“Empowering Your Financial Success”

Daily Market Insights: November 7th, 2023

Global Markets Summary:

Asian Markets:

- Hang Seng (Hong Kong): -0.02%

- Shanghai Composite (China): -0.10%

- Nikkei 225 (Japan): Closed.

European Markets:

- DAX (Germany): +0.11%

- FTSE 100: +0.01%

- CAC 40 (France): +0.00%

US Futures:

- S&P Futures: opened @ 4366.21(+0.01%)

US Market Snapshot:

Key Stock Market Indices:

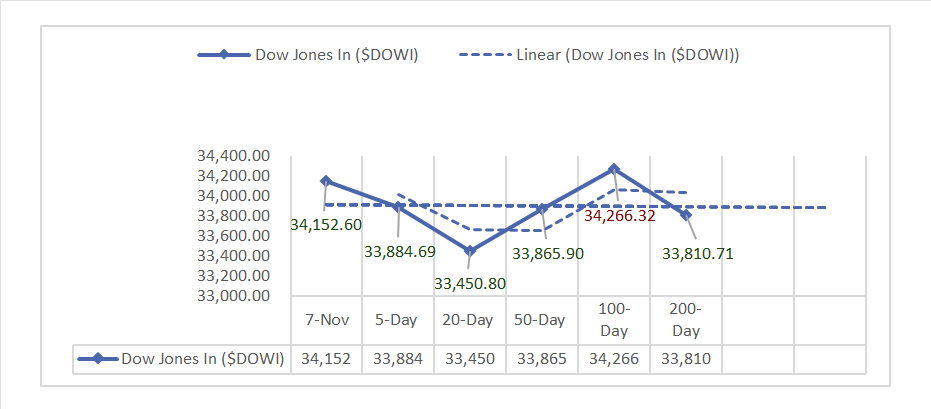

- DJIA ^DJI: 34,152.60 (+56.74, +0.17%)

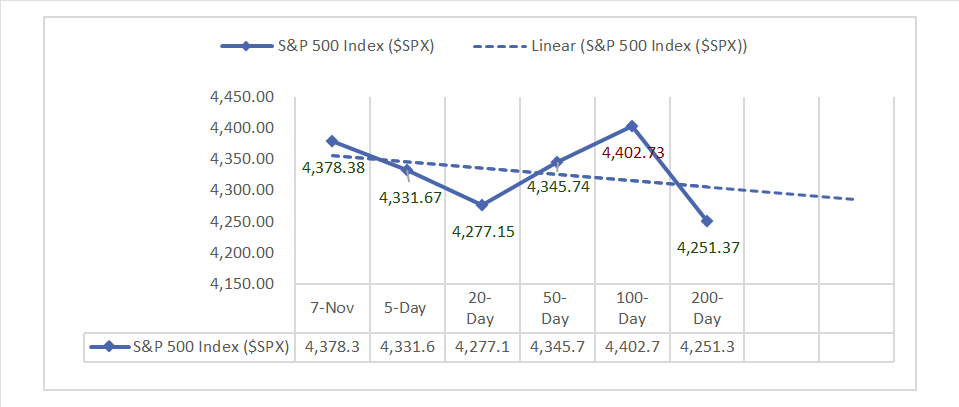

- S&P 500 ^GSPC: 4,378.38 (+12.40, +0.28%)

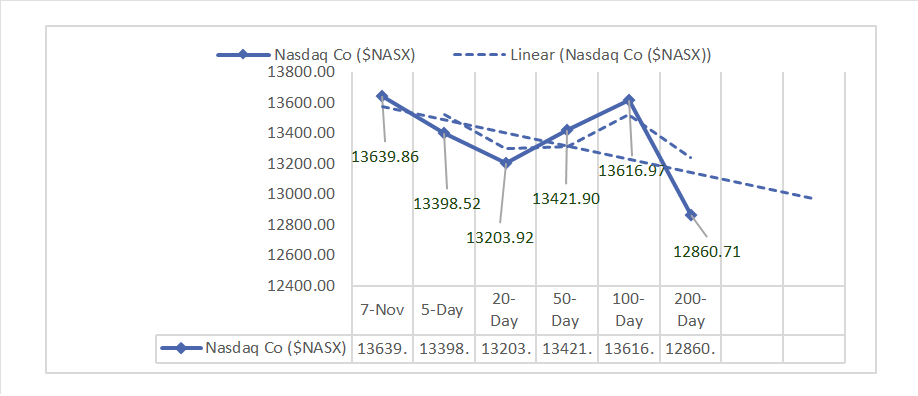

- Nasdaq Composite ^NASX: 13,639.86 (+121.08, +0.90%)

- Nasdaq 100 ^NDX: 15,296.02 (+141.09, +0.93%)

- NYSE Fang+ ^NYFANG: 7,817.17 (+148.60, +1.94%)

- Russell 2000 ^RUT: 1,733.15 (-4.79, -0.28%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: In September, the U.S. trade deficit increased, while consumer credit improved.

- Market Indices: Today, major stock indices mostly rose, led by Nasdaq and NYSE Fang+, while DJIA and S&P 500 had moderate gains, and Russell 2000 declined.

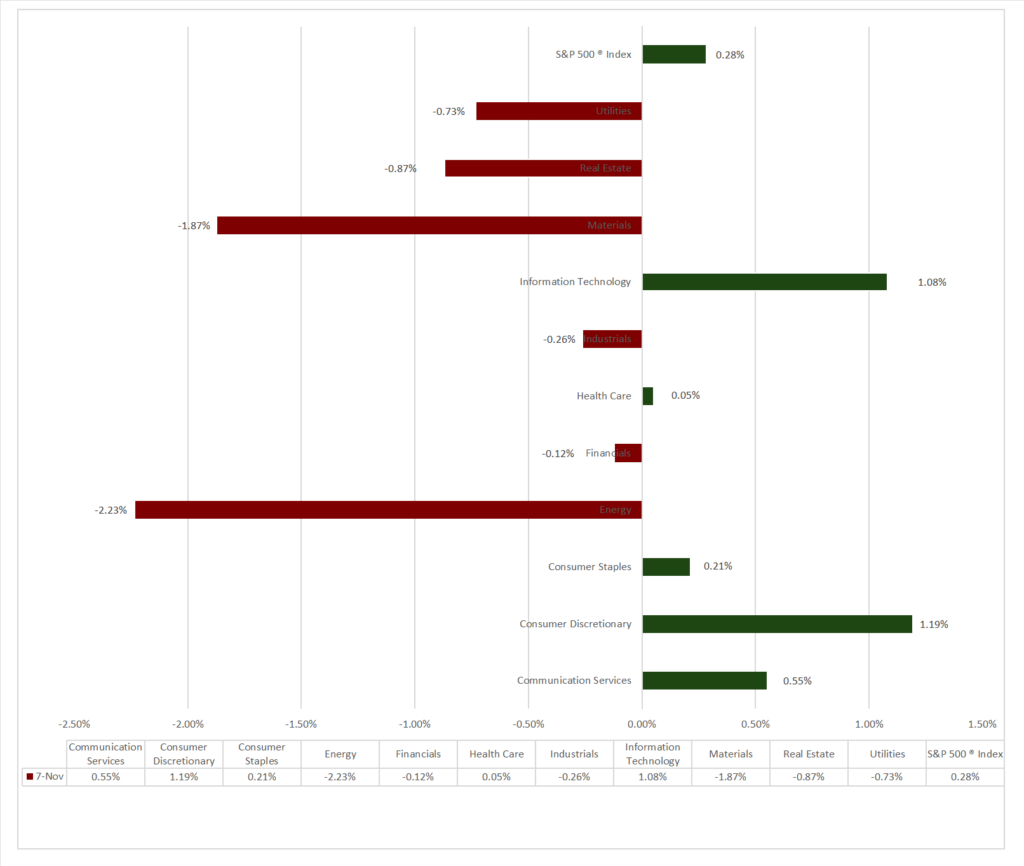

- Sector Performance: 6 of 11 sectors were lower, with Consumer Discretionary (+1.19%) leading and Energy (-2.23%) lagging. Top industry: Broadline Retail (+2.11%).

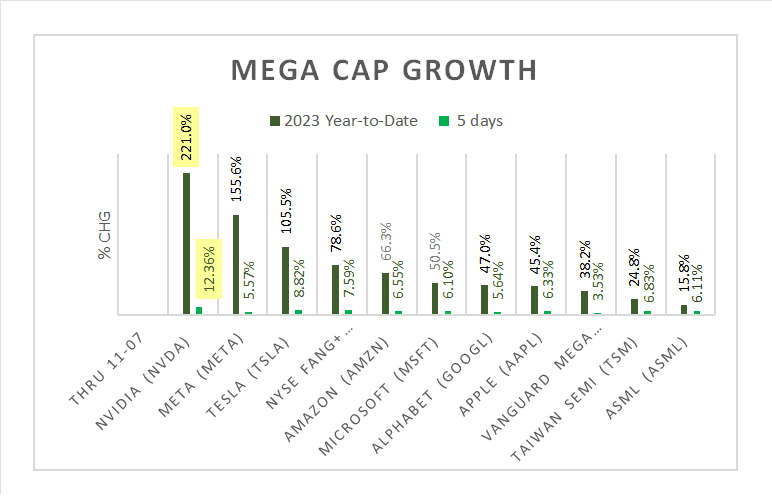

- Factors: Mega-cap growth tech stocks had a robust performance today.

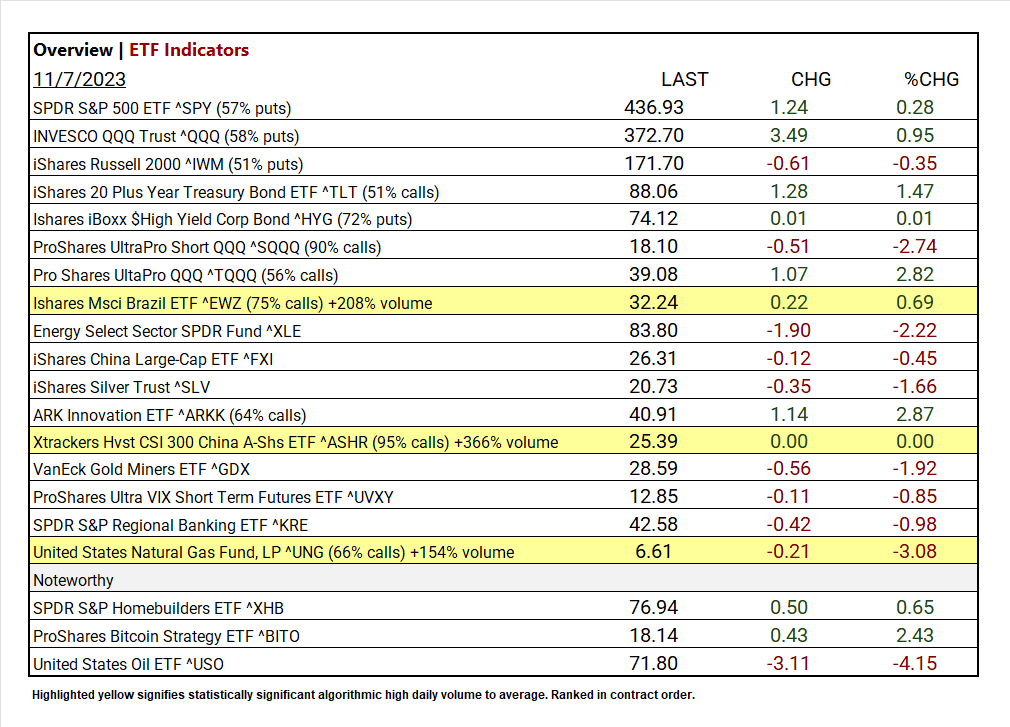

- Top ETF: ARK Innovation ETF ^ARKK (+2.87%).

- Low ETF: United States Natural Gas Fund, LP ^UNG -3.08%

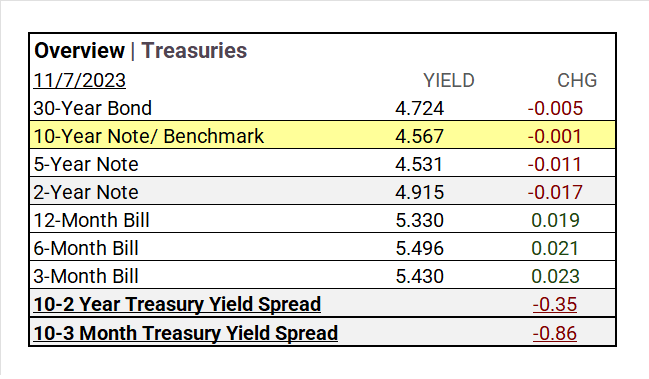

- Treasury Markets: Long-term yields retreated while short-term bills strengthened. The 12-Month Bill reached 5.330%, the 6-Month Bill was at 5.496%, and the 3-Month Bill stood at 5.430%.

- Currency and Volatility: The U.S. Dollar Index rose, CBOE Volatility fell 0.54%, and the Fear & Greed reading reflects fear.

- Commodity Markets: Gold futures, Bitcoin, Crude Oil futures, and the Bloomberg Commodity Index all saw minor declines.

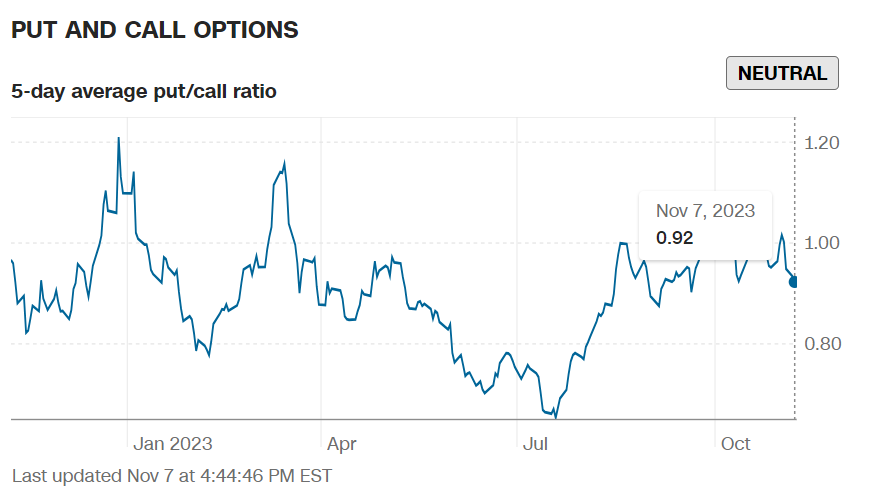

- Notable: Options market activity, INVESCO QQQ Trust ^QQQ jumped as Mega Cap Tech rallied, iShares Msci Brazil ETF ^EWZ heavily bullish with (75% calls) +208% of on daily volume.

Sectors:

- 6 of 11 sectors were lower, with Consumer Discretionary (+1.19%) leading and Energy (-2.23%) lagging. Top industries: Broadline Retail (+2.11%), Personal Care Products (+1.84%), and Textiles, Apparel & Luxury Goods (+1.67%).

Treasury Yields and Currency:

- Long-term yields retreated while short-term bills strengthened. The 12-Month Bill reached 5.330%, the 6-Month Bill was at 5.496%, and the 3-Month Bill stood at 5.430%. Additionally, the 10-2 Year Treasury Yield Spread was -0.35, and the 10-3 Month Treasury Yield Spread.

- Treas Yld Index-10 Yr Nts ^TNX: 45.71 (-0.91, -1.95%)

- The U.S. Dollar Index ^DXY: 105.51 (+0.30, +0.28%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 14.81 (-0.08, -0.54%)

- Fear & Greed Index (TY/LY): 41/59 (Fear/ Greed).

source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,969.86 (-6.88, -0.35%)

- Bitcoin USD: 35,412.40 (-2.90, -0.01%)

- Crude Oil Futures WTI: 77.09 (-0.28, -0.36%)

- Bloomberg Commodity Index: 103.02 (-1.98, -1.89%)

Factors:

- Mega Cap Growth Tech, ^NVDA leads.

ETF Performance:

Top 3 Best Performers:

- ARK Innovation ETF ^ARKK +2.87%

- Pro Shares UltaPro QQQ ^TQQQ +2.82%

- INVESCO QQQ Trust ^QQQ +0.95%

Top 3 Lowest Performers:

- United States Natural Gas Fund, LP ^UNG -3.08%

- ProShares UltraPro Short QQQ ^SQQQ -2.74%

- Energy Select Sector SPDR Fund ^XLE -2.22%

US Major Economic Data

- U.S. trade deficit in September: -$61.5B (compared to -$59.8B and $58.7B).

- Consumer credit in September: Actual $9.1B (Forecast $9.5B, Previous -$15.6 billion).

Earnings:

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- BEAT: Gilead (GILD), KKR & Co (KKR), Occidental (OXY), Nintendo ADR (NTDOY), Emerson (EMR), DR Horton (DHI), Datadog (DDOG), Globalfoundries (GFS), eBay (EBAY), STERIS (STE), Akamai (AKAM), TPG Inc (TPG), DaVita (DVA).

- MISSED: Uber Tech (UBER), Nippon ADR (NTTYY), UBS Group (UBS), Air Products (APD), Fidelity National Info (FIS), Devon Energy (DVN), Rivian Automotive (RIVN), Lucid Group (LCID), Toast (TOST), Robinhood Markets (HOOD).

Resources:

News

Investment and Growth News

- Gilead Sciences Results Beat Estimates – WSJ

- TikTok Is Bringing Logistics to the E-Commerce Dance – WSJ

- Rivian Ends Amazon Van Exclusivity, Boosts Output Forecast – Bloomberg

Infrastructure and Energy

- NEF Latest: Leaders From China to Saudi Arabia See Global Risks – Bloomberg

- LNG Demand to Keep Rising on Asia’s Energy Growth, Woodside Says – Bloomberg

Real Estate

- Signature Loan Sale Likely to Lower Commercial-Property Values – WSJ

Central Banking and Monetary Policy

- BOJ Likely to End Negative Rate in Early 2024, Price Expert Says – Bloomberg

- Europe Faces Soft Landing With High Rates Still Needed, IMF Says – Bloomberg

International Market Analysis (China)

- China trade: 4 takeaways from October’s data, with export growth sluggish amid soft demand, imports positive surprise – SCMP