“Empowering Your Financial Success”

Daily Market Insights: October 19th, 2023

Global Markets Summary:

Asian Markets:

- Shanghai Composite (China): -0.14%

- Hang Seng (Hong Kong): -0.56%

- Nikkei 225 (Japan): -0.74%

European Markets:

- DAX (Germany): -0.33%

- CAC 40 (France): -0.64%

- FTSE 100 (London): -1.17%

US Futures:

- S&P Futures: opened @ 4321.36 (+0.16%)

US Market Snapshot:

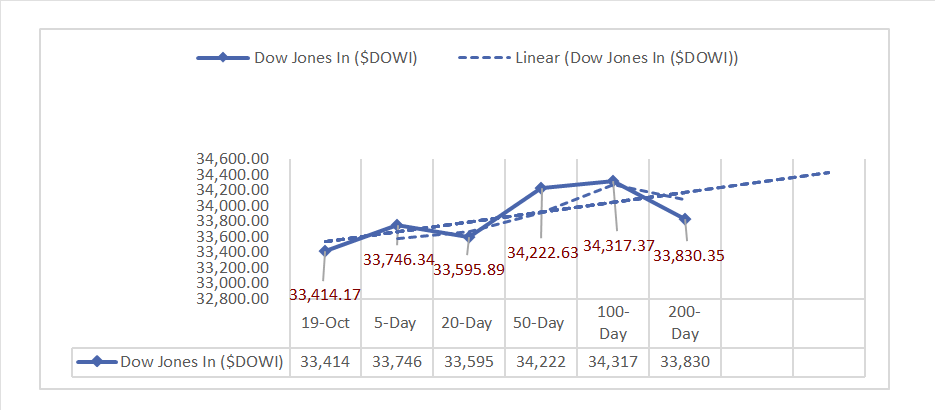

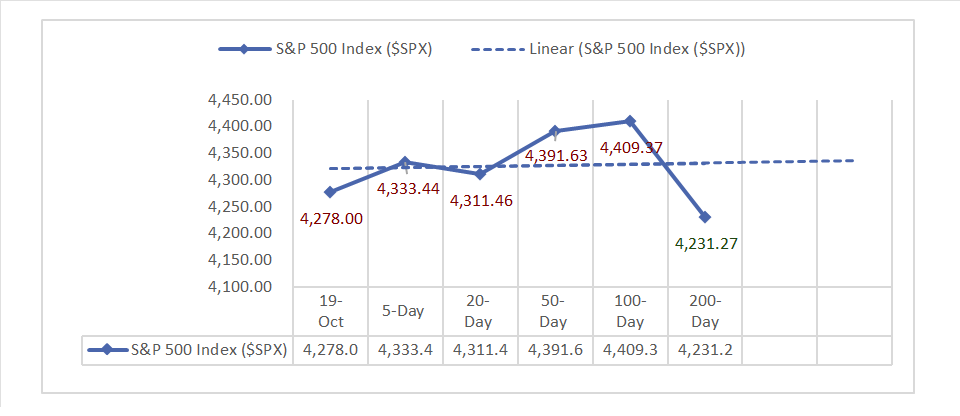

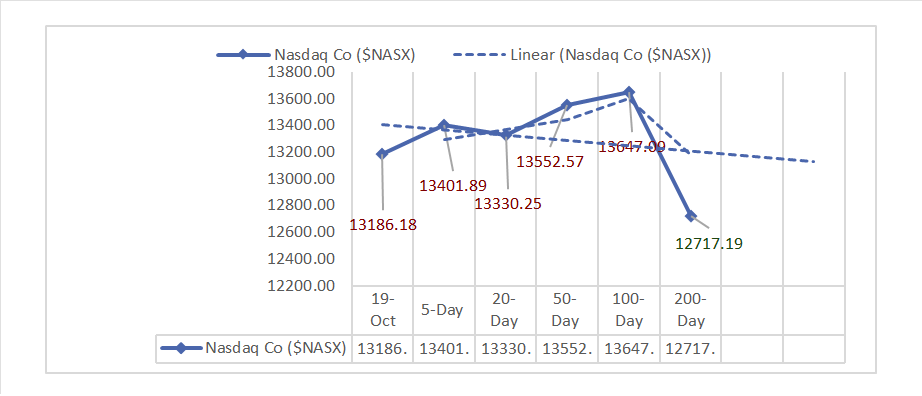

Key Stock Market Indices:

- DJIA ^DJI: 33,414.17 (-250.91, -0.75%)

- S&P 500 ^GSPC: 4,278.00 (-36.60, -0.85%)

- Nasdaq Composite ^NASX: 13,186.18 (-128.13, -0.96%)

- Nasdaq 100 ^NDX: 14,783.13 (-126.13, -0.85%)

- NYSE Fang+ ^NYFANG: 7,476.04 (+12.78, +0.17%)

- Russell 2000 ^RUT: 1,702.70 (-26.11, -1.51%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: Initial jobless claims at 198k (Expected: 210k, Prior: 211k). Philadelphia Fed manufacturing survey -5 (Expected: -6.8, Prior: -14). September home sales 3.96M (Expected: 3.9M, Prior: 4.04M). U.S. leading economic indicators for September -0.7% (Expected: -0.5%, Prior: -0.5%).

- Market Indices: All major indices saw notable declines: DJIA -0.75%, S&P 500 -0.85%, Nasdaq Composite -0.96%, Nasdaq 100 -0.85%, NYSE Fang+ +0.17%, and Russell 2000 -1.51%.

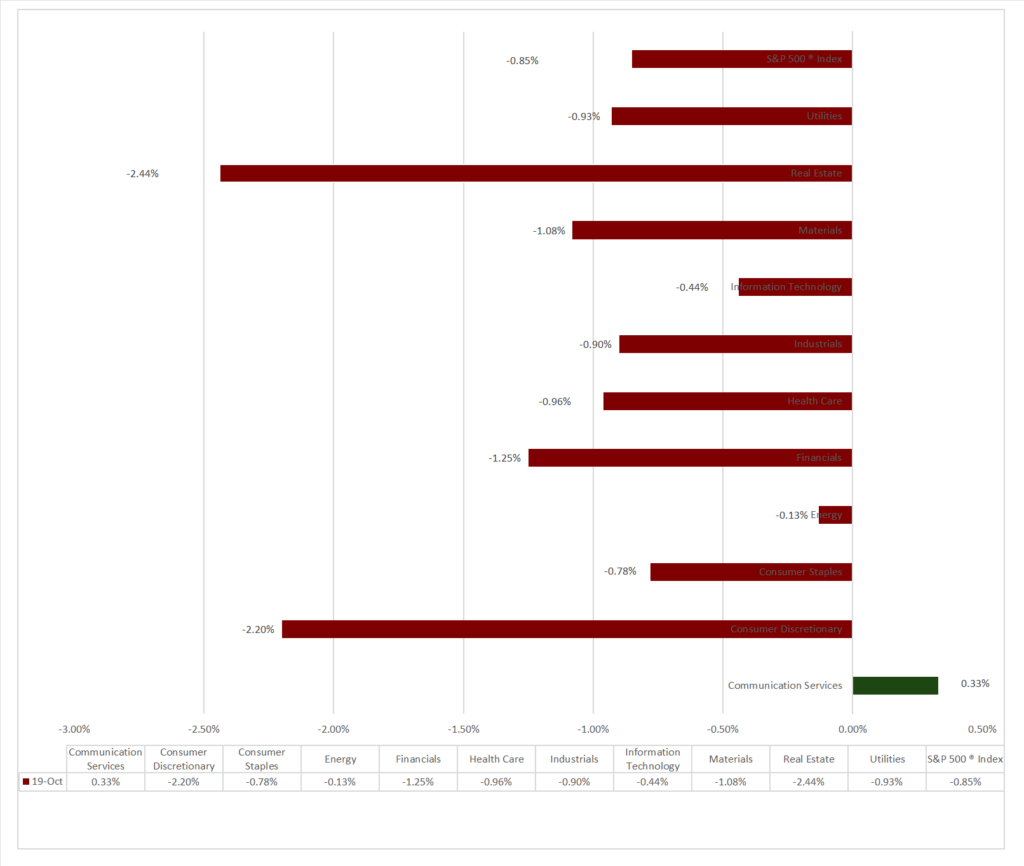

- Sector Performance: 10 of 11 Sectors declined, Communication Services (+0.33%) outperformed, while Real Estate (-2.44%) lagged. Top Industry: Entertainment (+5.14%).

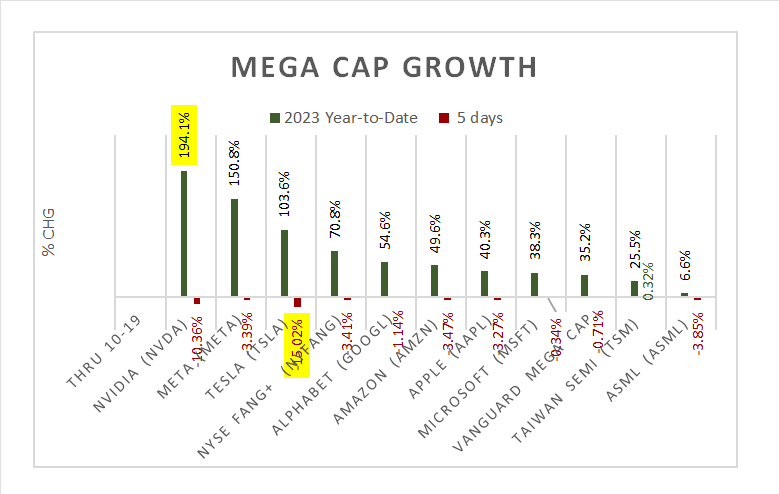

- Factors: Mega Cap Growth Value chart below.

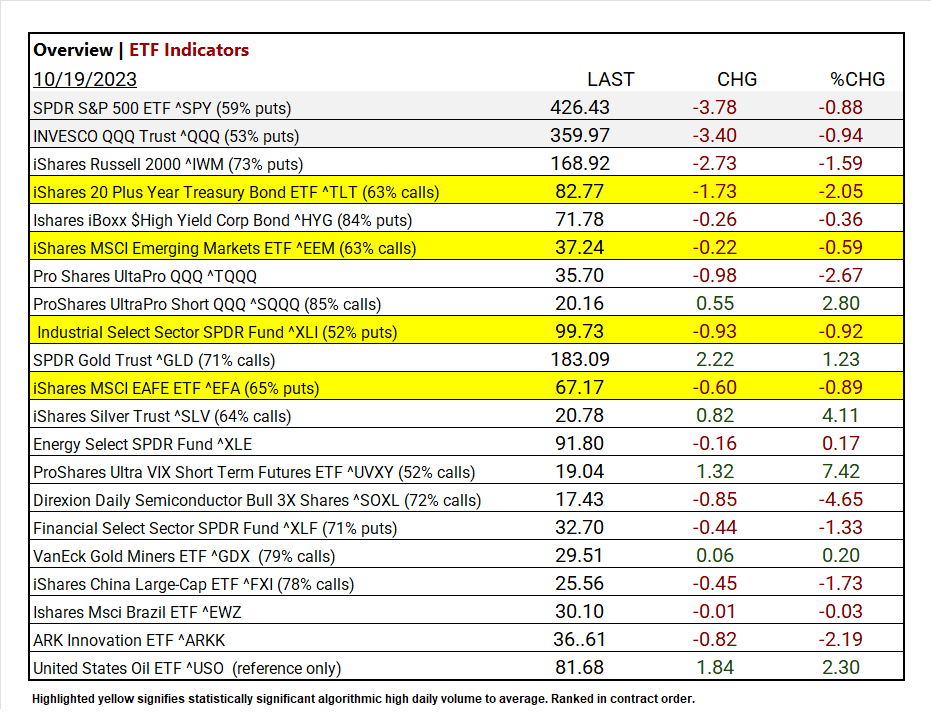

- Top ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY +7.42%

- Worst ETF: Direxion Daily Semiconductor Bull 3X Shares ^SOXL -4.65%

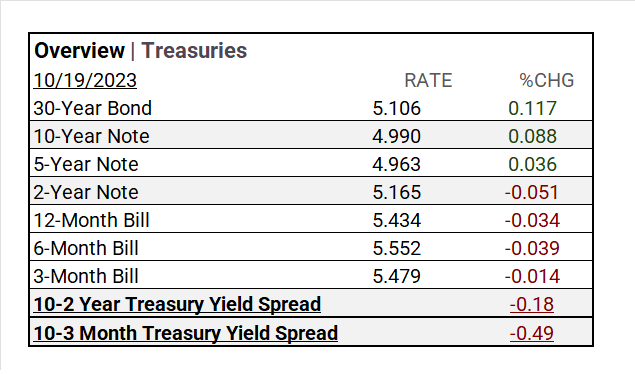

- Treasury Markets: Yield changes today: 30-Year Bond increased to 5.106%, 10-Year Note rose to 4.990%, and 2-Year Note declined to 5.165%.

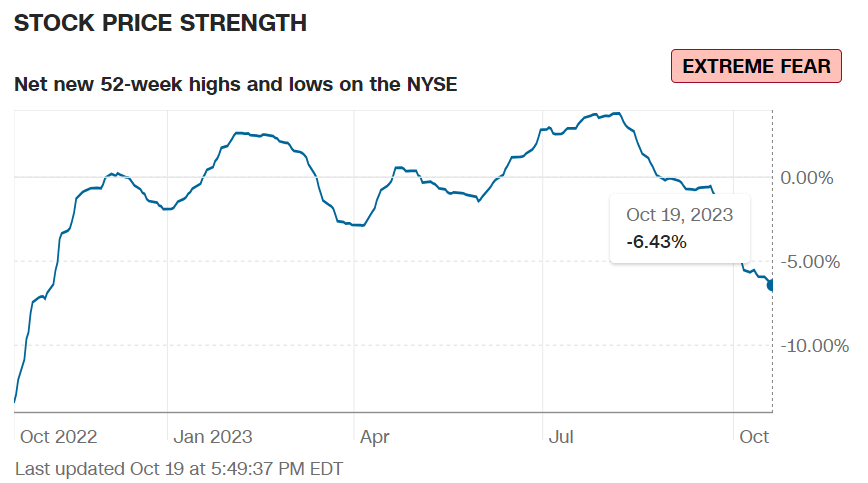

- Currency and Volatility: The U.S. Dollar Index up, CBOE Volatility rises +11.34%, and the Fear & Greed reading: Fear.

- Commodity Markets: Gold, Silver, Bitcoin, Oil, and the Bloomberg Commodity Index gain ground.

- Notable: Intense debt options bets on ETFs ^HYG (84% puts) and ^BKLN (100% puts) amid 1500% daily volume surge (supplemental article).

Sectors:

- 10 of 11 Sectors declined, Communication Services (+0.33%) outperformed, while Real Estate (-2.44%) lagged. Top Industry: Entertainment (+5.14%), Diversified Telecommunication Services (+3.84%), Ground Transportation (+0.42%).

Treasury Yields and Currency:

- Yield changes today: 30-Year Bond increased to 5.106%, 10-Year Note rose to 4.990%, and 2-Year Note declined to 5.165%. Yield spreads varied.

- The U.S. Dollar Index ^DXY: 106.23 (-0.33, -0.31%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 21.40 (+2.18, +11.34%)

- Fear & Greed Index (TY/LY): 28/29 (Fear/ Fear).

Source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,974.16 (+23.23, +1.19%)

- Bitcoin USD: 28,657.10 (+343.60, +1.21%)

- Crude Oil Futures WTI: 90.49 (+2.17, +2.46%)

- Bloomberg Commodity Index: 106.08 (+0.18, +0.17%)

Factors:

- Mega Cap Growth chart below.

ETF Performance:

Top 3 Best Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY +7.42%

- iShares Silver Trust ^SLV 4.11%

- ProShares UltraPro Short QQQ ^SQQQ +2.80%

Top 3 Worst Performers:

- Direxion Daily Semiconductor Bull 3X Shares ^SOXL -4.65%

- Pro Shares UltaPro QQQ ^TQQQ -2.67%

- ARK Innovation ETF ^ARKK -2.19%

US Major Economic Data

- Initial jobless claims on Oct. 14: 198,000 (Consensus: 210,000, Previous: 211,000).

- Philadelphia Fed manufacturing survey for Oct.: -5 (Consensus: -6.8, Previous: -14).

- Existing home sales in Sept.: 3.96 million (Consensus: 3.9 million, Previous: 4.04 million).

- U.S. leading economic indicators for Sept.: -0.7% (Consensus: -0.5%, Previous: -0.5%).

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- Beat: Taiwan Semiconductor (TSM), AT&T (T), Marsh McLennan (MMC), Freeport-McMoran (FCX), Truist Financial Corp (TFC), Fifth Third (FITB), Snap-On (SNA), Watsco (WSO), Pool (POOL), KeyCorp (KEY), East West Bancorp (EWBC), Knight-Swift Trans (KNX), Bankinter ADR (BKNIY), Western Alliance (WAL), Badger Meter (BMI), Bank Ozk (OZK), WD-40 (WDFC), BancFirst (BANF), Texas Capital (TCBI).

- Miss: Nestle ADR (NSRGY), L’Oreal ADR (LRLCY),Roche Holding ADR (RHHBY), Philip Morris (PM), Union Pacific (UNP),Blackstone (BX), Intuitive Surgical (ISRG), CSX (CSX), DNB Bank ASA (DNBBY), Genuine Parts (GPC), Nokia ADR (NOK), American Airlines (AAL), Webster Financial (WBS), Iridium (IRDM), Home BancShares (HOMB), Alaska Air (ALK), First Financial Bankshares (FFIN), ManpowerGroup (MAN).

Resources:

News

Investment and Growth News

- Sell TSMC, Buy ASML’ Gains Traction as China-Taiwan Risks Grow – Bloomberg

- Nvidia’s Top Gamer Graphics Card Caught Up in US-China Trade War – Bloomberg

- Union Pacific Profit Falls on Weaker Freight Demand – WSJ

- Apple’s Tim Cook Makes Surprise China Visit as iPhone Sales Slump – WSJ

Infrastructure and Energy

- World’s Biggest Battery Maker CATL Earnings Miss as EV Sales Dip – Bloomberg

Real Estate

- Record Sales and Off-Market Trades: Why Aspen’s Luxury Market Seems Unstoppable – WSJ

Central Banking and Monetary Policy

- US Jobless Claims Fall to 198,000, Lowest Level Since January – Bloomberg

- Home Sales Slide to Lowest Pace Since 2010 as High Rates Squeeze Market – WSJ

- Jerome Powell Signals Fed Will Extend Interest-Rate Pause – WSJ

International Market Analysis (China)

- Pain could be too much’: China’s regional banks facing US$300 billion shortfall – SCMP