“Empowering Your Financial Success”

Daily Market Insights: November 2nd, 2023

Global Markets Summary:

Asian Markets:

- Hang Seng (Hong Kong): +0.03%

- Shanghai Composite (China): 0.00%

- Nikkei 225 (Japan): 0.00%

European Markets:

- DAX (Germany): +3.11%

- CAC 40 (France): +1.85%

- FTSE 100: +1.42%

US Futures:

- S&P Futures: opened @ 4268.26 (+0.72%)

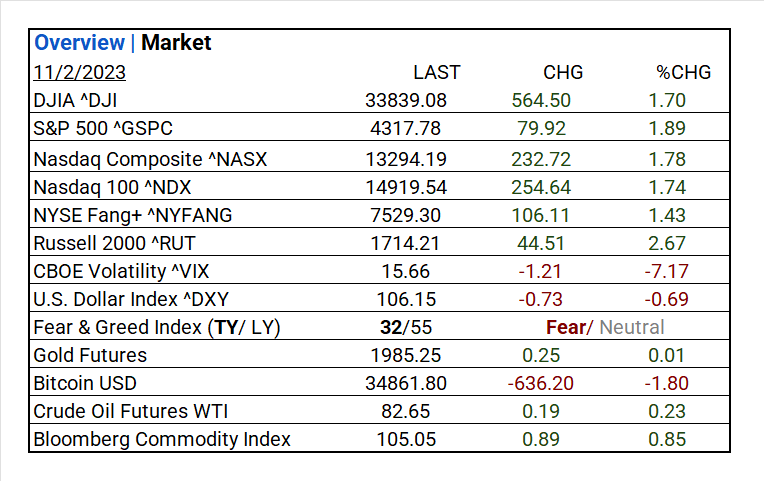

US Market Snapshot:

Key Stock Market Indices:

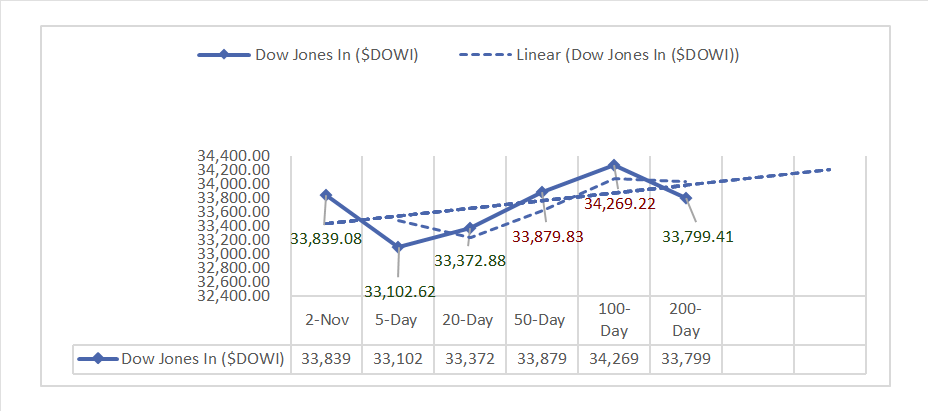

- DJIA ^DJI: 33,839.08 (+564.50, +1.70%)

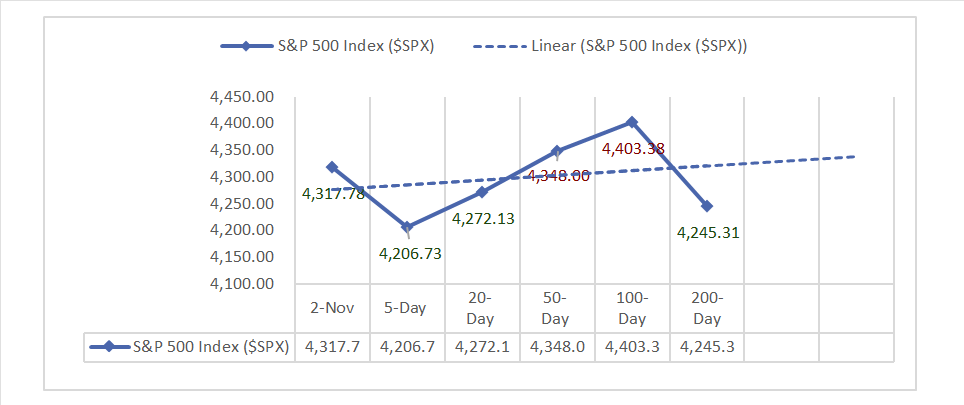

- S&P 500 ^GSPC: 4,317.78 (+79.92, +1.89%)

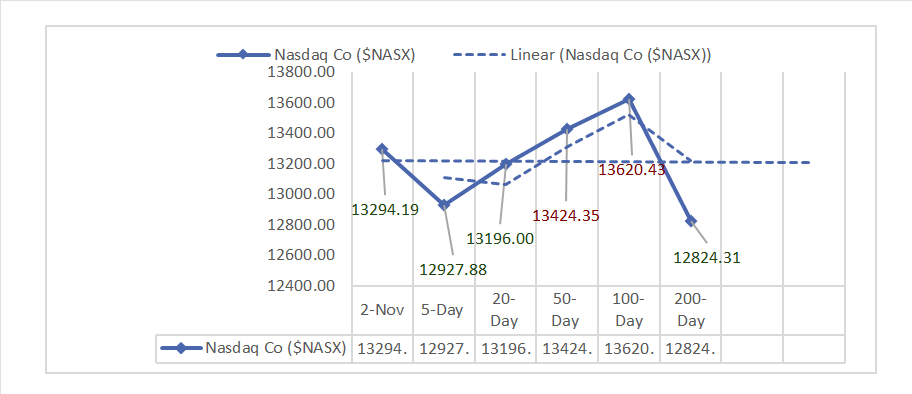

- Nasdaq Composite ^NASX: 13,294.19 (+232.72, +1.78%)

- Nasdaq 100 ^NDX: 14,919.54 (+254.64, +1.74%)

- NYSE Fang+ ^NYFANG: 7,529.30 (+106.11, +1.43%)

- Russell 2000 ^RUT: 1,714.21 (+44.51, +2.67%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: Initial Jobless Claims, US Productivity, and Factory Orders all exceeded expectations, while Continuing Claims met consensus. However, Unit Labor Costs fell short of the consensus.

- Market Indices: In today’s trading, the major stock indices showed strong gains, with the DJIA, S&P 500, Nasdaq Composite, Nasdaq 100, NYSE Fang+, and Russell 2000 all posting significant increases, reflecting positive market sentiment.

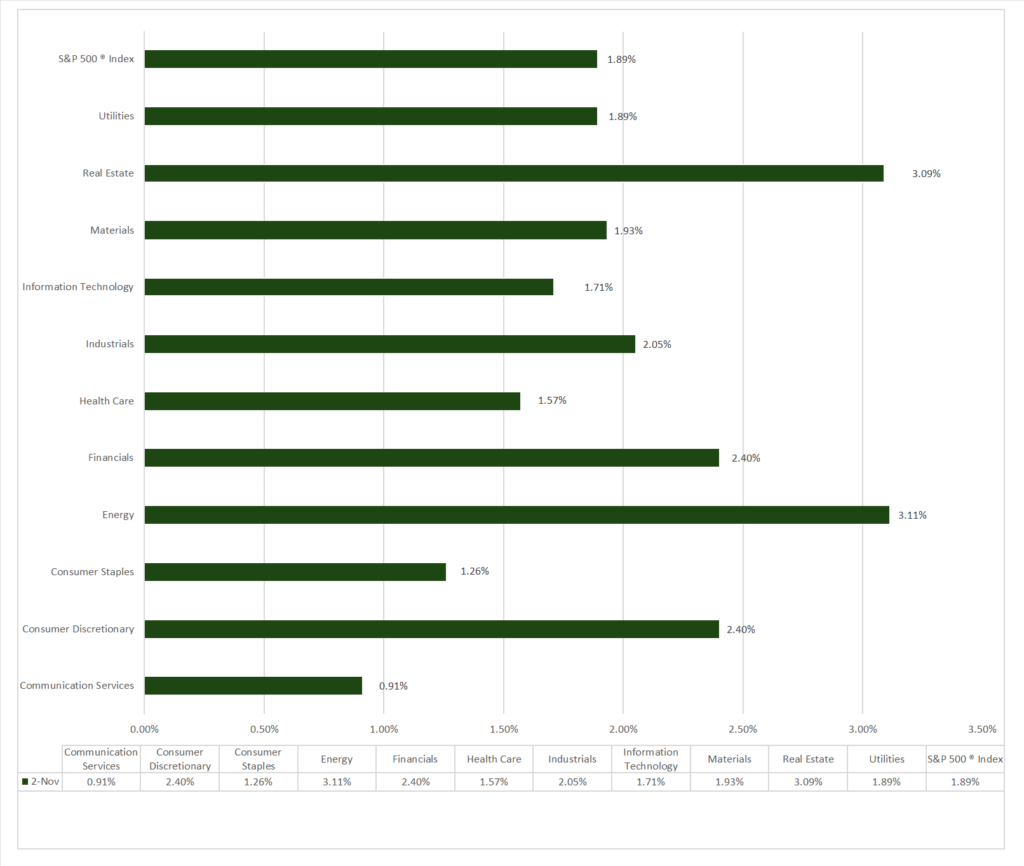

- Sector Performance: All 11 sectors higher, Energy (+3.11%) leading and Communication Services (+0.91%) lagging. Top-performing industry Construction & Engineering (+9.69%).

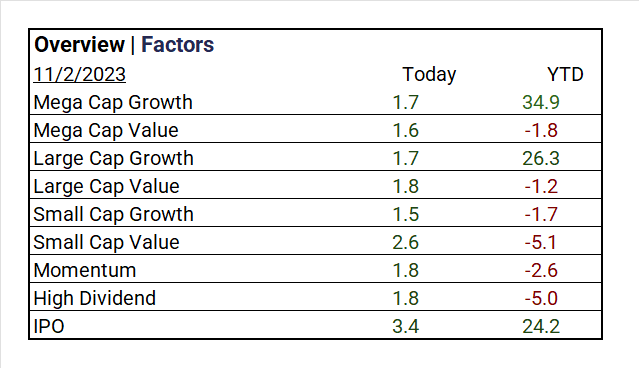

- Factors: IPO’s (+3.4%) and Small Cap Value (+2.6%) led.

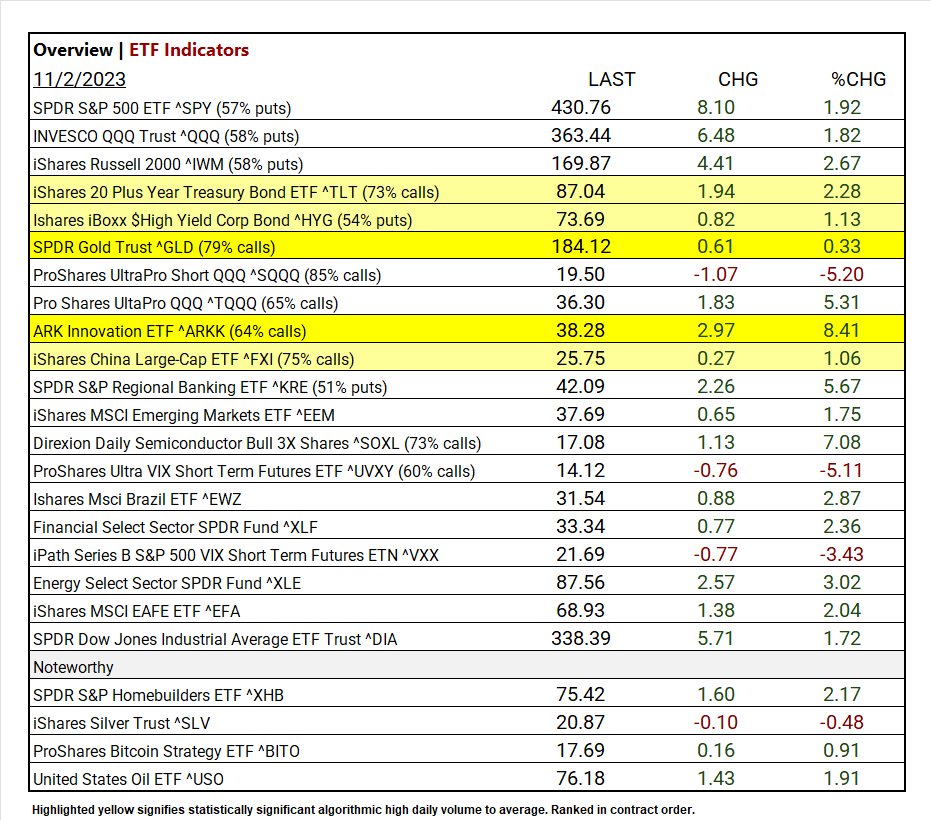

- Top ETF: ARK Innovation ETF ^ARKK (+8.41%).

- Low ETF: ProShares UltraPro Short QQQ ^SQQQ (-5.20%).

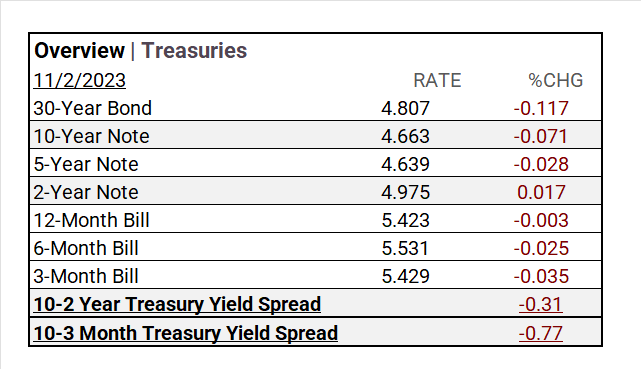

- Treasury Markets: Yields fluctuated: 30-Year Bond 4.807% (-0.117), 10-Year Note 4.663% (-0.071), 5-Year Note 4.639% (-0.028), indicating slight decreases. Short-term yields dropped. Yield spreads hinted at economic uncertainty.

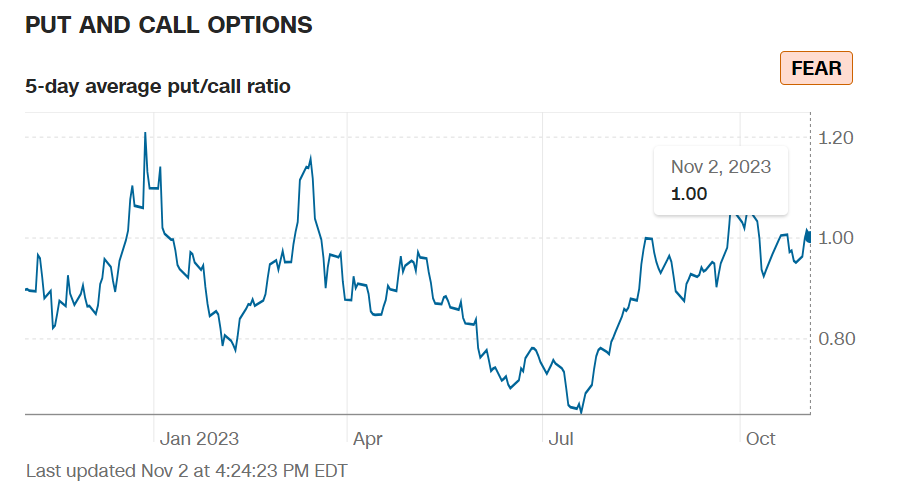

- Currency and Volatility: The U.S. Dollar Index declined, CBOE Volatility dropped by 7.17%, and the Fear & Greed reading indicates a state of fear.

- Commodity Markets: Gold futures stable, Bitcoin declined, and Crude Oil futures, along with the Bloomberg Commodity Index, recorded slight increases.

- Notable: Options market activity, ARK Innovation ETF ^ARKK saw a 365% daily volume increase, iShares 20 Plus Year Treasury Bond ETF ^TLT heavily bullish on strong volume.

Sectors:

- All 11 sectors were higher, with Energy (+3.11%) leading and Communication Services (+0.91%) lagging. Top industries: Construction & Engineering (+9.69%), Automobiles (+5.81%), Personal Care Products (+5.09%), Office REITs (+5.01%), and Water Utilities (+4.79%).

Treasury Yields and Currency:

- Yields fluctuated with the 30-Year Bond at 4.807%, the 10-Year Note at 4.663%, and the 5-Year Note at 4.639%, indicating slight decreases. Short-term yields dropped, reflecting economic uncertainty.

- The U.S. Dollar Index ^DXY: 106.15 (-0.73, -0.69%).

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 15.66 (-1.21, -7.17%)

- Fear & Greed Index (TY/LY): 32/55 (Fear/ Neutral).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,985.25 (+0.25, +0.01%)

- Bitcoin USD: 34,861.80 (-636.20, -1.80%)

- Crude Oil Futures WTI: 82.65 (+0.19, +0.23%)

- Bloomberg Commodity Index: 105.05 (+0.89, +0.85%)

Factors:

- IPO’s (+3.4%) and Small Cap Value (+2.6%) led market factor performance.

ETF Performance:

Top 3 Best Performers:

- ARK Innovation ETF ^ARKK +8.41%

- Direxion Daily Semiconductor Bull 3X Shares ^SOXL +7.08%

- SPDR S&P Regional Banking ETF ^KRE +5.67%

Top 3 Lowest Performers:

- ProShares UltraPro Short QQQ ^SQQQ -5.20%

- ProShares Ultra VIX Short Term Futures ETF ^UVXY -5.11%

- iPath Series B S&P 500 VIX Short Term Futures ETN ^VXX -3.43%

US Major Economic Data

- Initial Jobless Claims: 217k (vs. 214k consensus), prior revised to 212k from 210k.

- US Productivity: 4.7% q/q (vs. 4.3% consensus), prior revised to 3.6% from 3.5%.

- Continuing Claims: 1.818 million (vs. 1.81 million consensus), prior revised to 1.783 million from 1.79 million.

- Unit Labor Costs: -0.8% q/q (vs. .7% consensus), prior revised to 3.2% from 2.2%.

- Factory Orders: 2.8% (vs. 2.5% consensus), prior 1.0%.

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- BEAT: Apple (AAPL), Eli Lilly (LLY), Novo Nordisk ADR (NVO), S&P Global (SPGI), Stryker (SYK), Starbucks (SBUX), Booking (BKNG), Cigna (CI), Regeneron Pharma (REGN), Shopify Inc (SHOP), Marriott Int (MAR), Cheniere Energy (LNG)

- MISSED: Shell ADR (SHEL), ConocoPhillips (COP), Southern (SO), Zoetis Inc (ZTS), Duke Energy (DUK), Mitsubishi Corp. (MSBHF), Ferrari NV (RACE)

Resources:

News

Investment and Growth News

- Apple Sales Decline as China Market Weighs on Earnings Report – WSJ

- Obesity Drug Demand Outstrips Supply – WSJ

- Block Soars on Boosted Profit Outlook as Cash App Grows – Bloomberg

Infrastructure and Energy

- Sunrun Takes $1.2 Billion Charge in Latest Blow to Solar – Bloomberg

- China’s EV Makers Want Top Oil Producing Nations to Go Electric – Bloomberg

- China’s Grip on Africa’s Minerals Sparks a US Response – Bloomberg

Real Estate

- Google, Lendlease Scrap $15 Billion Real-Estate Development in Silicon Valley – WSJ

- Real Estate Stocks Soar as Fed Rate Hold Sparks Relief Rally – Bloomberg

Central Banking and Monetary Policy

- Fed Extends Pause on Rate Hikes but Keeps Door Open to Moving Higher – WSJ

- What to Watch in Friday’s Jobs Report: How Long Can Labor Market Keep Booming? – WSJ

- US Productivity Grows by Most Since 2020, Labor Costs Decrease – Bloomberg

International Market Analysis (China)

- China cements party control over finance, clamping down on risk but making investors sweat – SCMP