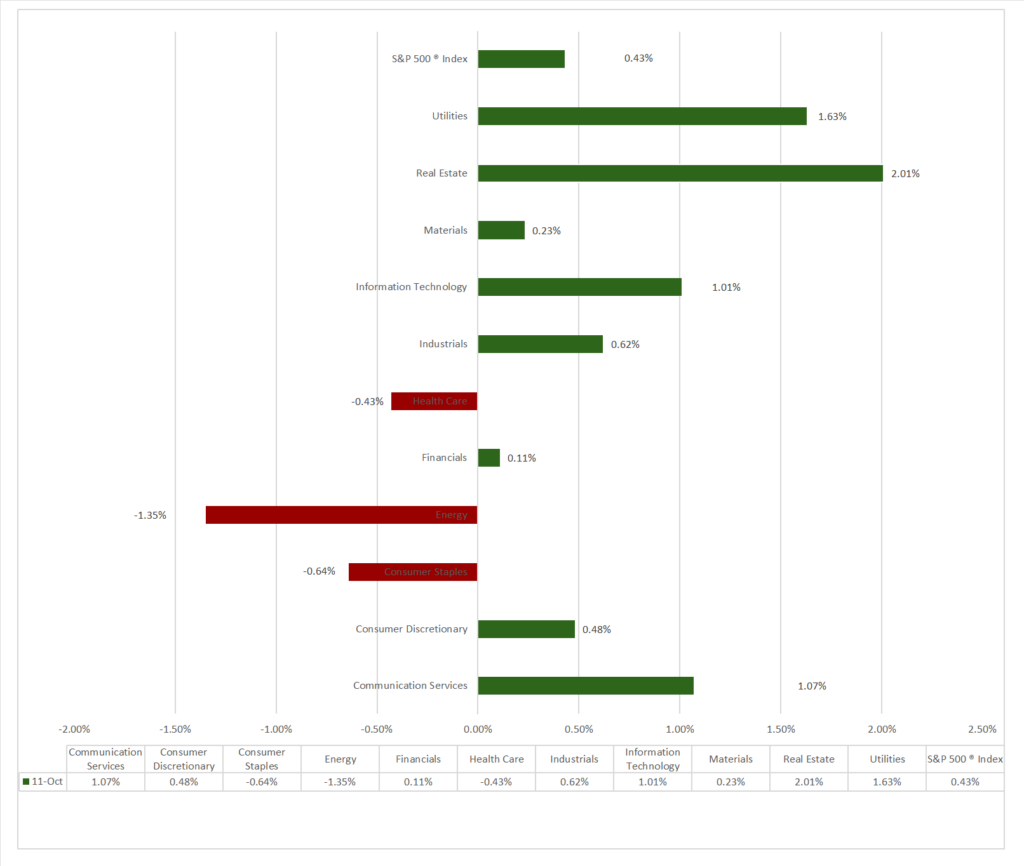

- Sector Performance: 8 of 11 sectors gained, Real Estate outperformed (+2.01%), while Energy (-1.35%) lagged. Top Industry: Ind Power & Renewables (+3.00%).

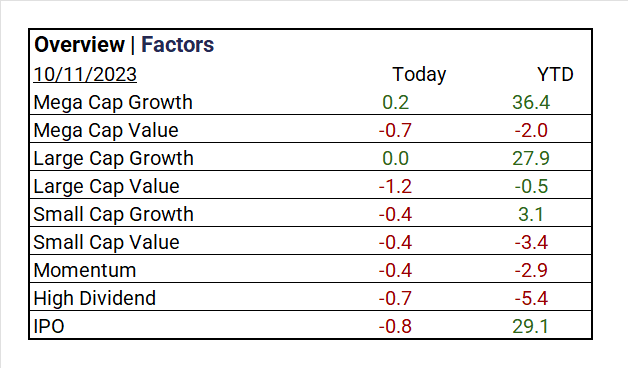

- Factors: Mega Cap Growth leads (+0.2%).

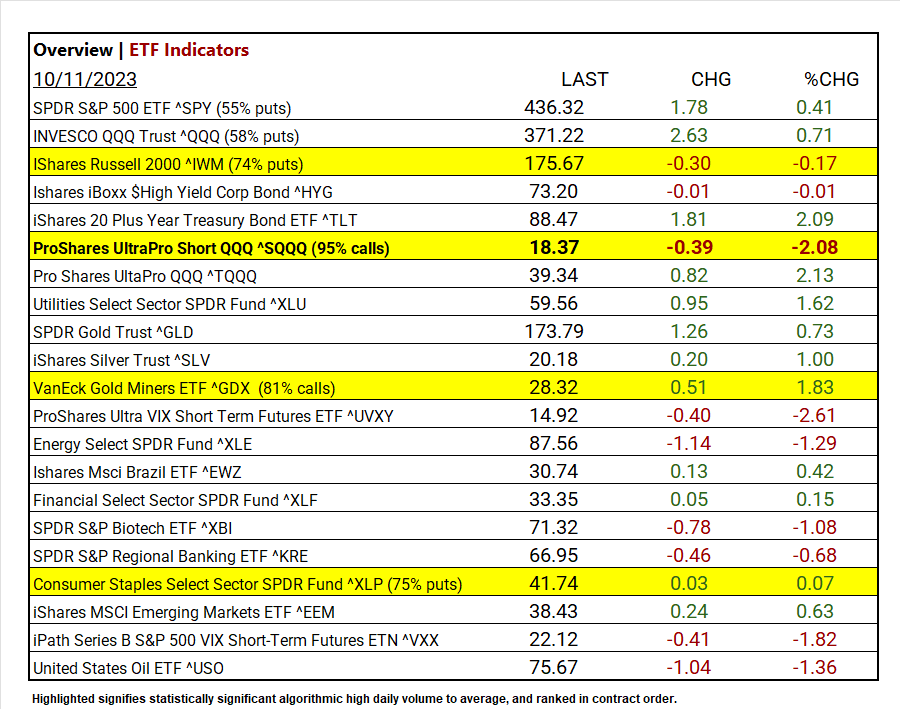

- Top ETF: Pro Shares UltaPro QQQ ^TQQQ +2.13%.

- Worst ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY -2.61%.

- Treasury Markets: US Treasury yields fell across maturities.

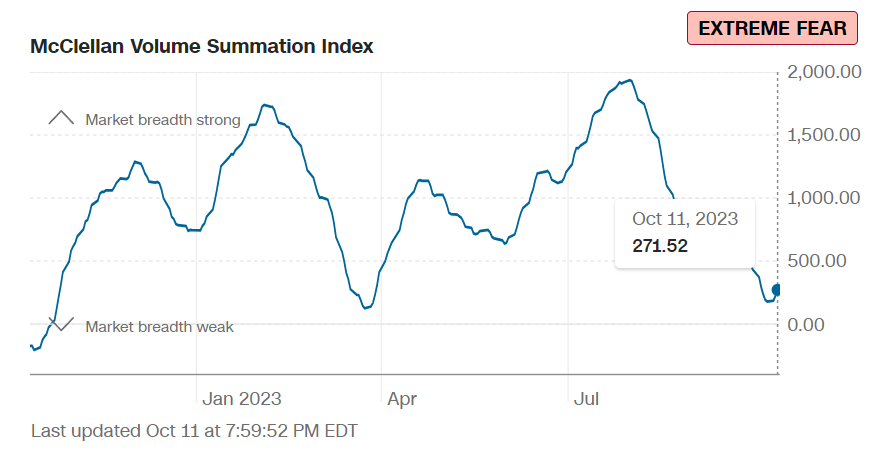

- Currency and Volatility: The U.S. Dollar Index down, CBOE Volatility fell -5.52%, and the Fear & Greed reading: Fear.

- Commodity Markets: Gold gains as Bitcoin, Oil, and the Bloomberg Commodity Index decline.

Sectors:

- 8 of 11 sectors gained, Real Estate outperformed (+2.01%), while Energy (-1.35%) lagged. Top Industry: Independent Power and Renewable Electric Prod (+3.00%), Health Care REITs (+ 2.43%), Specialized REITs(+ 2.39%).

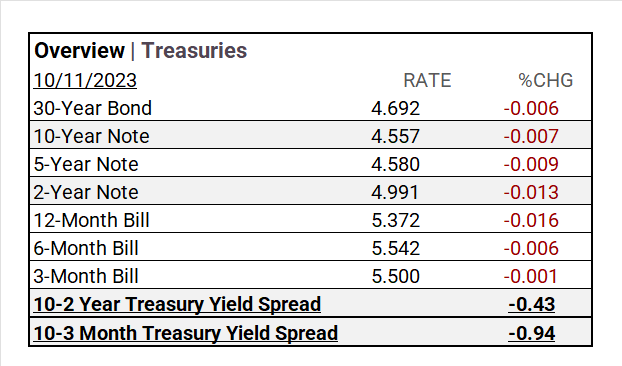

Treasury Yields and Currency:

- US Treasury yields fell across maturities, the 30-Year Bond dropped to 4.692% (-0.006) and the 10-Year Note to 4.557% (-0.007). Yield spreads tightened.

- The U.S. Dollar Index ^DXY: 105.69 (-0.13, -0.12%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 16.09 (-0.94, -5.52%)

- Fear & Greed Index (TY/LY): 33/16 (Fear/ Extreme Fear).

Source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,875.86 (+16.11, +0.87%)

- Bitcoin USD: 26,801.70 (-67.40, -0.25%)

- Crude Oil Futures WTI: 83.14 (-0.35, -0.42%)

- Bloomberg Commodity Index: 103.04 (-0.57, -0.55%)

Factors:

- Mega Cap Growth leads (+0.2%).

ETF Performance:

Top 3 Best Performers:

- Pro Shares UltaPro QQQ ^TQQQ +2.13%

- iShares 20 Plus Year Treasury Bond ETF ^TLT +2.09%

- VanEck Gold Miners ETF ^GDX +1.83%

Top 3 Worst Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -2.61%

- ProShares UltraPro Short QQQ ^SQQQ -2.08%

- iPath Series B S&P 500 VIX Short-Term Futures ETN ^VXX -1.82%

US Major Economic Data

- PPI (Producer Price Index): September: MoM (Month over Month): 0.5% (Consensus: 0.3%), YoY (Year over Year): 2.2% (Consensus: 1.6%), Prior Month: 0.7% MoM and 2% YoY.

- Core PPI (Excluding Food and Energy): September: MoM: 0.3% (Consensus: 0.2%), YoY: 2.7% (Consensus: 2.3%), Prior Month: 0.2% MoM and 2.2% YoY

- MBA (Mortgage Bankers Association) 30-Year Mortgage Rate on October 6: 7.67%, Prior Week: 7.53%

- MBA Mortgage Applications on October 6: 0.6%, Prior Week: -6%

- MBA Purchase Index on October 6: 137.5, Prior Week: 136.6

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- Beat:

- Miss: Aeon ADR (AONNY)

Resources:

- What’s Expected in October

- Vica Partners Economics Forecast

News

Investment and Growth News

- Exxon to Buy Pioneer in $60 Billion Deal to Create Shale Giant – WSJ

- Xiaomi Holds Talks With Carmakers About Possible Partnerships – Bloomberg

Infrastructure and Energy

- Qatar Signs Long-Term LNG Supply Deals With France – Bloomberg

- Coal’s Coming Decline Has Miners Facing 400,000 Layoffs by 2035 – Bloomberg

Real Estate Market Updates

- DWS Manager Links Real Estate Turmoil to ESG Debt Market – Bloomberg

Central Banking and Monetary Policy

- What to Watch in the CPI Report: A Mild Inflation Reading Could Keep Fed on Hold – WSJ

- Fed Minutes Flag High Rates for ‘Some Time’ While Risks Shift – Bloomberg

International Market Analysis (China)

- Chinese scientists unlock potential of memristor semiconductor building block that could boost artificial intelligence, self-driving cars and more – SCMP