Stay Informed and Stay Ahead: Market Watch, December 14th, 2023.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: Dec. 9 Initial Jobless Claims lower, Nov. U.S. Retail Sales exceed consensus, Import Price Index for Nov. beats expectations.

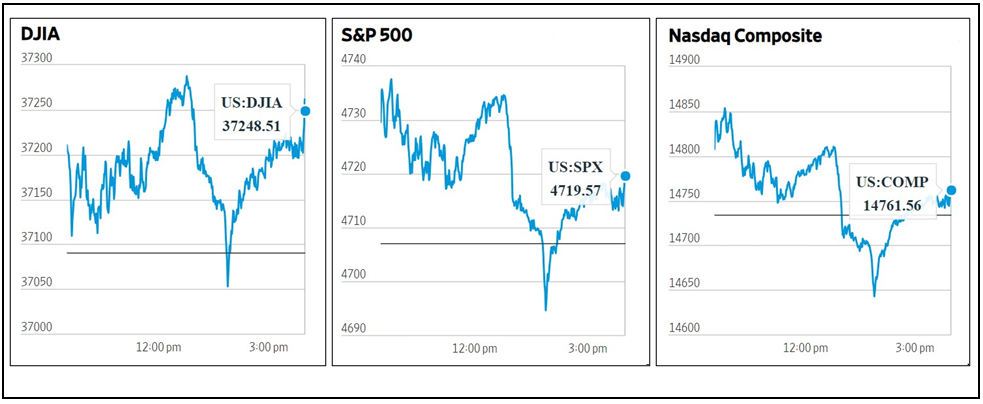

- Market Indices: DJIA (+0.43%), S&P 500 (+0.26%), Nasdaq Composite (+0.19%).

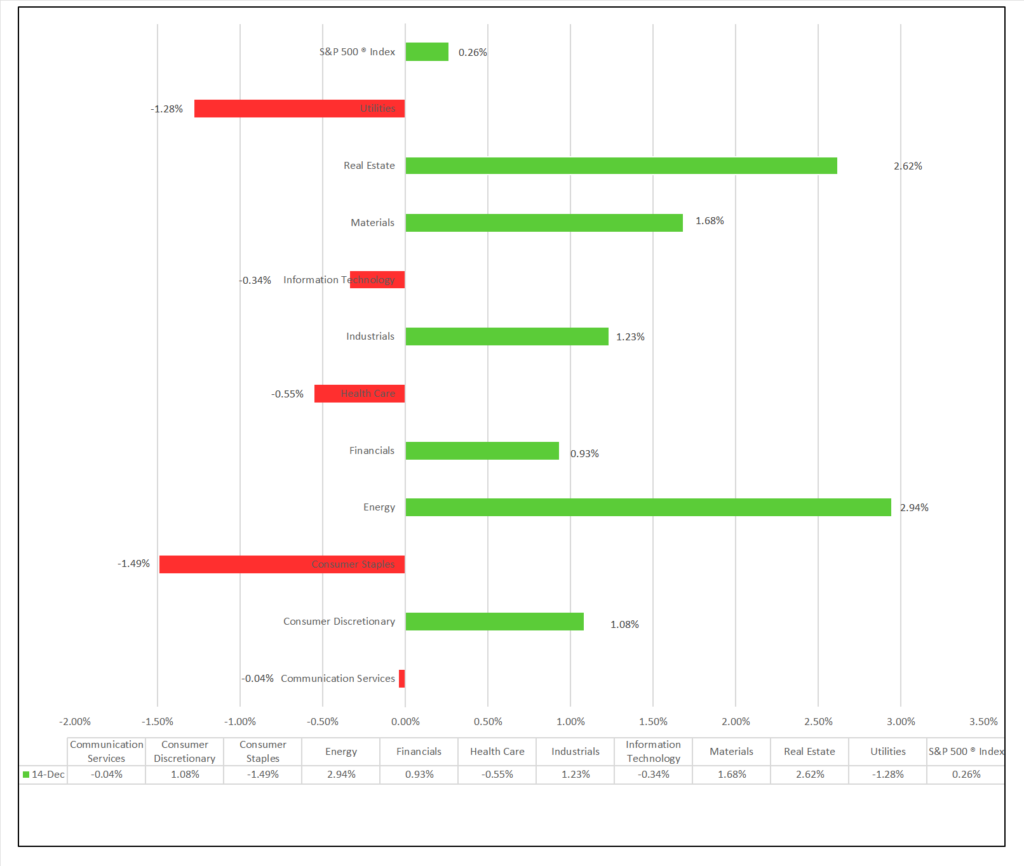

- Sector Performance: 6 of 11 sectors higher; Energy (+2.94%) leading, Consumer Staples (-1.49%) lagging. Top industry: Automobile Components (+8.44%).

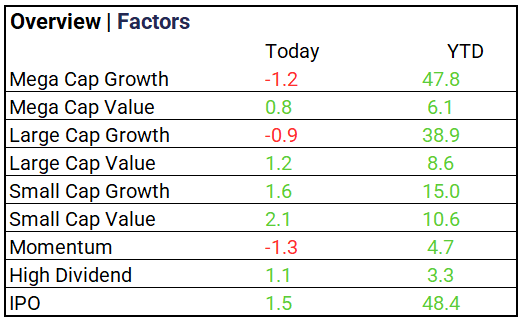

- Factors: Small caps shine, Mega and Large Cap growth dip.

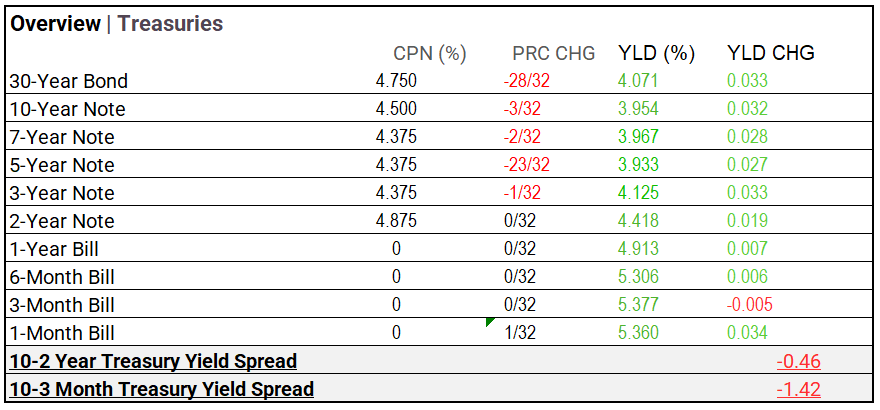

- Treasury Markets: Longer notes climb, with the 30-year bond leading with a yield change of 0.033.

- Commodities: Bitcoin, Gold, and Crude Oil futures dip moderately, while the Bloomberg Commodity Index jumps.

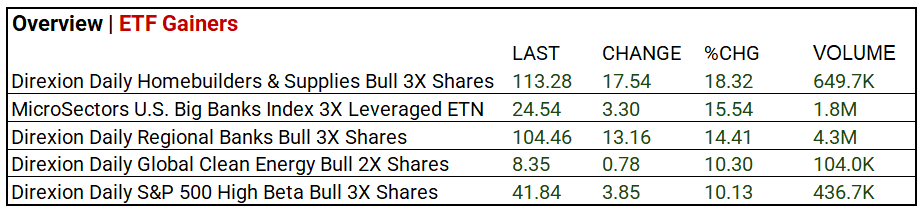

- ETFs: Winners include Direxion Daily Homebuilders & Supplies Bull 3X Shares (18.32%), MicroSectors U.S. Big Banks Index 3X Leveraged ETN (+15.54%), and Direxion Daily Regional Banks Bull 3X Shares (14.41%). Real Estate and Banks outperform.

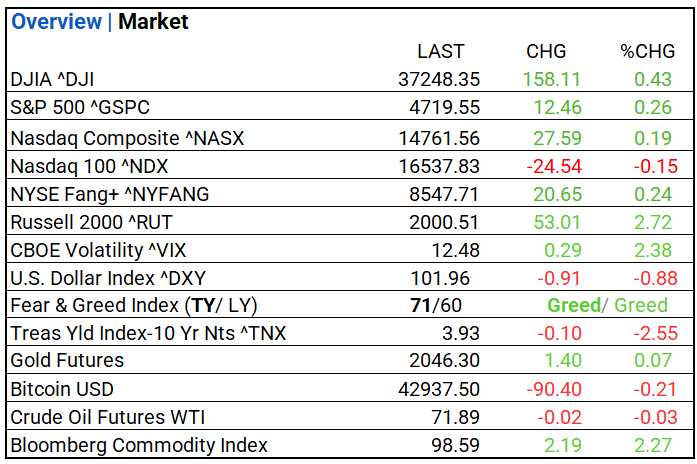

US Market Snapshot: Key Stock Market Indices:

- DJIA ^DJI: 37,248.35 (+158.11, +0.43%)

- S&P 500 ^GSPC: 4,719.55 (+12.46, +0.26%)

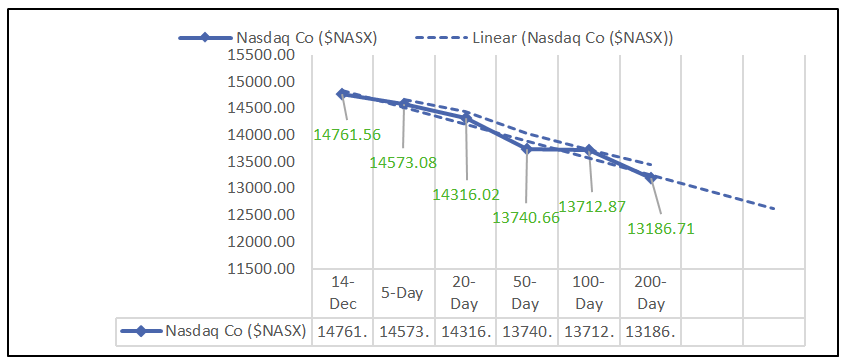

- Nasdaq Composite ^NASX: 14,761.56 (+27.59, +0.19%)

- Nasdaq 100 ^NDX: 16,537.83 (-24.54, -0.15%)

- NYSE Fang+ ^NYFANG: 8,547.71 (+20.65, +0.24%)

- Russell 2000 ^RUT: 2,000.51 (+53.01, +2.72%)

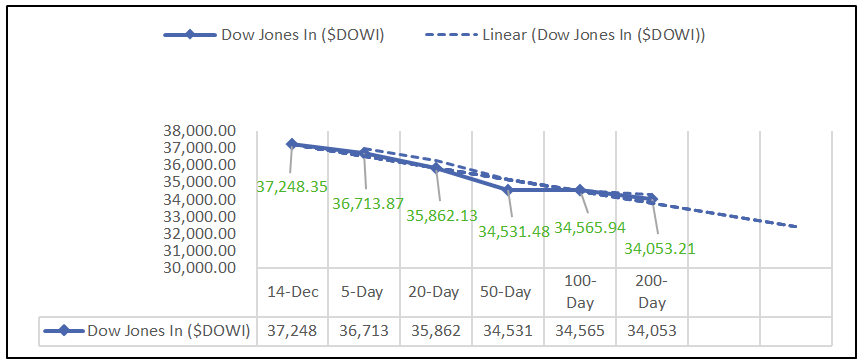

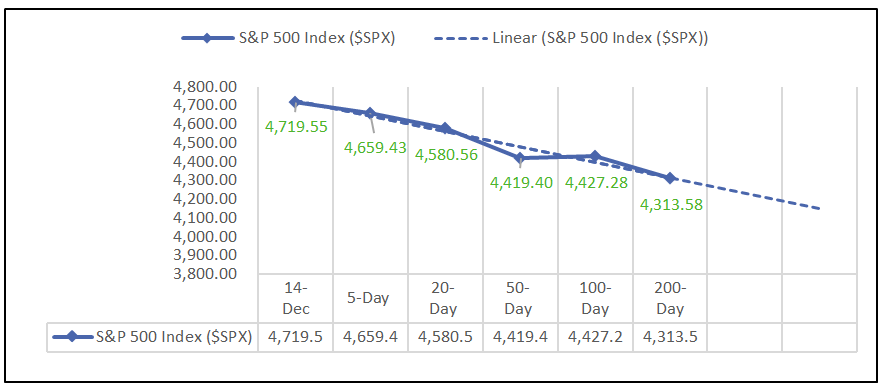

Moving Averages: DOW, S&P 500, NASDAQ:

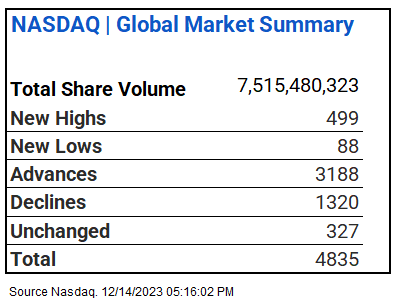

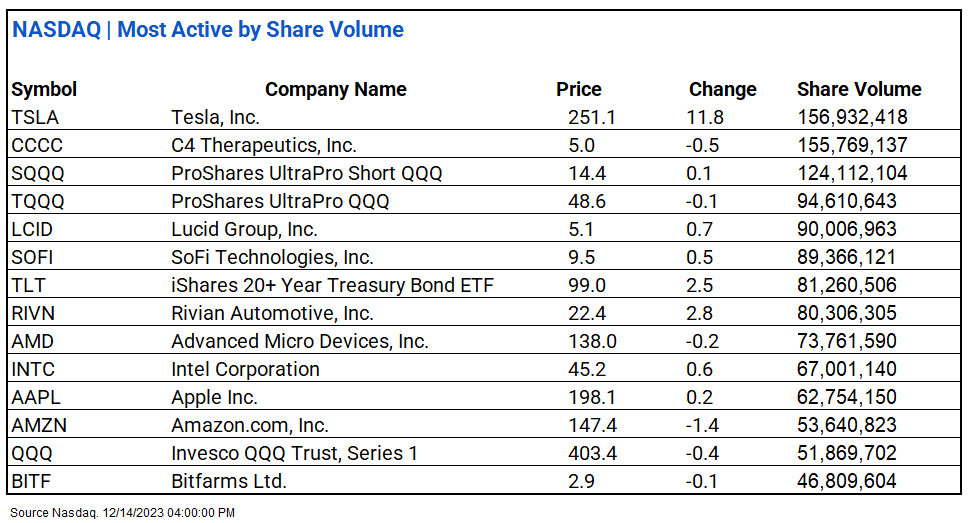

NASDAQ Global Market Summary:

Sectors:

- 6 of 11 sectors higher; Energy (+2.94%) leading, Consumer Staples (-1.49%) lagging. Top industries: Automobile Components (+8.44%), Office REITs (+7.12%), Industrial REITs (+6.10%), and Household Durables (+5.28%).

Factors:

- Small caps shine, Mega and Large Cap growth dip.

Treasury Markets:

- Longer notes climb, with the 30-year bond leading with a yield change of 0.033.

Currency and Volatility:

- U.S. Dollar Index down, CBOE Volatility rises, Fear & Greed indicates Greed.

- CBOE Volatility ^VIX: 12.48 (+0.29, +2.38%)

- Fear & Greed Index: 71/LY 60 (Greed/ Greed)

Commodity Markets:

- Gold Futures: $2,046.30 (+$1.40, +0.07%)

- Bitcoin USD: $42,937.50 (-$90.40, -0.21%)

- Crude Oil Futures WTI: $71.89 (-$0.02, -0.03%)

- Bloomberg Commodity Index: 98.59 (+$2.19, +2.27%)

ETF’s:

US Economic Data:

- Initial Jobless Claims (Dec. 9): 202,000 (Previous: 221,000, Forecast: 220,000)

- Import Price Index (Nov.): -0.4% (Previous: -0.6%, Forecast: -0.8%)

- Import Price Index minus Fuel (Nov.): 0.2% (Previous: -0.2, Forecast: –)

- U.S. Retail Sales (Nov.): 0.3% (Previous: -0.2%, Forecast: -0.1%)

- Retail Sales minus Auto (Nov.): 0.2% (Previous: 0.0%, Forecast: 0.0%)

- Business Inventories (Nov.): -0.1% (Previous: 0.2%, Forecast: -0.1%)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Costco (COST), Lennar (LEN), Quanex Building Products (NX)

- MISSED: Jabil Circuit (JBL), Scholastic (SCHL),

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 1.17%

- Hang Seng (Hong Kong): 0.00%

- Shanghai Composite (China): -0.33%

- CAC 40 (France): 0.59%

- DAX (Germany): -0.08%

- FTSE 100 (UK): 1.33%

Central Banking and Monetary Policy, Noteworthy:

- World Central Banks Signal Victory Over Inflation Is in Sight – WSJ

- Behind the US Jobs Boost: Men, Teenagers and Health-Care Work – Bloomberg

Energy:

- US Still Needs Fossil Fuels, White House Climate Adviser Says – Bloomberg

- Oil-Demand Growth to Weaken Next Year, IEA Says – WSJ

- How Energy Traders Made a Fortune Switching Off a Nation’s Gas Supply – Bloomberg

China:

- China wants to build ‘first-class’ investment banks – but isn’t telling the industry how – SCMP