Stay Informed and Stay Ahead: Market Watch, April 9th, 2024.

Wall Street Early Week Edition

Market Highlights & Analysis: Indices, Sectors, and More…

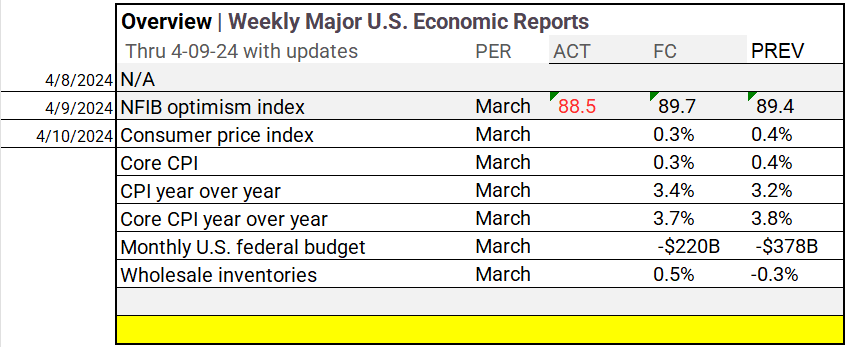

- Economic Data: NFIB optimism index down from last month.

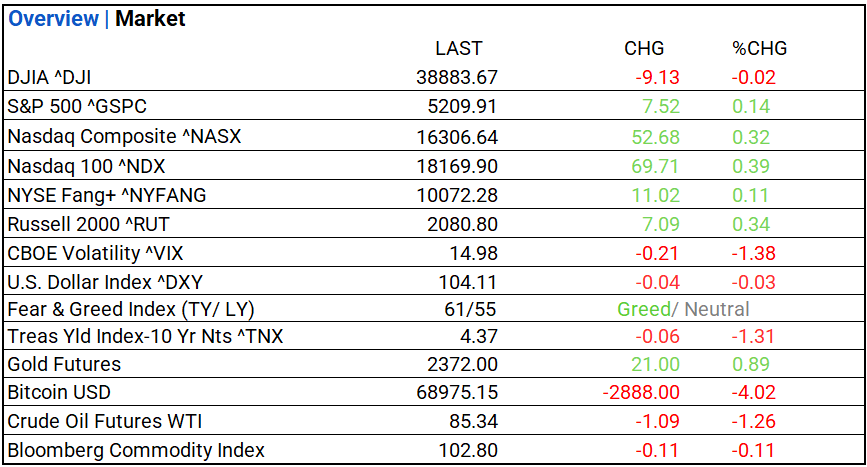

- Market Indices: DJIA (-0.02%), S&P 500 (+0.14%), Nasdaq Composite (+0.32%).

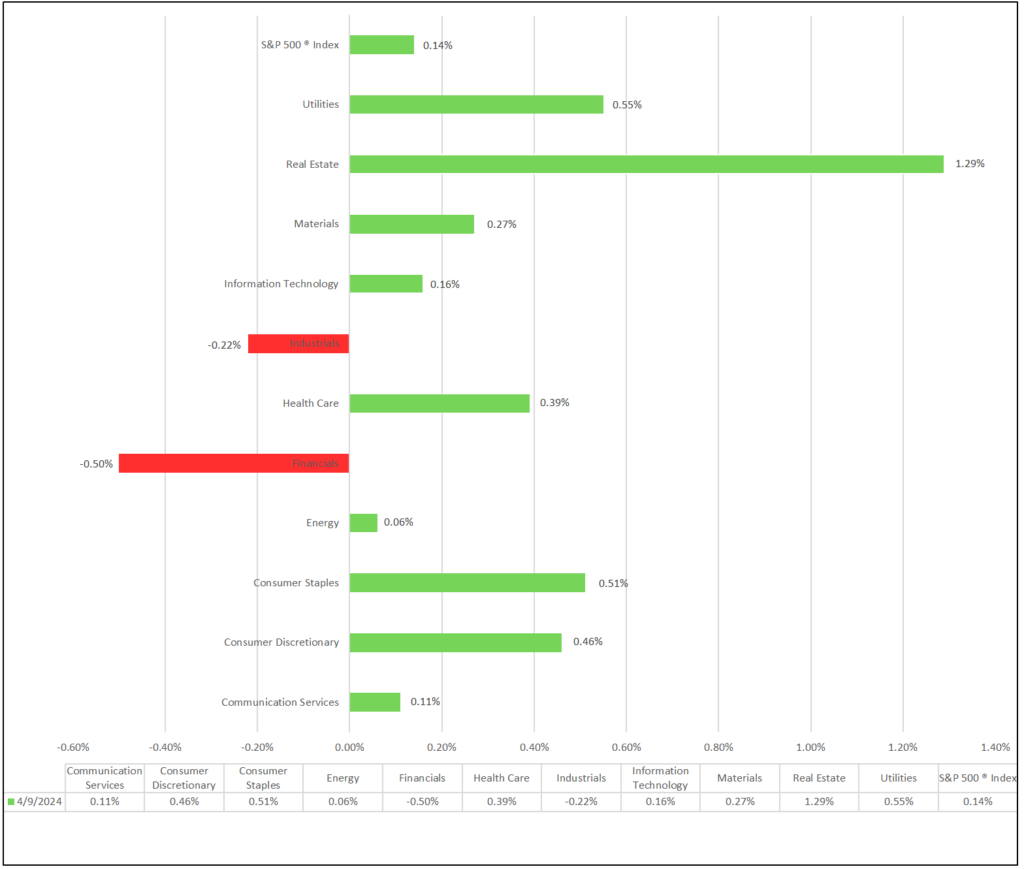

- Sector Performance: 9 of 11 sectors higher; Real Estate (+1.291%) leading, Financials (-0.50%) lagging. Top industries: Automobile Components (+3.10%).

- Factors: Small Cap Value lead on the day, Momentum +17.9% YTD.

- Treasury Markets: Shorter durations Bills fare better than longer term Bond/ Notes.

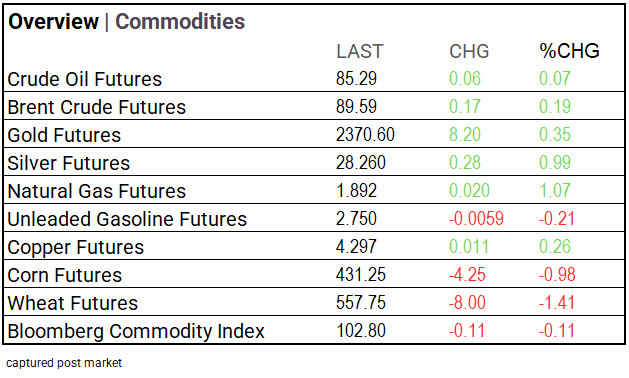

- Commodities: Natural Gas and Silver Futures outperform.

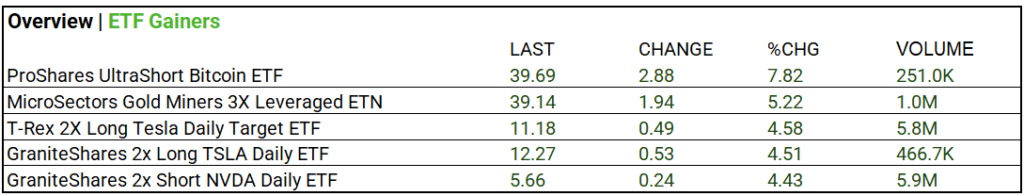

- ETFs: T-Rex 2X Long Tesla Daily Target ETF (+4.58%) on 5.8M in volume.

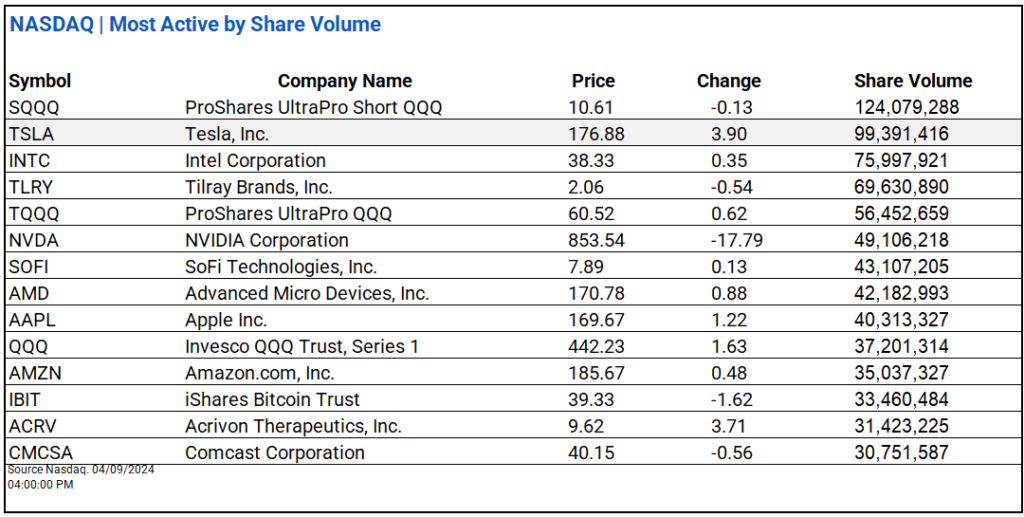

US Market Snapshot:

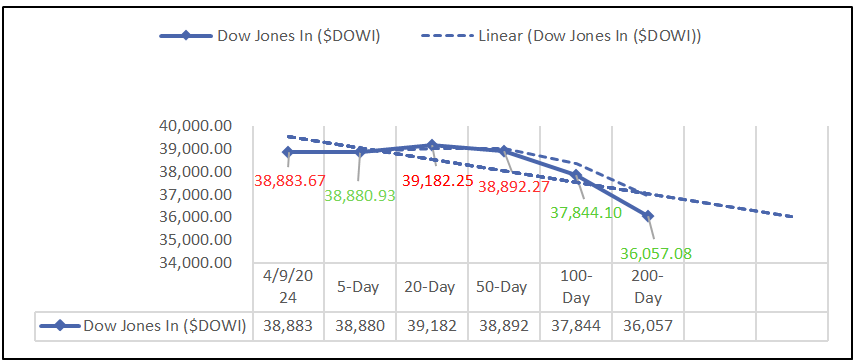

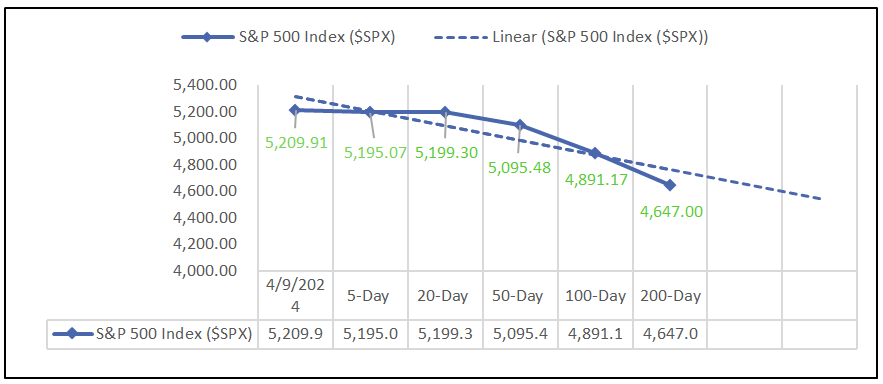

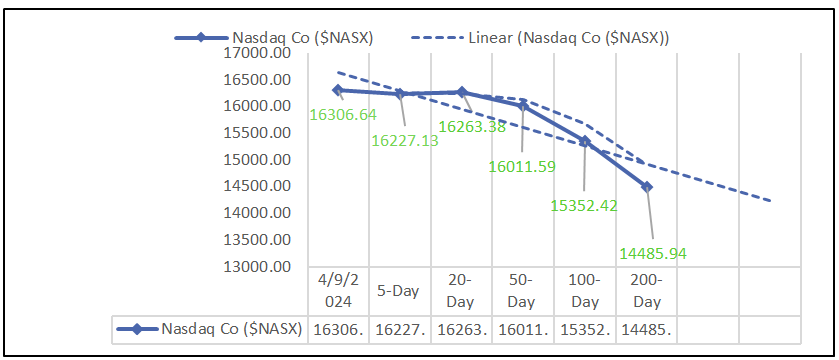

Moving Averages: DOW, S&P 500, NASDAQ:

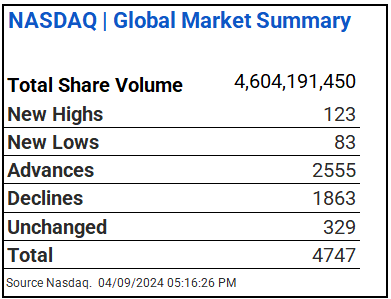

NASDAQ Global Market Summary:

Sectors:

- 9 of 11 sectors higher; Real Estate (+1.291%) leading, Financials (-0.50%) lagging. Top industries: Automobile Components (+3.10%), Office REITs (+2.59%) and Automobiles (+2.02%).

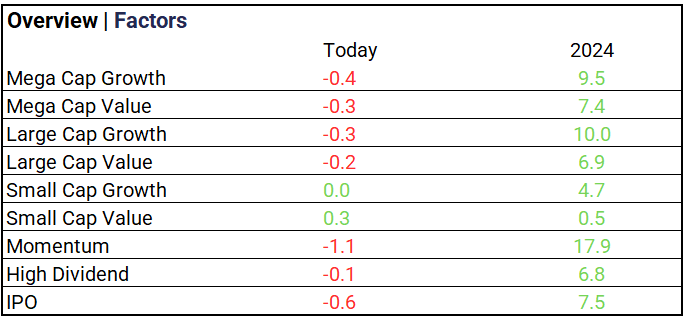

Factors:

- Small Cap Value lead on the day, Momentum +17.9% YTD.

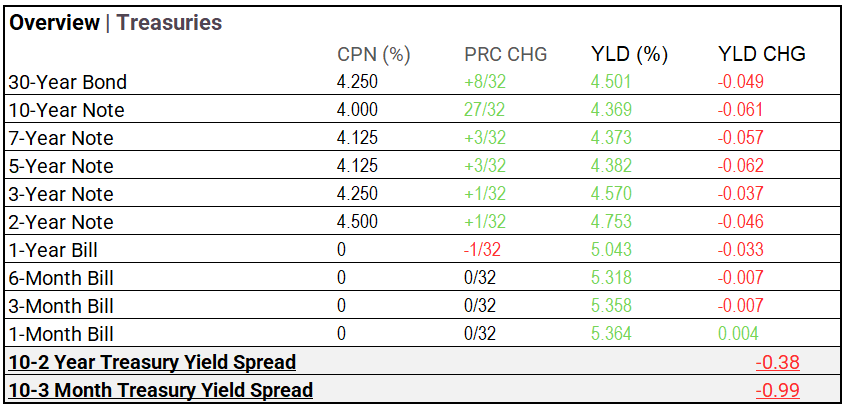

Treasury Markets:

- Bond yields fluctuated mostly down; shorter durations fared better adjusting marginally.

Currency and Volatility:

- U.S. Dollar Index ^DXY: 104.11 (-0.04, -0.03%)

- CBOE Volatility ^VIX: 14.98 (-0.21, -1.38%)

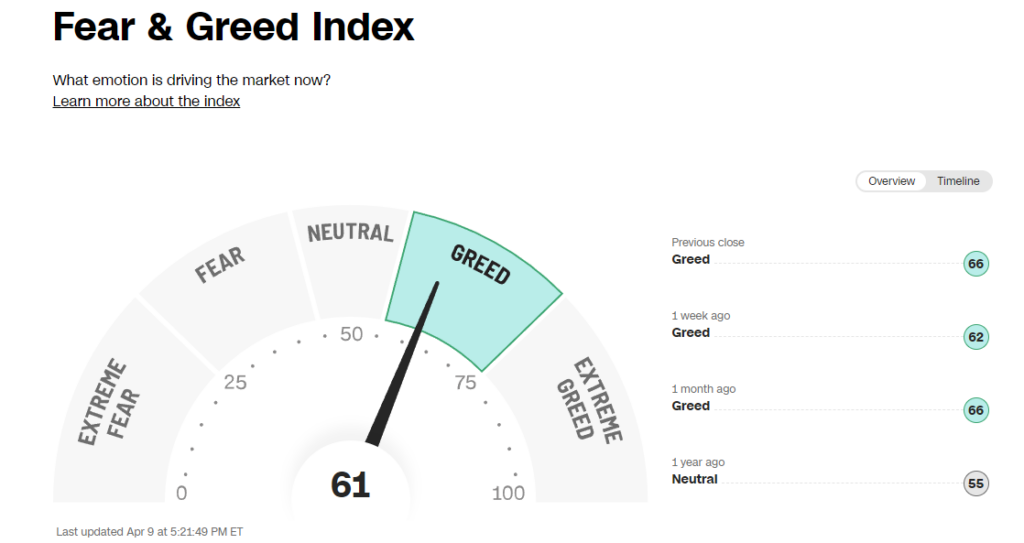

- Fear & Greed Index: 61/TY 55/LY (Greed/Neutral)

Commodity Markets:

ETF’s:

- Biggest volume gainer: T-Rex 2X Long Tesla Daily Target ETF (+4.58%) volume of 5.8M.

US Economic Data:

- NFIB optimism index falls short in March @88.5 down from last month’s 89.4. Big CPI Day tomorrow!

Notable Earnings Today:

- BEAT: Royal Gold (RGLD), PriceSmart (PSMT).

- MISSED: Norfolk Southern (NSC), WD-40 (WDFC), Neogen (NEOG).

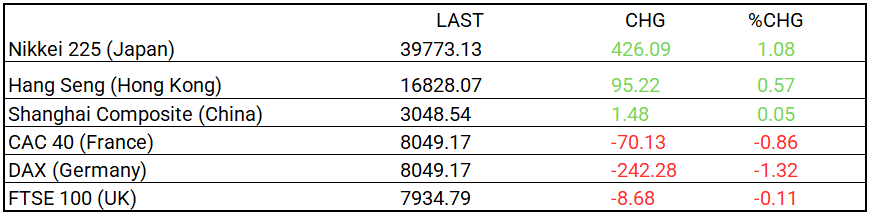

Global Markets Summary: Asian & European Markets:

Central Banking and Monetary Policy, Noteworthy:

- BOJ Gov. Leaves Door Open to Future Rate Increases – WSJ

- Fed’s Bostic Sees One Cut, But Leaves Door Open to Changing View – Bloomberg

Energy:

- Wildfires Make Utilities a Tricky Investment. Just Ask Warren Buffett –WSJ

- Power Bills Will Keep Rising Even After the Fed Tames Inflation – Bloomberg

China:

- Gold Hits New High as Central Banks Ramp Up Purchases – WSJ