Market Concerns Report – 11/1/23

Economic Landscape: Balancing Optimism and Concern

The current economic landscape offers both optimism and concern. While the specter of a 2023 recession appears distant due to robust consumer spending, a deeper analysis reveals areas of caution.

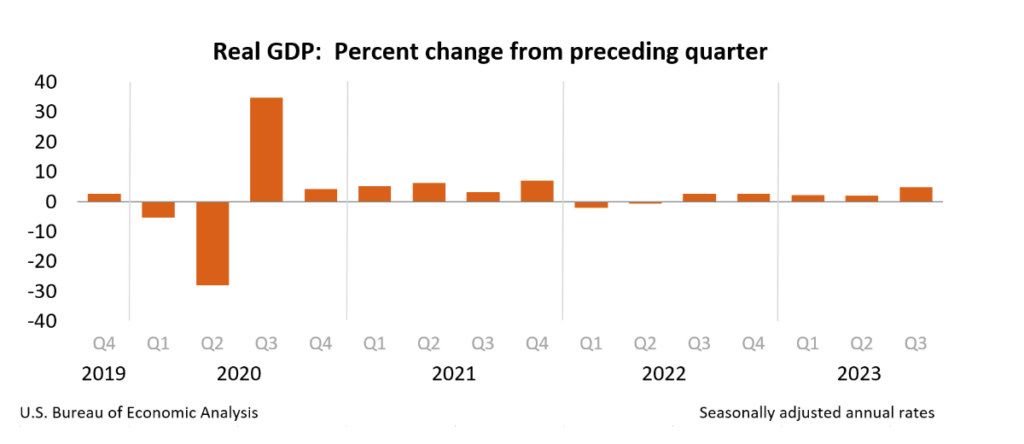

The impressive third-quarter GDP growth, nearly hitting 5%, is a standout achievement, underpinned by a remarkable 4% annual surge in consumer spending, largely driven by credit card activity.

However, disconcerting trends emerge in economic indicators. Real disposable personal income has shrunk by over 1% when adjusting for inflation, and stagnant wages over the past six months have failed to keep up with rising prices, warranting scrutiny.

Disposable personal income increased $95.8 billion, or 1.9 percent, in the third quarter, compared with an increase of $296.5 billion, or 6.1 percent, in the second quarter. Real disposable personal income decreased 1.0 percent, in contrast to an increase of 3.5 percent- US Bureau of Economic Analysis

Economic Trends: Savings, Retail, GDP, and Inflation

In the financial sector, personal savings have dwindled from 5.2% to 3.8%, indicating reduced savings and increased consumption, possibly in response to higher living costs and income adjustments.

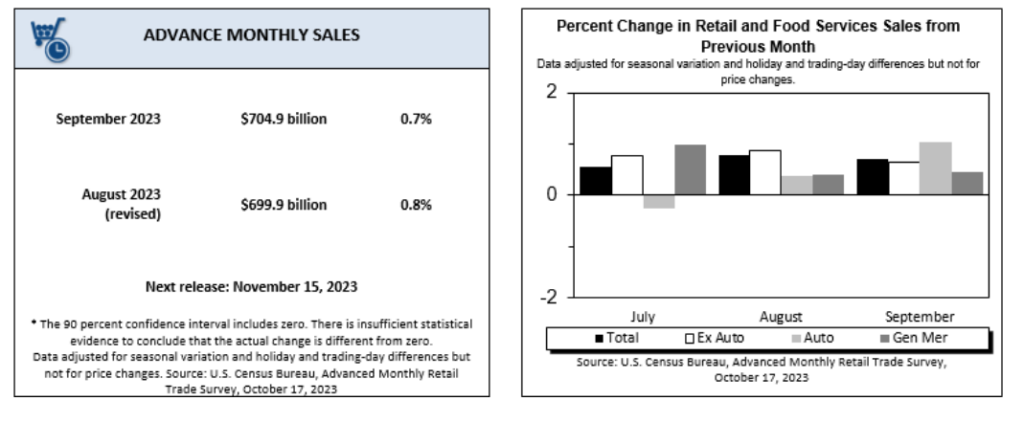

The third quarter has seen a notable boost in retail sales and job growth, making it more challenging for individuals to maintain a standard of living beyond “getting by.”

Broader economic perspectives reveal impressive nominal GDP growth of 8.5% in the third quarter, yet a disappointing headline PCE inflation rate of 3.5%, raising questions about its implications.

The Federal Reserve’s vigilance over food and energy prices acknowledges their potential impact on the overall economy. As we approach the fourth quarter, challenges loom with the intersection of holiday shopping and elevated oil prices

While the Job Growth metric suggests labor market strength, persistently high food prices contribute to inflationary pressures, particularly in the core PCE, which dipped below the expected range of 2.4% to 2.5%.

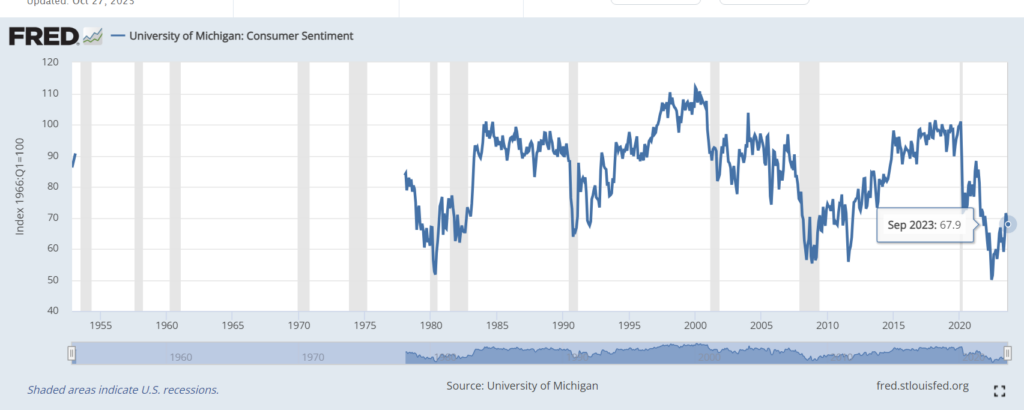

Market Dynamics and Consumer Sentiment: Precursors to an Uncertain 2024

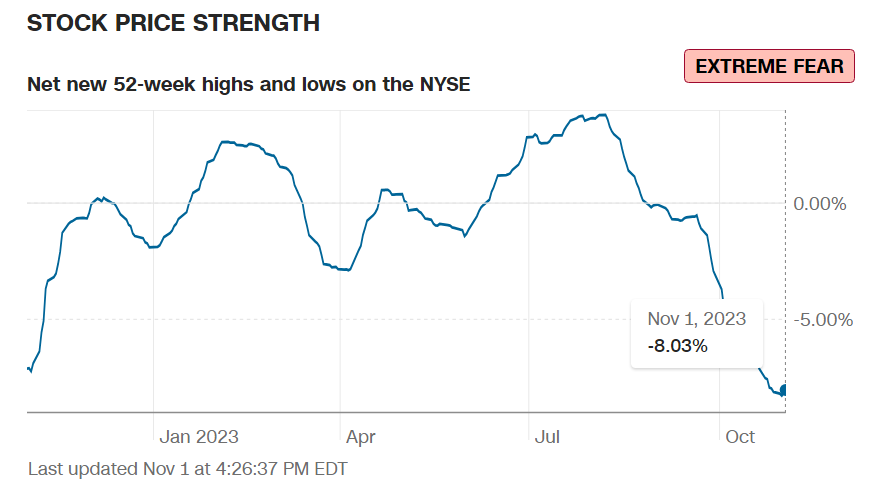

Financial markets reflect caution with declining market indices and slightly lower bond yields. Bitcoin stands out with an upward trajectory, in contrast to stable oil prices below $90 per barrel and gold prices moving away from $2,000.

The deteriorating consumer sentiment raises concerns, potentially influencing events in 2024 as the economy grapples with growing uncertainties. The multifaceted economic landscape demands a nuanced understanding. Given the current information, we anticipate ongoing economic challenges, making 2024 a year to watch closely.