Stay Informed and Stay Ahead: Market Watch, December 19th, 2023.

Market Highlights & Analysis: Indices, Sectors, and More…

- Economic Data: Housing starts for November at 1.56 million surpassed expectations, while building permits at 1.46 million fell slightly short.

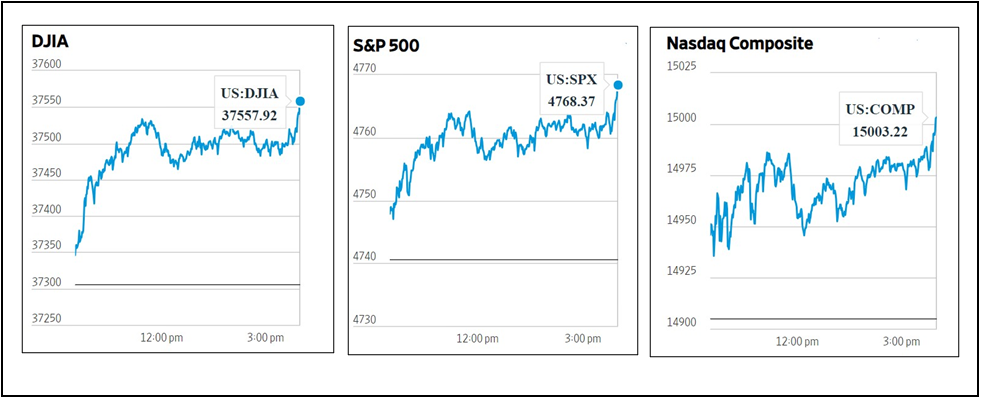

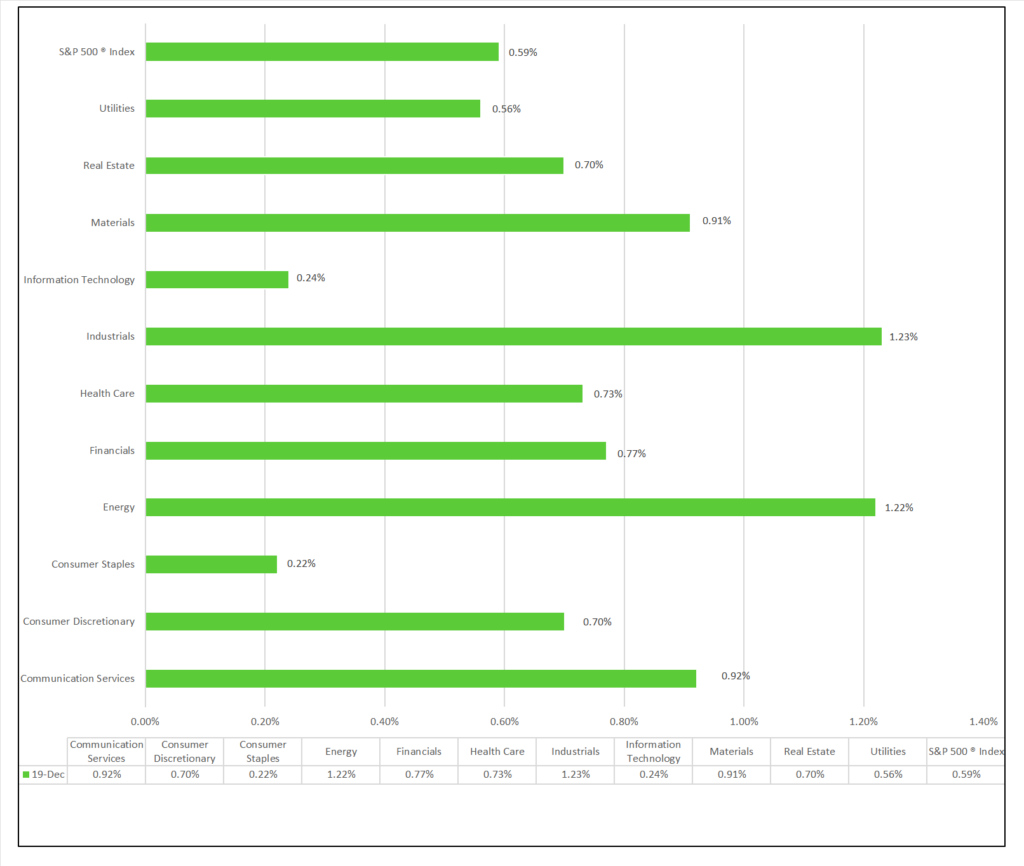

- Market Indices: DJIA (+0.68%), S&P 500 (+0.59%), Nasdaq Composite (+0.66%).

- Sector Performance: All11 sectors higher; Industrials (+1.23%) leading, Consumer Staples (0.22%) lagging. Top industry: Personal Care Products (+3.20%).

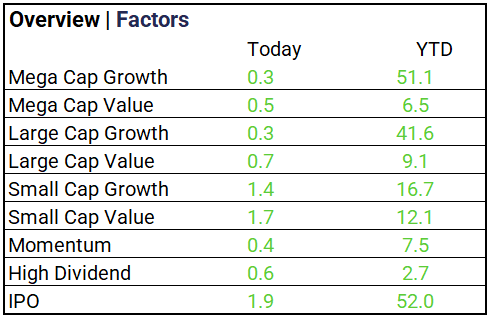

- Factors: IPOs +1.9%, and Small Cap Value showed an impressive gain of 1.7%.

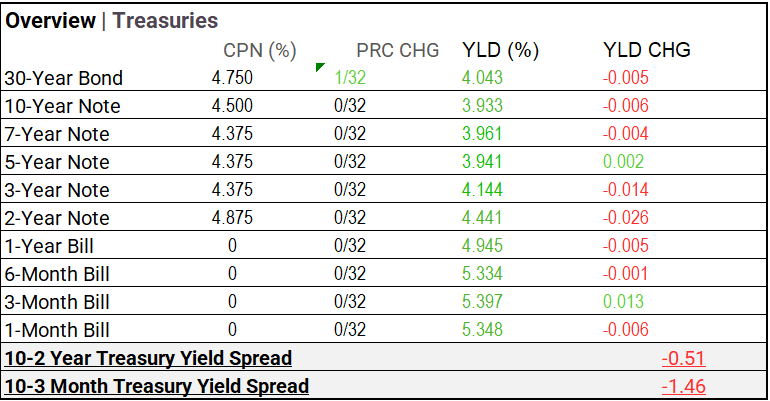

- Treasury Markets: Yields retreat across the curve, except for the 5-Year Note and 3-Month Bill.

- Commodities: Bitcoin declines, Gold rises, Crude Oil futures rally, and the Bloomberg Commodity Index increases.

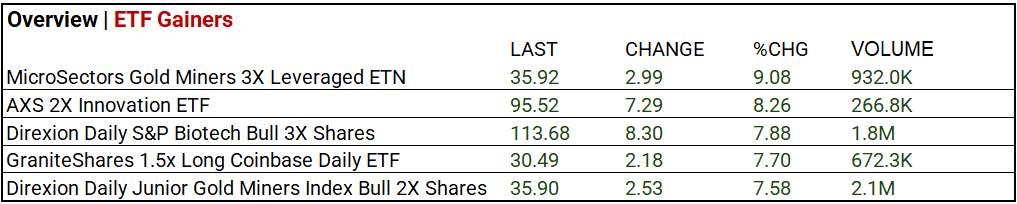

- ETFs: Winners include 3X Gold, 2X Innovation, 3X Biotech and 1.5X Coinbase long.

US Market Snapshot: Key Stock Market Indices:

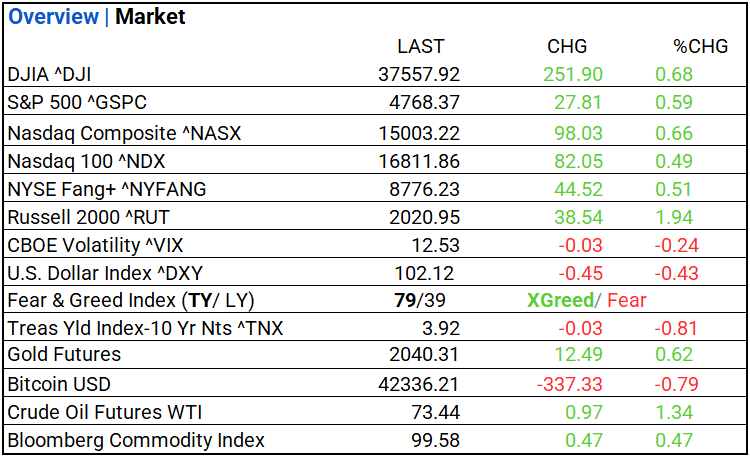

- DJIA ^DJI: 37,557.92 (+251.90, +0.68%)

- S&P 500 ^GSPC: 4,768.37 (+27.81, +0.59%)

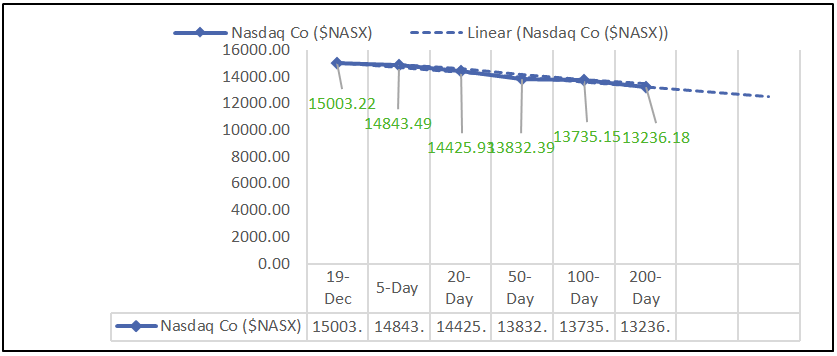

- Nasdaq Composite ^NASX: 15,003.22 (+98.03, +0.66%)

- Nasdaq 100 ^NDX: 16,811.86 (+82.05, +0.49%)

- NYSE Fang+ ^NYFANG: 8,776.23 (+44.52, +0.51%)

- Russell 2000 ^RUT: 2,020.95 (+38.54, +1.94%)

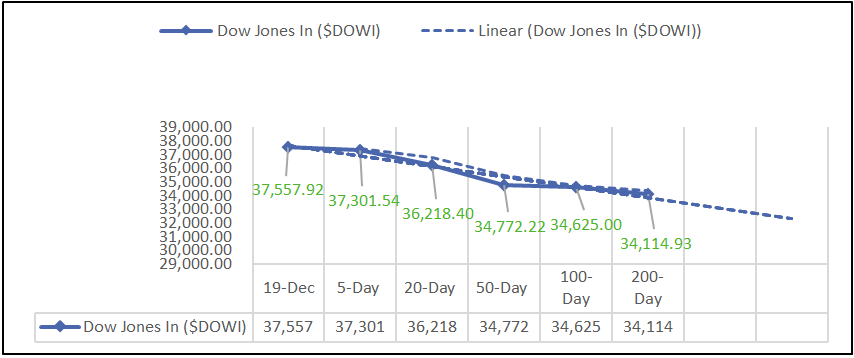

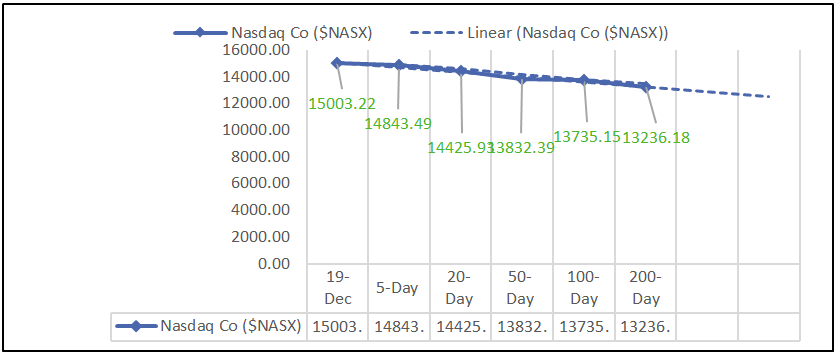

Moving Averages: DOW, S&P 500, NASDAQ:

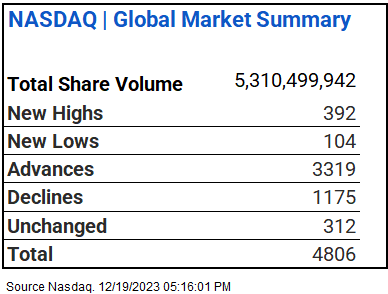

NASDAQ Global Market Summary:

Sectors:

- All 11 sectors higher; Industrials (+1.23%) leading, Consumer Staples (0.22%) lagging. Top industries: Personal Care Products (+3.20%), Automobiles (+1.91%), Life Sciences Tools & Services (+1.84%), and Metals & Mining (+1.81%).

Factors:

- IPOs rose by 1.9%, and Small Cap Value showed an impressive gain of 1.7%.

Treasury Markets:

- Yields pullback across the curve except for 5-Year Note and 3-Month Bill.

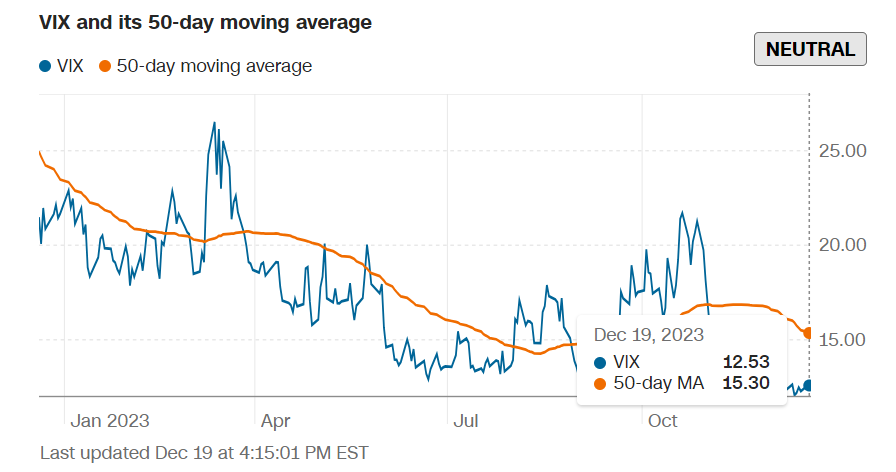

Currency and Volatility:

- U.S. Dollar Index ^DXY: 102.12 (-0.45, -0.43%)

- CBOE Volatility ^VIX: 12.53 (-0.03, -0.24%)

- Fear & Greed Index: 79/LY 39 (Extreme Greed/ Fear)

Commodity Markets:

- Gold Futures: $2,040.31 (+$12.49, +0.62%)

- Bitcoin USD: $42,336.21 (-$337.33, -0.79%)

- Crude Oil Futures WTI: $73.44 (+$0.97, +1.34%)

- Bloomberg Commodity Index: 99.58 (+$0.47, +0.47%)

ETF’s:

- Winners include 3X Gold, 2X Innovation, 3X Biotech and 1.5X Coinbase long.

US Economic Data:

- Housing Starts (Nov.): 1.56 million (Previous: 1.36 million, Forecast: 1.36 million)

- Building Permits (Nov.): 1.46 million (Previous: 1.5 million, Forecast: 1.48 million)

Earnings:

- Q4 Forecast: Analysts significantly lowered S&P 500 companies’ Q4 earnings per share (EPS) estimates during October and November, with a 5.0% decline in the bottom-up EPS estimate. This drop surpasses the average declines over the past 5, 10, 15, and 20 years, marking the most substantial decrease since Q1 2023. Among sectors, Health Care experienced the largest decline (-19.9%), while Information Technology saw a modest increase (+1.5%) in their Q4 2023 bottom-up EPS estimates.

Notable Earnings Today:

- BEAT: Accenture (ACN), FactSet Research (FDS), , Worthington Industries (WOR), Enerpac Tool Group (EPAC)

- MISSED: FedEx (FDX), Steelcase (SCS)

Global Markets Summary: Asian & European Markets:

- Nikkei 225 (Japan): 1.41%

- Hang Seng (Hong Kong): -0.75%

- Shanghai Composite (China): 0.05%

- CAC 40 (France): 0.08%

- DAX (Germany): 0.56%

- FTSE 100 (UK): 0.31%

Central Banking and Monetary Policy, Noteworthy:

- US Housing Starts Unexpectedly Rise to a Six-Month High – Bloomberg

- Fed Official Says Rate Cuts Could Be Needed Next Year to Prevent Overtightening – WSJ

- Bank of Japan Keeps Policy Targets Unchanged – WSJ

Energy:

- Gaza Is Making Oil and Gas Markets Twitchier – WSJ

- COP28 Latest: Summit Hailed as ‘Turning Point’ in Climate Fight – Bloomberg

China:

- Is China uninvestable or irreplaceable? Foreign investors ponder rising risks vs rewards of world’s second-largest economy – SCMP