“Empowering Your Financial Success”

Daily Market Insights: October 25th, 2023

Global Markets Summary:

Asian Markets:

- Hang Seng (Hong Kong): +0.12%

- Shanghai Composite (China): -0.12%

- Nikkei 225 (Japan): -1.83%

European Markets:

- FTSE 100: +0.33%

- CAC 40 (France): +0.31%

- DAX (Germany): +0.08%

US Futures:

- S&P Futures: opened @ 4232.42 (-0.36%)

US Market Snapshot:

Key Stock Market Indices:

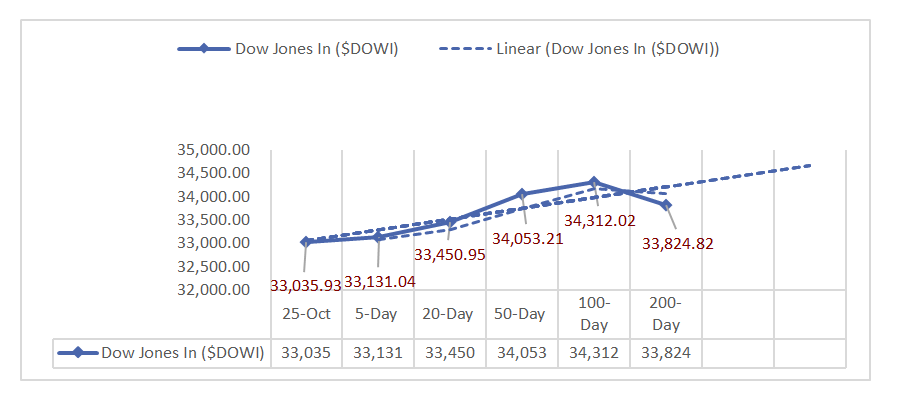

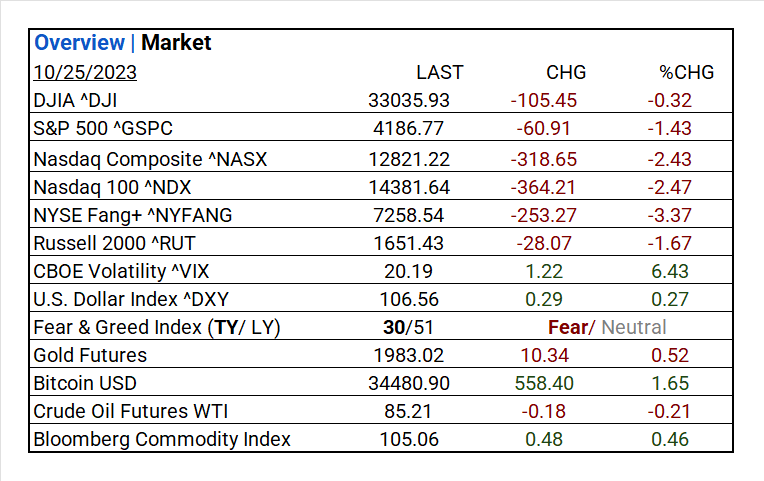

- DJIA ^DJI: 33,035.93 (-105.45, -0.32%)

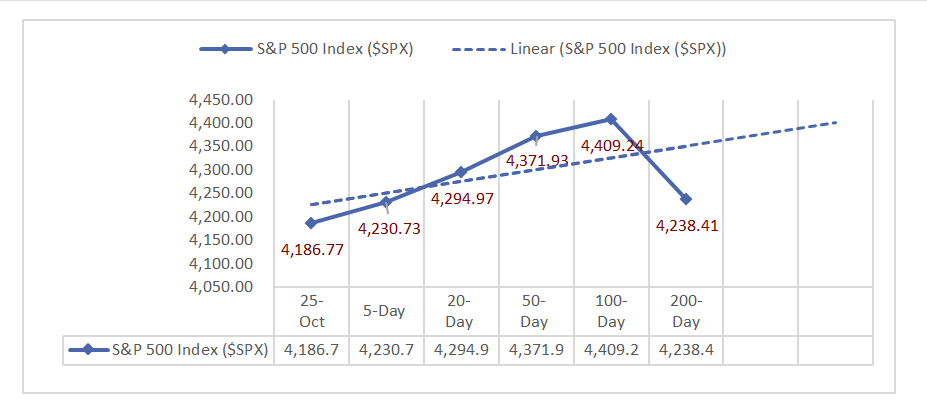

- S&P 500 ^GSPC: 4,186.77 (-60.91, -1.43%)

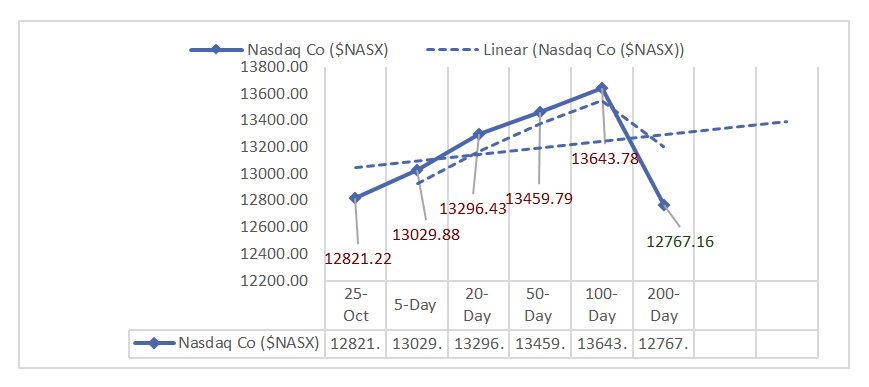

- Nasdaq Composite ^NASX: 12,821.22 (-318.65, -2.43%)

- Nasdaq 100 ^NDX: 14,381.64 (-364.21, -2.47%)

- NYSE Fang+ ^NYFANG: 7,258.54 (-253.27, -3.37%)

- Russell 2000 ^RUT: 1,651.43 (-28.07, -1.67%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: In September, new home sales surged to 759,000, surpassing the expected 680,000 and the previous month’s 676,000. Mortgage applications dipped by 1% compared to the prior week, which had seen a substantial 6.9% decline, while the 30-year mortgage rate increased to 7.9% from the prior week’s 7.7%.

- Market Indices: Major indices all down today, led by the Nasdaq Composite/Tech sector. NYSE Fang+ index had the largest decline at -3.37%.

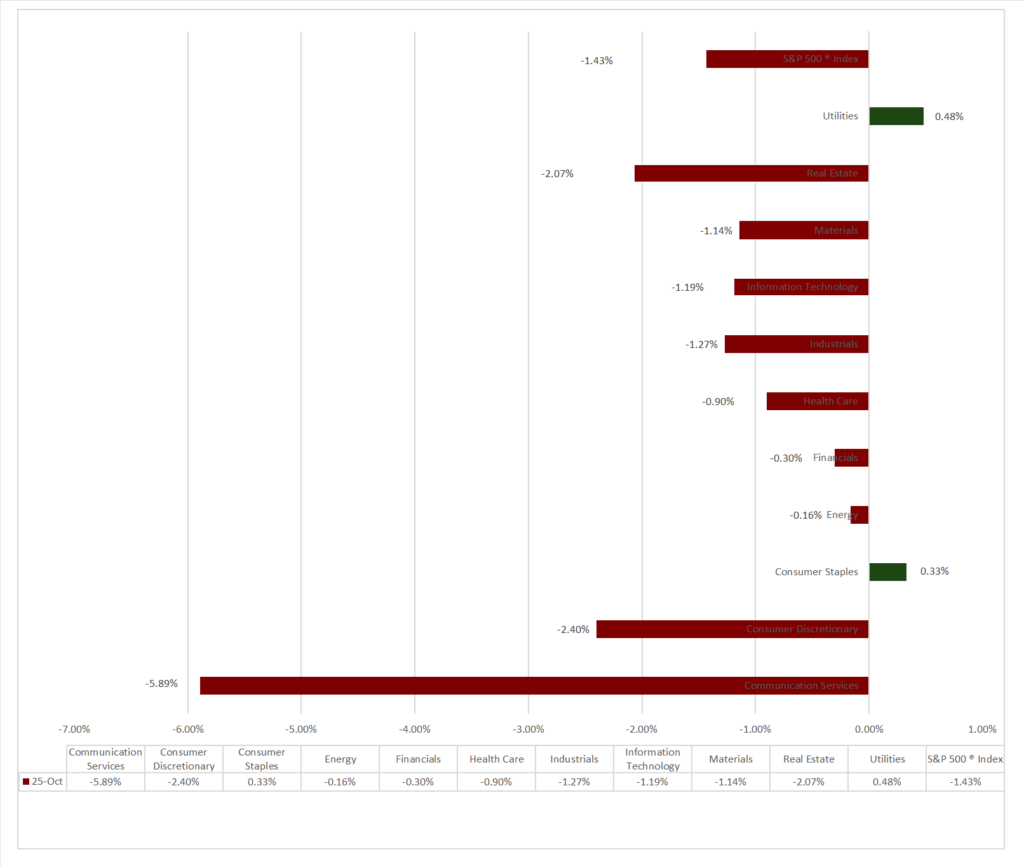

- Sector Performance: 9 of 11 sectors fell, led by Utilities (+0.48%), while Communication Services (-5.89%) lagged. Top industry: Commercial Services & Supplies (+1.61%).

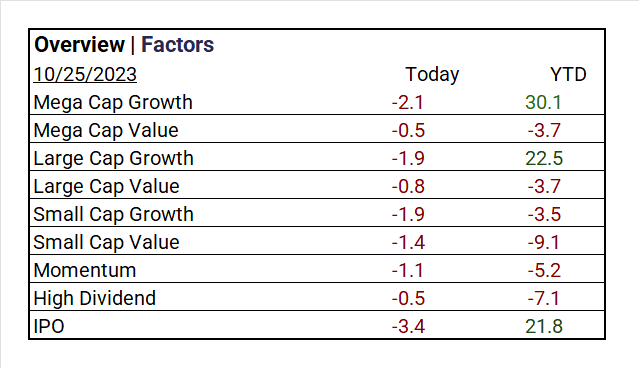

- Factors: High Div and Mega Cap Value both declined by -0.5%, with IPOs lagging at -3.4%.

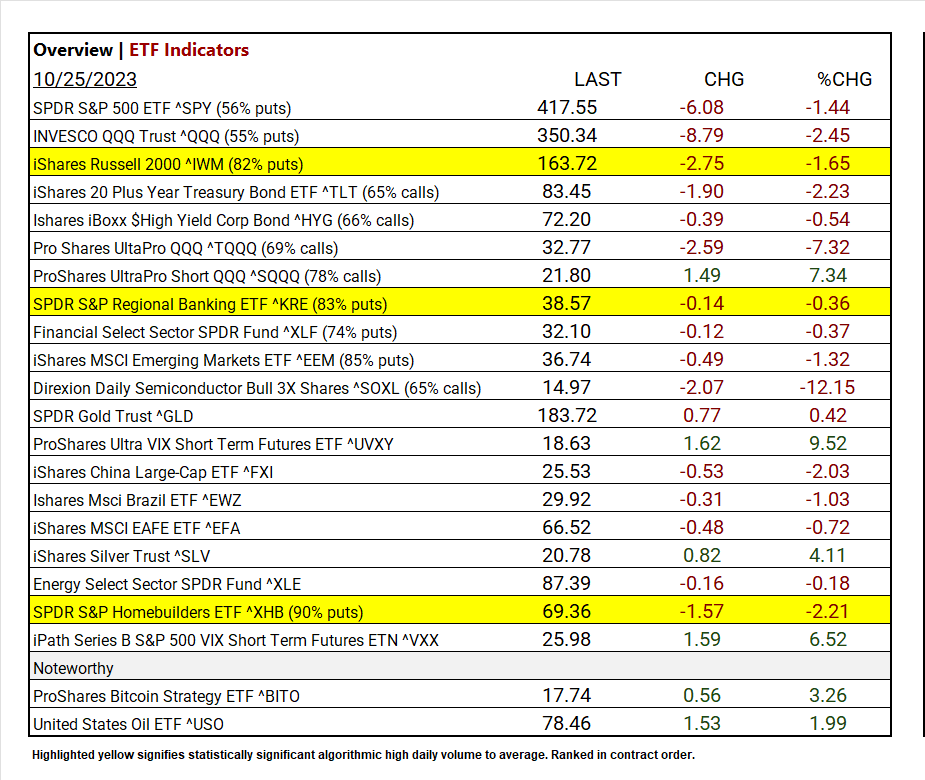

- Top ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY +9.52%

- Low ETF: Direxion Daily Semiconductor Bull 3X Shares ^SOXL -12.15%

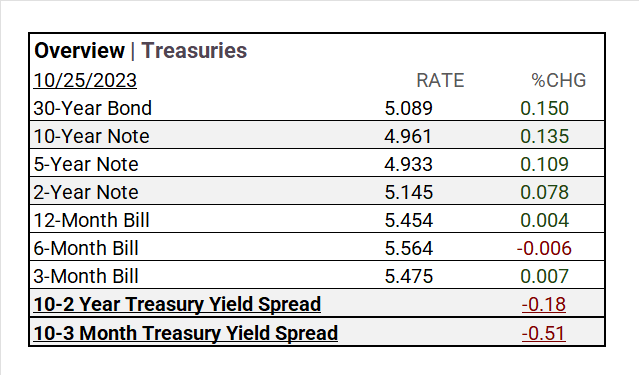

- Treasury Markets: Yields on Treasury securities rose for most durations, except the 6-Month Bill, slightly narrowing yield spreads between 10-Year and 2-Year notes.

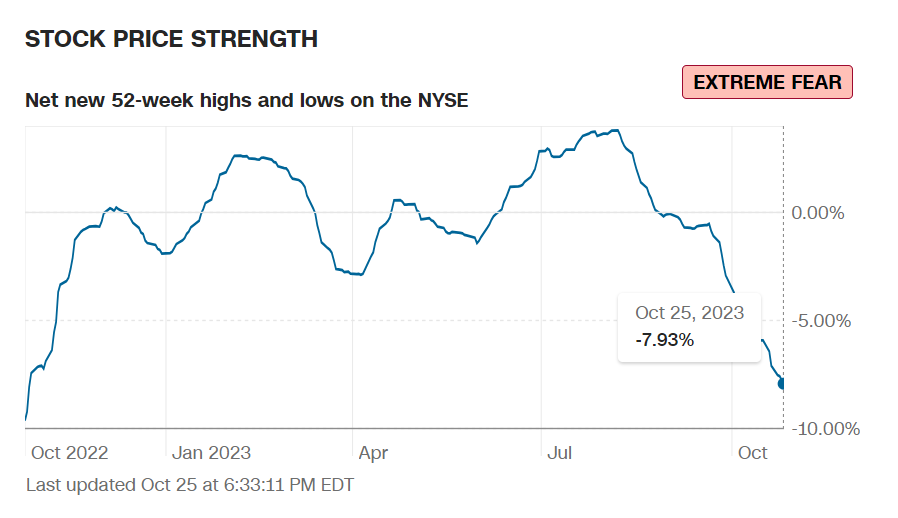

- Currency and Volatility: The U.S. Dollar Index gains, CBOE Volatility rise +6.43%, and the Fear & Greed reading: Fear.

- Commodity Markets: Bitcoin, Gold and the Bloomberg Commodity Index rise while Oil moderately declines.

- Notable: Options market activity, QQQ (INVESCO QQQ Trust) underperformed, driven by a bullish sentiment favoring the broader macroeconomic outlook rather than the Big Tech sector.

Sectors:

- 9 of 11 sectors lower, with Utilities (+0.48%) leading and Communication Services (-5.89%) lagging. Top industries: Commercial Services & Supplies (+1.61%), Food Products (+1.56%), Independent Power and Renewable Electricity Producers (+1.03%).

Treasury Yields and Currency:

- Yields on Treasury securities increased for most durations, except for the 6-Month Bill, which saw a minor decrease. This resulted in a narrowing of the yield spreads between 10-Year and 2-Year, as well as 10-Year and 3-Month notes.

- The U.S. Dollar Index ^DXY: 106.56 (+0.29, +0.27%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 20.19 (+1.22, +6.43%)

- Fear & Greed Index (TY/LY): 30/51 (Fear/ Neutral).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,983.02 (+10.34, +0.52%)

- Bitcoin USD: 34,480.90 (+558.40, +1.65%)

- Crude Oil Futures WTI: 85.21 (-0.18, -0.21%)

- Bloomberg Commodity Index: 105.06 (+0.48, +0.46%)

Factors:

- High Div and Mega Cap Value both declined by -0.5%, with IPOs lagging at -3.4%

ETF Performance:

Top 3 Best Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY +9.52%

- ProShares UltraPro Short QQQ ^SQQQ +7.34%

- iPath Series B S&P 500 VIX Short Term Futures ETN +6.52%

Top 3 Lowest Performers:

- Direxion Daily Semiconductor Bull 3X Shares ^SOXL -12.15%

- Pro Shares UltaPro QQQ ^TQQQ -7.32%

- INVESCO QQQ Trust ^QQQ -2.45%

US Major Economic Data

- New Home Sales for September: 759,000 (Actual), 680,000 (Consensus/Expected), 676,000 (Previous)

- Mortgage Applications: Weekly Change -1% (Previous Week -6.9%), 30-Year Mortgage Rate 7.9% (Previous Week 7.7%).

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- BEAT: Meta Platforms (META), IBM (IBM), ServiceNow Inc (NOW), General Dynamics (GD), Equinix (EQIX), KLA Corp (KLAC), Atlas Copco AB (ATLKY), Moody’s (MCO), O’Reilly Automotive (ORLY), Amphenol (APH), Hess (HES), Edwards Lifesciences (EW), Old Dominion Freight Line (ODFL), Hilton Worldwide (HLT), Waste Connections (WCN), Baker Hughes (BKR), Ameriprise Financial (AMP), United Rentals (URI), Molina Healthcare (MOH), Whirlpool (WHR).

- MISSED: Thermo Fisher Scientific (TMO), T-Mobile US (TMUS), Boeing (BA), ADP (ADP), CME Group (CME), Santander ADR (SAN), Dassault Systemes SA (DASTY), Norfolk Southern (NSC), Otis Worldwide (OTIS), VICI Properties (VICI), Agnico Eagle Mines (AEM), Avery Dennison (AVY), Penske Automotive (PAG).

Resources:

News

Investment and Growth News

- Alphabet 10% Plunge Follows Tesla in Stern Warning on Valuation – Bloomberg

- Silver Lake Says It’s Working on Offer to Buy Endeavor Group – Bloomberg

- Whirlpool Sales Rise Amid Growing Market Share – WSJ

- UPS To Buy Reverse Logistics Specialist Happy Returns from PayPal – WSJ

Infrastructure and Energy

- US, Australia Consider Tapping Public Finance Vehicles for Critical Mineral Projects – Bloomberg

Real Estate

- Topeka, Kan., Topped WSJ/Realtor.com Housing Index in Third Quarter – WSJ

Central Banking and Monetary Policy

- What Can the Fed Do About the Deficit? Nothing – WSJ

- Strongest US Economic Growth Since 2021 Puts Fed in Tough Spot – Bloomberg

- US New-Home Sales Surge to Fastest Clip Since February 2022 – Bloomberg

- What Economists Got Wrong About the Great Recession –Bloomberg

International Market Analysis (China)

- China embarks on transition to consumption-centered economy as Beijing moves to unleash spending power: investment guru – SCMP