“Empowering Your Financial Success”

Daily Market Insights: October 18th, 2023

Global Markets Summary:

Asian Markets:

- Nikkei 225 (Japan): -1.50%

- Hang Seng (Hong Kong): Closed.

- Shanghai Composite (China): Closed.

US Futures:

- S&P Futures: opened @ 4357.35 (-0.36%)

European Markets:

- CAC 40 (France): -0.91%

- DAX (Germany): -1.03%

- FTSE 100 (London): -1.14%

US Market Snapshot:

Key Stock Market Indices:

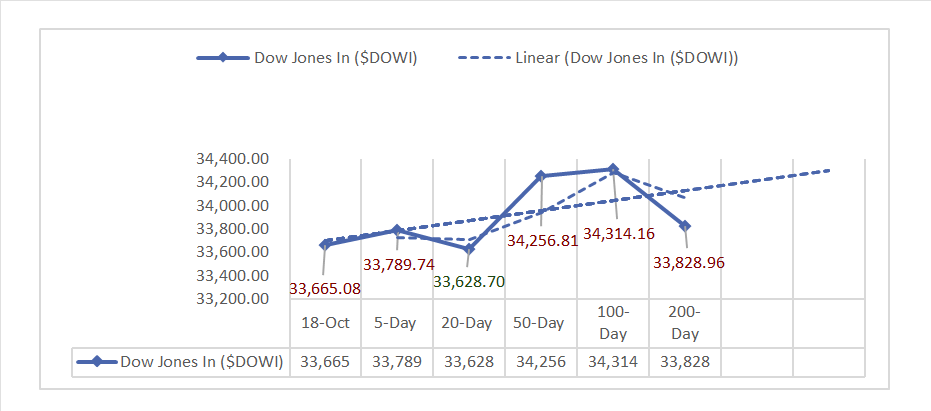

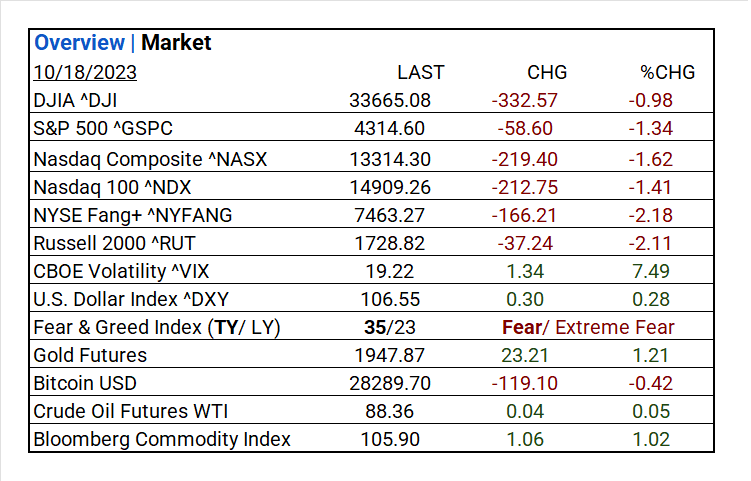

- DJIA ^DJI: 33,665.08 (-332.57, -0.98%)

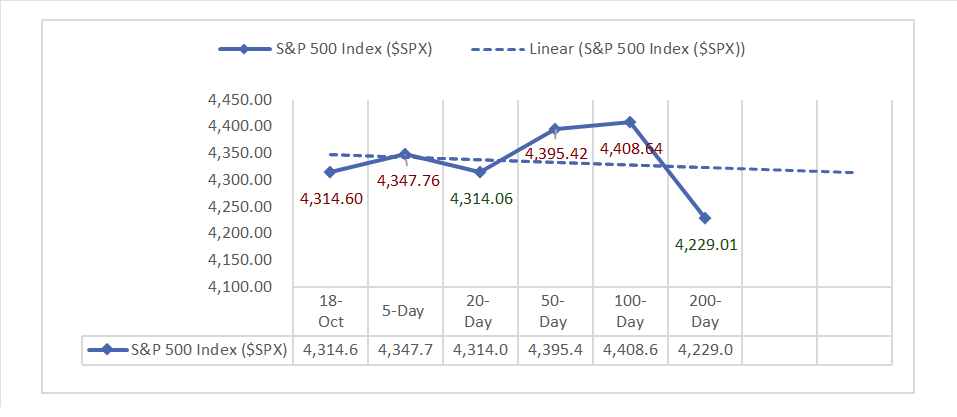

- S&P 500 ^GSPC: 4,314.60 (-58.60, -1.34%)

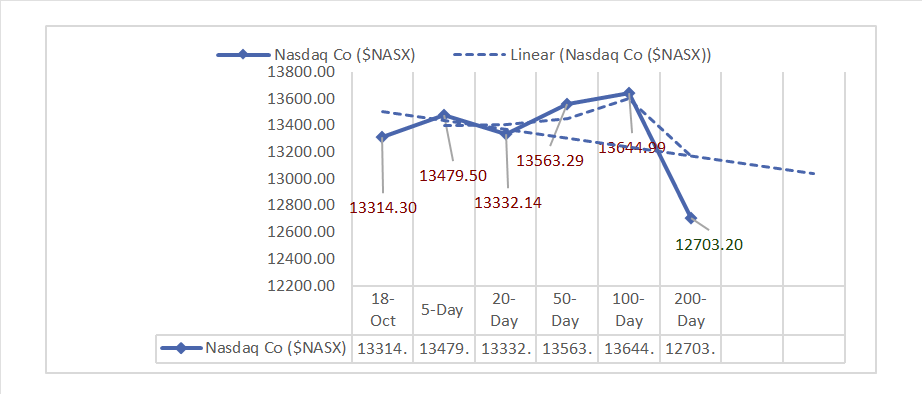

- Nasdaq Composite ^NASX: 13,314.30 (-219.40, -1.62%)

- Nasdaq 100 ^NDX: 14,909.26 (-212.75, -1.41%)

- NYSE Fang+ ^NYFANG: 7,463.27 (-166.21, -2.18%)

- Russell 2000 ^RUT: 1,728.82 (-37.24, -2.11%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: In September, Building Permits fell short of consensus at 1.473 million (prior 1.541 million), and Housing Starts were slightly below consensus at 1.358 million (prior 1.283 million).

- Market Indices: The DJIA, S&P 500, Nasdaq Composite, Nasdaq 100, NYSE Fang+, and Russell 2000 all experiencing significant declines.

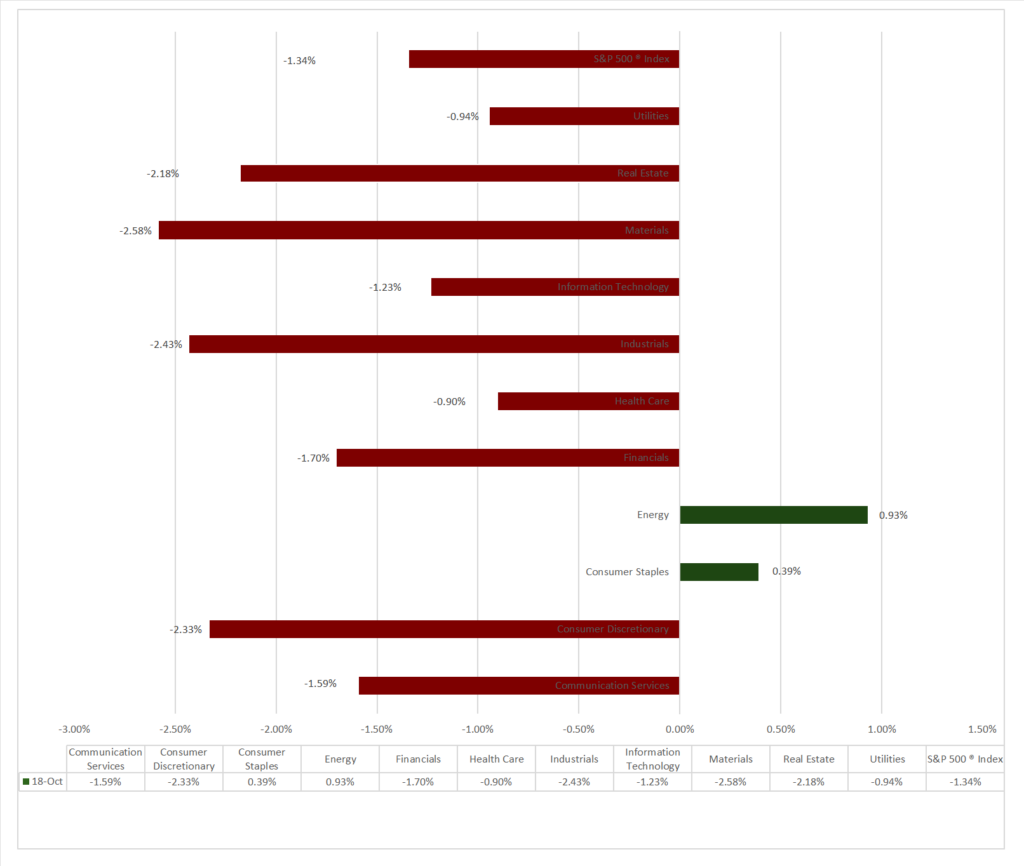

- Sector Performance: 8 of 11 Sectors declined, Energy (+0.93%) outperformed, while Materials (-2.58%) lagged. Top Industry: Household Products (+2.20%).

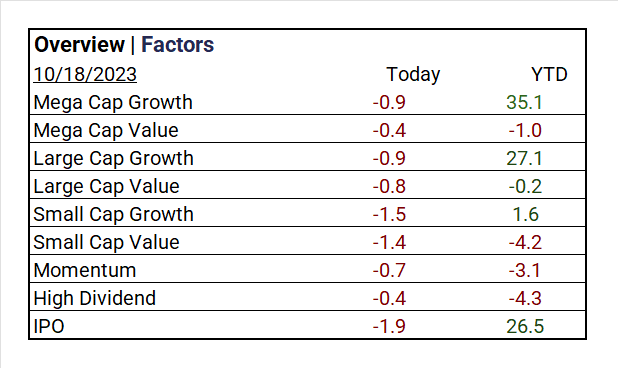

- Factors: Mega Cap Value (-0.4%), High Dividend (-0.4%) outperform.

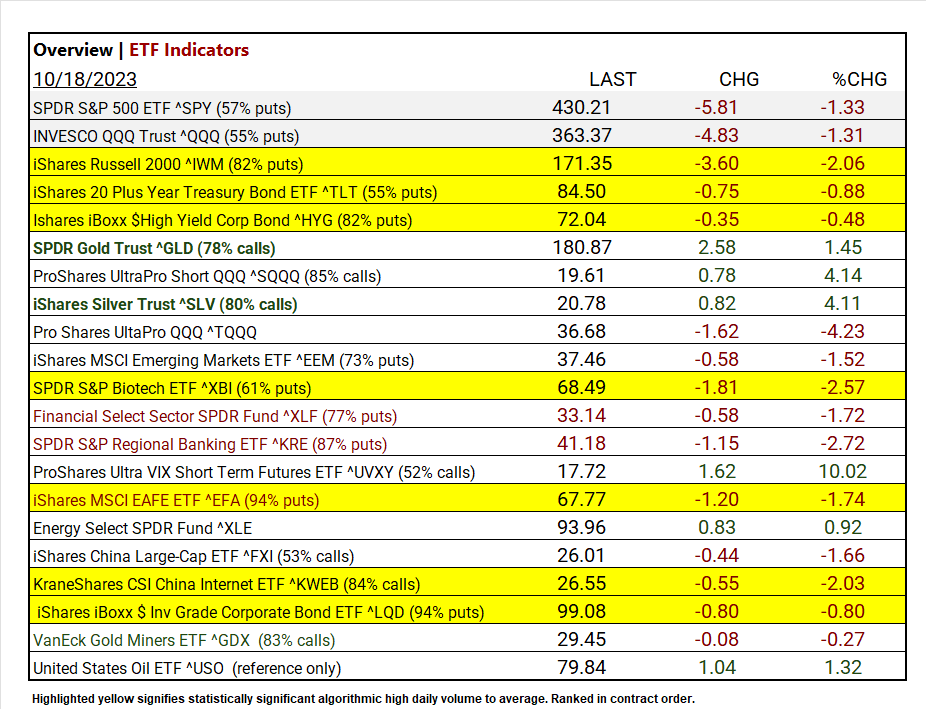

- Top ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY +10.02%

- Worst ETF: Pro Shares UltaPro QQQ ^TQQQ -4.23%

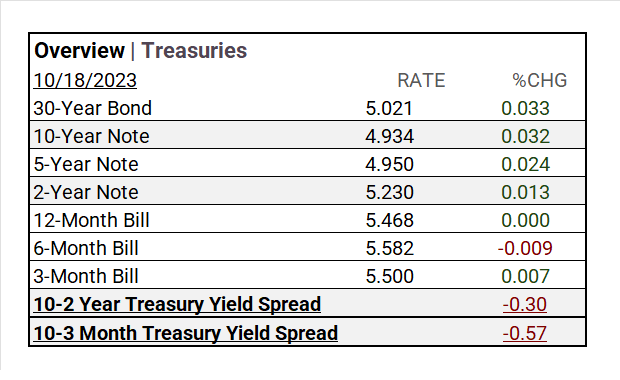

- Treasury Markets: Yield changes varied: 30-Year Bond up to 5.021% (+0.033), 10-Year Note at 4.934% (+0.032), and 2-Year Note at 5.230% (+0.013). Spreads: 10-2 Year (-0.30) and 10-3 Month (-0.57).

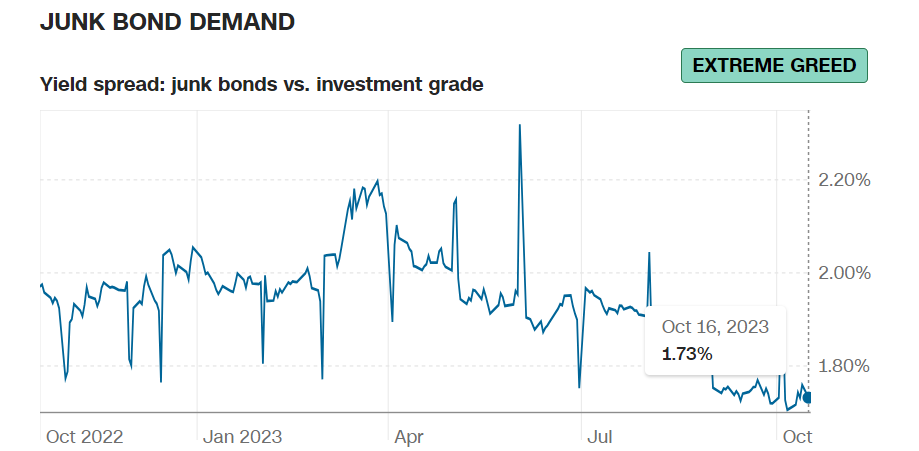

- Currency and Volatility: The U.S. Dollar Index up, CBOE Volatility rises +7.49%, and the Fear & Greed reading: Fear.

- Commodity Markets: Gold, Silver, Oil, and the Bloomberg Commodity Index gain ground, whereas Bitcoin declines.

- Bonus Insight: Options market heavily shorting Regional Banks, SPDR S&P Regional Banking ETF ^KRE (-2.72%).

Sectors:

- 8 of 11 Sectors declined, Energy (+0.93%) outperformed, while Materials (-2.58%) lagged. Top Industry: Household Products (+2.20%), Oil, Gas & Consumable Fuels (+0.98%), and Independent Power and Renewable Electricity Producers (+0.87%).

Treasury Yields and Currency:

- Yield changes were mixed today. The 30-Year Bond increased to 5.021%, up by 0.033. The 10-Year Note rose to 4.934%, a 0.032 increase, and the 2-Year Note reached 5.230%, marking a 0.013 rise. Yield spreads also varied, with the 10-2 Year Treasury Yield Spread at -0.30 and the 10-3 Month Treasury Yield Spread at -0.57.

- The U.S. Dollar Index ^DXY: 106.55 (+0.30, +0.28%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 19.22(+1.34, +7.49%)

- Fear & Greed Index (TY/LY): 35/23 (Fear/ Extreme Fear). Waiting for the 10-18 update.

Source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,947.87 (+23.21, +1.21%)

- Bitcoin USD: 28,289.70 (-119.10, -0.42%)

- Crude Oil Futures WTI: 88.36 (+0.04, +0.05%)

- Bloomberg Commodity Index: 105.90 (+1.06, +1.02%)

Factors:

- Mega Cap Value (-0.4%), and High Dividend (-0.4%) outperform.

ETF Performance:

Top 3 Best Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY +10.02%

- ProShares UltraPro Short QQQ ^SQQQ +4.14%

- iShares Silver Trust ^SLV +4.11%

Top 3 Worst Performers:

- Pro Shares UltaPro QQQ ^TQQQ -4.23%

- SPDR S&P Regional Banking ETF ^KRE -2.72%

- SPDR S&P Biotech ETF ^XBI -2.57%

US Major Economic Data

September

- Building Permits: 1.473 million vs. 1.45 million consensus, prior 1.541 million.

- Housing Starts: 1.358 million vs. 1.38 million consensus, prior 1.283 million.

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- Beat: Procter&Gamble (PG), Abbott Labs (ABT), Netflix (NFLX),Morgan Stanley (MS), Lam Research (LRCX), U.S. Bancorp (USB), Volvo ADR (VLVLY), Las Vegas Sands (LVS), PPG Industries (PPG), Nasdaq Inc (NDAQ), M&T Bank (MTB), Rexford Inl Rty (REXR), First Industrial RT (FR), Zions (ZION), Liberty Oilfield (LBRT).

- Miss: Tesla (TSLA), ASML ADR (ASML), SAP ADR (SAP), Elevance Health (ELV), ABB ADR (ABBNY), Crown Castle (CCI), Travelers (TRV), Kinder Morgan (KMI), Wipro ADR (WIT), Discover (DFS), State Street (STT), Equifax (EFX), Steel Dynamics (STLD), Northern Trust (NTRS), Citizens Financial Group Inc (CFG), Ally Financial Inc (ALLY), Commerce Bancshares (CBSH), Alcoa (AA).

Resources:

- What’s Expected in October

- Vica Partners Economics Forecast

News

Investment and Growth News

- Tesla’s Musk Warns of Cybertruck Challenges – WSJ

- Amazon Introducing Warehouse Overhaul With Robotics to Speed Deliveries – WSJ

- OpenAI Is in Talks to Sell Shares at $86 Billion Valuation – Bloomberg

Infrastructure and Energy

- Albemarle’s $4.16 Billion Lithium Bet Scuttled by Australia’s Richest Person – WSJ

- Venezuela Oil Production Seen Rising 25% as US Eases Sanctions – Bloomberg

- Amazon Has EV Charging Operators in Its Rear-View Mirror – Bloomberg

Real Estate

- Commercial-Property Distress in the US Rises to a 10-Year High – Bloomberg

- Asia’s Small Homes, Decluttering Drive Self-Storage Investments – Bloomberg

Central Banking and Monetary Policy

- Household Net Worth Surged After the Pandemic Hit – WSJ

- Fed’s Williams Says Interest Rates Need to Be Restrictive ‘for Some Time’ – Bloomberg

International Market Analysis (China)

- China’s economy ‘turned a corner’: 7 takeaways from third-quarter GDP, September data – SCMP